Ethereum’s latest ‘low’ – How ETH’s price action is affecting staking

- The variety of new ETH staked each day has dropped on the charts

- This may be attributed to the altcoin’s meek value efficiency

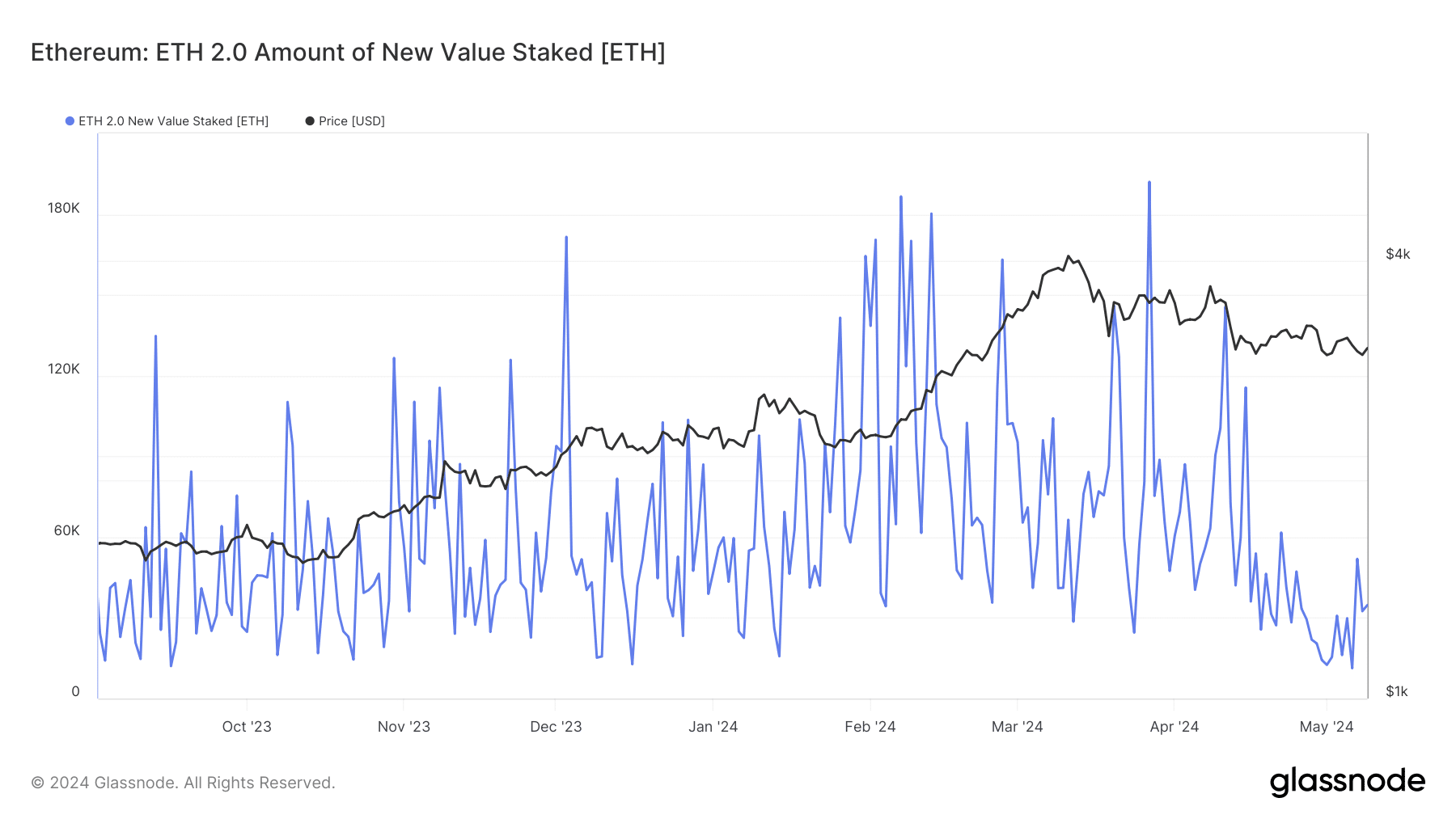

The each day quantity of latest Ethereum [ETH] staked fell to a year-to-date (YTD) low on 6 Could, based on Glassnode’s information.

