How Bitcoin, Ethereum turned the crypto market around

- Bitcoin grew 93% compared to gold in 2023.

- In distinction to Bitcoin’s triple-digit development price in 2023, the altcoins might solely develop by 37%.

Placing the ache of the crypto winter behind, the digital belongings market, led by Bitcoin [BTC] and Ethereum [ETH], posted a robust restoration in 2023.

Whereas the king coin has greater than doubled in worth for the reason that begin of the yr, the king of alts accrued positive aspects of greater than 50%, in line with CoinMarketCap. And though the final two quarters had been comparatively calm, the indicators of a bullish market had been stronger than ever on the time of publication.

How a lot are 1,10,100 BTCs price at present?

‘Digital gold’ beats actual world counterpart

The 2023 growth pushed the digital belongings market far forward of conventional market bellwethers.

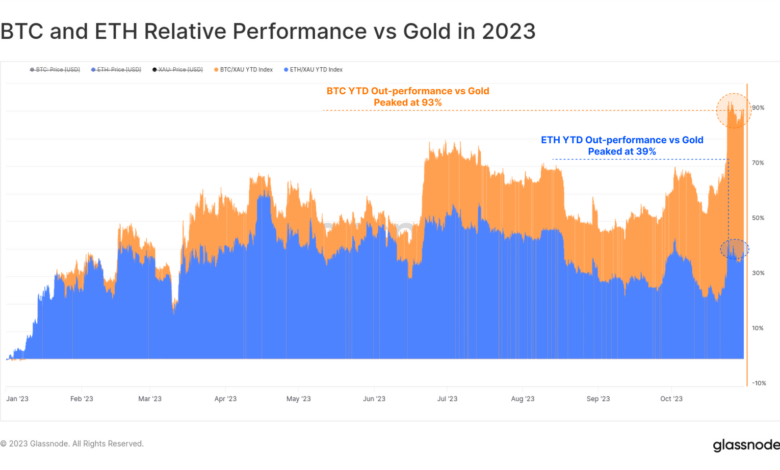

In accordance with a report printed by on-chain analytics agency Glassnode, Bitcoin grew 93% compared to gold. Equally, ETH appreciated nearly 40% relative to the most well-liked retailer of worth.

Supply: Glassnode

On a better examination, it grew to become evident that the momentum in crypto market accelerated since mid-October. Optimism over approval of half-a-dozen odd spot BTC exchange-traded fund (ETF) functions was the main catalyst.

What can be of specific curiosity to potential buyers was that the rally got here amidst a interval of world uncertainty. The battle within the Center East induced considerations over the macroeconomic well being of nations and triggered conventional markets to shiver.

Nonetheless, the unhindered development of digital belongings might pitch them as enticing funding bets, leading to a move of buyers from TradFi to the crypto realm.

Regardless of these invites, buyers ought to carry out due diligence earlier than coming into the crypto market, for its temporary historical past has been marked by surprising swings.

Even within the present instance, it may be seen that each ETH and BTC had a lot stronger value strikes in both route. Gold, then again, was far much less risky.

Supply: Glassnode

Other than the benefits over conventional asset lessons, another noteworthy developments might end in elevated capital flows into the digital asset market.

What did ETH’s market sign?

Ethereum, the second-largest crypto asset, breached the $1,800 barrier just lately. As per Glassnode, this was 22% above ETH’s Realized Worth of $1,475. This meant that a mean ETH holder was realizing a revenue of twenty-two%, an attractive sign for a potential purchaser.

Nonetheless, the MVRV Ratio, which is outlined as an asset’s market cap divided by realized cap, revealed conflicting outcomes. The MVRV has been beneath the 180-day transferring common for almost three months, suggesting a adverse market.

Supply: Glassnode

Having stated that, a marked shift in investor sentiment got here to gentle when one seems to be on the Investor Confidence in Development indicator. In accordance with the information analyzed by AMBCrypto, the market was transitioning in direction of a bullish market.  Supply: Glassnode

Supply: Glassnode

Altcoins pump however BTC nonetheless the king

Whereas the sentiment round cryptos within the top-tier was enhancing, the remainder of the market didn’t keep far behind. The entire altcoin market cap, which excludes BTC, ETH, and stablecoins, logged a 21% enhance in October.

Solely six buying and selling days recorded a bigger share change earlier than, with 5 of them coming through the bull market of 2021.

Supply: Glassnode

Though the altcoin sector made spectacular positive aspects, it was price noting that the BTC together with ETH, accounted for greater than half of the entire crypto market cap.

The was exemplified by wanting on the positive aspects made by the 2 units of cryptos on a year-to-date (YTD) foundation. In distinction to Bitcoin’s triple-digit development price in 2023, the altcoins might solely develop by 37%.

Subsequently, one can conclude that whereas altcoins outperformed fiat currencies like USD comfortably, it was Bitcoin which remained the king inside crypto circles.

Learn ETH’s Worth Prediction 2023-24

The crypto market cheered the choice of the U.S. Federal Reserve (Fed) to maintain the benchmark rates of interest unchanged. At press time, BTC and ETH had been up 2.80% and 1.76% respectively within the 24-hour interval.

The upside potential of the market seemed sturdy contemplating different developments as properly. In a remark shared with AMB Crypto, Shivam Thakral, CEO of Indian crypto trade BuyUcoin, famous.

“Invesco Galaxy spot Bitcoin ETF has been listed together with BlackRock on the DTCC website, including to the present euphoria round Bitcoin ETFs. The market will stay risky within the coming days as a result of quickly evolving macroeconomic situations.”