How Bitcoin’s shifting dynamics can affect BTC

- Massive holders of BTC are not in accumulation mode.

- Though the web taker quantity was in a deep adverse zone, merchants’ sentiment remained bullish.

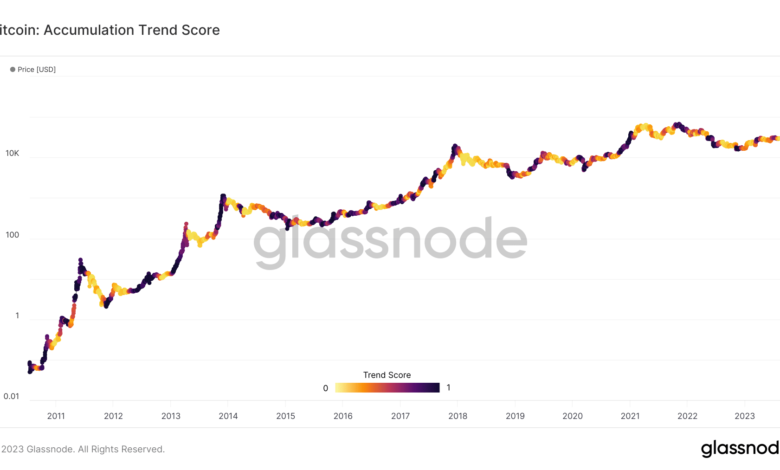

Bitcoin’s [BTC] on-chain exercise has undergone a noticeable shift not too long ago, marking a departure from the earlier accumulation pattern. For BTC’s value motion, the stability between accumulation and distribution is vital to understanding market sentiment. And one metric that explains that is the buildup pattern rating.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

Evaluation of the metric suggests a transition in direction of a extra widespread distribution of Bitcoin. As an indicator of market conduct, the accumulation trend score displays the variety of new cash gathered or offered inside a particular interval.

Energy has modified palms

When the buildup pattern rating is nearer to 1, it signifies that massive entities are accumulating. However when the metric inches nearer to zero, it depicts a shift towards promoting. At press time, the Bitcoin accumulation pattern rating was 0.05, indicating that enormous holders’ sentiment was towards the latter.

Supply: Glassnode

Earlier on, AMBCrypto reported that whales had been accumulating Bitcoin in massive numbers. And this motion was instrumental to the coin’s rise above $30,000 at one level. Subsequently, the change in sentiment might have impacted on the current consolidation BTC has needed to cope with.

If this metric continues to remain the identical, then BTC’s consolidation or drawdown might proceed to linger. Moreover, CryptoQuant’s analyst JA_Maartunn famous on 12 August that the BTC’s incapacity to climb might be linked to the web taker quantity.

The net taker volume measures the distinction between the shopping for and promoting quantity of Bitcoin’s futures contracts. By taking the metric into historic makes use of, the analyst referred to 2021 saying that,

“In Might 2021, Bitcoin was buying and selling at round $60,000, whereas Taker Promote Quantity was $600 million increased than Taker Purchase Quantity. This means heavy promoting by market orders, regardless that the worth was nonetheless excessive.”

So, when the web taker quantity is at deep constructive values, and the worth is comparatively low, it signifies that aggressive shopping for is happening. However Bitcoin’s case was totally different. In keeping with the chart shared by Maartunn, the web taker quantity was adverse, indicating heavy promoting stress.

Supply: CryptoQuant

Enthusiasm reigns regardless

Regardless of the heavy promoting stress, Santiment revealed that the funding on Binance was 0.01%. A constructive funding fee signifies that long-position merchants are dominant and prepared to pay funding to brief merchants.

Conversely, a adverse funding fee implies that brief merchants are paying a funding payment to longs to maintain their positions open. Subsequently, the metric’s press time state implies that bullish sentiment thrived.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

Supply: Santiment

Nonetheless, merchants might must be careful for the continuing accumulation and distribution. If Bitcoin’s distribution continues to outpace the previous, then it’s solely a matter of time earlier than some longs turn out to be liquidated. That’s if the BTC value shrinks sharply.