Grayscale files spot AAVE ETF – Sparks institutional shift narrative

At the beginning of February 2026, Grayscale filed with the SEC to transform its Grayscale Aave Belief right into a spot AAVE ETF. The product would record on NYSE Arca and immediately monitor AAVE.

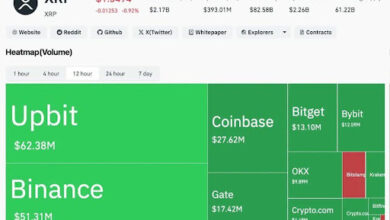

Notably, the proposal included a 2.5% sponsor price paid in AAVE, with Coinbase as custodian.

With AAVE close to a $1.8B market cap, the submitting shifted tone. This led to a tough query about institutional intent. Regardless of these developments, approval remained unsure.

Nevertheless, the sign was clear: conventional finance was watching intently.

Is AAVE getting into its institutional period?

Derivatives rebuilt. Weekly Energetic Addresses recovered. The token reclaimed ascending assist. In the meantime, Grayscale’s ETF submitting pulled establishments into the dialog.

As we progress into 2026, sustained energy above $148–$180 would verify growth.

Ought to the development proceed, institutional doorways might open wider, inserting AAVE nearer to the extent of consideration seen with Ethereum and Bitcoin.

Open Curiosity rebounds: AAVE reclaims ascending assist

Utility altcoins usually see consideration most occasions when Bitcoin bounces again from reversals. That’s precisely what occurred to this DeFi lending protocol token.

On the fifteenth of February 2026, as Bitcoin pushed closely towards $70K, danger urge for food returned throughout the market. AAVE reacted instantly.

It snapped again with energy whereas Open Curiosity expanded sharply, doubling from $153M to round $237M. In consequence, the value climbed over 22% from $106 and stabilized close to $128.

Supply: CoinGlass

On the day by day timeframe, AAVE reclaimed its long-term ascending assist. It had briefly misplaced that construction in early February. Holding above it dominated the breakdown a fakeout.

Supply: TradingView

Nevertheless, native resistance remained between $148 and $180. Failure to clear it will stall momentum. However the MACD confirmed the energy was actual with a bullish crossover. Clearing it uncovered $348–$398.

Weekly lively addresses bounce again up

AAVE’s Weekly Energetic Addresses climbed again to ranges seen in late 2024 and early Q1 2025. That restoration marked a decisive return in community participation. Specifically, consumer engagement expanded after a mid-cycle cooldown.

Supply: Token Terminal

Furthermore, rising on-chain interplay aligned with the derivatives rebound. This was not leverage alone driving exercise. Participation throughout the protocol strengthened the general backdrop.

Subsequently, the restoration carried extra weight than a easy speculative spike.

Remaining Abstract

- AAVE mixed structural restoration, rising Open Curiosity, and community development into one forceful rebound.

- Grayscale’s ETF submitting intensified institutional consideration, however resistance ranges nonetheless demanded respect.