How Bitcoin miners are countering BTC’s price decline

- Miner capitulation has but to happen regardless of BTC’s latest poor value efficiency.

- Nevertheless, they’ve continued to take revenue.

In a latest report, pseudonymous CryptoQuant analyst Yonsei Dent famous that regardless of Bitcoin’s [BTC] value decline post-Change Traded Fund (ETF) approval, miner capitulation has but to set in.

Dent thought-about BTC’s Hash Ribbon metric – which identifies market developments and miner habits by monitoring the Hash transferring averages of the hashrate (30DMA and 60DMA) – and located that the indicator has not signaled a dying cross even with the coin’s poor efficiency since ETFs grew to become tradeable.

A dying cross happens when the Hash Ribbon’s shorter-term transferring common (30DMA) falls beneath its longer-term transferring common (60DMA). This means a decline in miner exercise and signifies that miners could be seeing low profitability.

Additional, Dent assessed BTC’s Miner’s Place Index (MPI) and located that within the present market, miner capitulation doesn’t appear to be occurring at ranges seen throughout earlier bear market lows. BTC’s MPI measures the historic sample of the promoting habits of miners throughout market downturns.

In line with Dent:

“If we look at miner capitulation promoting at an MPI index stage of 4.0 throughout earlier bear market lows and bottoms, it turns into clear that this adjustment doesn’t signify the emergence of miner capitulation.”

No capitulation but, however miners have offered some cash

As identified by Dent, “miners (have) offered vital portions of BTC in January 2024.” The analyst famous that this could be a “proactive transfer in preparation for future halving occasions.”

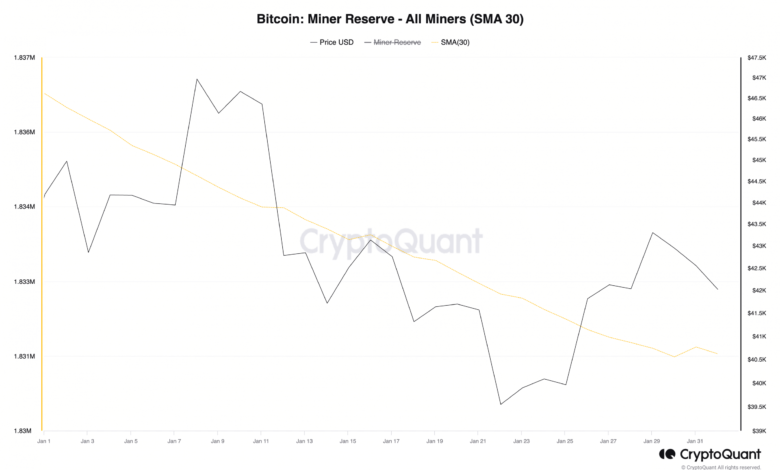

In line with information from CryptoQuant, BTC Miner Reserve measured on a 30DMA has declined by 1% year-to-date. This metric measures the quantity of cash held in affiliated miners’ wallets. Its decline usually suggests a rally in coin sell-offs amongst community miners.

Supply: CryptoQuant

Likewise, the coin’s Miner to Change Move measured throughout the identical interval has recorded a forty five% progress. This indicator measures the quantity of BTC that’s flowing from miners to exchanges.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

When it surges, it implies that miners are promoting extra BTC than they’re mining for revenue.

Nonetheless dealing with vital resistance on the $43,000 value stage, BTC exchanged fingers at $42,085 at press time. In line with information from CoinMarketCap, the coin’s worth has grown by 5% within the final week.