How Ethereum restaking is slowly gaining traction

- EigenLayer’s weekly ETH deposits doubled.

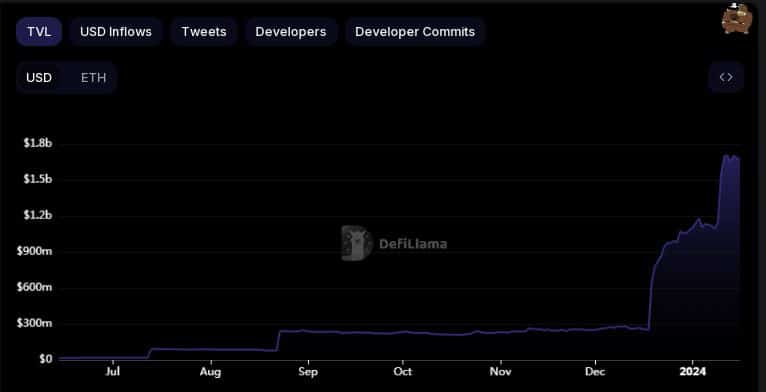

- EigenLayer’s complete worth locked (TVL) soared to $1.67 billion at press time.

Whereas spot ETFs, real-world belongings (RWA), layer-2 options, and different common narratives dominate crypto-related talks lately, slowly however absolutely a lesser-known class was catching up – Ethereum [ETH] restaking protocols.

Improve in native ETH on restaking protocols

A major improve in native ETH deposits into restaking protocols was noticed during the last week, in keeping with on-chain analytics agency TK Research.

As per the put up dated fifteenth of January, the most important beneficiary was EigenLayer, with a weekly enhance of 168K ETH, greater than doubling from the earlier week.

EtherFi got here a distant second with an inflow of 14.45K ETH, marking a rise of practically 28%. Renzo Protocol witnessed a soar of 4.5K ETH, equating to a formidable 55% rise.

Mixed, the three protocols attracted round 186.5K ETH in deposits. As per prevailing market prices, this amounted greater than $470 million of ETH locked into premier restaking tasks.

A comparatively younger idea, restaking permits ETH stakers to take part in validating new software program modules developed on high of the Ethereum ecosystem.

Put merely, the identical ETH staked on the Ethereum community could be repurposed to increase safety to different functions. The safety, due to this fact, will get shared throughout the ecosystem.

Be aware that aside from staking ETH natively, validators even have an possibility of staking liquid derivatives (LSDs) from Lido, Rocket Pool, and Coinbase.

Furthermore, validators earn additional yield in return because the staked ETH is used for securing extra functions.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

EigenLayer leads the away

EigenLayer, the biggest restaking protocol, noticed a pointy surge in deposits since its mainnet launch in June final yr. Nevertheless, the expansion has been meteoric over the previous month. Complete worth locked (TVL) logged a 6x soar to $1.67 billion.

The surge adopted a elevate within the protocol’s restaking restrict to 500,000 ETH from the earlier 120,000 ETH.

Supply: DeFiLlama