Here’s how EIGEN is driving the future of Ethereum staking solutions

- EigenLayer’s deal with progress highlighted surging adoption with a 148.61% hike in new addresses

- Market sentiment stabilized as improvement exercise and MVRV ratios pointed to balanced buying and selling dynamics

Within the dynamic blockchain area, EigenLayer [EIGEN] has seen spectacular community progress, signaling its rising prominence amongst Ethereum staking options. The truth is, over the previous week alone, the platform has recorded a surge in new addresses, lively accounts, and total person engagement.

These developments, collectively, spotlight higher curiosity in EigenLayer’s choices, making it a standout performer within the Ethereum ecosystem. At press time, EIGEN was buying and selling at $3.69, following a slight 1.66% decline within the final 24 hours.

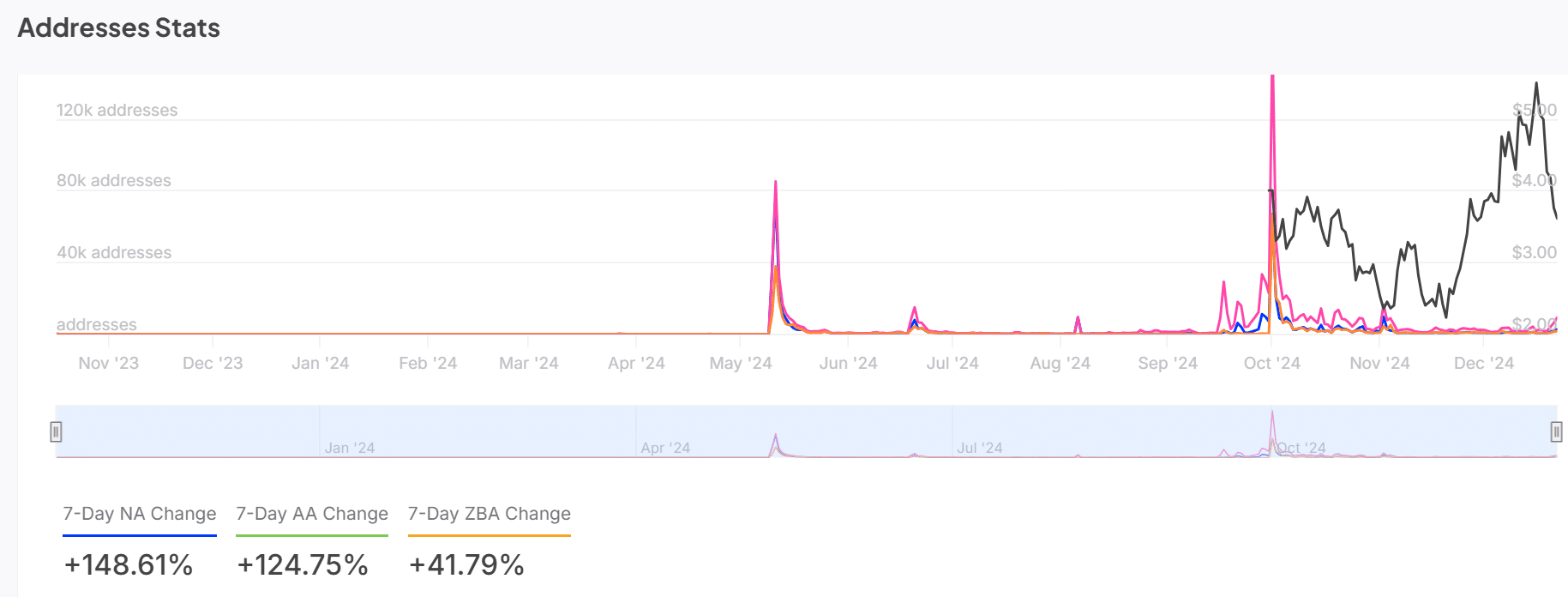

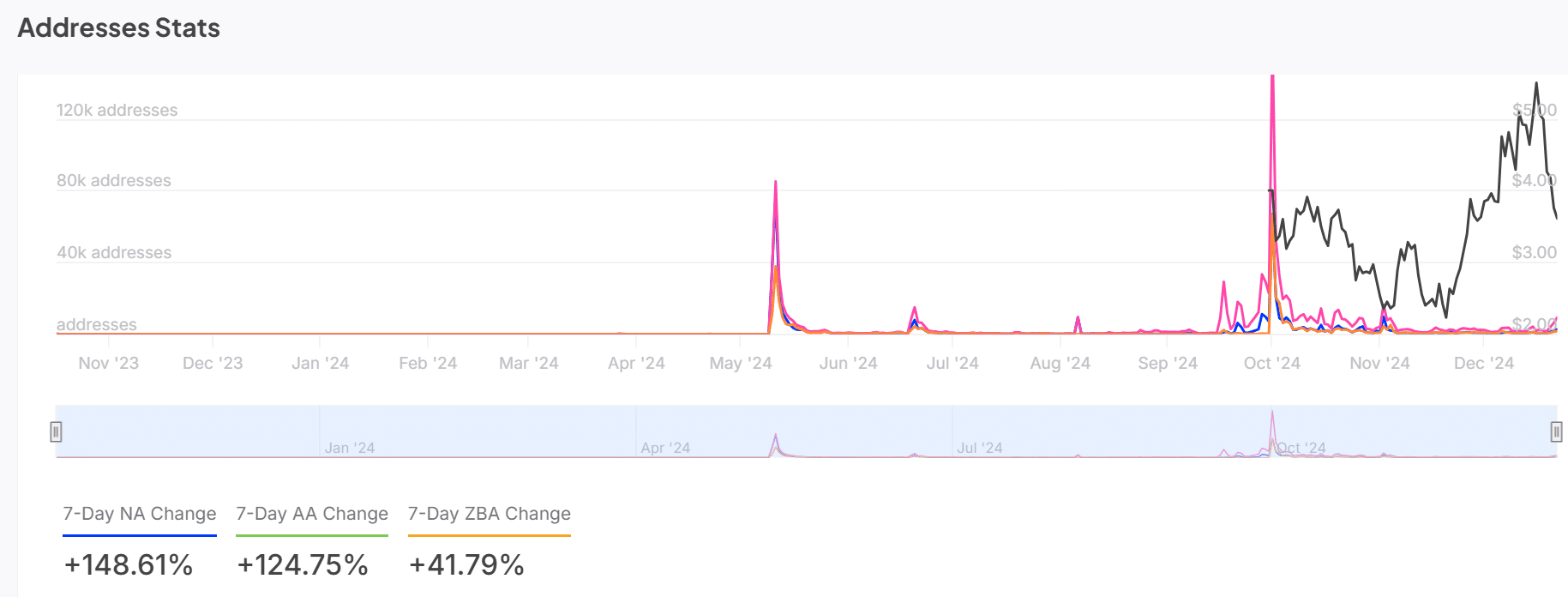

EIGEN deal with progress reveals increasing community exercise

EigenLayer’s deal with statistics highlighted a community noting fast progress and engagement. The 148.61% surge in new addresses mirrored an inflow of recent individuals, drawn to the platform’s revolutionary staking options.

Moreover, the 124.75% uptick in lively addresses underlined sustained exercise amongst present customers – An indication of sturdy retention. In the meantime, the 41.79% enhance in zero-balance accounts pointed to rising curiosity from potential buyers exploring the platform.

These mixed metrics will be seen to allude to EigenLayer’s increasing footprint within the Ethereum staking ecosystem.

