Here’s what Bitcoin miners are up to as they reel under sell pressure

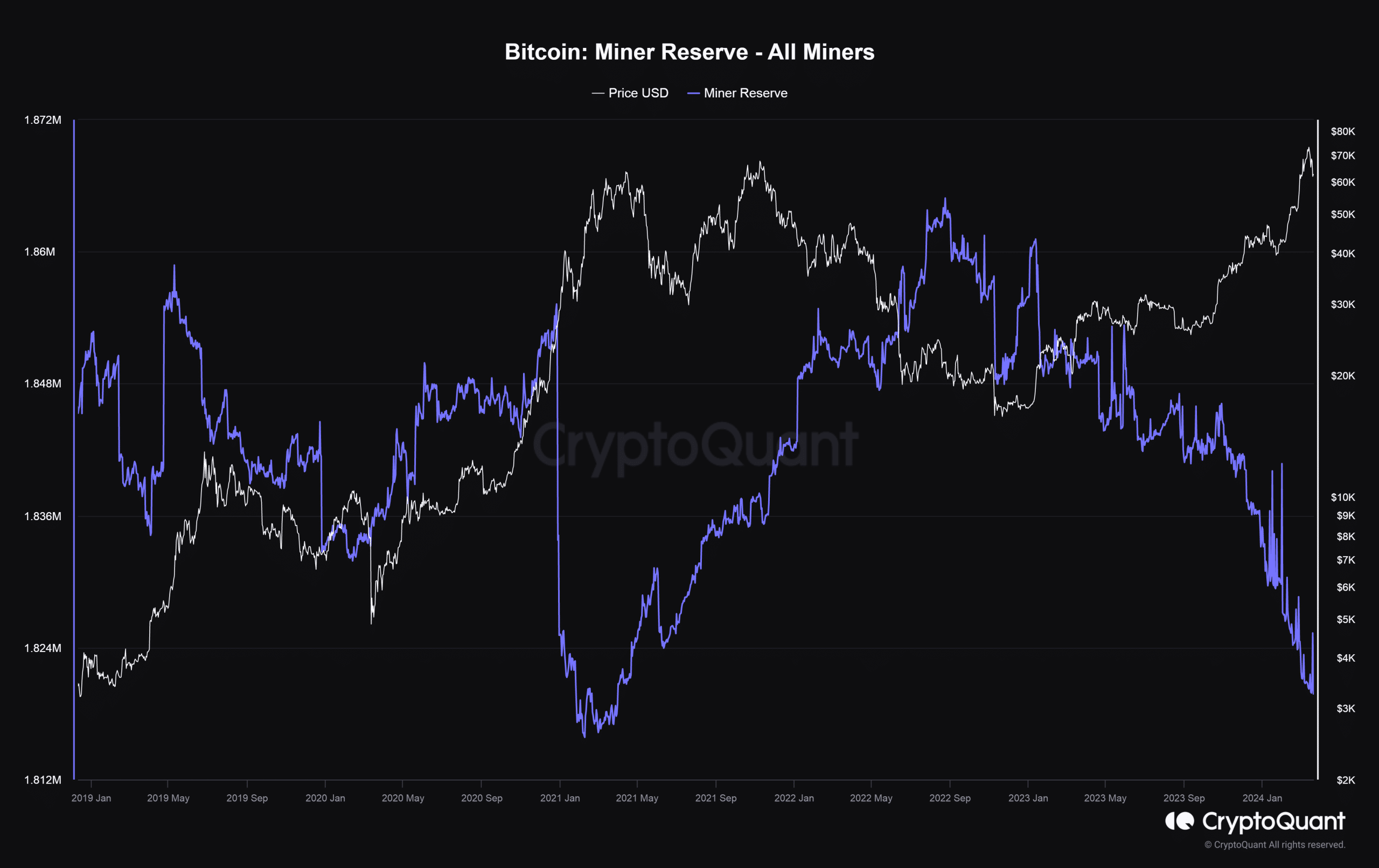

- Drop in miners’ reserves comes alongside Bitcoin’s worth beneficial properties.

