How Ethereum’s MVRV could have a say in its next price rally to $3.8K

- Ethereum’s MVRV momentum neared a bullish cross, with technical indicators signaling robust upward potential

- Increased derivatives exercise and quick liquidations lent gas to Ethereum’s bullish momentum

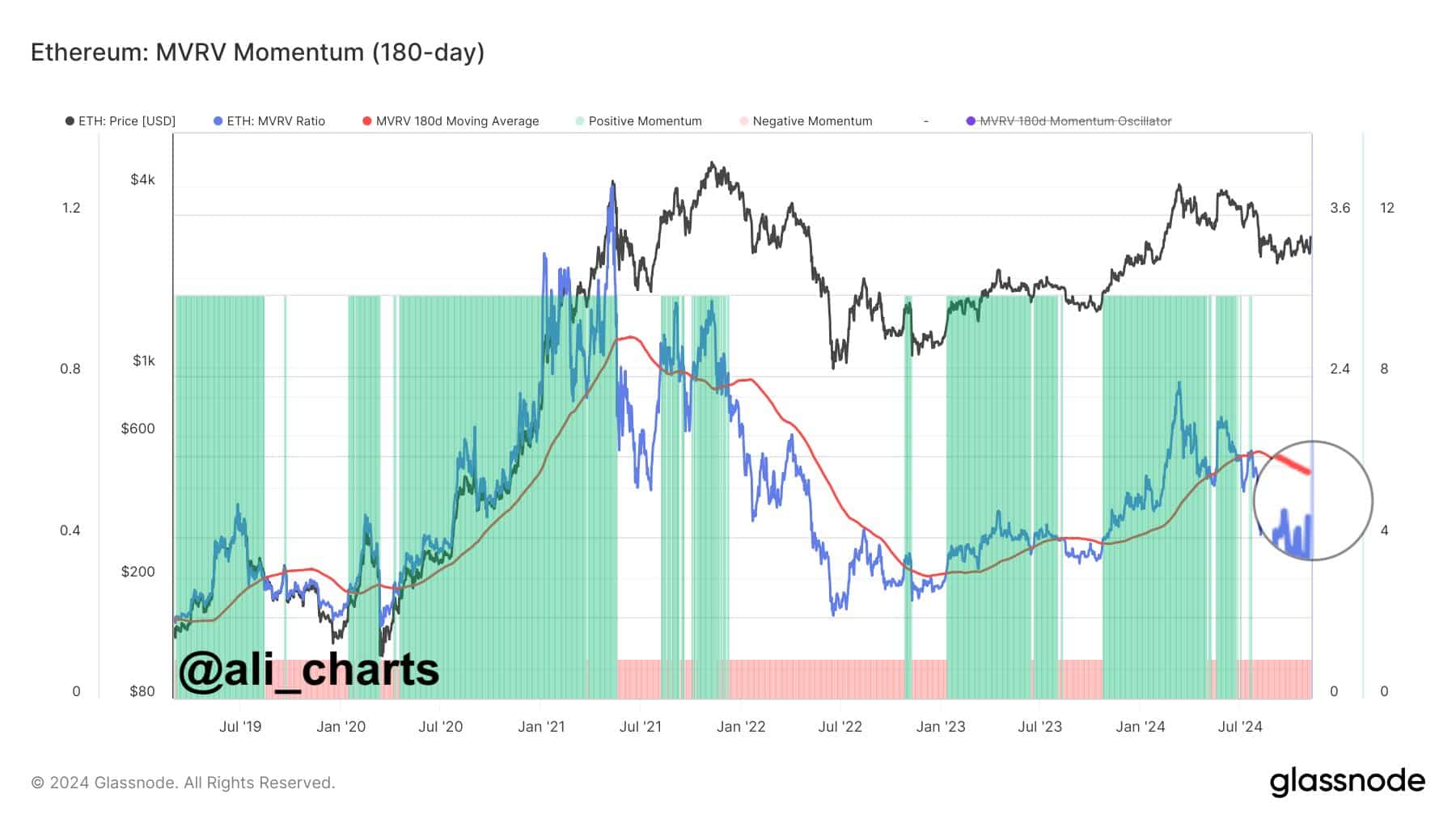

Ethereum [ETH], on the time of writing, was gaining traction because it appeared to be approaching a important MVRV Momentum cross above the 180-day transferring common—A historic indicator of bullish efficiency. This sign, carefully watched by merchants, usually marks the beginning of Ethereum’s strongest uptrends by highlighting when ETH is undervalued, relative to the typical revenue margin of its holders.

Following ETH’s current rally from $2,400 to $2,800, the crypto group is eyeing this cross as a possible catalyst for additional good points.