Supply: IntoTheBlock

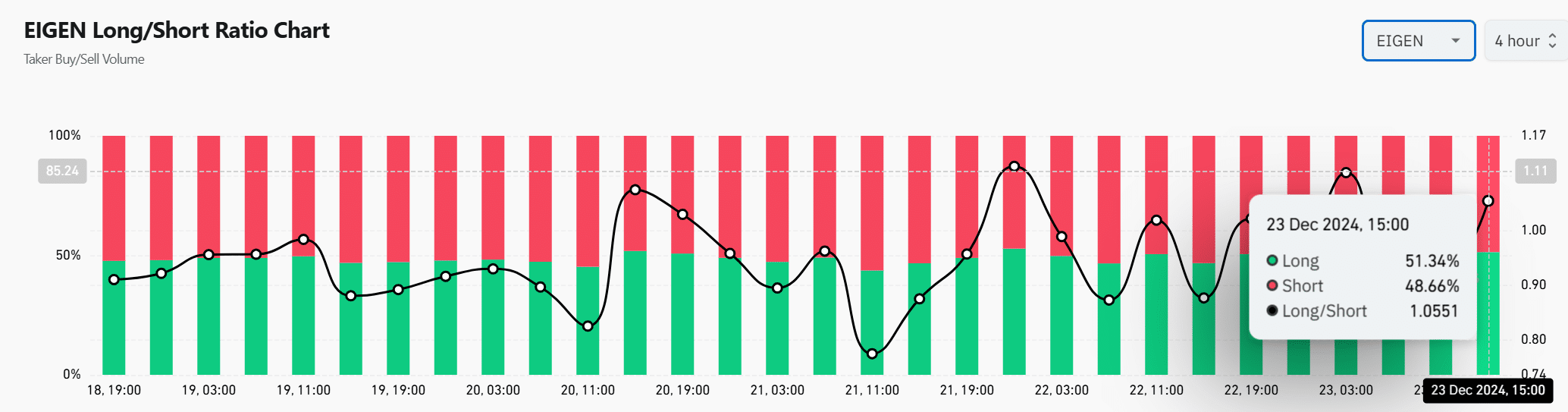

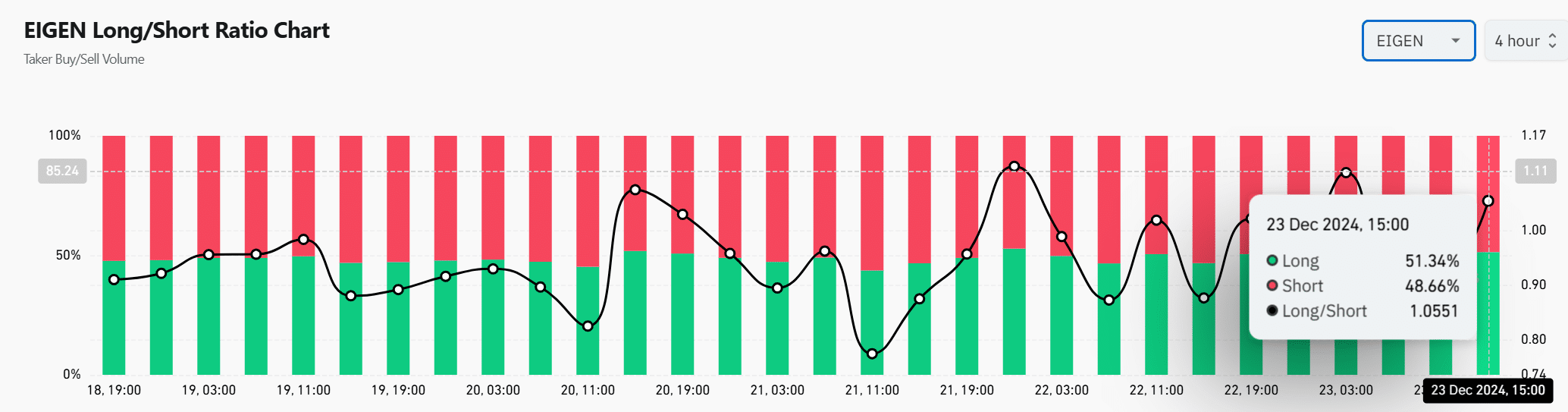

A balanced market sentiment?

The market sentiment for EIGEN has remained pretty well-balanced, because the lengthy/brief ratio indicated a near-equal break up. On the time of writing, 51.34% of positions had been lengthy, with 48.66% brief – Underlining a cautious but optimistic outlook amongst merchants.

Latest spikes in lengthy positions signaled that some buyers are betting on a possible worth restoration, regardless of its current volatility.

