High amounts of Ethereum get unstaked – Should you be concerned?

- Giant quantities of ETH get unstaked from CEXs.

- Exercise on the community remained excessive, curiosity in NFTs grew.

Ethereum [ETH], over the previous couple of days, witnessed a surge in its value following BTC’s rally. Nevertheless, within the staking panorama, the story was fairly completely different.

Not within the APR

A crypto analyst famous a big improve within the quantity of ETH being unstaked by way of centralized exchanges (CEXes) within the final 5 months.

This shift was anticipated as a result of many customers, significantly these on CEXes, are extra within the asset’s value improve than staking for annual share price (APR) beneficial properties.

Based on the analyst, it’s untimely to promote at this level.

The quantity of $ETH staked by way of CEXs has skilled its highest surge in unstaking up to now 5 months.

I absolutely anticipated this to occur as most customers (particularly on CEXs) will not be staking for the APR achieve however the value appreciation of the asset.

Nonetheless too early to promote IMO. pic.twitter.com/3Vpi7gIYHy

— Emperor Osmo

(@Flowslikeosmo) November 7, 2023

The rise in unstaking by way of centralized exchanges (CEXs) might have a number of implications for Ethereum.

On the optimistic facet, extra ETH being unstaked may point out that customers have gotten extra lively and will probably be trying to make use of their ETH for buying and selling or different functions.

The elevated liquidity available in the market might result in extra buying and selling exercise and probably drive the worth of ETH greater.

Nevertheless, there are additionally destructive points to contemplate. The truth that customers are unstaking their ETH might point out lowered confidence within the asset’s long-term prospects.

If extra folks need to promote or commerce their ETH, it might put downward strain on the worth. Moreover, if a big quantity of ETH is unstaked, it’d have an effect on the general safety and decentralization of the Ethereum community.

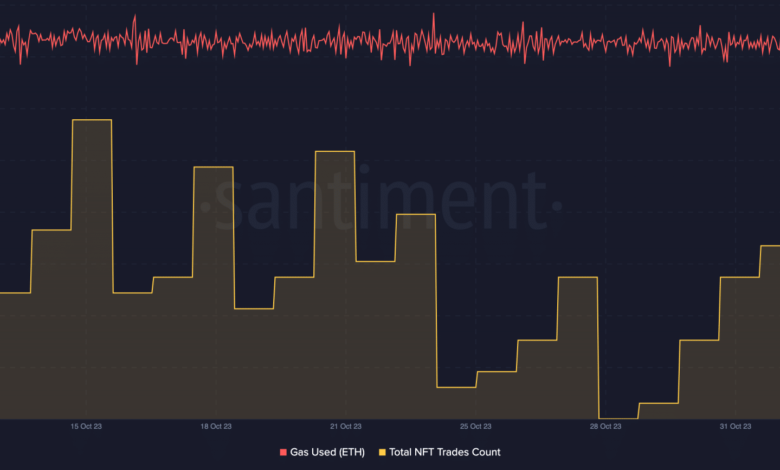

Coming to the state of the Ethereum community, the fuel utilization has remained regular. This confirmed that the exercise on the community was excessive on the time of writing.

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

This might be because of the huge surge in NFT trades that occurred on the Ethereum community over the previous few days. An lively Ethereum ecosystem might present ETH a lot wanted stability within the unstable markets.

At press time, ETH was buying and selling at $1,886.58 and had fallen by $0.03% within the final 24 hours.

Supply: Santiment