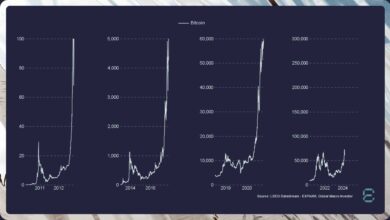

Here’s why ‘safe’ Bitcoin miners sold big right before the halving

- Miners bought their BTCs forward of the halving

- Proportion of miners’ income derived from transaction charges rose too

Miners’ Bitcoin [BTC] holdings cratered to a 12-month low forward of the now-completed halving occasion, in line with IntoTheBlock. This might be an indication that the community’s miners bought off their cash earlier than the halving truly occurred.

As Bitcoin goes into the halving, miners’ BTC holdings hit 12 12 months low. This means that miners have been internet sellers main as much as the halving. pic.twitter.com/WNi74RkluG

— IntoTheBlock (@intotheblock) April 19, 2024

The surge in coin sell-offs from BTC miners earlier than their rewards acquired slashed was gleaned from the spike noticed within the coin’s Miner to Trade Circulation.

The Miner to Trade Circulation metric measures the quantity of BTC flowing from miners to exchanges. When this metric rallies, miners are promoting extra BTC than they’re mining. That is typically interpreted as an indication that miners are bearish on the value of Bitcoin.

In accordance with CryptoQuant’s information, on 19 April, BTC miners despatched 366 BTC valued at $23.45 million at present market costs to crypto-exchanges. This represented a 128% spike from the 126 BTC that was despatched to exchanges by miners on 18 April.

On the time of writing, the quantity of BTC held in affiliated miners’ wallets totalled 1.81 million BTC.

Miners are the “winners”

As Bitcoin community customers rally to mint fungible tokens following the launch of the Runes Protocol, the charges paid by customers to get transactions included in blocks have spiked considerably. Created by Bitcoin Ordinals creator Casey Rodmarmor, the Runes Protocol has been described as a extra environment friendly solution to create new tokens on the Bitcoin community.

In accordance with information from Bitcoin block explorer mempool.space, the halving block, Block 840,000, obtained 40.7 BTC price over $2.5 million in charges as customers rallied to “etch” new tokens on the community.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Moreover, information from Messari revealed that because of the surge in transaction charges, the share of miner income derived from charges has risen correspondingly. With a studying of 15% at press time, this has climbed by 50% within the final 24 hours alone, in line with the on-chain information supplier.

At press time, BTC was valued at $64,262, on the again of a minor 3% value uptick in 24 hours, in line with CoinMarketCap.

Nonetheless, throughout that interval, day by day buying and selling quantity declined by 8%. This divergence might trace at the opportunity of a value retraction within the quick time period as exhaustion begins to set in.