60 new Bitcoin whales are loading up: What secrets do they know?

- Whales have began shopping for extra Bitcoin, spending tens of hundreds of thousands on acquisitions over the previous few months.

- Market sentiment exhibits these whales may be holding the asset for the long run.

Bitcoin [BTC] has maintained a gradual threshold available in the market, shifting inside a decent vary and recording no important acquire—solely as much as 1% previously month.

New market perception means that sentiment might quickly shift, with Bitcoin probably rising in worth as whales proceed to build up the asset.

Whale curiosity in Bitcoin rises

Whales, recognized to manage a good portion of any asset, have proven renewed curiosity in Bitcoin over the previous few months.

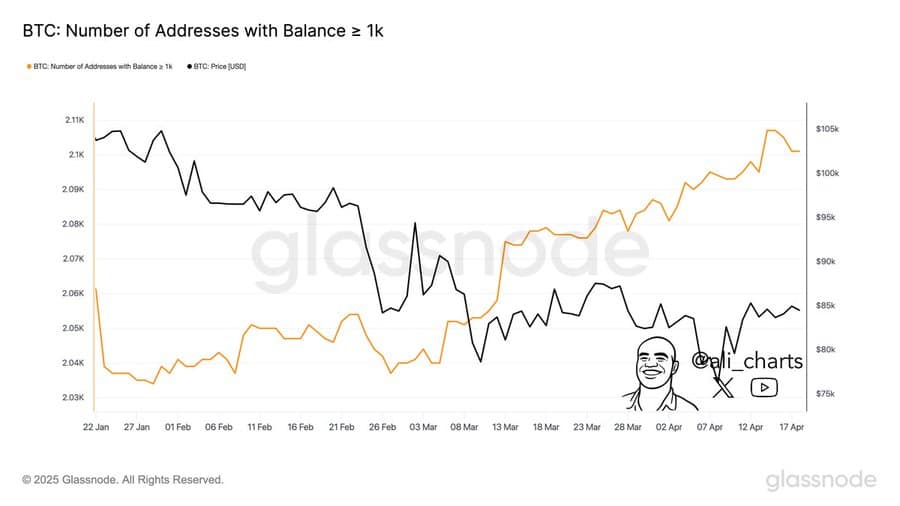

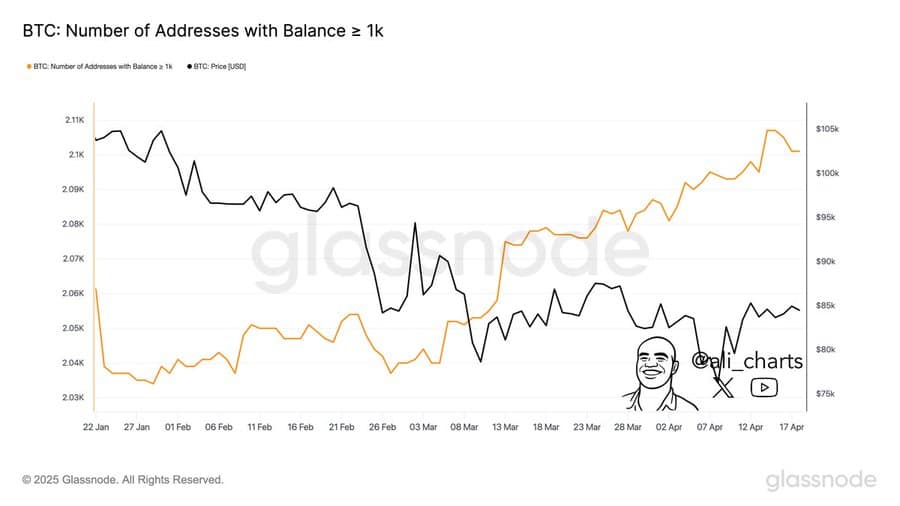

Since early March, evaluation exhibits new whales have entered the market and began buying Bitcoin. To this point, 60 of those investors have every bought a minimum of 1,000 Bitcoin, totaling roughly $85 million.

Supply: Glassnode

Naturally, this inflow got here whereas BTC traded nicely under its all-time excessive, hinting at undervaluation within the eyes of enormous traders.

This enhance in whale participation can be noteworthy given the general decline in crypto market liquidity.

In simply the previous two weeks, capital influx has dropped from $8.2 billion to $2.38 billion.

With shrinking funds getting into the market, property receiving liquidity change into extra attention-grabbing, as they’re prone to outperform others. Whale exercise in BTC confirms it might proceed to steer market positive aspects.

Establishments and key whales are making strikes

Having stated that, it wasn’t simply whales shopping for the dip.

AMBCrypto evaluation recognized one whale benefiting from Bitcoin’s current worth decline to build up a major quantity of the asset.

In line with insights from Arkham Intelligence, a whale identified as “Abraxas Capital Mgmt” has been actively buying Bitcoin.

For the reason that starting of April, this whale has grown its Bitcoin holdings from $2.8 million to $253 million, confirming sturdy investor bias towards the asset.

Apparently, underneath a special handle, this whale additionally holds another $43 million in LBTC, bringing its whole to $296 million.

Supply: CoinGlass

Institutional traders have additionally slowed their promoting and ended the week with inflows into Bitcoin ETFs (exchange-traded funds). Evaluation exhibits this group purchased $106.90 million price of BTC by week’s finish.

If accumulation by whales and establishments continues, Bitcoin’s worth might rise, probably resulting in a rally.

Lengthy-term merchants are shopping for

To find out whether or not this accumulation is non permanent or sustainable, AMBCrypto examined the habits of long-term holders.

Utilizing Bitcoin’s Coin Days Destroyed (CDD) metric which signifies whether or not long-term holders are promoting or holding, AMBCrypto discovered the latter to be true.

Supply: CryptoQuant

At the moment, the CDD trended close to zero—implying long-term holders weren’t promoting. Actually, they’ve continued to carry their positions, even via market chop.

With whales accumulating, establishments rotating again in, and long-term holders staying put, Bitcoin has emerged as the first liquidity magnet in a drying market.

If these tailwinds persist, BTC might not simply maintain regular—it could possibly be gearing up for its subsequent rally.