How to Backtest a Crypto Trading Strategy

Earlier than placing actual cash in danger, merchants use crypto backtesting to see how a method would have carried out underneath previous market circumstances. It’s the quickest technique to check concepts, spot weaknesses, and refine what works with out emotional or monetary strain. This information walks you thru tips on how to backtest step-by-step, from setting guidelines and gathering knowledge to measuring efficiency like a professional.

What Is Backtesting in Crypto Buying and selling?

Backtesting is the method of testing a buying and selling technique in opposition to historic market knowledge to see how it might have carried out prior to now. As a substitute of risking actual capital, merchants simulate trades utilizing previous value actions to know how a method behaves underneath completely different market circumstances.

In crypto, backtesting usually depends on OHLCV knowledge—open, excessive, low, shut, and quantity—to recreate the value motion over a particular interval. By making use of your technique’s entry and exit guidelines to this dataset, you may measure hypothetical outcomes corresponding to win charge, drawdown, and whole returns.

The aim isn’t to foretell the long run completely, however to confirm whether or not your strategy has a constant logic and danger profile earlier than shifting to reside buying and selling. When performed correctly, backtesting helps merchants establish weak assumptions early and refine methods for higher real-world efficiency.

Why Backtesting Is Essential for Crypto Merchants

Backtesting offers merchants a technique to consider whether or not a method is more likely to work earlier than actual cash is on the road. It transforms buying and selling concepts into measurable outcomes, displaying how a plan would have carried out underneath completely different market circumstances.

By reviewing efficiency metrics corresponding to whole return, win charge, or most drawdown, merchants can establish if their technique is constant or too dangerous. These metrics spotlight strengths and weaknesses that aren’t apparent from a single commerce or a brief live-testing interval.

Extra importantly, backtesting encourages disciplined decision-making. It replaces guesswork with knowledge, serving to merchants give attention to refining what works and discarding what doesn’t. A well-tested technique offers confidence and construction—two issues each crypto dealer wants when the market will get risky.

Totally different Methods to Backtest a Crypto Technique

Crypto merchants can backtest in a number of methods, relying on their expertise and targets. Every technique presents a trade-off between velocity, accuracy, and suppleness.

