Here’s why Bitcoin’s 15% spike in Open Interest signals caution

- Bitcoin’s OI made a outstanding 15.8% bounce because the weekly CME futures closed at $84K.

- BTC sliced by way of the 50-day SMA, with the following key hurdle being the 200-day SMA at $87K.

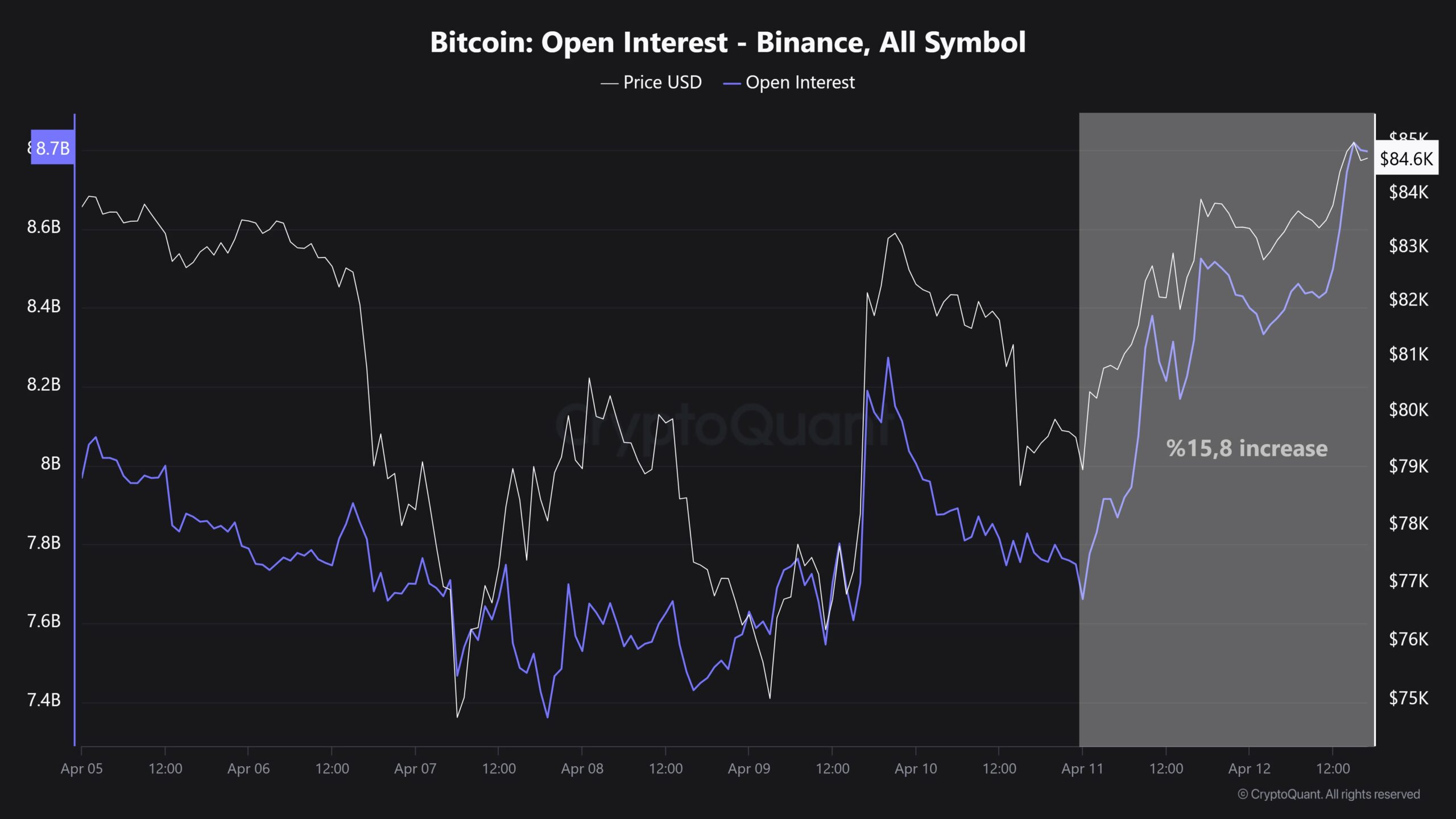

