95% Bitcoin holders are in profit, but you should wait before selling

- BTC was up by greater than 10% within the final seven days.

- Metrics recommended promoting strain was low, and some indicators regarded bullish.

Bitcoin [BTC] showcased a bullish efficiency within the final week, as its worth surged by greater than 10%. Within the final 24 hours alone, the king coin’s worth went up by over 2%.

On the time of writing, BTC was buying and selling at $57,141.35 with a market capitalization of over $1.12 trillion. As per a latest tweet from IntoTheBlock, BTC’s latest uptrend made 95% of its buyers worthwhile.

This raised the probabilities of holdings getting liquidated. To examine whether or not the belief may come true, AMBCrypto took a have a look at BTC’s metrics.

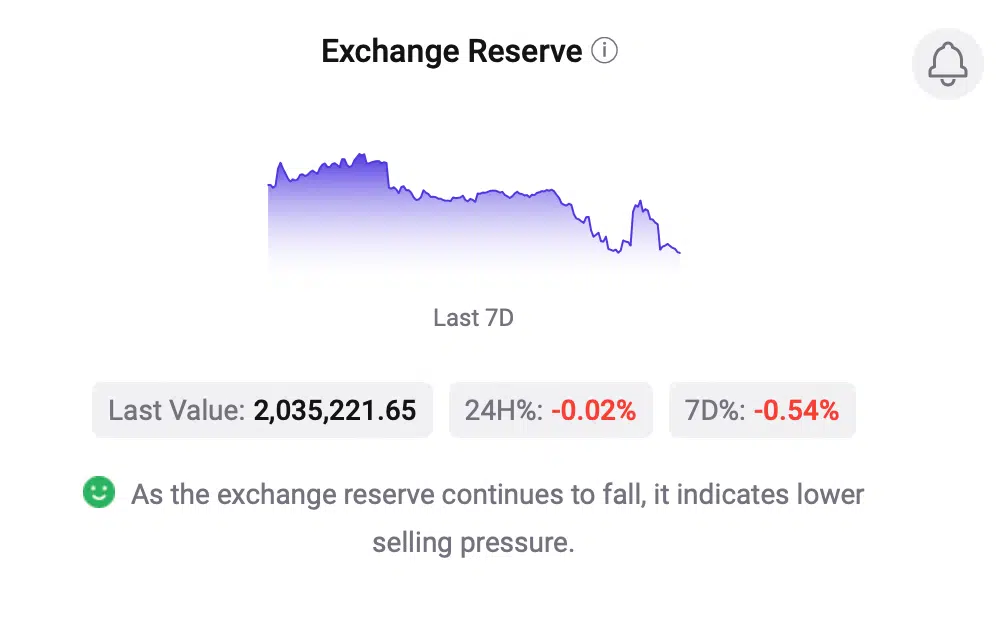

Our evaluation of CryptoQuant’s data revealed that Bitcoin’s alternate reserve was dropping at press time. This meant that promoting strain was not excessive.

Its Coinbase premium was additionally within the inexperienced, that means that purchasing sentiment was dominant amongst US buyers on the time of the report.

Issues look bullish for Bitcoin

The probabilities of Bitcoin’s downtrend due to excessive promote strain regarded unlikely, latest knowledge confirmed. Thus, there have been elevated probabilities of BTC persevering with its bull rally.

Notably, the coin’s MVRV Z rating scored +2 for the primary time this bull cycle, which has traditionally risen throughout bull rallies.

Nonetheless, Philip Swift, the founding father of LookintoBitcoin, tweeted that there was nonetheless a protracted approach to go earlier than this cycle grew to become overheated.

Subsequent, to raised perceive the opportunity of a continued northward worth motion, AMBCrypto checked Bitcoin’s each day chart. Our evaluation identified that BTC’s MACD displayed a bullish crossover at press time.

This recommended that the bull rally may last more.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

On the flip aspect, although, BTC’s Relative Power Index (RSI) was within the overbought zone.

Its Chaikin Cash Circulate (CMF) additionally registered a slight downtick, which indicated that the opportunity of a worth correction within the brief time period can’t be dominated out.