How Ethereum on exchanges dropped to a 5-year low

- Ethereum on exchanges hits a five-year low.

- The variety of ETH holders grows steadily as the value hovers round $1,900.

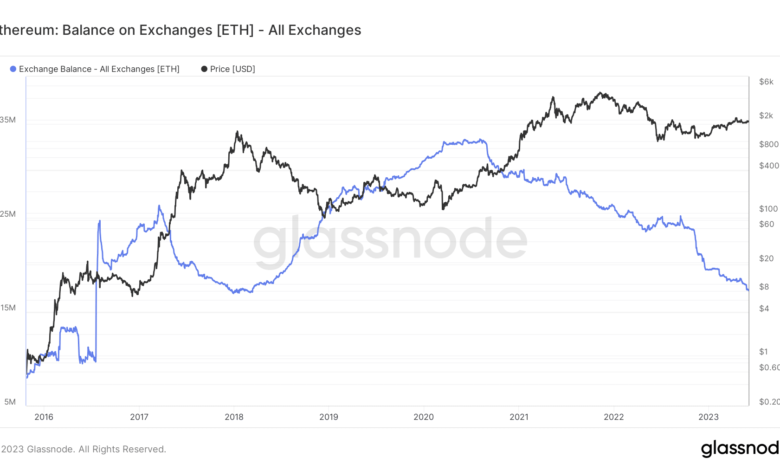

New knowledge indicated a dwindling inflow of Ethereum onto exchanges prior to now few weeks. The newest chart evaluation revealed that the present steadiness of Ethereum on exchanges reached a brand new nadir, indicating a decline in total liquidity on these platforms.

Ethereum on exchanges decline

Glassnode Alerts not too long ago unveiled a chart showcasing the continuing decline of Ethereum on exchanges. It additionally confirmed that every passing day marked a brand new file low.

The most recent knowledge from Glassnode indicated that the present steadiness of ETH on exchanges stood at roughly 17.2 million, marking the bottom level witnessed prior to now 5 years.

Comparatively, again in January, the steadiness on exchanges exceeded 19 million; initially of Might, it surpassed 18 million.

Supply: Glassnode

This downward development implied a discount in out there liquidity inside exchanges. Nevertheless, it is very important be aware {that a} lower in ETH on exchanges doesn’t essentially point out a lower in ETH holders.

Ethereum holders stay regular

Whereas it could appear that Ethereum is leaving exchanges at the next fee than it’s being deposited, the dynamics surrounding the whole variety of ETH holders inform a unique story.

The Santiment chart confirmed a gentle improve within the variety of ETH holders. Presently, roughly 100 million people maintain various quantities of ETH.

This progress has been gradual, with round 98.4 million holders reported on the finish of April.

Supply: Santiment

The declining steadiness on exchanges and the simultaneous progress within the variety of holders could be attributed to 2 primary components: self-custody and staking.

Firstly, extra people go for self-custody, holding their ETH in private wallets slightly than leaving them on centralized exchanges. It gives customers with better management and safety over their property.

Secondly, staking has grow to be more and more common. Staking entails locking up a certain quantity of Ethereum to take part within the community’s proof-of-stake consensus mechanism.

In return for securing the community, stakers obtain rewards within the type of further ETH. It incentivizes customers to carry their ETH in staking contracts slightly than on exchanges. As of this writing, the whole variety of ETH deposits for staking was over 780,000 and rising.

The ETH TVL and value

In accordance with knowledge from DefiLlama, Ethereum’s dominance by way of Complete Worth Locked (TVL) remained steadfast. As of this writing, the TVL stood at roughly $27.35 billion, accounting for over half of the general TVL.

This signified a continuing inflow of liquidity into the Ethereum ecosystem, emphasizing ETH’s ongoing relevance and significance.

How a lot are 1,10,100 ETHs value at the moment

Moreover, a look at CoinMarketCap knowledge revealed that ETH boasted the third-highest buying and selling quantity within the final 24 hours. The overall quantity of your entire cryptocurrency market surpassed $19 billion, with ETH contributing over $3 billion in buying and selling quantity.

Moreover, ETH maintained its place because the second-largest cryptocurrency by market capitalization, trailing behind Bitcoin. As of this writing, ETH was buying and selling at roughly $1,900.