How Strategy outperformed Bitcoin by 3.3X with 2,115% share gains

- Technique’s BTC holding crossed 500K and hit 2.4% of the full provide.

- The agency had $15B left for debt issuance and general $39B capital to be raised per its 21/21 plan.

Technique (previously MicroStrategy) turned the primary public firm to cross 500K Bitcoin [BTC] holdings after the newest buy.

On the twenty fourth of March, Michael Saylor, founding father of Technique, stated that the agency acquired an additional 6,911 BTC price $584 million.

The agency’s complete holdings jumped to 506,137 BTC price $43.9B, translating to 2.4% of the full BTC provide (21M cash).

To place this in perspective, 492,750 BTC can be mined between now and March 25, 2028, simply earlier than the following halving. Merely put, Technique held extra BTC than would ever be mined within the subsequent three years.

MSTR as a Bitcoin beta

Since Technique’s aggressive BTC strategy in 2020, its share, MSTR, has been the biggest beneficiary.

Over the previous 5 years, MSTR gained 2,115% whereas BTC rallied 638%. It outperformed the world’s largest cryptocurrency by 3.3X.

Supply: CryptoQuant

On a month-to-date foundation, MSTR was up practically 25%, whereas BTC bounced about 1%. The outperformance was very clear, even on a YTD (year-to-date) timeframe.

MSTR was up 12% in 2025, whereas BTC was down 8%, reinforcing the inventory as the last word BTC proxy play.

That stated, the newest buy was financed by a current inventory sale (each MSTR and STRK), SEC filing confirmed.

“The bitcoin purchases (6,911 BTC) have been made utilizing proceeds from the Frequent ATM and the STRK ATM.”

In brief, the current most well-liked inventory sale (STRF) was but to be deployed. BTC analyst James Van Straten noted that the agency might purchase an additional 7K BTC within the subsequent few days.

For the unfamiliar, this was a part of the agency’s 21/21 plan to lift $42B of capital by means of inventory issuance and debt financing for BTC buys.

In accordance with analyst Ragnar, the agency had $15B price of debt issuance remaining beneath the plan, with an general $39B capital left to be raised.