This stability recommended a market that’s rigorously weighing dangers and alternatives, with no excessive bias in the direction of both aspect. Such sentiment usually precedes vital strikes, making this a essential space to look at.

Supply: Coinglass

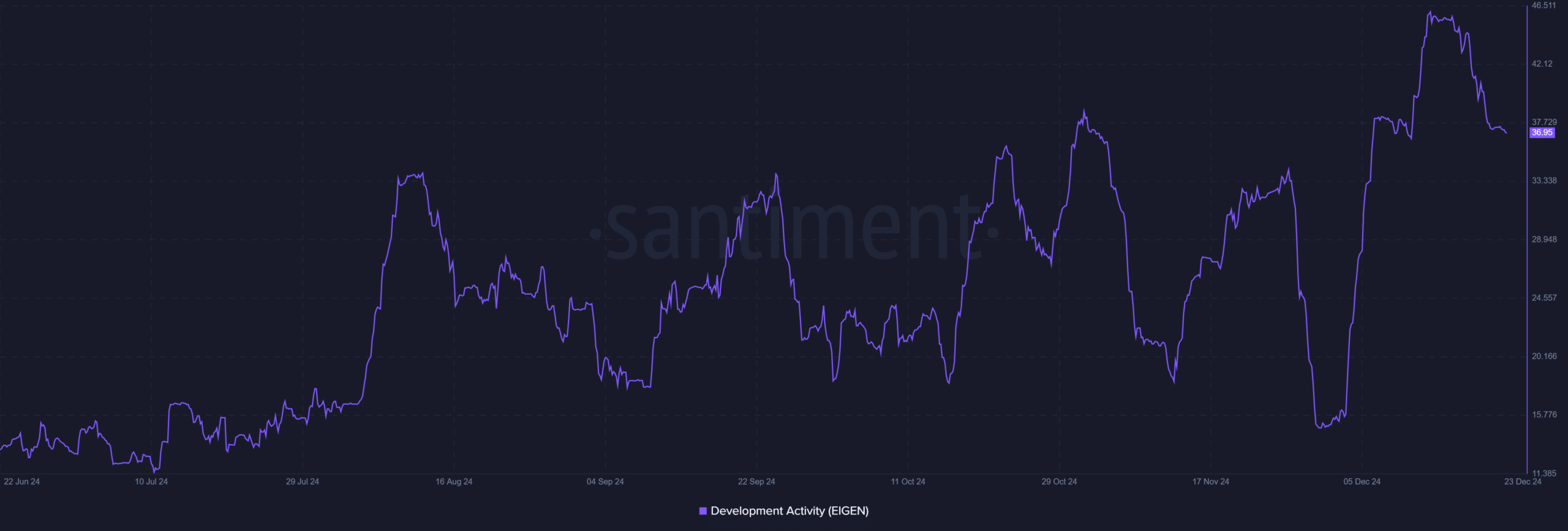

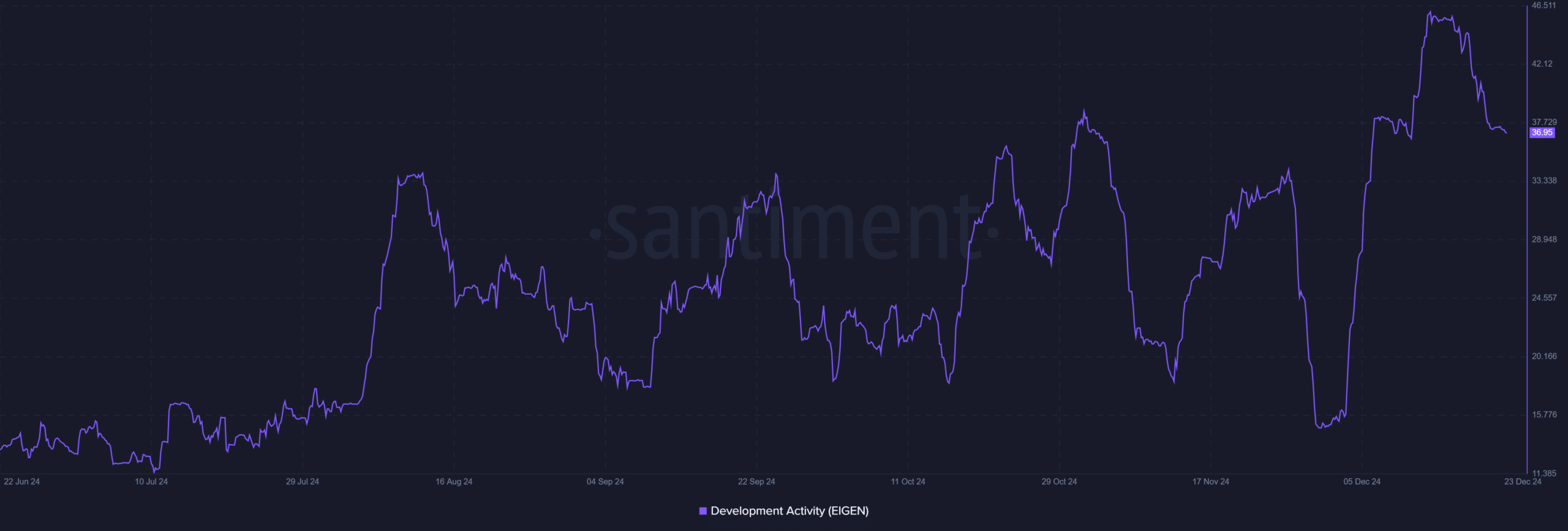

Regular improvement exercise reinforces innovation

Improvement exercise on EigenLayer has maintained a gradual tempo, with a press time rating of 36.95. Whereas not at its peak, this stage of exercise is an indication of steady enhancements and enhancements to the platform.

Common updates and improvements reassure customers and buyers of the mission’s long-term dedication to staying aggressive. Subsequently, EigenLayer’s constant improvement efforts present a strong basis for sustained progress within the Ethereum staking area.

