How and why Ethereum and Bitcoin’s ETF approvals were different

- SEC authorised spot Ethereum ETFs – An indication of accelerating crypto acceptance

- Nevertheless, variations in BTC and ETH spot ETF approvals have raised a number of questions

Crypto-adoption appears to be on the rise after the US’ Securities and Change Fee (SEC) gave the inexperienced mild to Ethereum [ETH] spot exchange-traded funds (ETFs).

This approval lastly got here by way of on 23 Might, roughly 5 months after the SEC authorised Bitcoin [BTC] spot ETFs on 11 January.

Nevertheless, a better have a look at the approval processes of those two cryptocurrencies reveals clear distinctions between them.

Opposite to the spot Bitcoin ETFs, which have been authorised by a vote from the SEC’s five-member committee, together with Chair Gary Gensler, the spot Ether ETFs have been authorised by the SEC’s Buying and selling and Markets Division.

This raises an important query – Why didn’t SEC Chair Gary Gensler vote on the ETH ETF? Does he nonetheless take into account Ether a safety relatively than a commodity?

Was ETH ETF approval a political stunt?

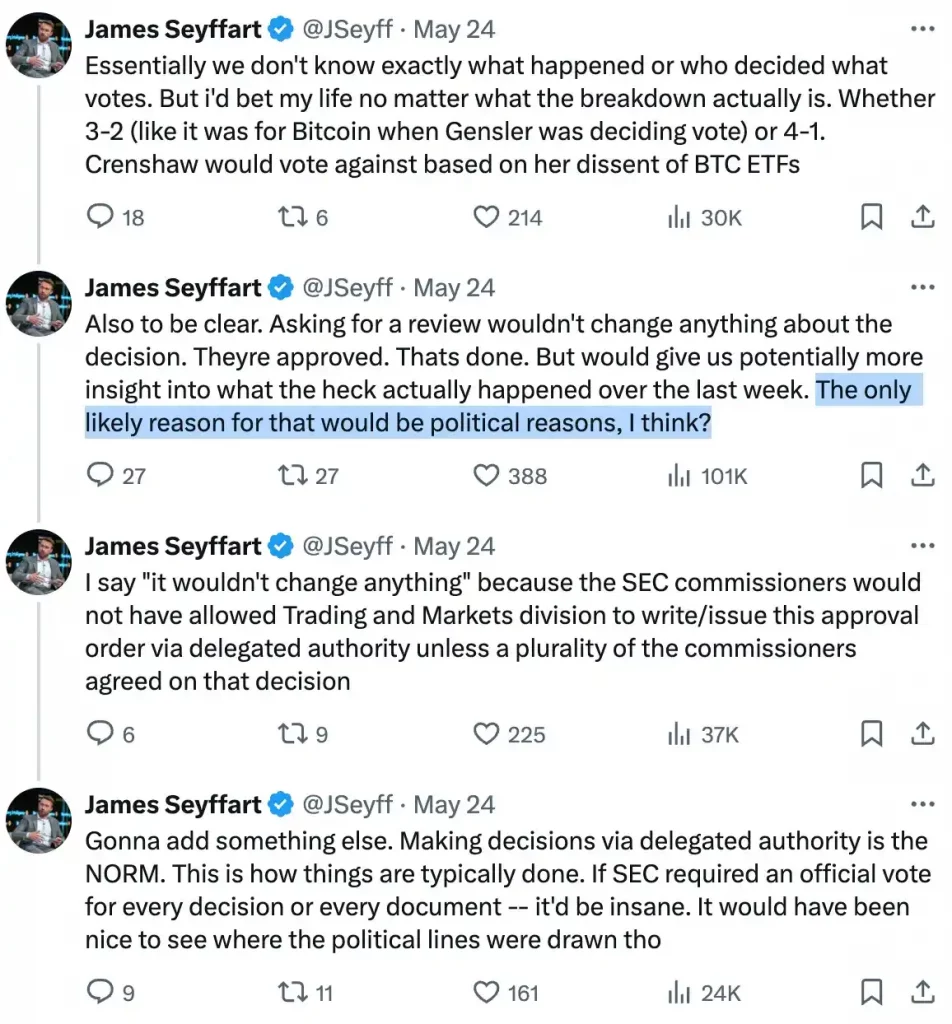

James Seyffart, a analysis analyst at Bloomberg Intelligence, addressed this query when he implied that broader political implications and the SEC’s inner dynamics are the first causes behind this distinction. On 24 Might, he tweeted,

Supply: James Seyffart/X

Right here, Seyffart is underlining that the approval was issued by way of delegated authority and although it’s a typical follow, it leaves ambiguity about particular person positions as there aren’t any public commissioner votes to see.

He additional went on so as to add that despite the fact that the approval is closing for now, SEC Commissioners like Crenshaw might nonetheless request a assessment.

These variations didn’t go unnoticed amongst many within the crypto-community, particularly in mild of ETH’s indifference on the charts instantly after the approval. In truth, one commentator went on to say,

Supply: The Thinker/X

Bitcoin vs. Ethereum

The variations between the 2 ETFs have been evident not solely within the approval processes, but in addition within the subsequent value actions of each cryptos. Following the approval of the BTC ETF, Bitcoin’s value surged from slightly below $46,000 to round $47,500. In the meantime, ETH noticed an 11% hike, surpassing $2,500 for the primary time in 20 months.

Nevertheless, the market response was fairly completely different after the approval of the ETH ETF. On 24 Might, Bitcoin, together with varied different altcoins together with Ethereum, registered vital declines on the charts.

Gensler maintains his anti-crypto place

As anticipated, individuals are nonetheless speculating on the explanations behind Gensler’s voting strategy through the BTC ETF approval, and his absence from the vote for the ETH ETF. His historical past of anti-crypto positions, nonetheless, implies that he favors neither Bitcoin nor Ethereum.

The identical was evidenced by a latest remark he made,

“Crypto is a small piece of our total markets. However, it’s an outsized piece of the scams and frauds and issues within the markets.”