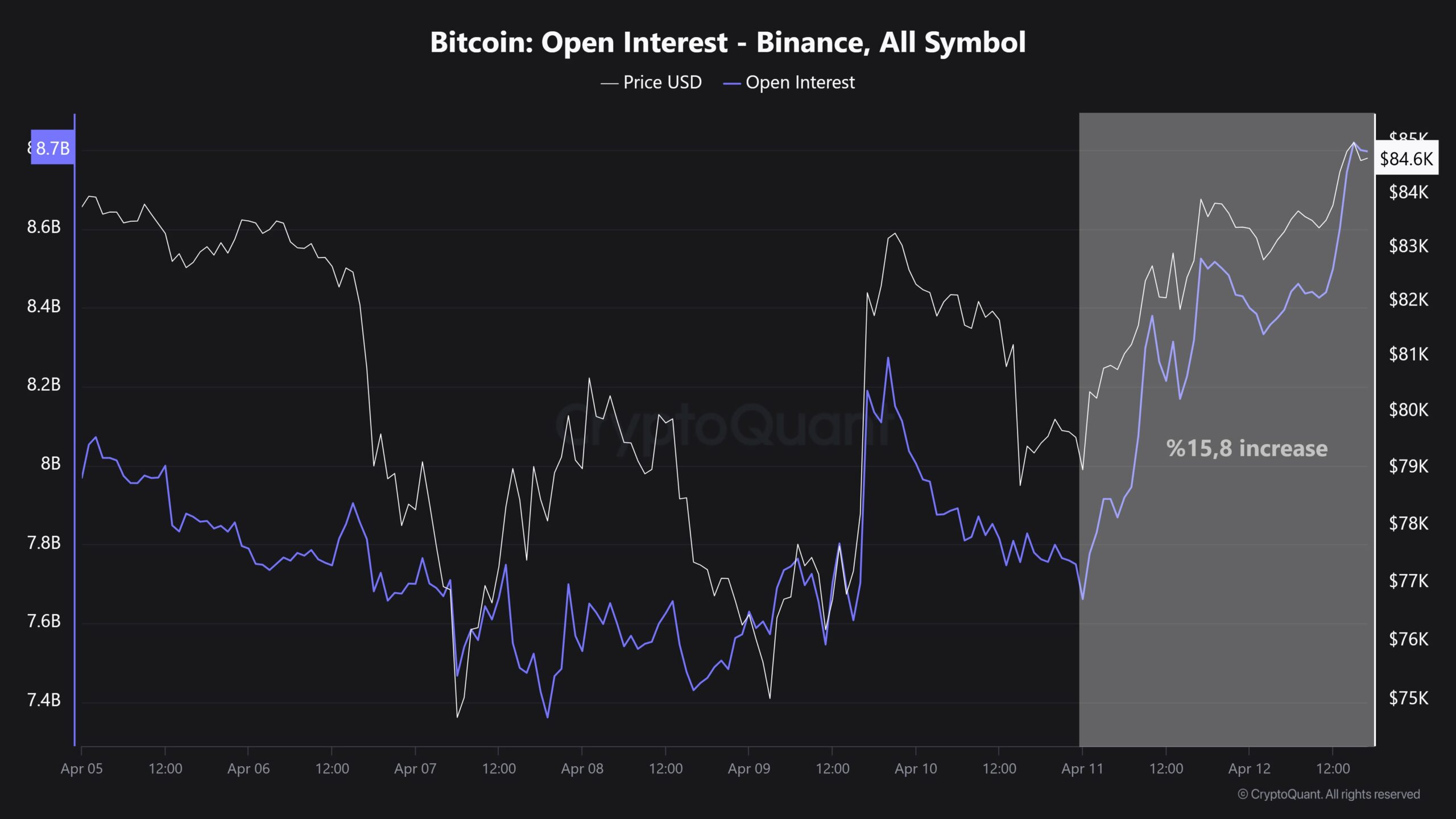

Binance’s Bitcoin [BTC] Open Curiosity (OI) noticed a 15.8% progress in a day, elevating it from $7.6 billion to $8.8 billion, at press time. The market and dealer engagement elevated considerably due to this fast $1.2 billion enhance.