Supply: Santiment

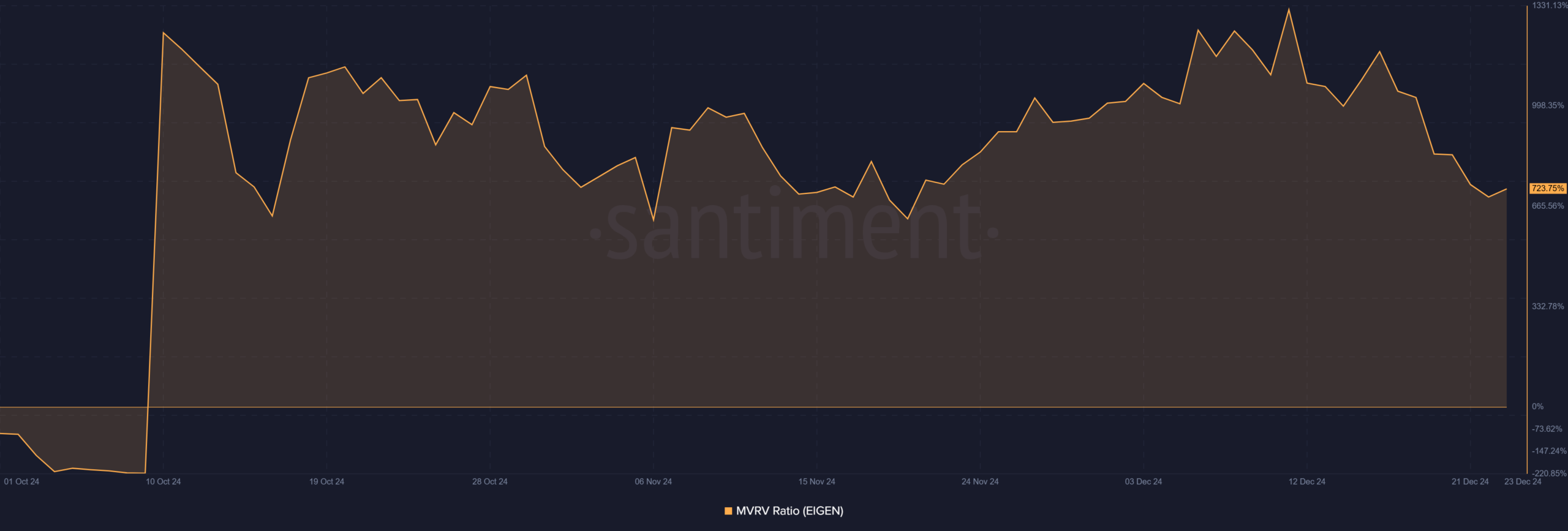

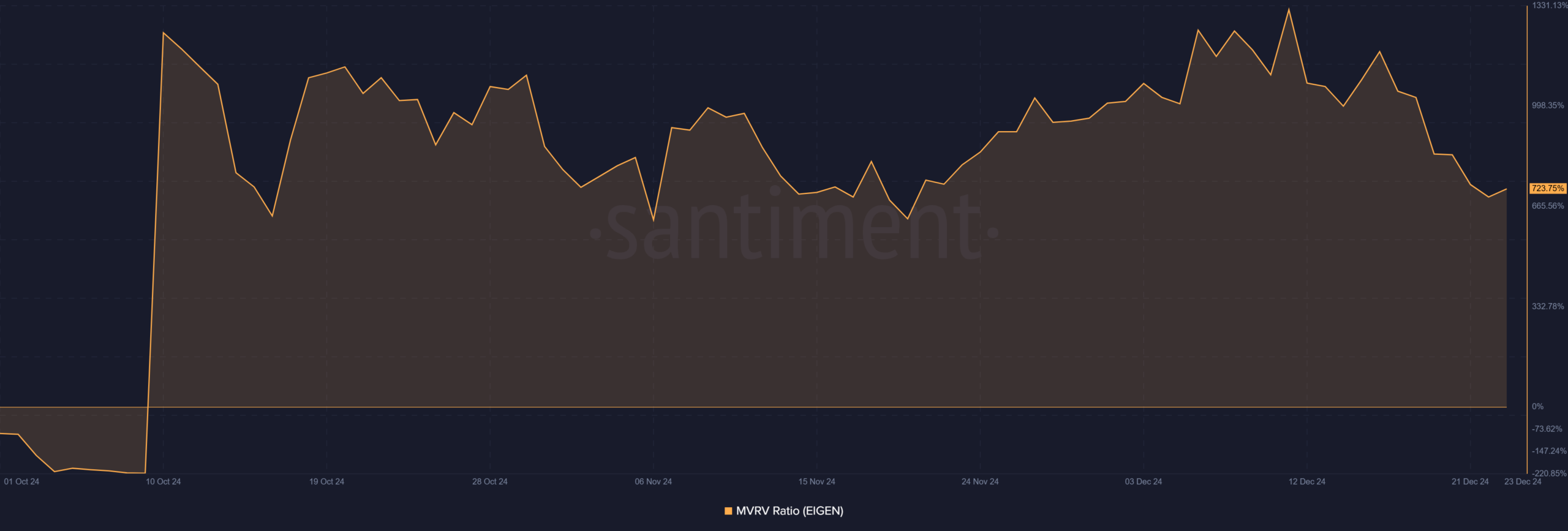

MVRV ratio indicators potential for profit-taking

The MVRV ratio, standing at 723.75%, recommended that many early adopters have had vital unrealized good points. Elevated MVRV ranges usually coincide with higher profit-taking, which may lead to short-term volatility.

Nonetheless, such exercise might also current a chance for brand new buyers to enter at cheaper price factors. This dynamic between profit-taking and recent shopping for may create an fascinating worth motion sample within the coming days.

