How Do Bitcoin ATMs Work? How to Use a Bitcoin ATM – A Step-by-Step Guide

Whereas many crypto customers consider in a cashless and fiatless world, it’s but to come back. Most of us nonetheless need to carry out numerous transactions utilizing good ol’ money, together with BTC and different crypto purchases.

Irrespective of whether or not you want a fiver for a cup of espresso or wish to prime up your Bitcoin pockets with out having to undergo a centralized financial institution, crypto ATMs may be of nice assist to anybody trying to convert their crypto to money and vice versa.

Hello, I’m Zifa, a crypto fanatic and author for over 3 years. As we speak, I’ll present you use a Bitcoin ATM, step-by-step. Let’s get began!

What Is a Crypto ATM?

A Crypto ATM, quick for cryptocurrency automated teller machine, is a kiosk or terminal that permits customers to purchase and promote cryptocurrency utilizing money or a debit card. Functioning equally to conventional financial institution ATMs, these machines present a handy method for people to have interaction in cryptocurrency transactions and entry their digital belongings.

Crypto ATMs function by connecting customers to respected cryptocurrency exchanges, linking their cryptocurrency wallets, and facilitating the switch of funds. Whereas most Crypto ATMs enable customers to buy varied cryptocurrencies like Bitcoin, Ethereum, and Litecoin, it’s vital to notice that not all ATMs help the sale of those digital belongings.

Crypto ATMs have gained recognition and can be found worldwide in quite a few places, similar to purchasing facilities, airports, and comfort shops. Nonetheless, their availability could differ relying on the area or nation on account of regulatory constraints or restricted market demand.

What Is a Bitcoin ATM?

A Bitcoin ATM does precisely what its identify suggests — it’s a regular ATM (Automated Teller Machine) that accepts BTC and different crypto cash and tokens as an alternative of fiat currencies and money. It is usually typically referred to as a Bitcoin Teller Machine, or BTM. Shopping for Bitcoin this manner is as straightforward as depositing money to your financial institution card utilizing conventional ATMs.

Most Bitcoin ATMs enable customers to each purchase and promote Bitcoin, however not all of them: don’t neglect to test whether or not the ATM you’re planning to make use of presents your required performance. You can even use crypto ATMs to ship BTC to a different person’s Bitcoin pockets — simply enter their tackle within the recipient discipline.

Whereas these ATMs are designed to be safe and hold your funds protected, there are nonetheless some dangers related to utilizing them to promote and purchase Bitcoin.

- Bitcoin transactions are irreversible as a result of nature of blockchain know-how, so you want to be additional cautious when getting into all of your private knowledge, similar to your Bitcoin pockets tackle.

- There are numerous completely different Bitcoin ATM operators on the market, and a few may be much less… honorable than others. Don’t pay for any additional items or providers supplied by the ATM operator, and take a look at to take a look at the critiques for that individual ATM if it’s run by an organization you’ve by no means heard of earlier than.

- Identical to when utilizing fiat ATMs, take note of your environment: whereas there gained’t be a bank card for anybody to seize out of your hand, thieves can nonetheless take your cash, steal your private data, and so forth.

How Do Bitcoin ATMs Work?

Bitcoin ATMs don’t look all that completely different from fiat ones. Nonetheless, they function in a totally completely different method: as an alternative of being related to a financial institution, they convey immediately with the Bitcoin blockchain.

With a purpose to purchase and promote Bitcoin utilizing a crypto ATM, you’ll solely want two issues: a digital pockets and a conventional one. Simply insert some payments into the machine after which scan the QR code in your digital pockets or enter its tackle manually — that is all you want to purchase Bitcoin utilizing a Bitcoin ATM.

The cryptocurrency you get from a Bitcoin ATM is distributed from the pockets of its operator firm.

Find out how to Use a Bitcoin ATM

Though Bitcoin ATMs could appear a bit uncommon at first, they’re straightforward to make use of.

Step 1 – Get a Crypto Pockets

Step one to performing any crypto transaction is getting a pockets that helps the coin or token you wish to purchase. It may be a paper pockets, a digital pockets, or a {hardware} one — its kind doesn’t matter so long as it might probably ship and obtain digital cash and is safe.