Binance remained dominant in crypto derivatives buying and selling, as its OI place occupies 31.4% of the $28 billion whole OI capital.

Quick-rising OI signaled the danger of market volatility, as these wide-ranging liquidations may impression each prolonged lengthy and quick positions with excessive leverage.

Supply: CryptoQuant

A rise in OI usually signifies rising bullish sentiment; nonetheless, it might additionally set off opposing market actions or immediate aggressive place unwinding.

A pointy rise in OI could end in temporary value fluctuations, primarily pushed by shifts in market sentiment or failed makes an attempt to take care of crucial resistance ranges.

Leverage pushed pump and exercise

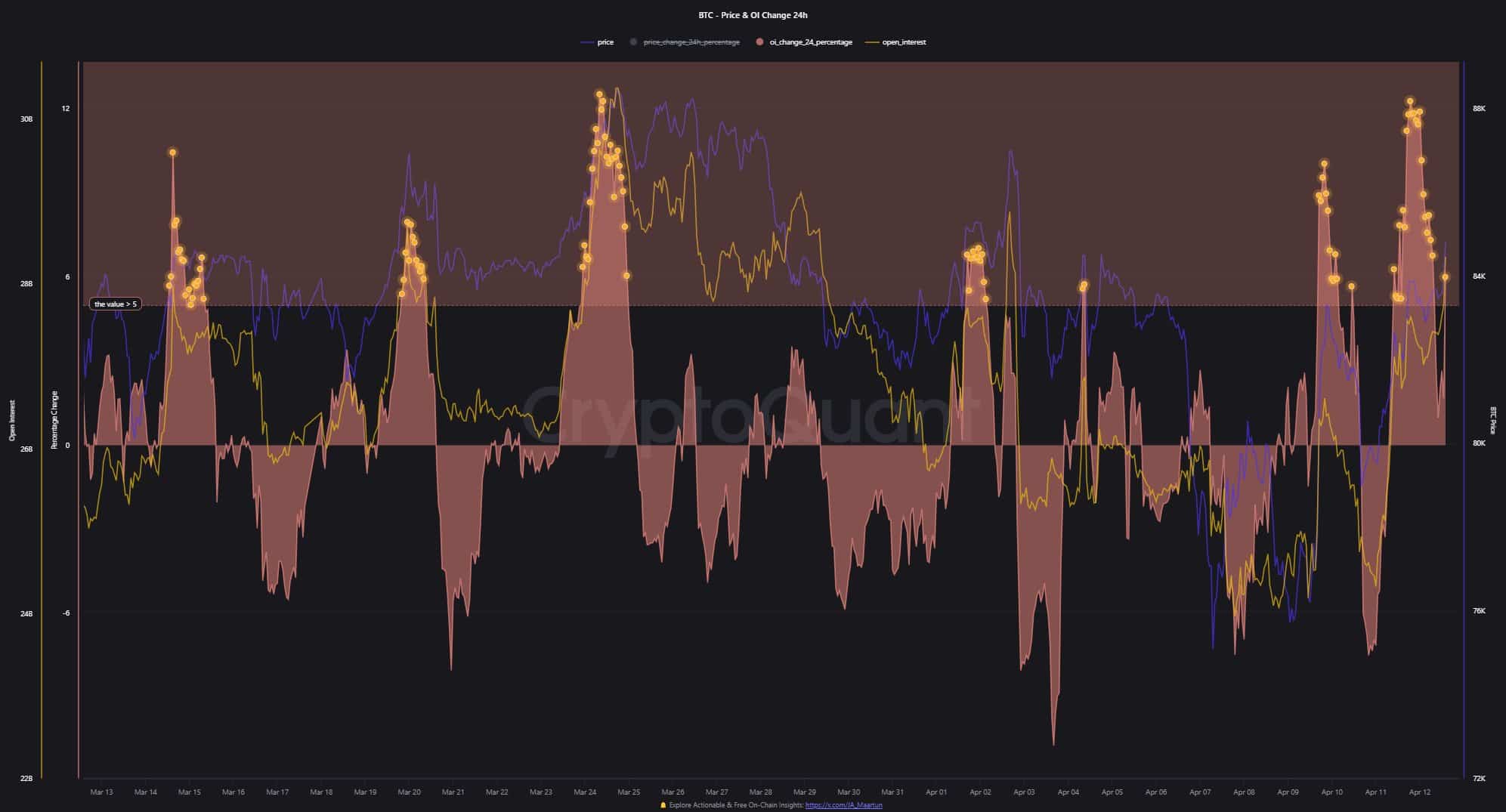

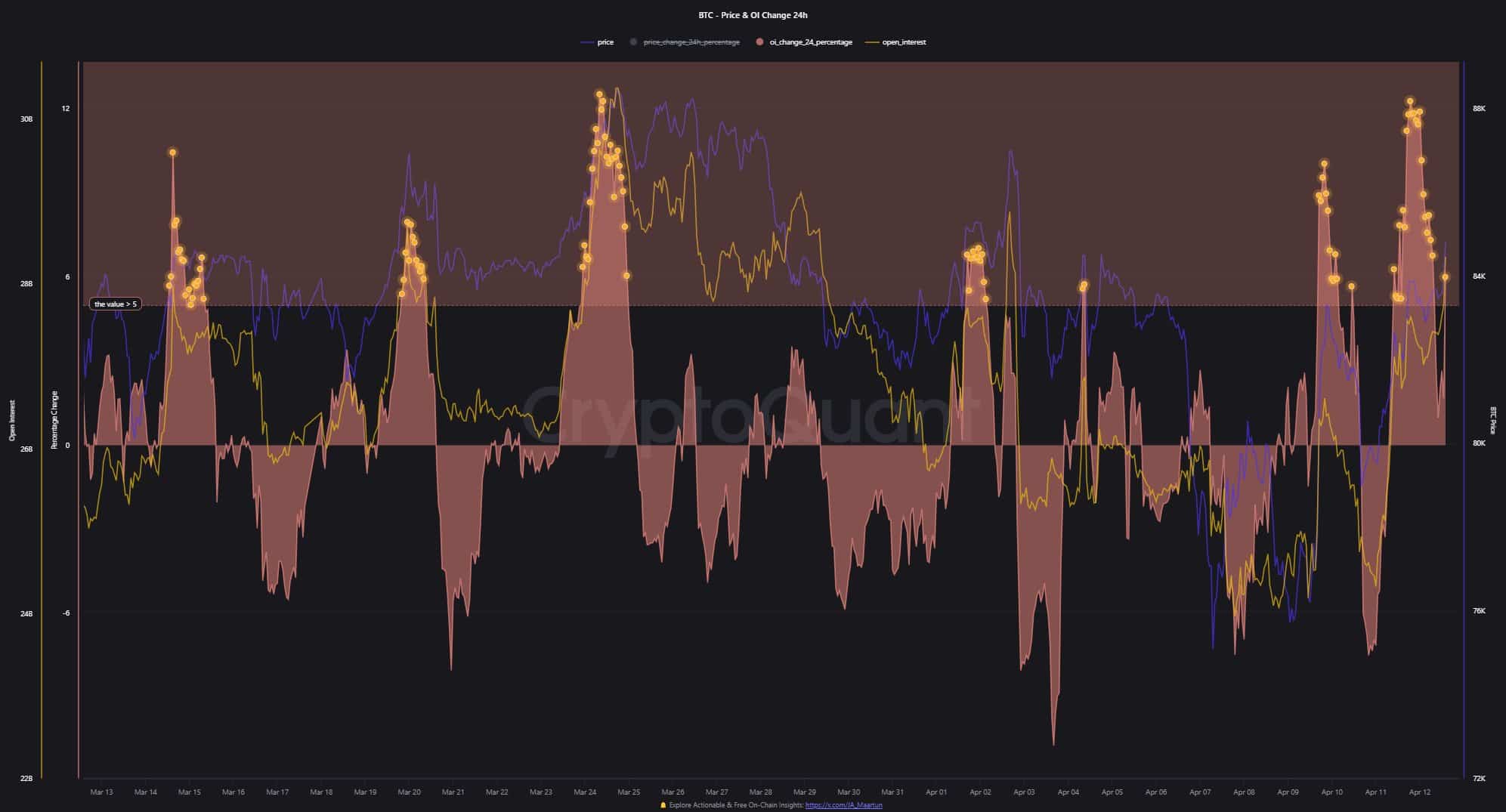

Following this, BTC spot costs closed on the $84K stage, as recorded within the weekly CME futures. The pump was as a result of will increase in extreme leverage, though this motion precipitated dangers for short-term market merchants.

This robust uptrend within the 24-hour proportion modifications in OI confirmed a number of factors exceeding +5, indicating excessive lengthy sentiment.

Supply: CryptoQuant

The latest value surge, pushed by high-leverage positions, highlighted dangers of fast pressured gross sales, much like tendencies noticed previously. This stage of market leverage underscored the significance of warning for merchants.