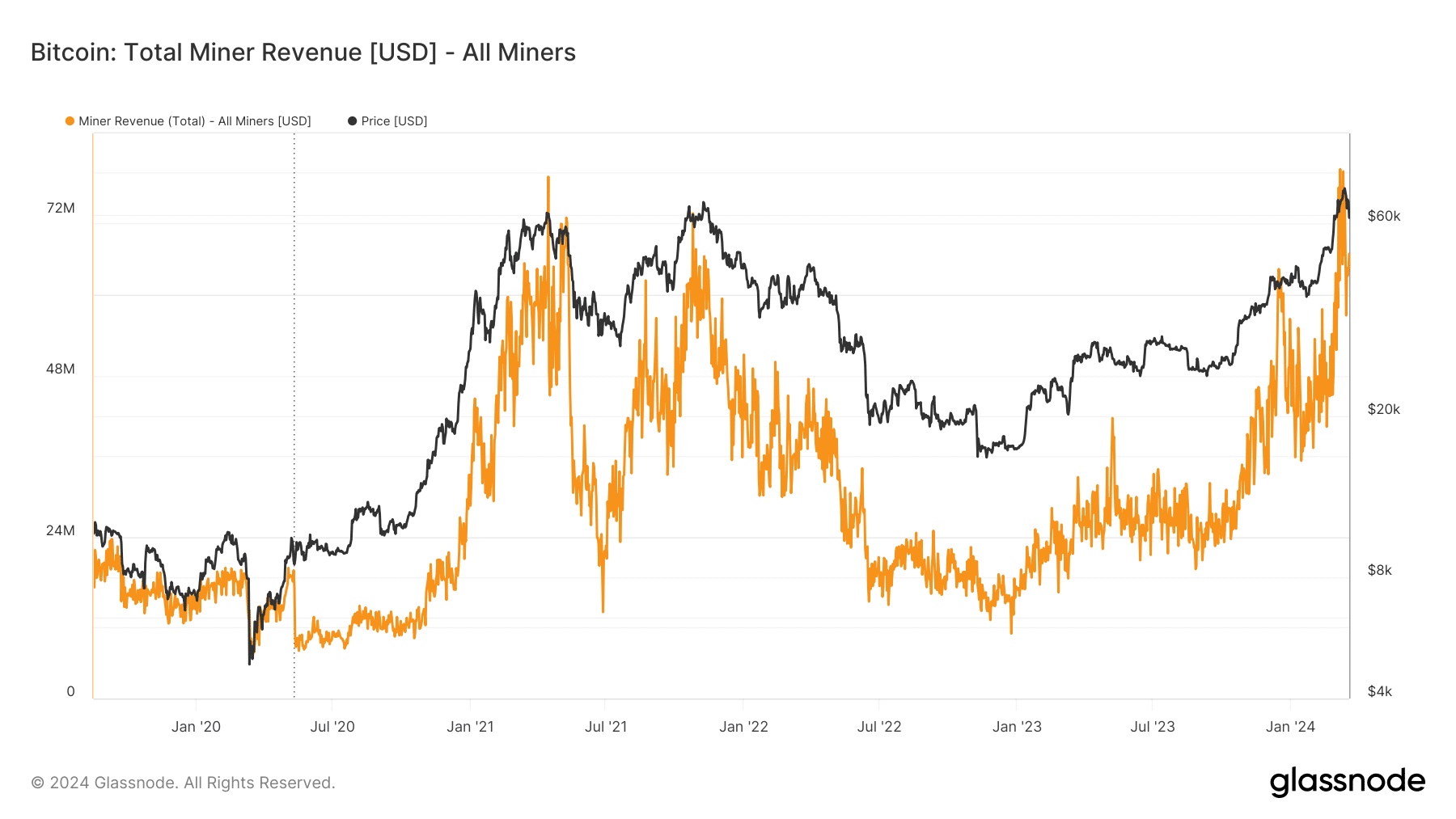

- Miners’ every day income spiked to its second-highest degree in historical past earlier this month.

The massacre out there continued as Bitcoin [BTC] plunged to a two-week low of $60.9k within the final 24 hours of buying and selling. Although the king coin recovered to $62k as of this writing, it was nonetheless beneath heavy promoting stress, having misplaced practically 15% of its worth over the week, in response to CoinMarketCap.

Amongst different elements, elevated liquidation of miners’ holdings might need contributed considerably to the hunch.

Miners go on promoting spree

In response to AMBCrypto’s examination of CryptoQuant’s knowledge, the quantity of Bitcoins held in miner wallets plunged to lows final seen practically three years in the past.

Supply: CryptpQuant

Miners, as we all know, continuously liquidate their holdings to cowl prices incurred in organising mining infrastructure. Nonetheless, such occasions find yourself exerting important downward stress Bitcoin;s worth. It is because miners are one of many largest holders of the asset.

Evidently, the decline turned steeper since November final 12 months. This was the time when Bitcoin arguably began its bull cycle, and miners capitalized on the upper returns to spice up their income.

Mining income surges

Miners’ earnings have soared considerably during the last 4 months, in response to knowledge from Glassnode. In truth, the every day income, comprising of transaction charges and stuck block subsidy of 6.25 BTCs, spiked to its second-highest degree in historical past on the seventh of March.