Info from the on-chain information supplier revealed that the variety of cash transferred to the staking deposit contract deal with on that day totalled 11,285 ETH (valued at roughly $34 million). This determine marked a 92% decline from the YTD peak of 192,008 ETH cash staked on 28 March.

Supply: Glassnode

Assessed utilizing a 30-day transferring common, the quantity of latest ETH staked initiated its downtrend on 29 February, with the identical since down by over 85%.

Fall in ETH’s value to be blamed?

The crash within the each day quantity of latest ETH staked might be attributed to the altcoin’s value motion. The truth is, based on CoinMarketCap’s information, ETH was valued at $3,033 at press time, having shed 14% of its worth in simply 30 days.

When ETH holders “lock” up their cash, their rewards are usually paid out in ETH upon maturity or expiration of the staking interval. Subsequently, if ETH’s worth declines, the greenback worth of these rewards to which they’re entitled additionally falls.

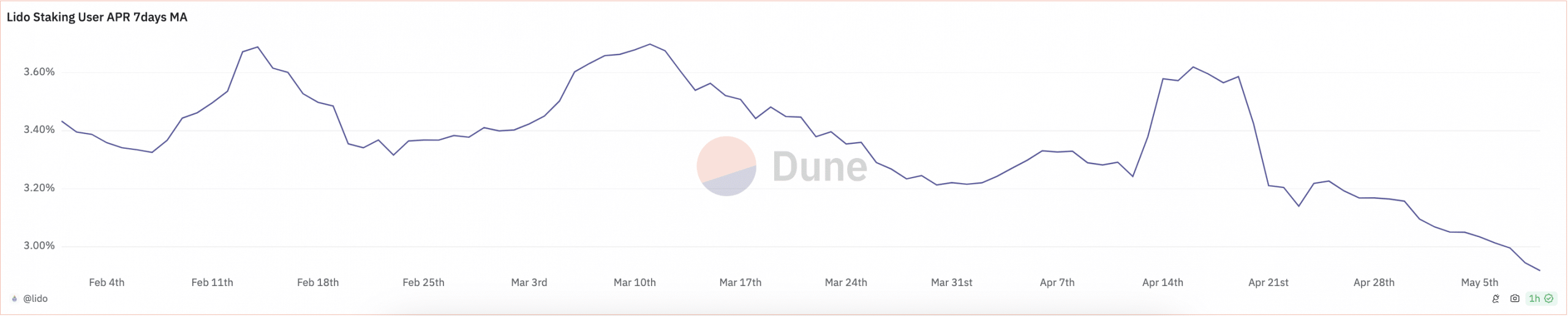

For instance, on the main liquid staking platform Lido Finance [LDO], its staking Annual Share Fee (APR) has trended south since 19 April. With a studying of two.9% on the time of writing, this has dropped by 19% for the reason that aforementioned date, based on information from Dune Analytics.

Supply: Dune Analytics

This will make staking a much less engaging enterprise to new buyers looking for returns.

Additionally, the coin’s short-term holders, identified to be the foremost drivers of day-to-day value motion, are sometimes paper-handed. This implies they’re prepared to promote at any sight of “hassle.” As such, they could be discouraged from staking their holdings if ETH’s value continues to drop, and so they might choose to promote their cash as a substitute.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Community validators are unmoved by low value motion

Regardless of ETH’s present efficiency, voluntary exits by its community validators have continued to fall. In keeping with Glassnode’s information, after rallying to a YTD peak of 2000 on 2 April, the each day rely of validators which have left the community has dropped by 61%.

Because of this, the variety of lively validators on the community has continued to surge. At press time, there have been 994,000 lively validators on the Ethereum community.