Here’s how Bitcoin long traders could be trapped by leverage-driven pump

- Bitcoin noticed leverage-driven pump as OI rose to $27.9 billion, marking a $3.3 billion hike

- Weak demand noticed Bitcoin traders flash indicators of warning

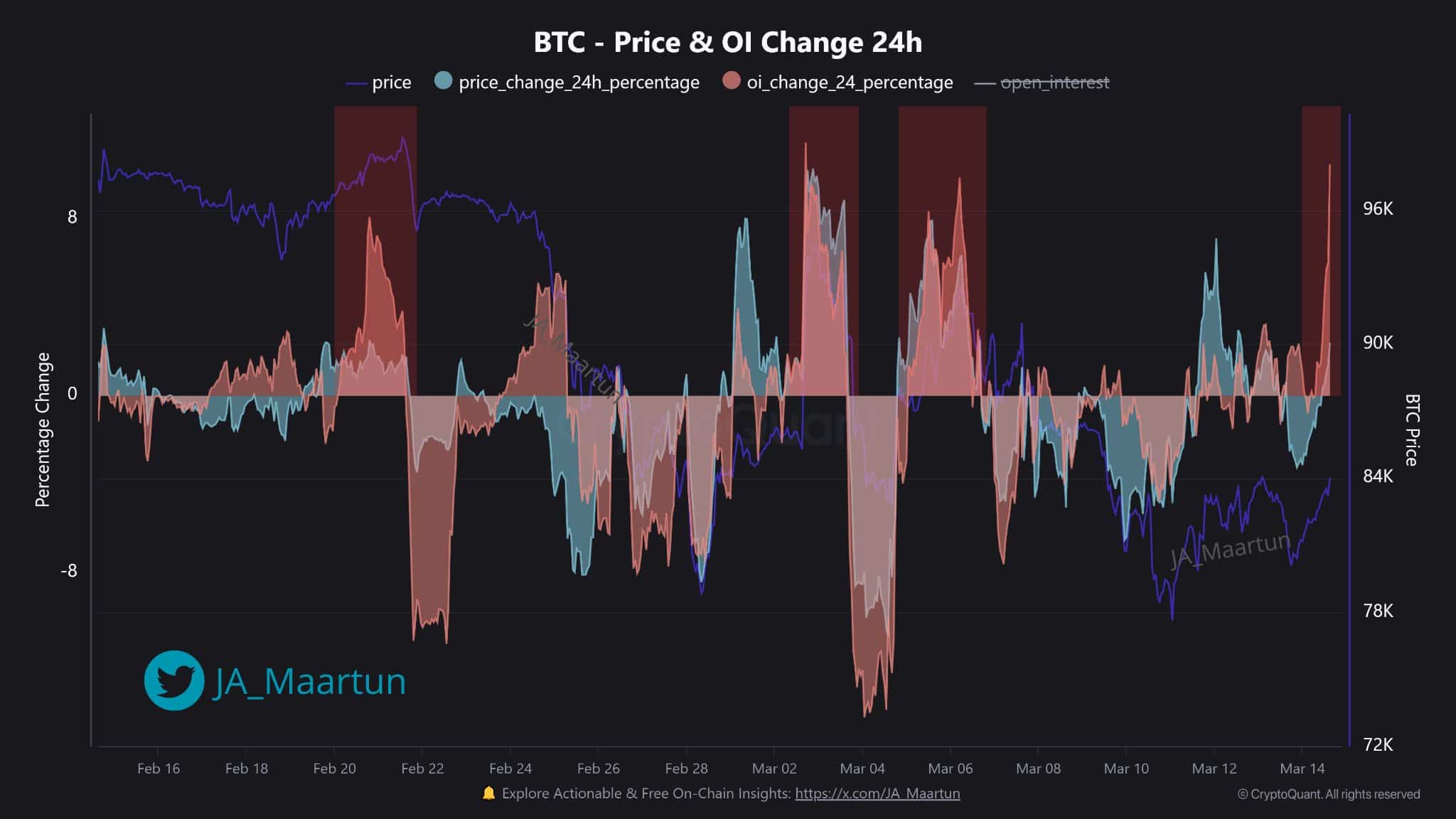

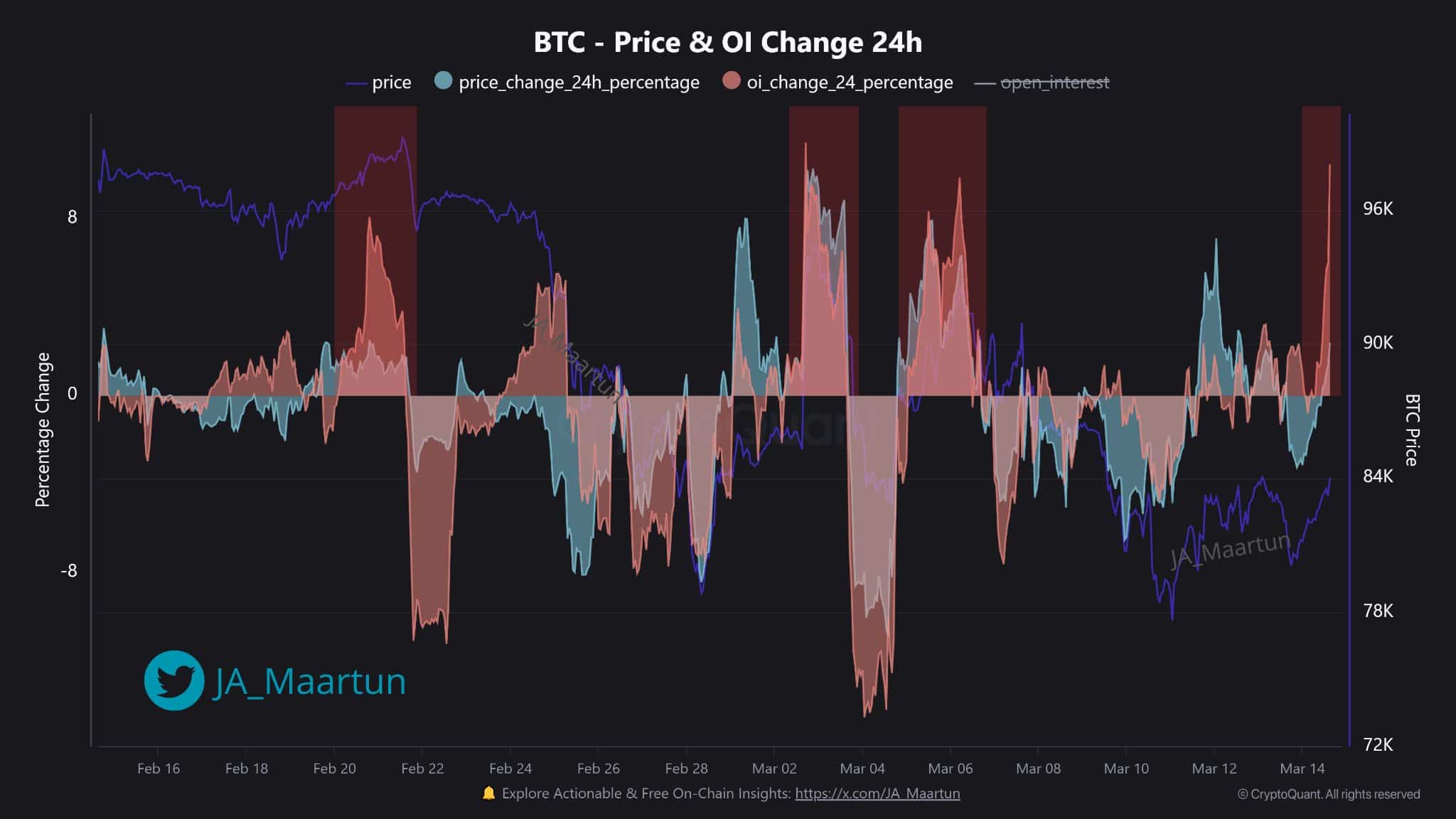

Bitcoin’s [BTC] Open Curiosity (OI) climbed to $27.9 billion, indicating a hike in leveraged market actions following a $3.3 billion pump – A 13% increase.

Earlier upticks in Open Curiosity led to unpredictable worth fluctuations. This triggered market fluctuations that affected the cryptocurrency on each 20 February and 4 March. In actual fact, the leveraged-driven pump signaled merchants to handle danger.