At press time, ETH was buying and selling at $2,829.58, following a 7.19% hike within the final 24 hours. Nevertheless, as this cross is but to happen, there should be extra room for Ethereum’s momentum to construct. Therefore, the query – Does this imply a significant rally could also be on the horizon?

Supply: X/Ali

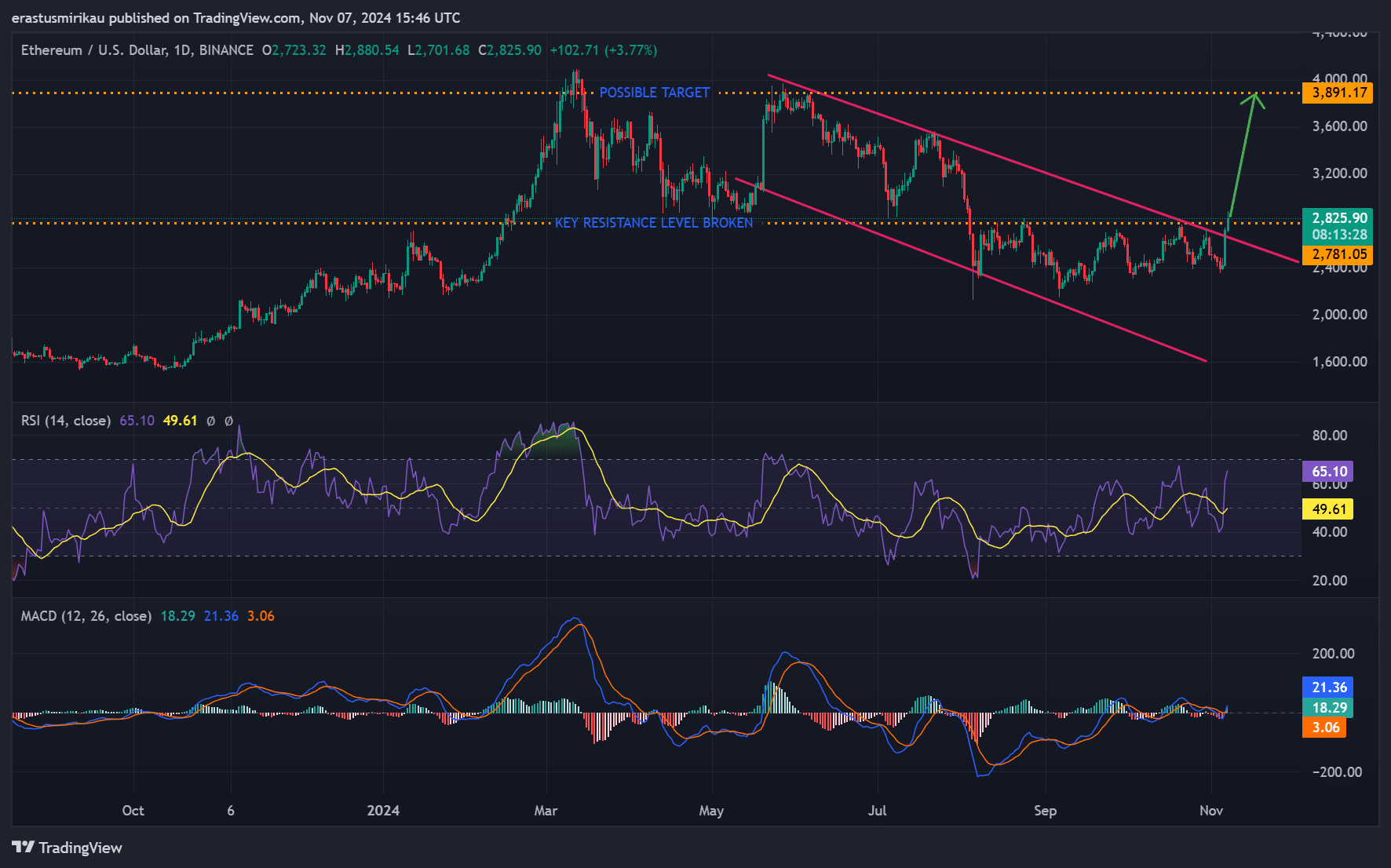

ETH chart evaluation – Technical indicators sign power

Inspecting Ethereum’s each day chart, key technical indicators revealed a promising outlook. ETH lately broke above a descending channel, indicating a shift in momentum. At press time, the RSI had a price of 65.10, barely under the overbought threshold. This recommended that there’s nonetheless room for additional upward motion.

In the meantime, the MACD crossed above the sign line, confirming a bullish pattern that might assist additional good points if shopping for strain continues. This confluence of indicators highlighted ETH’s robust place because it neared a important resistance, setting the stage for a attainable run in the direction of its subsequent goal of $3,891.