Supply: Santiment

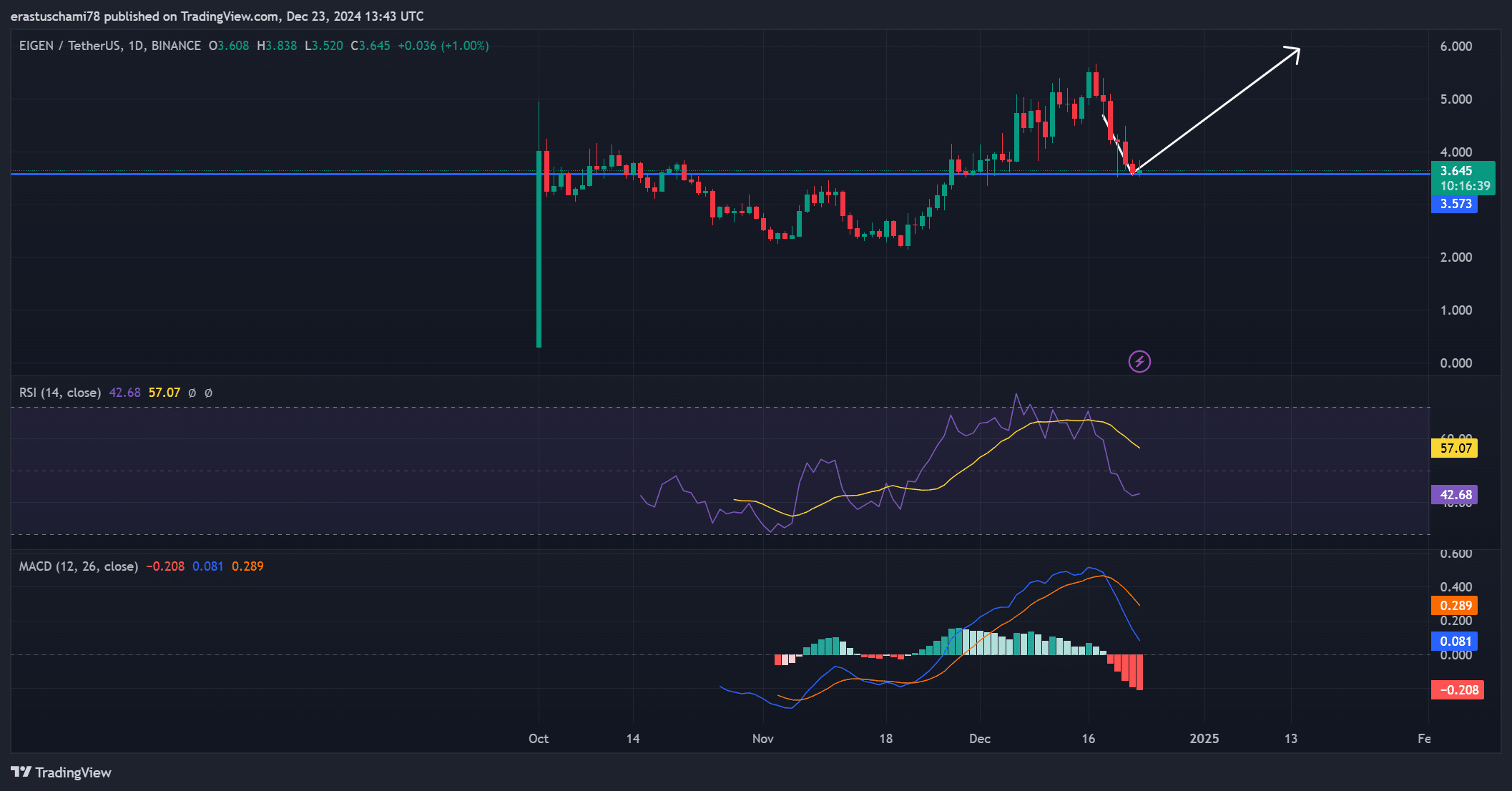

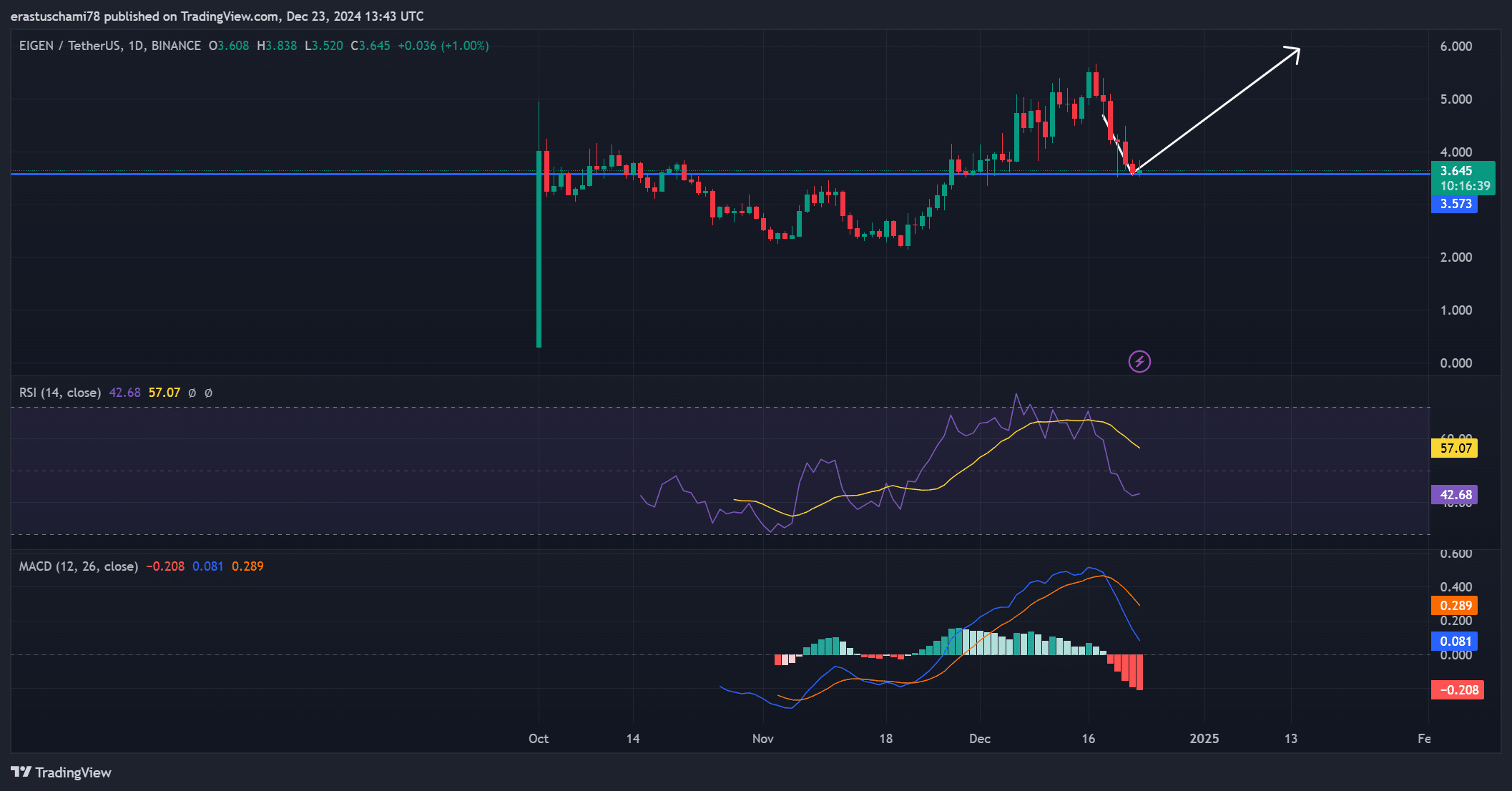

Potential for restoration?

Technical evaluation flashed blended indicators for EIGEN’s near-term worth trajectory. As an illustration – The RSI at 42.68 recommended that the token could also be nearing oversold territory, which regularly precedes a bounce.

In the meantime, the MACD indicated gentle bearish momentum, with a worth of -0.208. Nonetheless, with sturdy assist close to $3.57, EIGEN has the potential to stabilize and get better if bullish sentiment strengthens itself. Subsequently, a reversal in market sentiment may pave the best way for renewed upward momentum.

Supply: TradingView

Is your portfolio inexperienced? Try the EIGEN Revenue Calculator

EigenLayer’s sturdy deal with stats, balanced market sentiment, and constant improvement exercise underscore its rising relevance in Ethereum staking. Whereas short-term worth challenges stay, the platform’s spectacular metrics entail it’s well-positioned for sustained progress.