Handbook Backtesting with Spreadsheets or Charts

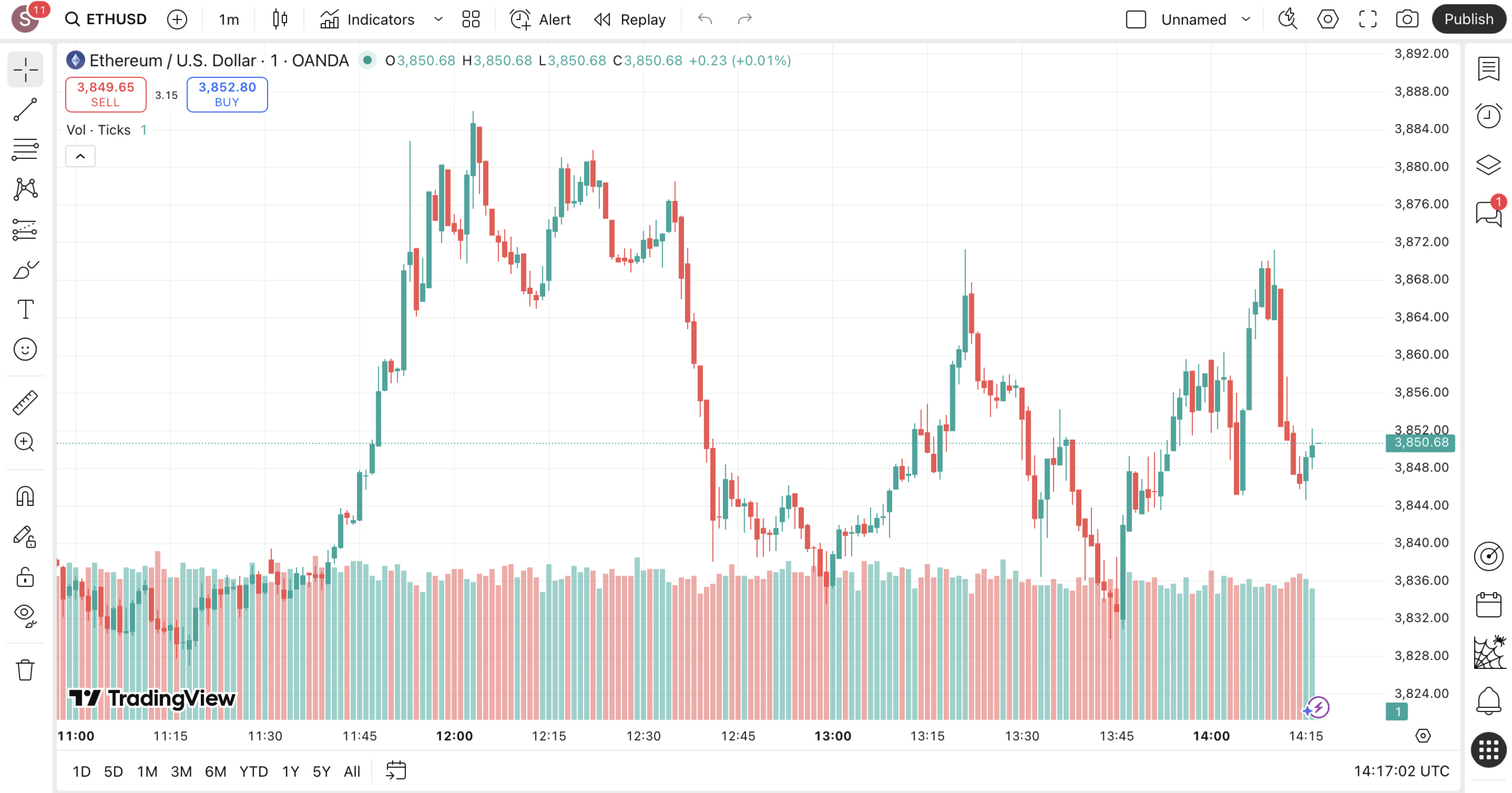

That is essentially the most easy technique. You scroll via historic value charts (normally candle-by-candle) and mark the place your entry and exit indicators would set off. Every simulated commerce is logged in a spreadsheet with its open value, shut value, revenue or loss, and notes concerning the setup.

Handbook testing helps you perceive market construction and the way your guidelines behave in several circumstances. Nevertheless, it’s time-consuming and vulnerable to bias since merchants can subconsciously skip dropping trades or alter indicators after seeing outcomes. It’s greatest for validating easy methods earlier than shifting to automated instruments.

Backtesting with TradingView Scripts or Bots

TradingView permits customers to code methods in Pine Script or use built-in templates. As soon as written, a script robotically checks your logic on years of historic knowledge and produces charts displaying entry/exit factors, win charges, and drawdowns.

Behind the scenes, these instruments use an event-driven backtester—a system that reacts to every new value “occasion” (like a candle shut) and triggers simulated trades accordingly. This makes outcomes extra correct and reproducible. Merchants may also forward-test these bots in reside mode to verify efficiency in actual markets.

Automated Backtesting Instruments (No Coding Wanted)

No-code platforms like Coinrule, Kryll, or 3Commas let customers design methods visually via logic blocks (e.g., “if RSI < 30, then purchase”). These companies run your logic on historic value knowledge and report revenue curves, commerce counts, and common returns.

They usually use a vectorized backtester, which means the system processes historic knowledge in bulk arrays as a substitute of step-by-step. This strategy allows quick testing throughout many cash and timeframes. It’s nice for non-technical merchants who need effectivity however can’t customise execution as deeply as with code-based options.