Supply: TradingView

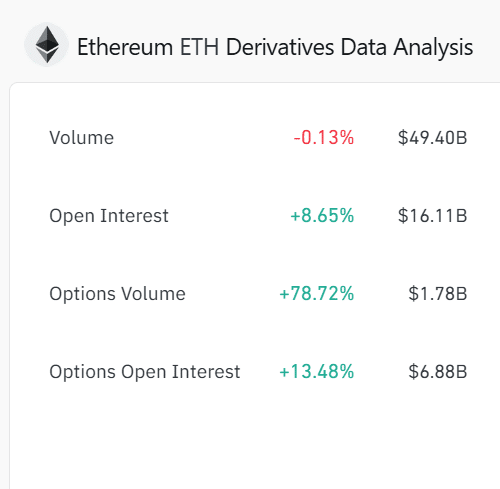

ETH derivatives knowledge – Rising investor curiosity

Ethereum’s derivatives knowledge strengthened this constructive outlook. Open curiosity climbed by 8.65% to $16.11 billion, displaying better dealer engagement. Moreover, Choices Open Curiosity grew by 13.48% – Totaling $6.88 billion – Whereas Choices quantity surged by 78.72%.

This hike in exercise alluded to confidence in Ethereum’s near-term progress potential. Particularly as extra traders place themselves for potential good points.

Supply: Coinglass

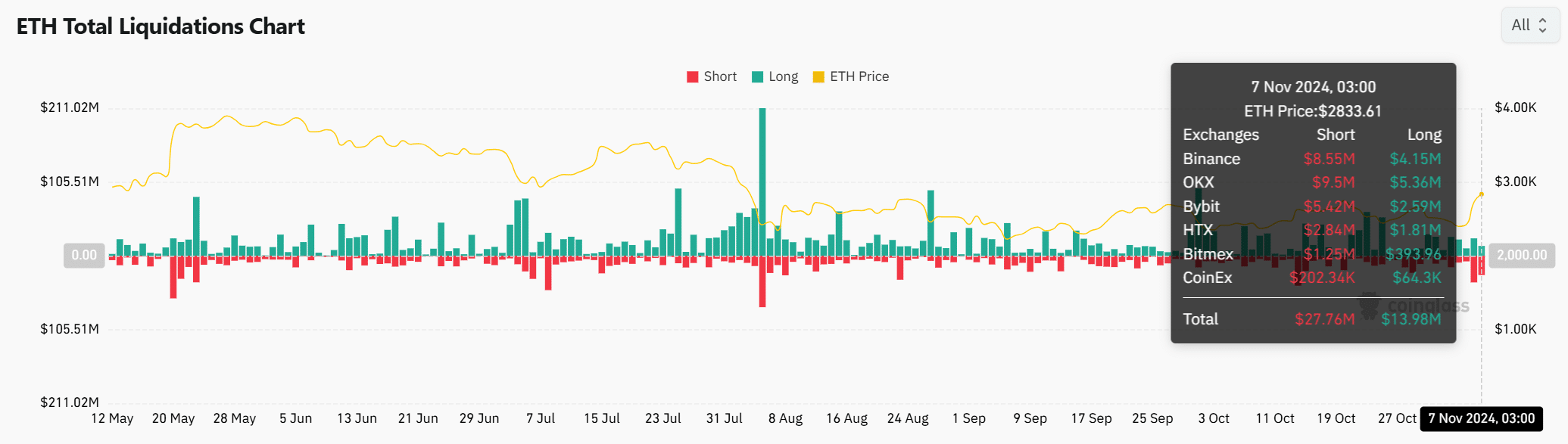

Ethereum liquidation ranges – Shorts face strain

Liquidation knowledge additional underscored ETH’s present dynamics. On 7 November, complete liquidations hit $41.74 million, with shorts comprising $27.76 million. This wave of quick liquidations highlighted mounting strain on bearish positions, which might drive additional buy-side assist.

If Ethereum’s value continues to climb, extra quick liquidations might observe, amplifying bullish momentum.

Supply: Coinglass

Learn Ethereum’s [ETH] Value Prediction 2024–2025

Will Ethereum’s MVRV momentum cross verify a rally?

With Ethereum nearing a vital MVRV Momentum cross, robust technical indicators, better derivatives exercise, and quick liquidations all pointed to a possible rally. Nevertheless, warning could also be warranted till the cross happens.

If confirmed, this sign might push Ethereum towards its $3,891 goal. Will ETH proceed north and meet bullish expectations, or will resistance maintain it again? Ethereum’s subsequent strikes are essential and shall be carefully watched.