Americans bullish on cryptos despite growing regulatory concerns

- Practically 70% Individuals felt that Bitcoin will hit its ATH over the following 5 years.

- 2/3 of the respondents felt that Bitcoin’s shortage might drive costs sooner or later.

Ripple CEO Brad Garlinghouse, whereas celebrating the win within the hotly contested authorized battle in opposition to the U.S. Securities and Change Fee (SEC), didn’t mince his phrases and went on to name the watchdog as a “bully”, in response to a current Bloomberg article.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

The acrimony, although, may not be simply restricted to Garlinghouse. U.S. monetary regulators have been receiving a number of flak from crypto market individuals with many calling current actions as a coordinated try and stem the expansion of digital property.

Crypto actions below scrutiny within the U.S.

SEC initiated authorized motion in opposition to the 2 largest buying and selling platforms within the sphere, Binance and Coinbase, for alleged violations of U.S. securities legislation. Other than this, different entities like crypto change Kraken and stablecoin Binance USD [BUSD] have been on the receiving finish of regulatory pushbacks in 2023.

Decentralized finance (DeFi) actions, rising as a sizzling sector within the Web3 realm, have additionally come below the radarof SEC. Final week, the U.S. senate proposed a invoice that may convey DeFi below the purview of anti-money laundering and financial sanctions compliance necessities.

The market, as anticipated, has responded negatively to those developments, with prime asset values immediately turning purple. Buyers concern that the financial atmosphere will grow to be more and more hostile for cryptos and blockchain-based providers within the U.S., the worldwide epicenter of the trade on the time of writing.

However regardless of the pessimism, most of the people in America nonetheless finds religion within the long-term prospects of cryptocurrencies.

The ‘crypto dream’ is alive

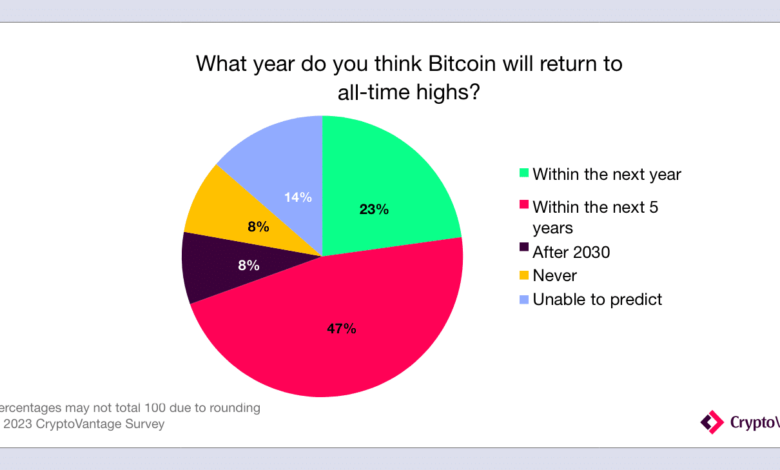

In accordance with a current survey carried out by CryptoVantage, practically 70% Individuals felt that Bitcoin [BTC] would return to its all-time excessive (ATH) of $69,000 over the following 5 years.

The survey solely polled residents who’ve traded in cryptocurrencies earlier than, with the intention to investigate elements which result in crypto investments.

Supply: CryptoVantage

Surprisingly, there have been a handful of lovers, about 23%, who believed that the king coin will hit the ATH in 2023 itself. Whereas the optimism was noteworthy, it regarded far-fetched given the momentum of the market.

Nonetheless, the respondents weren’t simply betting huge on BTC. Ethereum [ETH], the second-largest coin by marketcap, was picked up because the crypto with the very best risk of surpassing BTC within the subsequent bull run. About 46% of the folks felt so.

Is Bitcoin’s halving occasion on folks’s thoughts?

The survey additionally delved into the general public’s understanding of the elements which might in the end dictate crypto worth actions.

A considerable 2/3 of the respondents selected “provide and demand” as the first motive influencing market fluctuations. Contemplating that the all-important BTC halving event is lower than a 12 months away, the expectation holds worth.

BTC’s provide is hard-capped at 21 million and the coin is steadily transferring in direction of shortage. The quadrennial halving cuts miners’ block rewards in half and lowers the variety of tokens in circulation. Traditionally, these occurrences have preceded bull markets.

The halving in July 2016 was adopted by a 3x rise in BTC’s worth over the following 12 months. Equally, the final halving in Could 2o20 noticed the king coin explode by 500% within the following 12 months.

Supply: CoinMarketCap

International macroeconomic developments together with inflation and U.S. financial coverage, was highlighted as one other main issue influencing crypto costs.

We have now already seen how international locations battling hyperinflation like Turkey have taken refuge in cryptos, extra particularly stablecoins. And with a robust risk of the U.S. Federal Reserve pausing its cycle of rate of interest cuts amidst cooling inflation means investments into dangerous property may quickly rise.

Supply: CryptoVantage

Nonetheless, the implications of regulatory insurance policies have been additionally on folks’s thoughts. About 36% of the folks surveyed felt that regulatory and coverage choices would affect crypto market strikes in a giant approach.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Let’s examine what AI has to say

The pattern measurement taken for the survey, about 1,000 folks, might be very nicely debated. However on the identical time, it provides perspective on Individuals’ consciousness about developments and their religion in digital property.

Simply so as to add a tinge of AI to issues, we threw a query to ChatGPT concerning the developments creating the U.S. within the face of rising regulatory scrutiny.

The bot, in its typical politically right state, mentioned that whereas some could also be enchanted with Bitcoin’s protected haven narrative and proceed to stay, others may adapt to adjust to laws.

Supply: ChatGPT