How Ethereum navigated volatility, regulatory fears, and more in Q2

- Ethereum grew by way of market cap dominance regardless of volatility within the sector.

- Curiosity in staking rose, and merchants turned bullish.

All through Q2 in 2023, Ethereum[ETH] encountered vital fluctuations and excessive volatility. Regardless of these challenges, the Ethereum community demonstrated resilience and continued to draw an inflow of recent customers to its protocol. Notably, the platform displayed substantial development in numerous elements throughout this era.

Is your portfolio inexperienced? Try the Ethereum Revenue Calculator

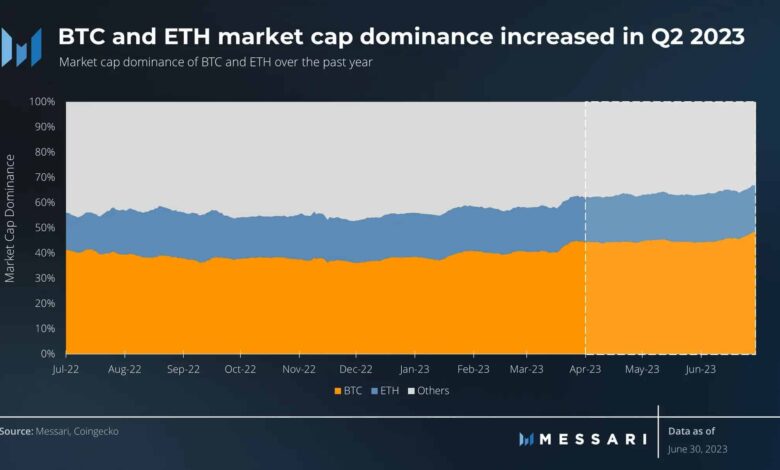

A show of dominance

Based on Messari’s knowledge, the central theme dominating the near-term narrative round Ethereum was regulation. The SEC’s actions in opposition to main exchanges like Coinbase and Binance, raised considerations about property’ classification as securities. Regardless of these challenges, ETH managed to extend its dominance out there.

Nonetheless, there’s hope that with Markets in Crypto Property (MiCA) in Europe, Ethereum’s market cap dominance will rise even additional as adoption begins to rise.

For context, MiCA is a part of a broader EU bundle geared toward updating the bloc’s method to varied digital monetary elements. MiCA primarily concentrates on crypto-asset suppliers and the obligations they should declare.

Supply: Messari

ETH’s robust tokenomics additionally performed a pivotal position in driving its efficiency. The bottom price burn skilled a considerable surge of 58% throughout the quarter, resulting in roughly 380,000 ETH being burnt.

This mechanism helped cut back the general provide of ETH, including shortage and potential upward worth stress. Moreover, the web ETH burnt additionally witnessed a exceptional threefold surge, rising from round 80,000 to roughly 230,000.

Supply: Messari

Stake it until you make it

The surge in fuel costs, propelled by the thrill surrounding PEPE, was the driving drive behind the upper burn of ETH. Because of this, validators noticed their actual yields rise to a powerful 6.1%.

This enhance in yields, coupled with the unlocking of staking, naturally attracted extra flows into the staking contracts. Might and June noticed the highest-ever internet flows, with 3 million and 1.9 million ETH respectively, additional contributing to the expansion and engagement of staking throughout the Ethereum community.

Learn Ethereum’s Value Prediction 2023-2024

Moreover, the variety of validators on the Ethereum community additionally surged. Based on Staking Rewards’ knowledge, the variety of validators on the Ethereum community grew by 8.81% during the last month.

Supply: Staking Rewards

Attributable to these components, merchants have been feeling bullish about ETH’s future. This was indicated by the declining put-to-call ratio for ETH, which indicated that the variety of calls exceeded the variety of places at press time.

Supply: TheBlock