Utilizing Python (for Superior Customers)

Python backtesting presents most flexibility. Merchants can construct or use open-source frameworks like Backtrader, Zipline, or vectorbt to simulate any crypto technique. This setup permits integration of reside knowledge, advanced indicators, and a number of exchanges.

Extra importantly, it allows optimization: adjusting parameters corresponding to stop-loss ranges, indicator thresholds, or lookback intervals to seek out essentially the most sturdy mixtures. Python backtesting may also embrace superior strategies like walk-forward validation and Monte Carlo simulations, giving merchants the identical analytical energy utilized by quantitative funds.

Methods to Put together Earlier than You Backtest

Begin by defining your entry indicators, the exact circumstances that set off a purchase or promote. These might be primarily based on indicators like shifting averages, RSI thresholds, or value breakouts. Simply as essential are your exit indicators, which let you know when to shut a place. Constant, rule-based indicators take away emotion and make efficiency simpler to measure.

Subsequent, resolve the way you’ll deal with danger administration. Set guidelines for optimum place dimension, stop-loss ranges, and revenue targets. This ensures your technique stays sustainable even throughout drawdowns.

Lastly, doc each rule earlier than testing. A well-prepared backtest mirrors actual buying and selling self-discipline, permitting you to give attention to enhancing logic as a substitute of improvising throughout evaluation.

Keep Secure within the Crypto World

Learn to spot scams and defend your crypto with our free guidelines.

Step-by-Step Information to Backtesting a Crypto Technique

Now, let’s speak about backtesting itself. It really works greatest when performed systematically. Observe these steps to make sure your outcomes are dependable and repeatable.

Step 1: Outline Your Technique

Begin by outlining the logic behind your buying and selling thought. Establish which indicators you’ll use to generate purchase or promote indicators, corresponding to shifting averages, RSI, or quantity filters. Then, resolve the precise circumstances that set off a commerce. Readability right here prevents confusion when you begin testing.

Step 2: Get Historic Crypto Worth Information

Acquire high-quality market info from respected sources or exchanges. Along with candles and quantity, superior customers could embrace order e book knowledge to simulate liquidity and slippage. Clear, full knowledge ensures your backtest mirrors life like buying and selling circumstances.

Step 3: Run the Backtest (Manually or Utilizing Instruments)

Apply your guidelines to the historic knowledge utilizing your chosen platform: guide spreadsheets, TradingView scripts, or automated software program. The backtest will simulate how your trades would have unfolded over time.

Step 4: Document Trades and Outcomes

Monitor each place, together with entry value, exit value, revenue or loss, and notes about market habits and context. Visualize commerce efficiency over time with an fairness curve—a chart displaying how your account steadiness would have modified. It helps you see volatility, drawdowns, and general consistency.

Step 5: Test Key Efficiency Metrics

Analyze your outcomes utilizing key statistics like return and max drawdown. Return exhibits how worthwhile the technique is, whereas drawdown reveals how a lot danger it carries. A very good system balances each—regular good points with manageable declines.

Methods to Measure Backtesting Outcomes

After operating a backtest, the next move is to guage efficiency objectively. Past fundamental returns, merchants use ratios to know how a lot danger was taken to attain these outcomes.

The Sharpe Ratio measures how a lot extra return your technique produced per unit of whole volatility. A better Sharpe means extra constant efficiency relative to danger.

The Sortino Ratio refines this by focusing solely on draw back volatility—penalizing losses however not steady or optimistic returns. It’s usually higher for crypto, the place markets are risky however trend-driven.

Collectively, these metrics present whether or not your technique’s income come from talent or from taking extreme danger, serving to you evaluate completely different approaches on an equal footing.

Widespread Backtesting Errors to Keep away from

Even sturdy methods can produce false confidence if the backtest isn’t life like. Preserve these factors in thoughts.

