HBAR’s rally to $0.42 hinges on THIS key resistance level – Details

- A technical inverse head-and-shoulders sample advised that HBAR could also be gearing as much as breach a vital resistance degree

- Each technical indicators and on-chain metrics flashed indicators of a possible rally

During the last 24 hours, HBAR has gained by 3.34% on the charts, constructing on a 6.86% hike in current weeks. Taken collectively, it is a signal of sustained progress, which by extension, might spotlight the opportunity of additional worth hikes sooner or later.

In truth, evaluation indicated that HBAR might surge by as a lot as 37% or extra if it efficiently breaks by way of the recognized resistance degree.

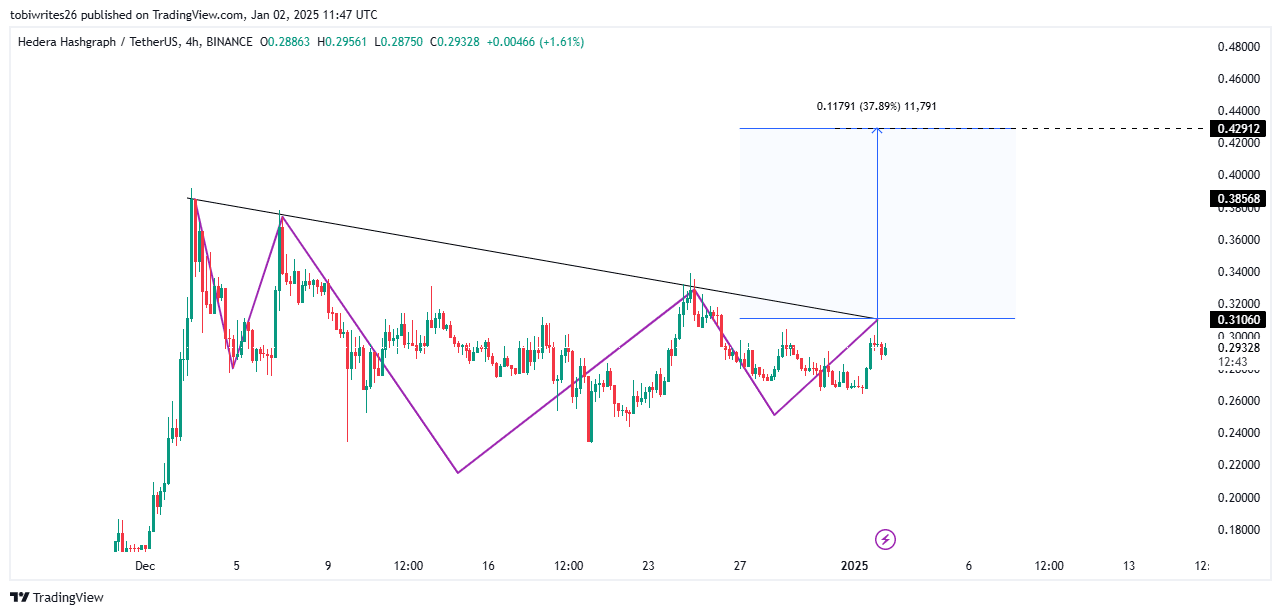

Vital resistance marks the ultimate hurdle for HBAR rally

On the time of writing, HBAR gave the impression to be buying and selling inside an inverse head-and-shoulders sample—A traditional formation that usually alerts an impending upward rally.

Nevertheless, for this bullish transfer to materialize, HBAR should first break by way of the important thing resistance, generally known as the neckline. A profitable breach of this degree might propel the crypto by 37.89%, pushing its worth to roughly $0.429.

Supply: TradingView

Whereas there’s an opportunity that HBAR’s worth might briefly stall earlier than crossing the resistance degree, technical indicators strongly advised an upward transfer could also be seemingly.