At press time, Bitcoin appeared to be sustaining a buying and selling worth of roughly $83k, though extreme leverage might result in market liquidations. The depreciation of lengthy positions would set off a quick pullback of the value in the direction of the $70,000 to $80,000 vary.

Supply: X

When OI exceeded 10% previously, the value fell by 5-8%. The identical was seen again on 22 February and 06 March. The prevailing market situations create a gap for brief sellers to revenue from liquidations which will happen.

A sustainable worth hike above $90k might generate situations for added market development. An OI flush would possibly quickly take away present worth hikes whereas merchants have to be cautious about sudden adjustments in Open Curiosity.

How merchants are reacting to weak demand?

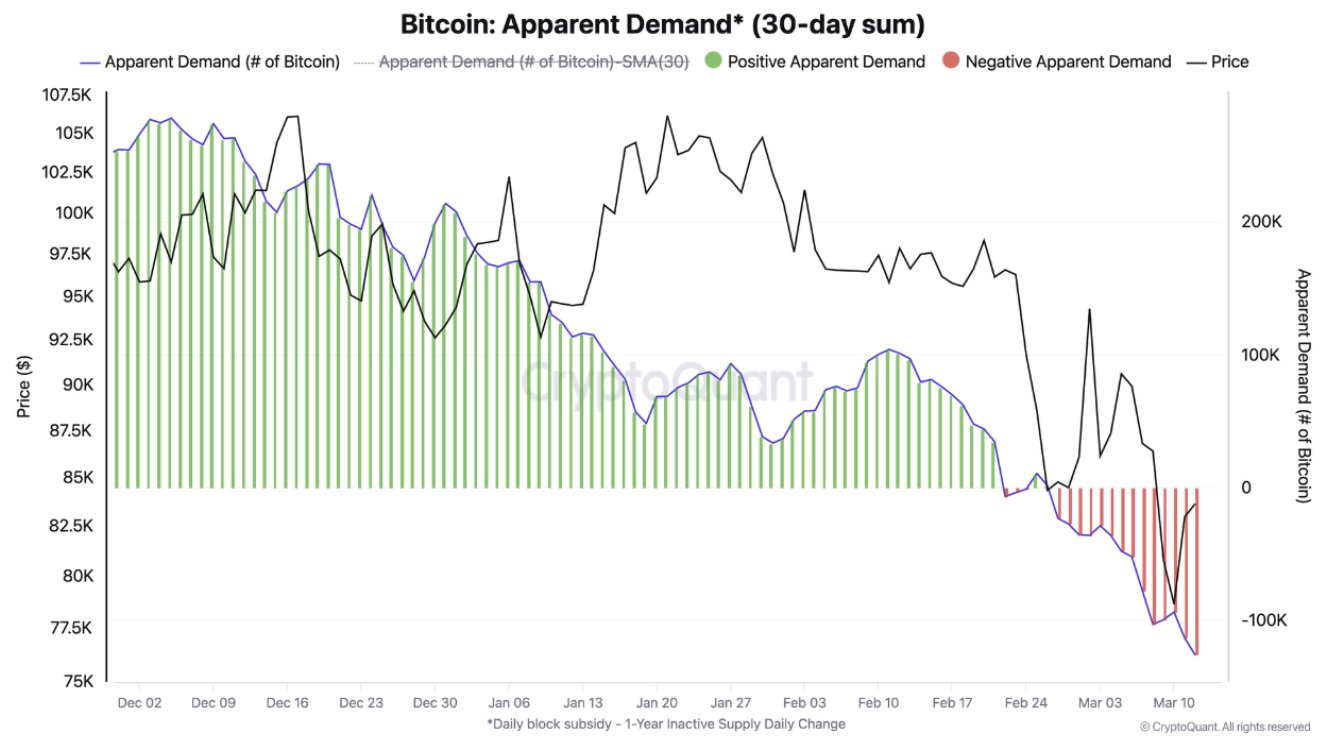

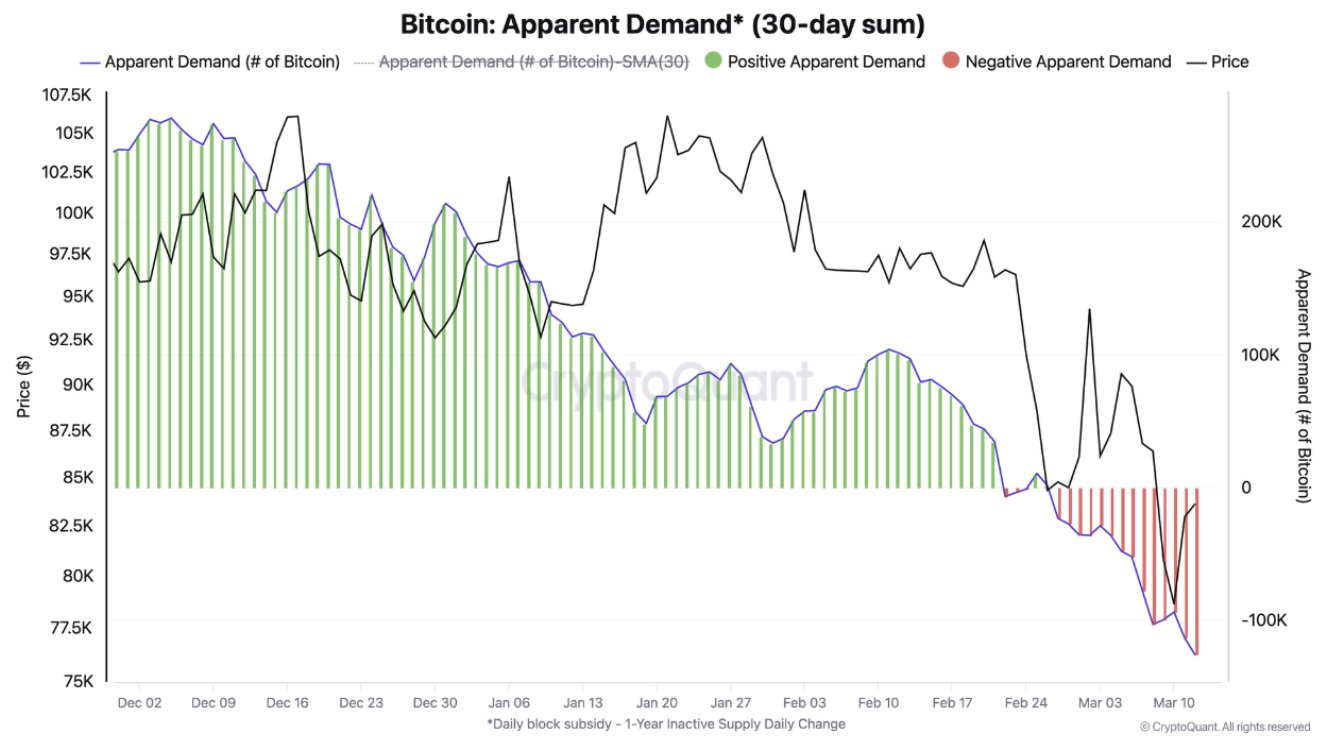

Once more, a big discount in BTC demand was seen from December 2024 to March 2025. Bitcoin buying and selling noticed a low annual demand of -100k BTC that occurred in mid-March 2025 after its most demand climbed to 105k Bitcoin in early December 2024.

The southbound in market worth, along with destructive demand zone construction, revealed robust investor warning. Circumstances turned extra unfavorable as a result of 30-day sum sustaining positions underneath the demand line as BTC’s worth fell from 105k to about 77k.

This hinted on the lack of particular investor motion info, though traders are inclined to safe their capital by buying defensive belongings which are much less dangerous. These include metals and U.S authorities bonds and secure digital forex USDT.

Supply: CryptoQuant

Market members are shifting investments to safer belongings throughout these unsure occasions as Bitcoin’s worth and market demand fall. Which means that BTC holders of lengthy positions might encounter important dangers since market situations seem to determine the muse for an anticipated bear market.

The market might additionally expose leveraged lengthy place holders to compelled sell-offs if the value drops to beneath the $80K-level and demand turns into destructive at -100k.

This might result in main losses occurring to holders since evaluation pointed to bearishness when demand stays beneath -100k since final December. Merchants who invested in BTC returning to above $100k might face losses.