Step 2 – Put together Your Bitcoin Pockets

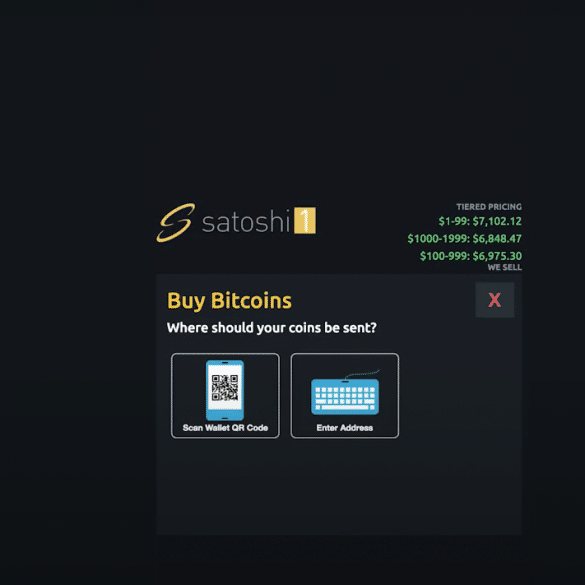

Most Bitcoin ATMs (Bitcoin Teller Machines) let you use QR codes to make Bitcoin transactions. Examine whether or not your digital pockets presents that function — in spite of everything, it might probably cut back one’s stress by eliminating the necessity to enter an extended and non-human-readable pockets tackle.

Step 3 – Discover a Bitcoin ATM Close to You

Cryptocurrencies are usually not broadly accepted but, so the probabilities of you operating right into a Bitcoin ATM out within the wild are reasonably slim, particularly when you don’t reside in a giant metropolis like London or NYC. The best option to discover Bitcoin ATM places close to you is to make use of reside maps like Coin ATM Radar, Bitcoin ATM Map, and others.

Most of those web sites, similar to Coin ATM Radar, let you search for ATMs by proximity, operator, charge, and different parameters.

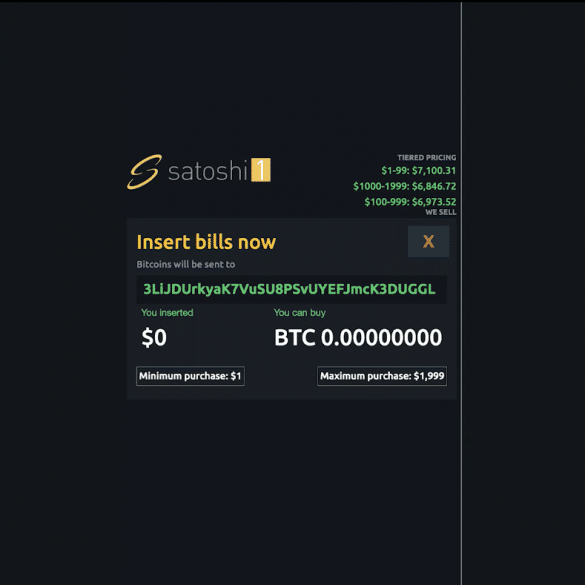

Step 4 – Set Up Your Transaction

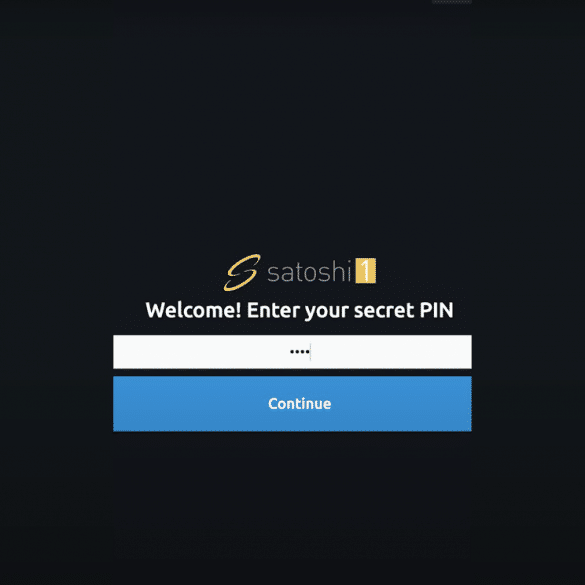

To make use of a Bitcoin ATM, you’ll first must confirm your id.