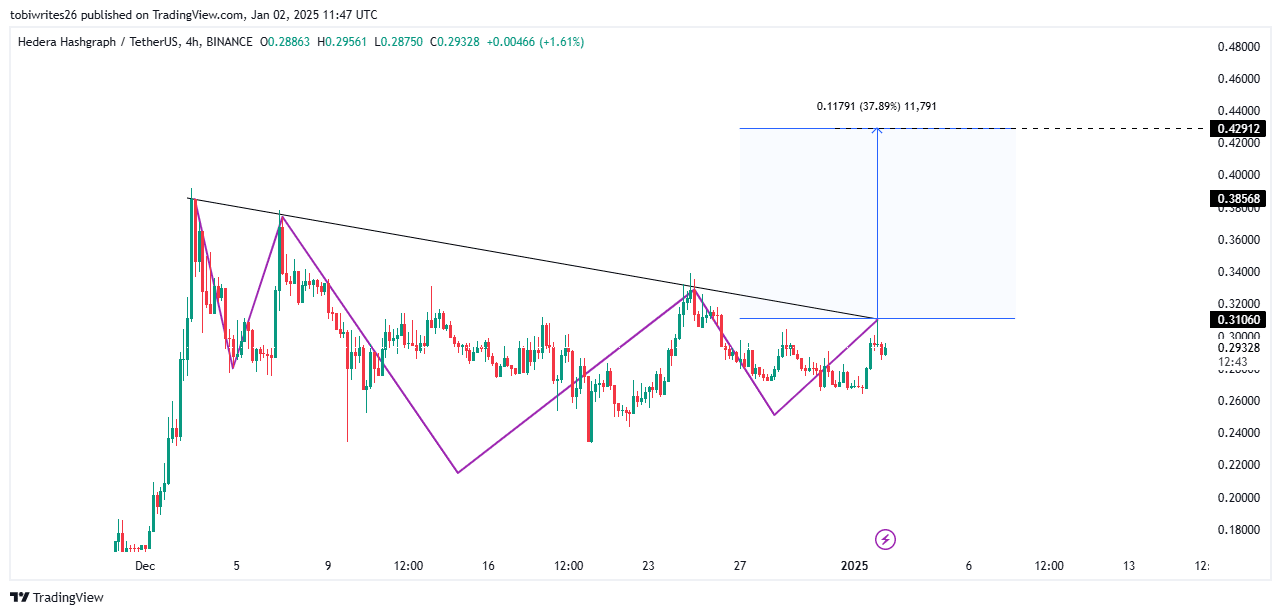

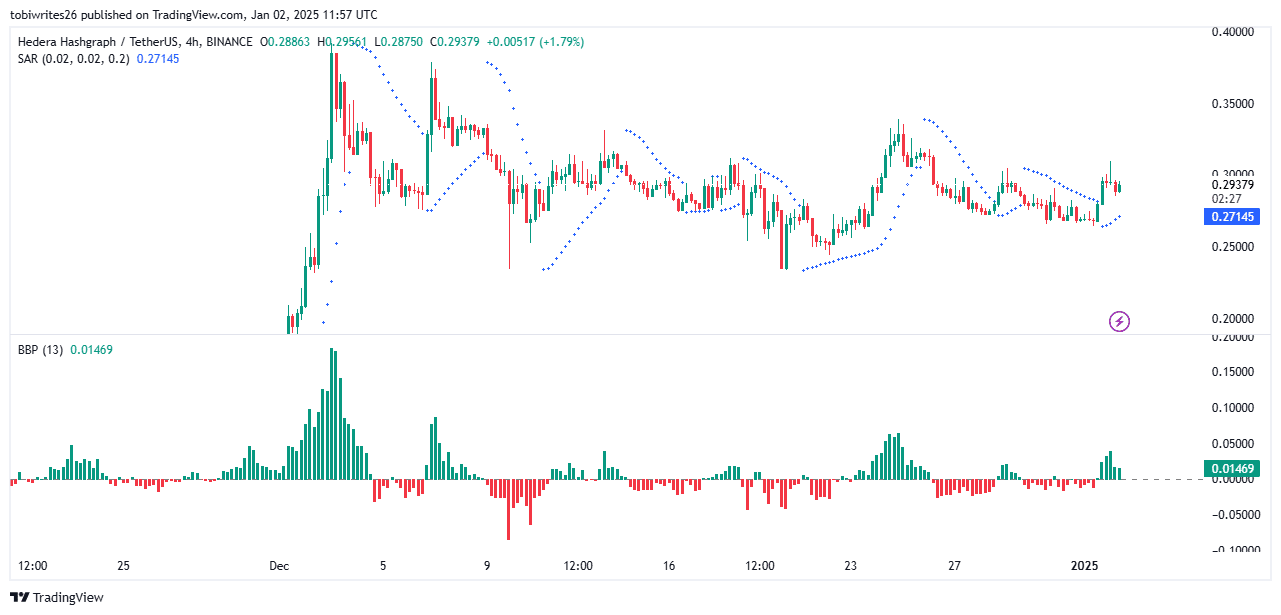

Indicators level to growing shopping for exercise

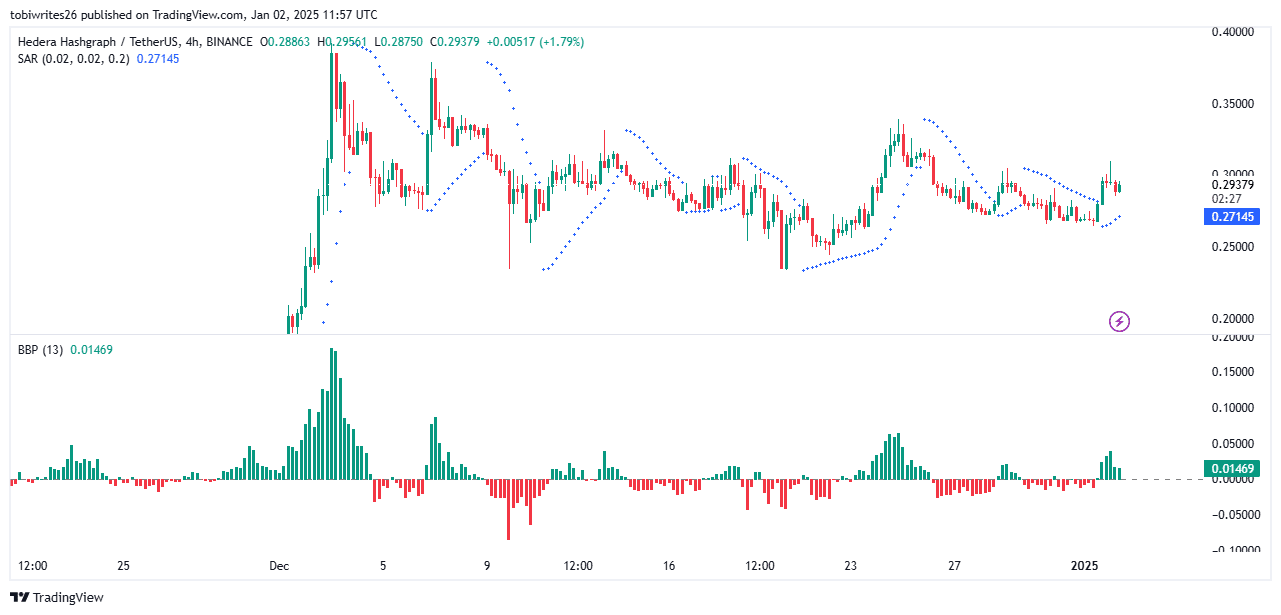

The Parabolic SAR (Cease and Reverse) indicator shaped its dotted markers beneath HBAR’s worth candles – An indication of an higher shopping for exercise and the next probability of a rally.

If these dots proceed to look beneath the value candles, it might imply sustained upward momentum, doubtlessly resulting in new greater highs as HBAR developments in the direction of its worth goal.

Supply: TradingView

Equally, the Bull Bear Energy (BBP) displayed six consecutive inexperienced histogram bars, indicating that bullish merchants have been the driving pressure behind HBAR’s current progress.

Ought to the variety of bullish histogram bars enhance additional, it might reinforce expectations of a continued worth hike. This is able to additionally suggest heightened confidence in HBAR’s upward trajectory amongst merchants.