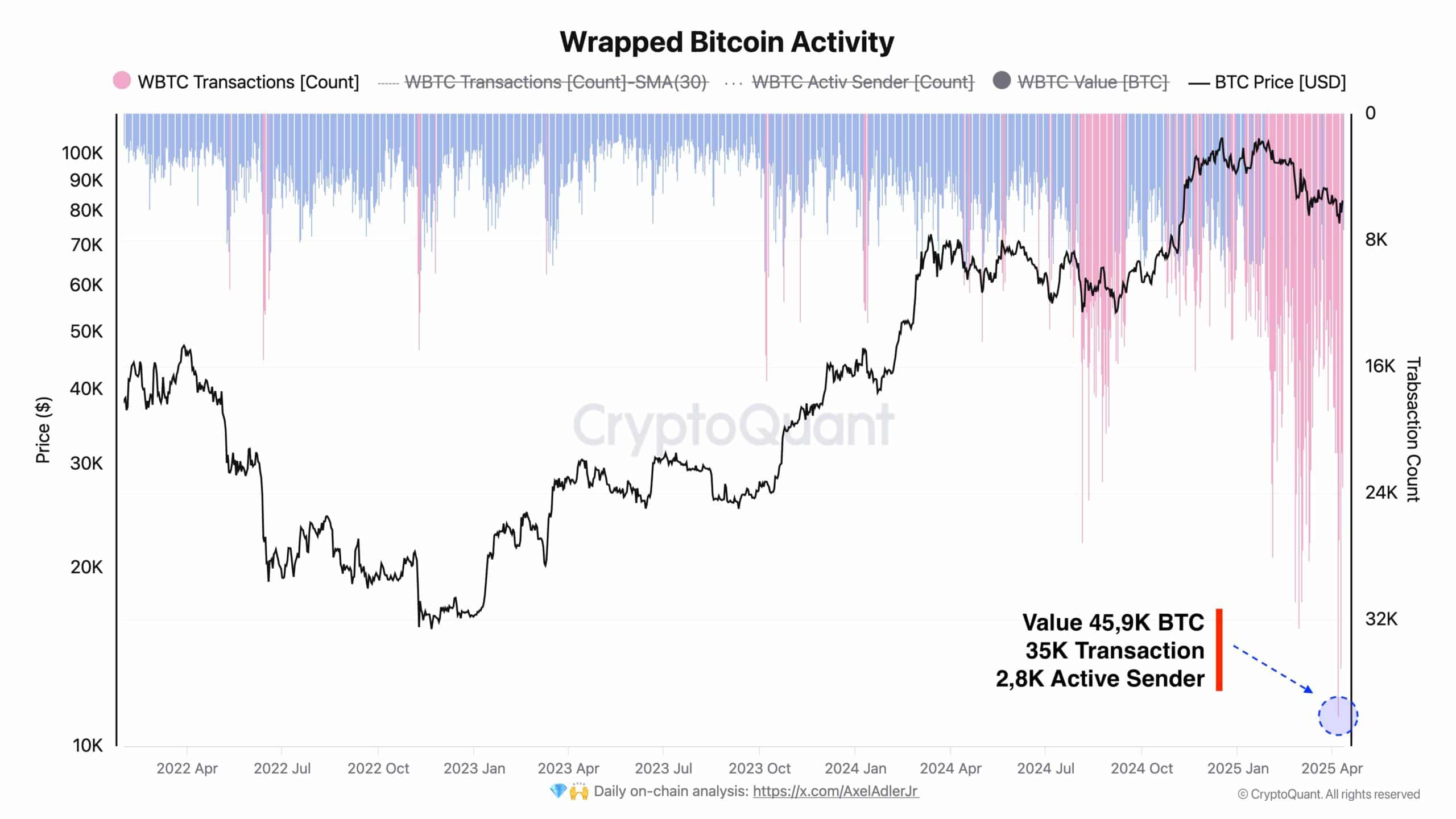

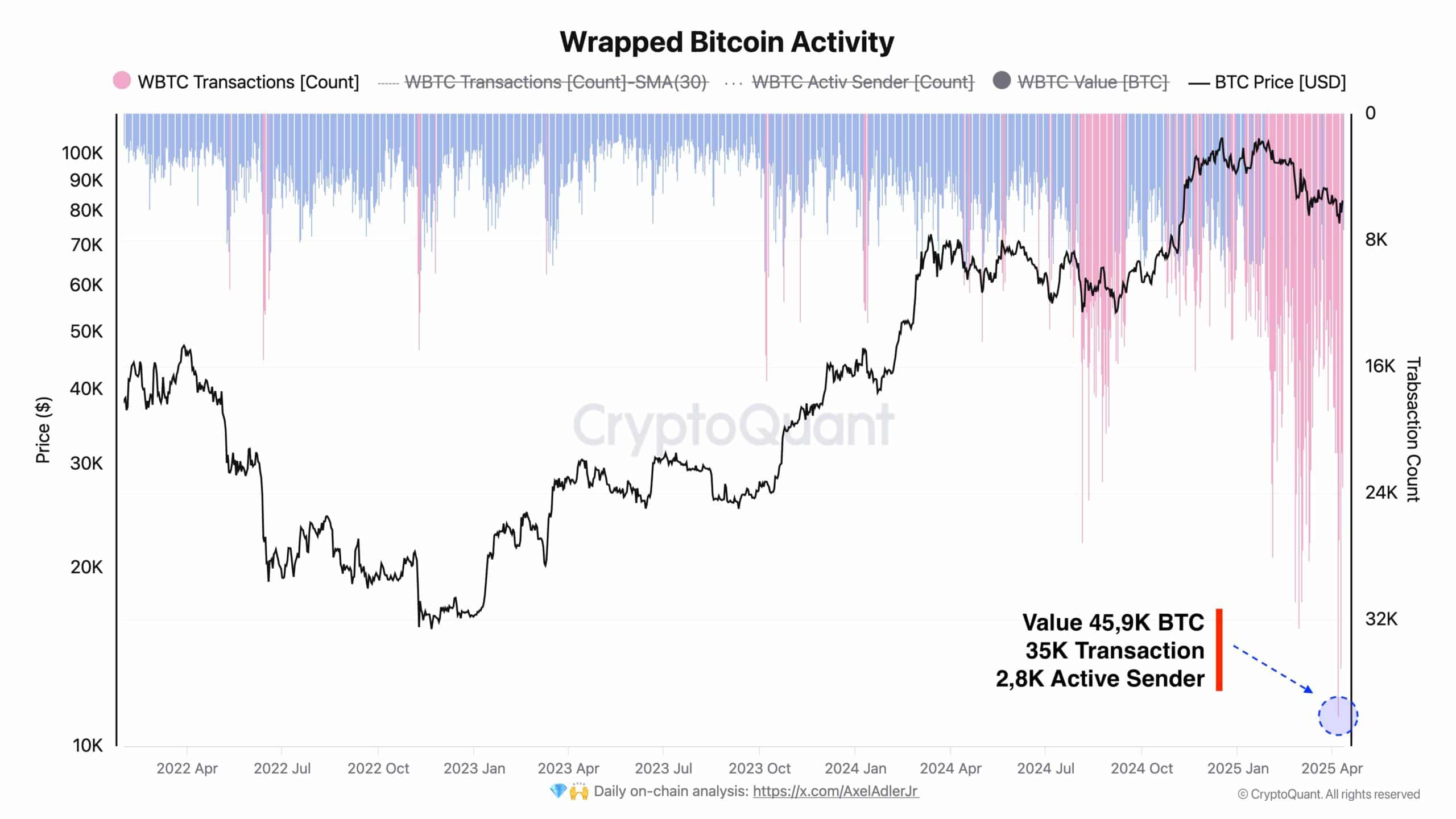

On the identical time, Wrapped BTC [WBTC] exercise reached an all-time excessive, with 35,000 transactions executed throughout 2,800 lively wallets, and a complete motion of 45.9K BTC.

These developments occurred amidst heightened market volatility brought on by geopolitical crises and commerce conflicts between nations. Regardless of these macroeconomic pressures, WBTC customers confirmed resilience, persevering with to drive a notable enhance in transactions.

Supply: CryptoQuant

Regardless of the 2 oppositional evaluations the place leveraged positions appeared to trigger short-term value fluctuations, WBTC exercise signaled enduring performance within the BTC house.