- Utilizing unhealthy or incomplete knowledge. Lacking candles, gaps, or incorrect timestamps distort outcomes. At all times confirm that your historic knowledge is correct and full earlier than testing.

- Overfitting your technique to previous outcomes. Overfitting happens when a mannequin is tuned too carefully to historic knowledge and fails in reside markets. Preserve methods easy and validate them on recent datasets.

- Ignoring slippage, charges, or market affect. Slippage modifications buying and selling outcomes when execution differs from anticipated costs, and buying and selling charges scale back returns. Embody these prices to mirror life like efficiency.

- Mistaking short-term luck for long-term efficiency. Keep away from look-ahead bias and ensure outcomes throughout a number of market cycles. A worthwhile backtest over a couple of months doesn’t assure future consistency.

Finest Instruments for Crypto Backtesting

Skilled merchants depend on dependable software program instruments to simulate methods underneath previous market circumstances and consider previous efficiency earlier than risking capital. The appropriate platform helps you accumulate knowledge, check concepts rapidly, and refine setups that result in buying and selling success.

Important instruments embrace:

- TradingView: Ideally suited for visible technique testing and efficiency monitoring. Nice for each freshmen and superior customers.

- Backtrader or vectorbt: Python frameworks that allow merchants automate the backtesting course of with full management over knowledge and execution.

- Coinrule, Kryll, and related no-code platforms: Let customers design and check buying and selling logic with out coding, helpful for quick experimentation.

- Paper buying and selling: A essential step after backtesting. It permits merchants to simulate reside execution with digital funds, confirming {that a} technique performs as anticipated in actual market circumstances.

What to Do After Backtesting Your Technique

Backtesting is only one a part of technique improvement. When you’ve confirmed {that a} setup performs effectively, the subsequent step is to validate it underneath new circumstances and refine the way you handle danger.

Use walk-forward evaluation to check your technique throughout completely different time intervals or market phases. This technique exhibits whether or not efficiency holds up when circumstances change, serving to you filter out programs that solely labored throughout particular traits.

Then assessment your place sizing. Even a worthwhile technique can fail if commerce sizes are inconsistent or too massive. Making use of a transparent sizing mannequin retains outcomes steady and prevents impulsive choices throughout volatility. Skilled merchants usually keep a number of methods to diversify efficiency and scale back drawdowns.

Ultimate Ideas: Is Backtesting Price It?

Backtesting isn’t about predicting the long run. A well-designed check reveals whether or not your buying and selling logic is sound, your assumptions life like, and your dangers underneath management.

When mixed with disciplined danger administration and ahead testing, crypto backtesting helps merchants refine their edge with out emotional or monetary strain. It turns uncooked concepts into structured programs, making success measurable as a substitute of unintended.

Briefly: backtest totally, handle danger rigorously, and let knowledge information your technique.

FAQ

Can I backtest a crypto buying and selling technique with out figuring out tips on how to code?

Sure. Many platforms now supply visible builders or automated instruments that allow you to check methods with out programming. They deal with knowledge, execution, and reporting for you.

What are the dangers of relying an excessive amount of on backtesting outcomes?

Overconfidence is frequent. Information snooping bias (whenever you tweak a method till it matches previous knowledge) could make outcomes look sturdy however fail in actual buying and selling.

Is it price backtesting easy methods like RSI or shifting common crossovers?

Completely. Easy methods are simple to check, interpret, and enhance. Even fundamental programs can reveal how completely different market circumstances have an effect on efficiency.

What’s one of the best timeframe to make use of when backtesting a crypto technique?

It depends upon your targets and knowledge frequency. Scalpers use minute-level knowledge, whereas swing merchants depend on 4-hour or each day charts for extra steady outcomes.

Is 100 crypto trades sufficient for backtesting?

Often, no. Dependable testing requires bigger pattern sizes throughout each in-sample and out-of-sample intervals to verify constant efficiency.

Disclaimer: Please be aware that the contents of this text are usually not monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.