How memecoins affected Ethereum’s gas prices

- Memecoins and MEV bot exercise affected Ethereum’s fuel utilization.

- Rise in NFT trades, elevated promoting stress on ETH holders, and shifting dealer conduct noticed.

Ethereum’s [ETH] traditionally excessive fuel costs have typically deterred customers from utilizing the community, main them to discover various protocols. Nevertheless, the current decline in fuel utilization might have constructive implications for each Ethereum and ETH sooner or later.

Ethereum is gassed up

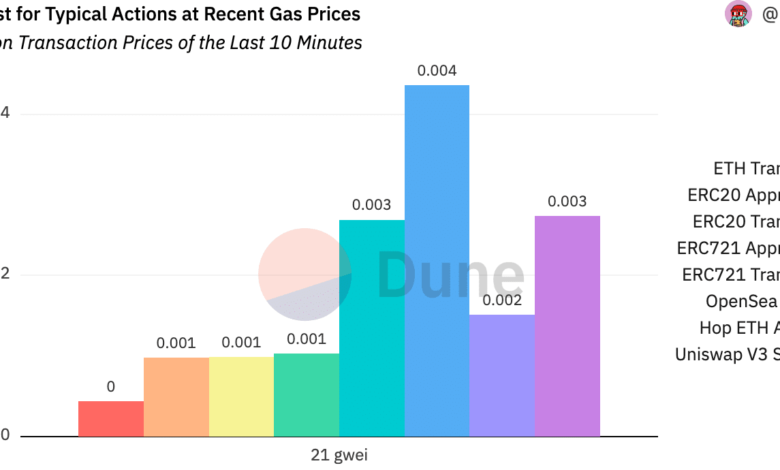

In accordance with Dune Analytics, Ethereum’s each day common fuel reached its lowest level prior to now two months. As of three June, the common fuel stood at 24gwei, with the press time fuel at 17gwei.

Supply: Dune Analytics

The lower in fuel charges could also be attributed to the current hype surrounding memecoins, which has elevated exercise on the community. The utilization of Miner Extractable Worth (MEV) bots might have additional contributed to the decline as effectively.

MEV bots are automated methods that leverage transaction sequencing to use worthwhile alternatives within the Ethereum community. The prevalence of those bots can influence fuel charges by optimizing transaction execution, probably lowering prices for customers.

The NFT angle

There was constant fuel utilization within the Ethereum protocol, facilitated by low fuel charges. Furthermore, the variety of NFT trades on the Ethereum community rose alongside.

Supply: Santiment

Notably, distinguished blue-chip NFTs like MAYC and Azuki drove the surge in NFT quantity. DappRadar’s data indicated that over the previous week, the quantity of those NFTs elevated by 29.9% and 129% respectively.

In the meantime, Ethereum’s native cryptocurrency, ETH, was buying and selling at $1,873 at press time. The coin’s MVRV (Market-Worth-to-Realized-Worth) ratio elevated during the last month, suggesting that the profitability of addresses holding ETH is comparatively excessive.

This might incentivize these deal with holders to promote and safe income, probably impacting the worth of ETH within the close to future.

Supply: Santiment

Is your portfolio inexperienced? Verify the Ethereum Revenue Calculator

Lastly, the put-to-call ratio for Ethereum has declined throughout this era. This means a shift in dealer conduct, with a decreased curiosity in protecting put choices relative to name choices.

Such a pattern might counsel rising optimism amongst merchants relating to the long run value motion of Ethereum.