As soon as that’s executed, you’ll must enter your PIN.

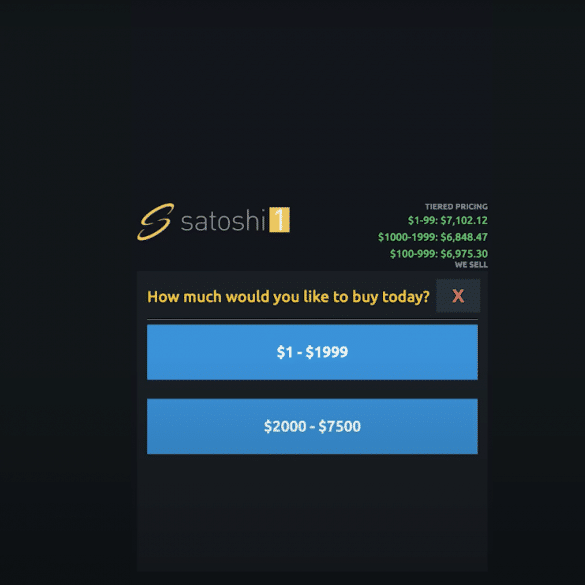

Subsequent, select the cryptocurrency you want to get (if the ATM presents a couple of) and enter the quantity you’d prefer to buy.

Step 5 – Enter Your Pockets Data

When you’ve arrange your transaction, you have to to enter your Bitcoin pockets tackle. Most ATMs let you use QR codes to reduce the danger of sending your new crypto to the unsuitable pockets tackle. In the event you select to not go together with the QR code possibility, please keep in mind to double-check the tackle you entered.

Step 6 – Insert Money

Double-check all transaction information and insert the required amount of money into the ATM.

Step 7 – Verify the Buy

That’s it! Verify the acquisition and wait in your new cryptocurrency to reach in your pockets. Supply instances rely on the cryptocurrency you’re buying however often vary from 10 to fifteen minutes.

Bitcoin ATM Charges

All Bitcoin ATM operators have completely different insurance policies in relation to transaction charges. A few of them may be fairly excessive, so typically it may be value it to journey a bit additional to benefit from the bottom charges within the space.

As cryptocurrencies develop into extra broadly accepted, the variety of lively Bitcoin ATMs is more likely to enhance, and the charges will in all probability go down. Till then, we advocate utilizing ATM finders that allow you to kind ATMs by charges.

Advantages of Utilizing a Bitcoin ATM

Why do individuals go for crypto ATMs? Listed here are the advantages BTC ATMs provide over conventional cryptocurrency exchanges.

Comfort

Bitcoin ATMs provide instant entry to money, making them extremely handy for customers. They permit instantaneous conversion of digital currencies to money, not like conventional exchanges that may require linking financial institution accounts and ready for fund transfers.

Moreover, their rising ubiquity means yow will discover these ATMs in varied handy places like purchasing facilities, gasoline stations, and airports. Working 24/7, they cater to customers at any time, mirroring the always-available nature of auto-teller machines.

Fast Transactions

One of many standout options of Bitcoin ATMs is the flexibility to order money prematurely for withdrawals, making certain fast entry when customers arrive. Transactions are nearly instantaneous, considerably lowering wait instances in comparison with conventional banking strategies. With their growing quantity worldwide, Bitcoin ATMs have gotten extra accessible, providing a swift means for money transactions and withdrawals.

No Financial institution Account or Identification Required

For smaller transactions, many Bitcoin ATMs don’t require identification, making them accessible even and not using a checking account. This function is especially helpful for low-risk transactions. Nonetheless, for bigger transactions, identification could also be required to adjust to AML and KYC laws. Customers usually confirm their id by a cellphone quantity, which is confirmed by way of SMS.

Acquainted Course of

The acquainted format of conventional ATMs is leveraged in Bitcoin ATMs, making them extra approachable for customers. Positioned in strategic, high-traffic places, they provide a easy and simple method for individuals to purchase Bitcoin. This acquainted setup may also help appeal to new crypto traders, providing a handy entry level into the crypto market with out the complexities of conventional exchanges.