Extra underlying shopping for stress

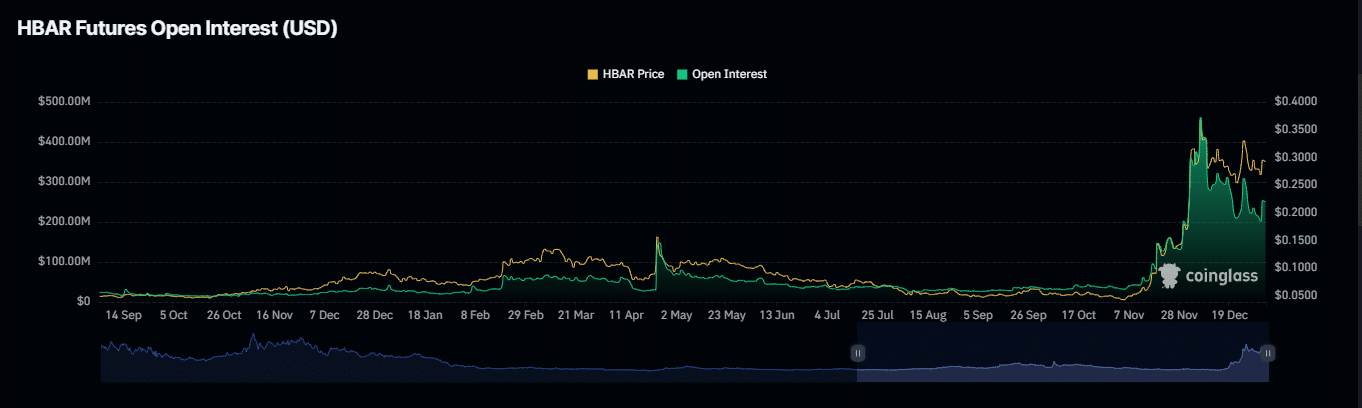

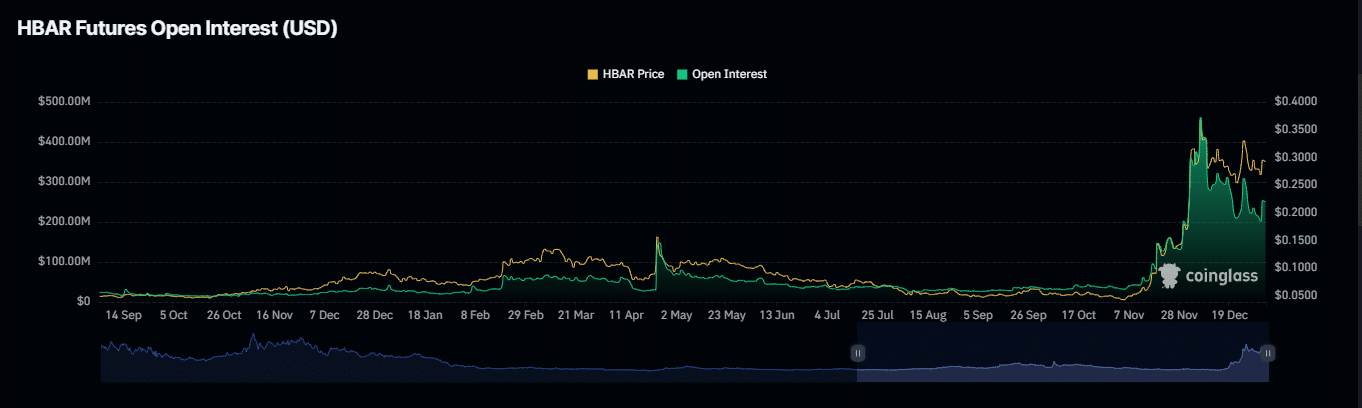

During the last 24 hours, HBAR has seen a notable enhance in Open Curiosity (OI). In truth, knowledge from Coinglass underlined a 9.90% hike, bringing the whole OI to $269.71 million.

Such a surge often signifies an uptick within the variety of unsettled by-product contracts tied to HBAR. Mixed with the asset’s 3.34% worth beneficial properties and a constructive funding fee, it meant {that a} majority of those contracts are being held by lengthy positions.

Supply: Coinglass

The funding fee, which determines whether or not bulls or bears are paying a premium to keep up their positions, had a worth of 0.0125% at press time—A comparatively excessive worth. This alluded to a powerful degree of confidence amongst bullish merchants, growing the probability of sustained upward worth motion.

