Glassnode Co-Founder Predicts Bull Run For Bitcoin Amidst Sideways Trading

Bitcoin (BTC) has been buying and selling inside a slim vary for the previous 12 days. Nonetheless, the truth that bulls have held the essential $30,000 help stage is seen as a short-term win for them.

Regardless that BTC has been experiencing sideways buying and selling, there’s a rising sense of optimism that it has the potential to interrupt via higher resistance zones and attain new highs.

BTC’s Sideways Buying and selling Units Stage For Bullish Momentum?

According to Yan Alleman, the co-founder of blockchain analytics agency Glassnode, Bitcoin’s latest sideways buying and selling has paved the way in which for potential bullish momentum shortly. BTC’s present range-bound buying and selling between $31,200 and $29,600 is seen as a consolidation interval permitting for a re-establishment of bullish momentum available in the market.

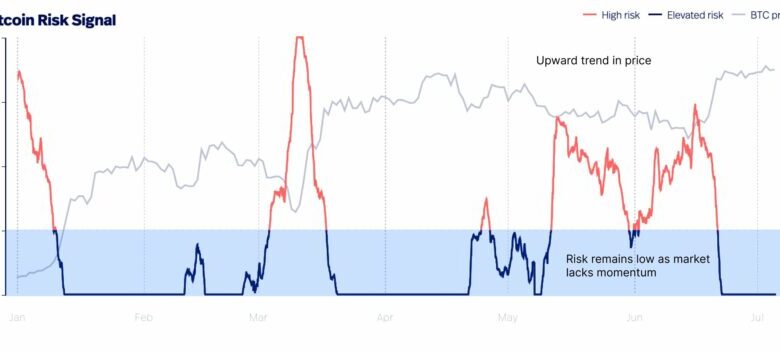

To evaluate market sentiment and potential worth actions within the Bitcoin market, Glassnode has developed a proprietary metric referred to as the Swissblock Danger Sign. This metric considers numerous components, together with volatility, on-chain exercise, social sentiment, and extra.

Within the context of Alleman’s evaluation, the Swissblock Danger Sign has remained secure at 0, as seen within the chart beneath, which means that the present market sentiment is impartial, with no clear dominance from both patrons or sellers.

This might point out that the market is in a consolidation part, as patrons and sellers are cautious earlier than making any important strikes.

Moreover, Alleman predicts that BTC will possible break above $31,200, offering a powerful basis for patrons to focus on resistance ranges at $33,000 and $34,800. Nevertheless, even when the help at $29,600 had been to interrupt, Alleman believes that remaining bullish till the 50% retracement stage close to $28,200 appears viable.

This pullback may symbolize a possibility for traders to build up BTC for the subsequent leap because the market reveals indicators of potential progress. As such, Alleman’s evaluation means that the present market situations current a positive alternative for these seeking to spend money on Bitcoin.

Bitcoin Faces Vital Second

Bitcoin is going through a important second as its worth fluctuates inside a slim vary, warns market analyst Michael Van de Poppe. With Bitcoin’s lows being taken once more, Van de Poppe believes that if it fails to recuperate quickly, it may take a look at help at $28,500.

Including to Bitcoin’s challenges is the expectation of a charge hike as a result of optimistic unemployment knowledge. This results in elevated hypothesis that the Federal Reserve will elevate rates of interest prior to anticipated. This might create a tougher financial atmosphere for cryptocurrencies.

If each main resistance traces of $29,600 and $28,500 give in to strain, a possible bull run within the quick time period may very well be at risk, probably leading to a retracement all the way down to the $27,500 resistance stage. This might symbolize a 9% pullback from the present stage of $30,200.

If such a situation had been to happen, it may take time for Bitcoin bulls to regain their present ranges. Previously, a interval of consolidation has usually adopted a pullback earlier than any additional continuation to regain misplaced ranges.

Nevertheless, regardless of Bitcoin’s challenges, so long as it may possibly maintain the $30,000 line, BTC bulls have the higher hand. On the time of writing, BTC is buying and selling at $30,200, down a slight 0.3% within the final 24 hours.

Featured picture from iStock, chart from TradingView.com