Privateness

Privateness is a key side of Bitcoin ATMs, interesting to those that worth monetary discretion. Customers can improve privateness by selecting ATMs that don’t require id verification and utilizing Bitcoin wallets with privateness options. Whereas they provide extra anonymity than on-line exchanges, full privateness isn’t at all times assured on account of potential safety measures like cameras or cell phone quantity verification.

Dangers of Crypto ATMs

Whereas crypto ATMs present comfort and accessibility, they aren’t with out dangers.

Excessive Charges

Bitcoin ATMs typically have increased charges in comparison with different monetary providers. These charges cowl the prices of working bodily machines, together with {hardware} upkeep, renting house, and offering buyer help. Conventional banks, benefiting from extra established infrastructures and a broader vary of providers, can hold their charges comparatively decrease. Equally, on-line crypto exchanges usually have decrease charges than Bitcoin ATMs, as they keep away from the overheads related to bodily machines and profit from bigger scale operations. In addition they are inclined to have decrease blockchain transaction (or gasoline) charges.

Funds Not Insured

One other important danger with cryptocurrency ATMs is the shortage of insurance coverage for funds. In contrast to conventional banks the place deposits are insured, cryptocurrencies in ATMs don’t get pleasure from this safety. This leaves customers uncovered to losses from safety breaches or technical failures. Moreover, many cryptocurrency ATMs lack anti-theft measures present in conventional ATMs, similar to surveillance cameras, which will increase the danger of theft. The absence of devoted buyer help will also be difficult, leaving customers to cope with points like transaction errors on their very own.

Transaction Limits

Transaction limits at Bitcoin ATMs differ. Operators could set predefined limits or alter them based mostly on buyer wants. Bigger transactions often require Know Your Buyer (KYC) verification to adjust to anti-money laundering laws. Some ATMs provide tiered verification ranges, permitting customers to extend their transaction limits by offering extra data, like linking a checking account.

Availability

Bitcoin ATMs, although rising in quantity, are much less widespread than on-line exchanges. As of November 2023, there are round 39,000 Bitcoin ATMs globally, a small determine contemplating the worldwide inhabitants. In distinction, on-line exchanges are accessible to anybody with an web connection, providing a extra intensive vary of choices and sooner setup for buying and selling Bitcoin.

How are Crypto ATMs Regulated?

The regulation of cryptocurrency ATMs is a fancy and evolving side of the monetary panorama, influenced by a mixture of worldwide, federal, and state legal guidelines. In the USA, the operation of those ATMs falls underneath the jurisdiction of the Monetary Crimes Enforcement Community (FinCEN). Operators are required to register as cash providers companies in compliance with the Financial institution Secrecy Act (BSA), which calls for a strong Anti-Cash Laundering (AML) program, together with submitting Suspicious Exercise Stories (SARs) and Foreign money Transaction Stories (CTRs) for sure transactions. The Patriot Act additional dietary supplements this framework with stringent Know Your Buyer (KYC) procedures, significantly for transactions above specified thresholds.

On the state stage, Crypto ATM operators typically want a cash transmitter license, adhering to particular state laws and shopper safety legal guidelines. These can embrace the clear disclosure of charges and trade charges and the safety of shopper knowledge. Native ordinances can also impression Crypto ATM operations, together with zoning legal guidelines and particular operational necessities.

Internationally, regulatory approaches can differ. A notable instance is the U.Ok., the place the Monetary Conduct Authority (FCA) has not too long ago intensified efforts to manage cryptocurrency ATMs. In a major transfer, the FCA has been cracking down on unregistered crypto ATMs, citing issues over cash laundering. This aligns with the broader regulatory coverage within the U.Ok., the place all cryptocurrency-related corporations are required to register with the FCA, making certain compliance with AML requirements and different regulatory measures.

This intricate regulatory tapestry, comprising each nationwide and worldwide guidelines, highlights the continued efforts to stability innovation within the cryptocurrency sector with the necessity for monetary safety and shopper safety.

A fast look again at Bitcoin ATMs

Let’s take a second to mirror on the attention-grabbing historical past of Bitcoin ATMs, a major growth within the cryptocurrency world. It began in 2013 in North America – in Vancouver, Canada, the place the primary operational Bitcoin ATM appeared. This progressive machine simplified the method of exchanging money for Bitcoin, making cryptocurrencies extra approachable and user-friendly.