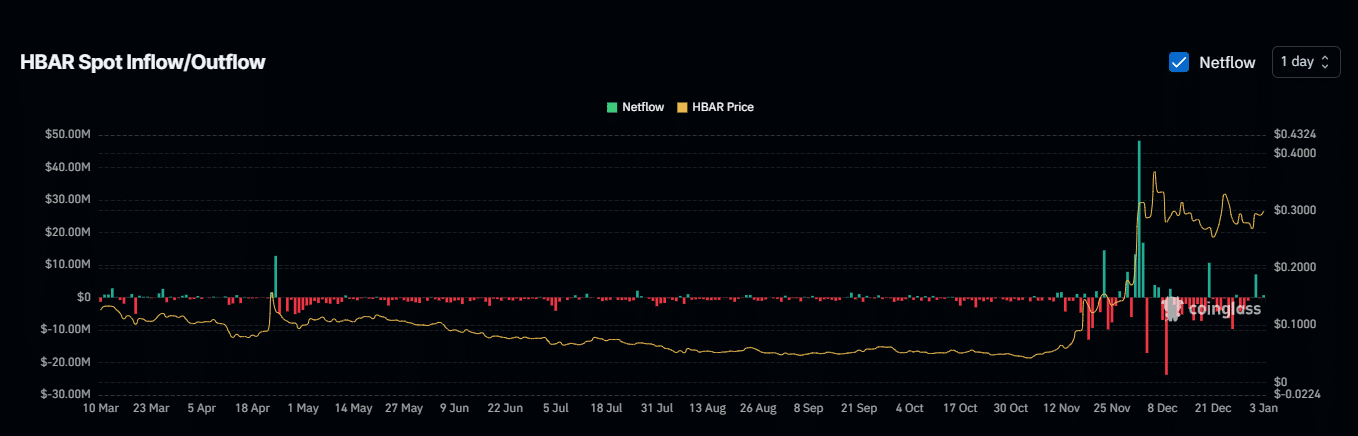

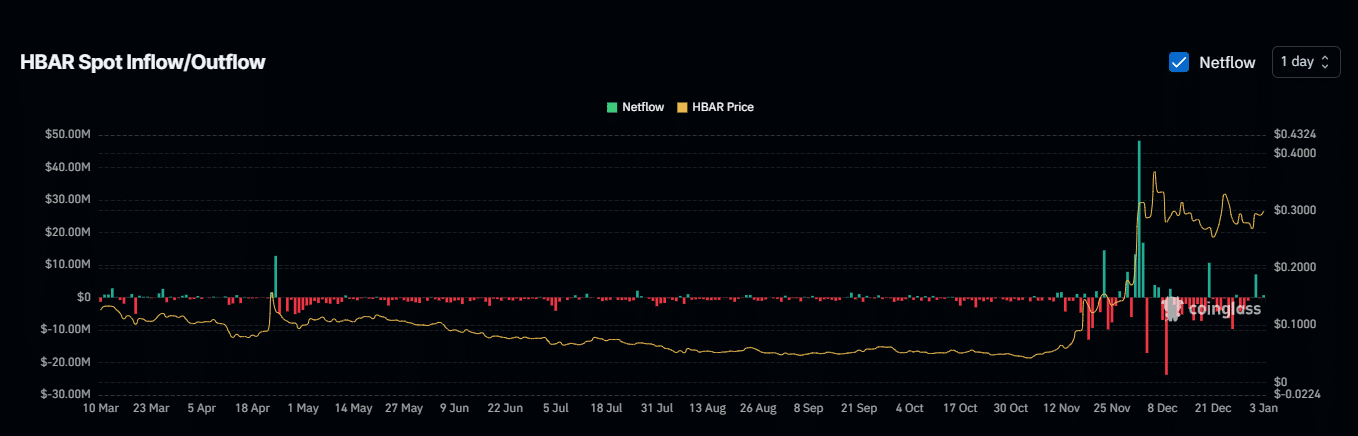

Nevertheless, on the time of writing, constructive trade netflows had briefly delayed HBAR’s breakout above the resistance neckline.

In accordance with Coinglass, $1.79 million price of HBAR was lately moved to exchanges – An indication of promoting exercise that has slowed the rally.

Supply: Coinglass

If netflows flip destructive—indicating merchants are withdrawing belongings from exchanges for long-term holding—HBAR might resume its upward trajectory and doubtlessly breach the essential resistance degree.