Supply: Glassnode

Nonetheless, with the upcoming halving set to cut back rewards to three.125 cash per block, miners have been anticipating a big hit to their income streams.

It was possible that miners have been elevating funds to purchase less expensive mining tools, which might assist them offset the income loss after halving.

Learn BTC’s Value Prediction 2024-25

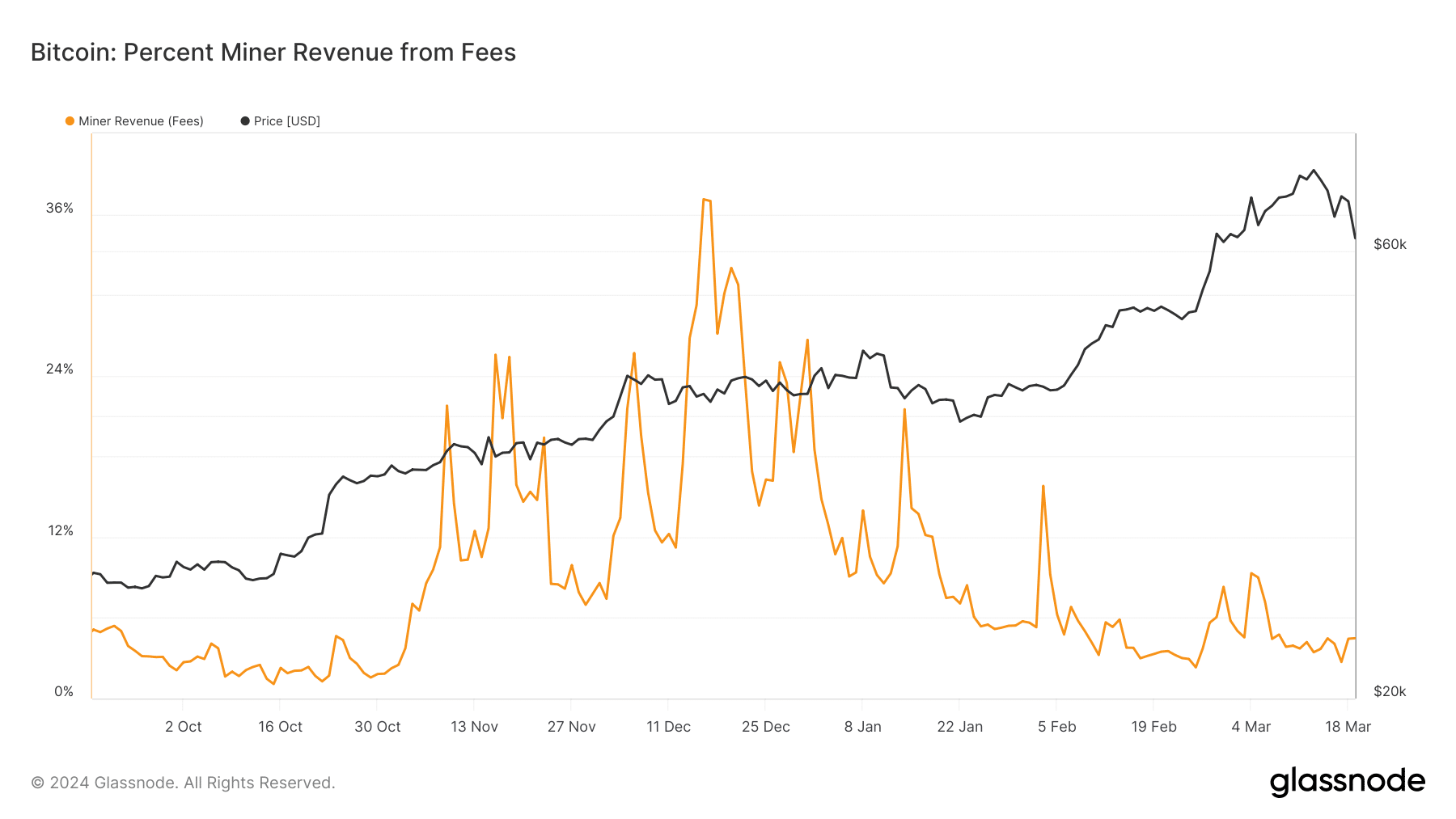

Miners not amassing sufficient charges

An even bigger concern for them was the plummeting price income. As of the nineteenth of March, transaction charges simply made by 4.45% of the full miner income on the day, a pointy and progressive drop from over 36% recorded throughout Inscriptions craze final December.

Supply: Glassnode