How miner revenues are shaping Bitcoin’s July prospects

- Bitcoin miner income displays the bettering state of BTC however gradual phases are anticipated.

- Bitcoin miner sentiments enhance in favor of the upside.

Is Bitcoin headed for one more low volatility section? That is perhaps the case now that Bitcoin miner income is tanking. That is opposite to what we’ve seen in the previous couple of months throughout which Ordinal Inscriptions fueled strong miner income progress.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Glassnode analysis revealed within the final 24 hours that Bitcoin % miner income generated from charges fell to a 4-month low. Ordinal inscriptions and unstable demand beforehand ensured larger charges because of extra market exercise, therefore extra miner income. This was notably the case in Could and June.

📉 #Bitcoin $BTC % Miner Income from Charges (7d MA) simply reached a 4-month low of two.075%

View metric:https://t.co/NphJIZNcsL pic.twitter.com/3LsX5UniQh

— glassnode alerts (@glassnodealerts) July 10, 2023

Miner income has traditionally been a wholesome indicator of market exercise. However could be much more helpful when mixed with different miner information. For instance, it may be mixed with miner flows and miner income to find out miner sentiment. So, what’s the present state of those metrics?

Miner exercise improves from June lows however miner flows point out that…

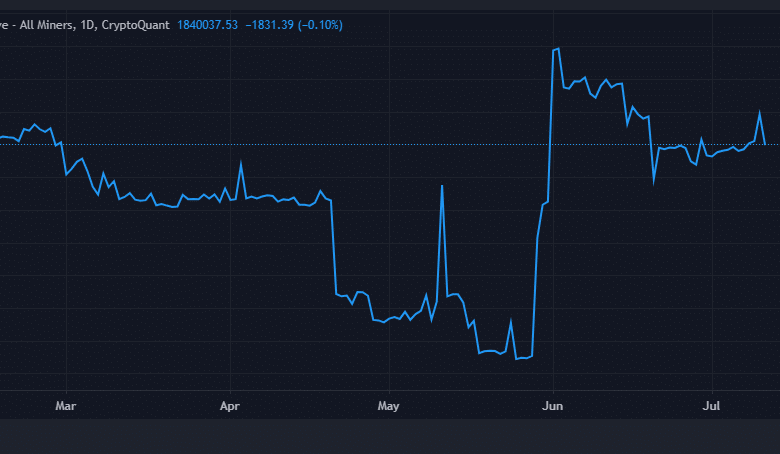

Miner income shot again up on the finish of Could and early June after a earlier downward slope. This spike confirmed a little bit of a sentiment change however the miner reserves have slipped barely from June highs. Nevertheless, it was value noting that miner reserves at the moment are larger than early March ranges.

Supply: CryptoQuant

Whereas Bitcoin miner flows are sustaining wholesome ranges in comparison with the previous couple of months, miner flows have shrunk. Each miner inflows and outflows have been at a month-to-month low. Nonetheless, it was value noting that miner outflows have been barely larger than inflows at press time.

Supply: Cryptoquant

Up to now, we will conclude that miner flows are low sufficient to not have an effect at present ranges. Maybe an indicator that Bitcoin’s present degree and prevailing market circumstances might not essentially level to a insecurity. Quite the opposite, it displays a return of some confidence since June. In different phrases, the present miner information means that miners are leaning extra in the direction of the facet of hodling.

What number of are 1,10,100 BTCs value right now

Maybe the above findings are due to the latest accumulation that we’ve seen in Bitcoin’s case. Particularly from establishments. As such, we’ve seen a drop within the quantity of BTC on exchanges. Glassnode information lately revealed that Bitcoin balances on exchanges have now dropped to 5-year lows.

📉 #Bitcoin $BTC Stability on Exchanges simply reached a 5-year low of two,251,571.825 BTC

Earlier 5-year low of two,251,575.975 BTC was noticed on 08 July 2023

View metric:https://t.co/9vOOAmwh32 pic.twitter.com/NYZDoH46J3

— glassnode alerts (@glassnodealerts) July 10, 2023

A decrease steadiness on exchanges displays the state of wholesome accumulation that has prevailed for the previous couple of weeks. Whereas these developments have fueled a restoration above the $30,000 worth vary, it doesn’t essentially assure the sustainability of those ranges.