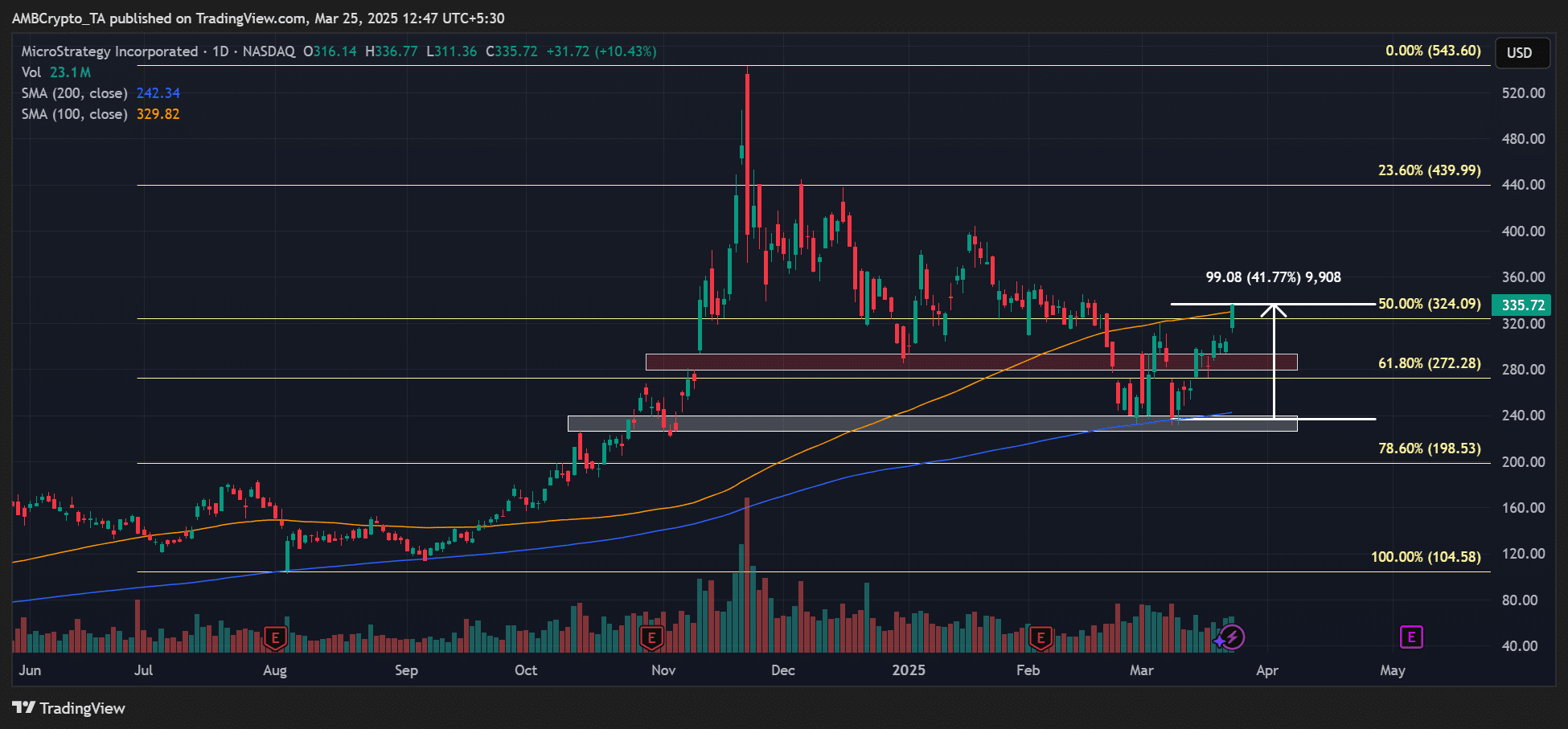

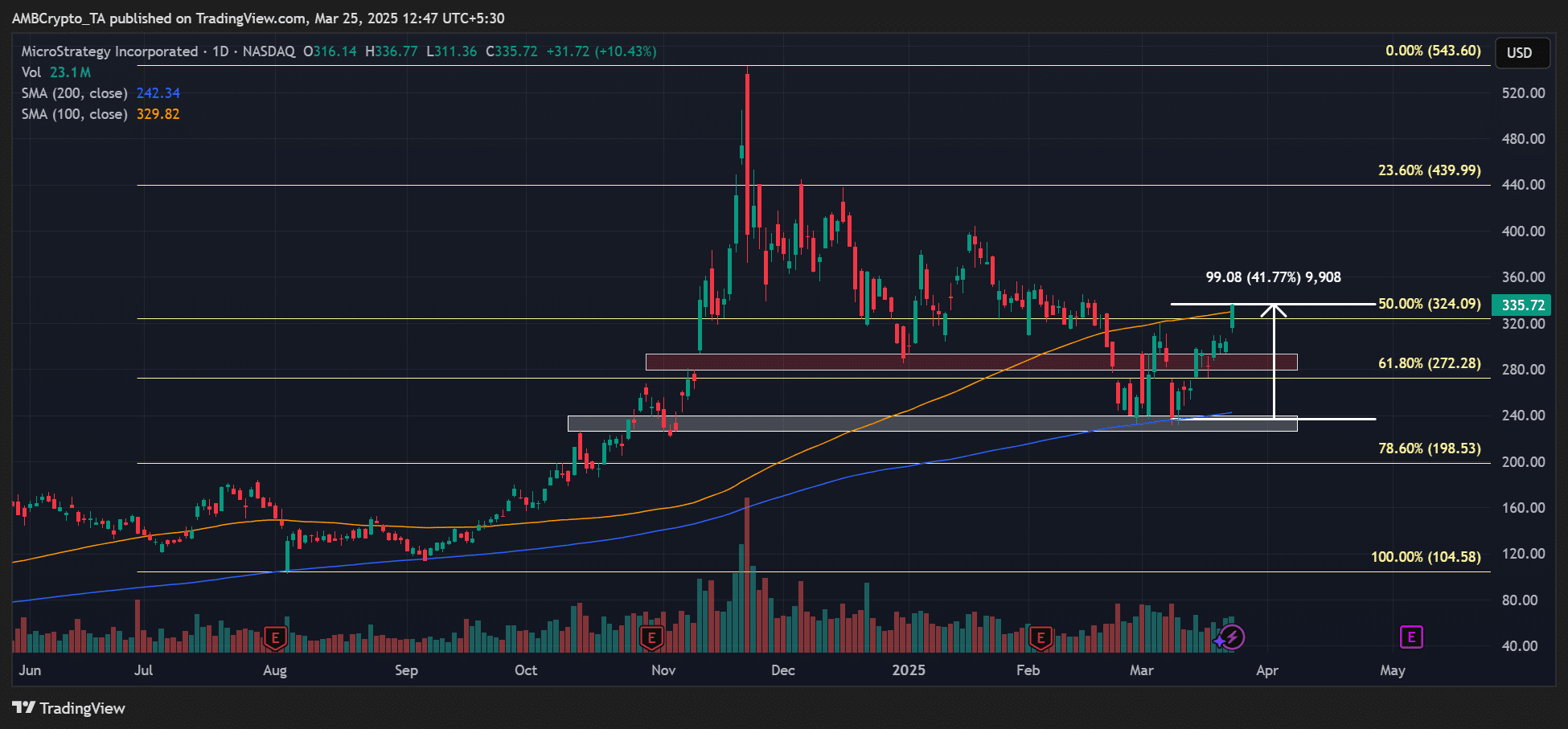

On the value chart, MSTR oscillated between 200DMA (Every day Transferring Common) and 100DMA.

The 41% rally seen up to now two weeks tapped the higher vary of 100DMA (orange). Whether or not a breakout would occur remained to be seen.

Supply: MSTR, TradingView