BTC potential value strikes

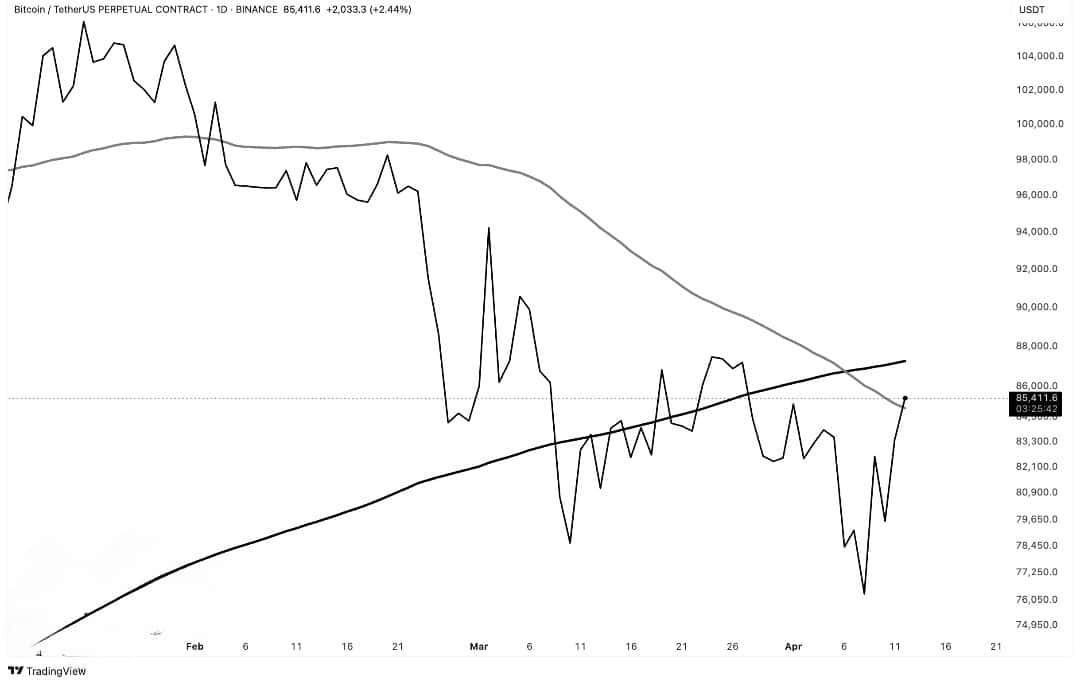

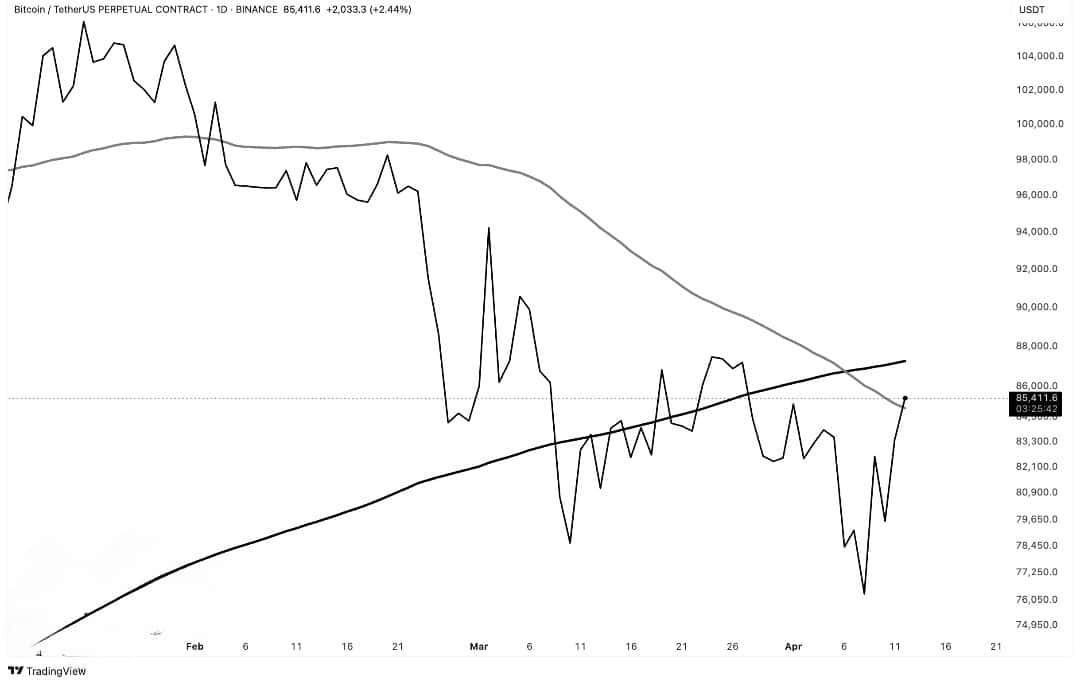

BTC additionally sliced the 50-day Easy Transferring Common (SMA) because it approached the resistance on the 200-day SMA.

This breakout confirmed an rising bullish pattern and a transfer above $87K may doubtless validate ongoing progress towards $94K, whereas vendor intervention is feasible close to that stage.

If the worth stays beneath $87K, it may verify the warnings linked to latest leverage-based pump actions.

This might imply reaching as little as $79K or $76K if costs drop beneath $84K, which might recommend additional bearish momentum.

Supply: X

The market’s indecision was confirmed by its stationary motion, which stayed between two elementary shifting averages.

Traders wanted to watch robust value actions on both facet to get BTC’s future course.

Market sentiment could flip bullish if costs exceed $87,000, however steady bearish efficiency beneath that stage will in all probability maintain a consolidation section or prolong the present correction interval.