Shortly after its debut in Vancouver, Bratislava, Slovakia, embraced the pattern by putting in its first Bitcoin ATM in 2014. This growth showcased the widespread curiosity in such digital options, highlighting the benefit of shopping for and promoting Bitcoin with conventional forex.

In 2014, the USA joined in. The primary Bitcoin ATM within the U.S. was arrange in Albuquerque, New Mexico. This was an thrilling step ahead for American cryptocurrency lovers, signaling a brand new stage of accessibility.

The Way forward for Bitcoin ATMs

The way forward for Bitcoin ATMs largely is dependent upon the additional growth of the crypto trade. As Bitcoin and different cryptocurrencies develop into extra fashionable and, much more importantly, extra broadly accepted as a fee technique by varied companies and providers, the variety of cryptocurrency ATMs you see on the streets may even enhance.

There may be at all times a risk that ATMs, usually, could develop into out of date sooner or later, however we don’t suppose that’s a possible situation — a minimum of, not for the subsequent 5 or 10 years.

Having studied the cryptocurrency ATM market, varied researchers got here to the conclusion that it’ll see important development within the subsequent few years. Specialists from Allied Market Analysis, for instance, predict that this trade is more likely to develop at a CAGR (compound annual development charge) of 58.5% annually from 2021 to 2030.

And when you can’t bear to attend till Bitcoin ATMs develop into commonplace and get all of the perks that include widespread recognition, you possibly can at all times purchase, trade, and promote Bitcoin and different cryptocurrencies on our instantaneous trade as an alternative.

FAQ

What’s the finest Bitcoin ATM to make use of?

Selecting the most effective Bitcoin ATM largely is dependent upon your location and particular wants. To discover a Bitcoin ATM close to you, the simplest technique is to make use of reside mapping providers like Coin ATM Radar or Bitcoin ATM Map. These platforms are extremely user-friendly and let you seek for ATMs based mostly on varied standards similar to proximity, operator, charges, and extra.

Among the many prime crypto ATM operators, you would possibly come throughout names like Coinstar Bitcoin Machines, recognized for his or her widespread presence. Coin Cloud Bitcoin ATM and RockitCoin are additionally fashionable for his or her user-friendly interfaces. For these on the lookout for handy choices, Simply Money ATM and LibertyX ATM stand out. Moreover, Pelicoin ATM is one other notable supplier, providing dependable providers in lots of places.

Bear in mind, when selecting an ATM, think about not simply the situation but in addition components like transaction charges, limits, and person critiques to make sure you get the absolute best expertise.

How do I ship cash to a Bitcoin ATM?

In case you are shopping for BTC, then you need to use money. In the event you’re promoting Bitcoin, you need to use your Bitcoin pockets by both manually getting into its tackle or scanning a QR code.

Do I want an account to make use of a Bitcoin ATM?

Whereas some Bitcoin ATMs could ask you to create an account, not all of them accomplish that. Most ATMs let you begin shopping for Bitcoin after merely getting into a textual content verification code.

Can you set money in a Bitcoin ATM?

Sure, you need to use money to buy Bitcoins in your nearest Bitcoin ATM.

Are Bitcoin ATMs protected?

Sure, they’re as protected as conventional ATMs and any trade. This is among the most continuously requested Bitcoin ATM questions since each crypto and conventional banking ATMs can typically be seen as much less dependable. Nonetheless, so long as you look out for issues like terminals on prime of current ones or cameras, it ought to usually be fantastic. Bitcoin ATMs are designed to be safe and defend your funds, however please at all times keep in mind to be cautious when utilizing them.

How do I take advantage of a Bitcoin ATM with a debit card?

Usually, the vast majority of Bitcoin ATM machines settle for money solely. In the event you can’t discover one that allows you to buy Bitcoin along with your card, you need to use a fiat forex ATM to withdraw money out of your checking account first and use it to purchase Bitcoins in a BTC ATM.

How a lot Bitcoin are you able to ship in a single transaction by way of a crypto ATM?

Every Bitcoin ATM operator (Bitcoin Depot, Coin Cloud, and so on.) has their very own limits which you can lookup on their web sites.

In addition they often publish directions on ship cash by their explicit Bitcoin ATM machine.

Disclaimer: Please word that the contents of this text are usually not monetary or investing recommendation. The knowledge offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native laws earlier than committing to an funding.