How to Earn Interest on Crypto With High Yields

Half 1: The Fundamentals of Incomes Crypto Curiosity

Cryptocurrency markets are well-known for his or her inherent volatility. Whereas this poses nontrivial dangers, it additionally opens up distinctive alternatives to earn yields and returns that the normal inventory market investor might not even dream of.

These substantial yield alternatives have grown bigger and extra accessible with the event of the decentralized finance (DeFi) trade. The actual recreation changer has come about with the growth of crypto centralized exchanges (CEXs) and decentralized exchanges (DEXs), each striving to offer clients a range of monetary merchandise.

On this article, we’ll present you tips on how to earn curiosity on crypto and, extra importantly, how to decide on funding alternatives that may optimize your yields.

Key Takeaways

- Some very important concerns in maximizing returns on crypto embody investing with stablecoins for extra secure revenue, sticking to at least one platform for increased long-term curiosity and understanding the kind of rate of interest.

- Understanding your nation’s stance on crypto relating to taxes is essential, as it could impression your complete achieve.

- Bybit provides you eight merchandise for incomes curiosity on crypto: Bybit Financial savings, Liquidity Mining, Twin Asset, Wealth Administration, ETH 2.0 Liquid Staking, Bybit Launchpool, Bybit Lending and Bybit NFT Market.

Jargon to Know to Assist You Earn Curiosity on Crypto

Earlier than diving into one of the best alternatives to earn curiosity on crypto, let’s cowl a few of the most vital phrases used within the crypto finance trade.

Annual Proportion Yield (APY)

Annual proportion yield (APY) is yearly curiosity that accrues to your funding, considering the impact of compounding.

Market Capitalization

Market capitalization is the measure of a crypto’s market worth, which is derived by multiplying its present market value by its circulating provide.

Complete Worth Locked (TVL)

Complete worth locked (TVL) refers back to the complete market worth of all of the crypto funds at present locked in a DeFi platform’s good contracts.

Bear Market

A bear market refers to a considerable and often extended market decline. Bear markets are characterised by the dominance of promoting fairly than shopping for amongst market gamers.

Blockchain

A blockchain is a decentralized digital community that shops transactions in chains of blocks. Transactional exercise on a blockchain is managed collectively by all the community’s members/customers. A lot of the exercise on a blockchain community — alternate of funds between customers, affirmation of transactions, and enterprise operations — includes the usage of crypto cash.

Proof of Stake

Proof of stake (PoS) is a consensus mechanism used on some blockchain networks for validating block transactions. In PoS blockchains, community customers lock a certain quantity of their crypto belongings on the platform for the suitable to validate transactions and obtain staking rewards.

Crypto Staking

In a broad sense, crypto staking refers to locking crypto funds, each on centralized and decentralized platforms, with the intention to generate revenue.

Liquidity Mining

Liquidity mining is a course of whereby you deposit your crypto belongings in a DEX’s liquidity pool with the intention to obtain rewards in tokens and charges.

Impermanent Loss

Impermanent loss happens when the value of a deposited asset in a liquidity pool decreases from the time while you deposited it.

Earn Curiosity on Your Crypto

The first strategies by means of which you’ll earn curiosity on crypto are staking and lending. Staking includes locking your funds on a blockchain to assist validate transactions, in return for which you earn crypto rewards from the platform. Moreover, some centralized platforms — similar to CEXs and liquid staking service suppliers like Lido — additionally supply staking alternatives.

Staking, nonetheless, has moved past its unique intent and now usually refers to a plethora of funding merchandise on CEXs and DEXs, by which funds aren’t particularly used for blockchain validation.

Lending refers to depositing your funds to lending swimming pools (and typically to different varieties of swimming pools as properly) with DeFi lending and borrowing protocols, in addition to with centralized crypto lending platforms.

Crypto Lending vs. Staking

When contemplating lending and staking crypto, of key curiosity to traders are the safety and funding dangers concerned.

Safety

Staking is commonly seen as a safer choice than lending. In spite of everything, staking is a elementary course of on a blockchain community, and is thus well-protected by the general blockchain safety mannequin. If staking fails on a blockchain, the complete blockchain fails, together with all of its decentralized apps (DApps). Resulting from this essential significance of staking, its security is secured towards all however essentially the most extreme hacks.

DeFi lending additionally takes place on DApps residing on high of the underlying blockchain, which introduces an extra layer of vulnerability. Moreover, DeFi lending presents some very particular safety dangers, similar to flash mortgage assaults and rug pulls.

Due to this fact, staking typically poses comparatively fewer safety threats to your funds as in comparison with lending.

Threat vs. Return Distinction

The danger-vs.-return between staking and lending, nonetheless, will not be as clear-cut. Usually, established lending protocols similar to Aave or Compound Finance supply decrease rates of interest for large-cap, well-liked cryptocurrencies, as in comparison with customary staking rates of interest. Nonetheless, some smaller lending platforms may supply extraordinarily high-interest charges, often for extremely unstable, small-cap cash.

As with every part on the earth of finance, the upper the speed provided, the extra threat the funding carries. The draw back dangers of investing in very new, “darkish horse” cryptos obtainable on some lending platforms could be extraordinarily excessive. Moreover, while you use DeFi lending protocols, you’ll additionally face the potential for impermanent loss, as a result of volatility of crypto belongings. Nonetheless, protocols often help with mitigating the losses by distributing a portion of the buying and selling charges to liquidity suppliers.

Collateralization

One other vital issue within the staking vs. lending comparability is collateralization. On lending and borrowing platforms, debtors are first required to lend funds to the protocol as collateral for his or her borrowed quantities. Staking, then again, includes no collateral.

| Staking | Lending | |

|---|---|---|

| Safety | Comparatively safer (just one level of vulnerability — blockchain) | Comparatively much less safe (two factors of vulnerability — blockchain and the lending DApp)DeFi lending prone to flash-loan assaults and rug pulls |

| Threat returns | Related threat, however usually increased returns as in comparison with conservative lending choices | Charge of risk-vs.-return is dependent upon the lending platform usedAdded threat of impermanent loss when utilizing DeFi lending platforms |

| Collateralization | No collateral required | Debtors present collateral to the protocol |

Staking on Exchanges vs. Staking on Blockchains

For those who resolve to stake your crypto funds, your two most important choices shall be through CEXs, and/or participation on a blockchain platform, which might be finished immediately by operating a validator node or by becoming a member of a staking pool.

Blockchain Staking

Working a blockchain validator node allows you to earn staking rewards immediately. Nonetheless, the technical setup and minimal funding necessities are sometimes important. For instance, to run a validator node on Ethereum, you’ll have to obtain the complete blockchain, be on-line always to keep away from “slashing” penalties and run all of the requisite software program.

Monetary necessities for validator nodes are additionally removed from trivial. As an example, Ethereum validators should stake no less than 32 ETH (round $51,765 as of Sep 14, 2023).

As a substitute for direct staking, you could be part of a staking pool similar to Lido or Rocket Pool for ETH staking. These staking pool options enable customers to stake with considerably decrease technical and monetary commitments. Many ETH staking swimming pools additionally supply stakers a liquid staking spinoff token that represents the staked ETH and its related rewards, which can be utilized for varied DeFi functions. Nonetheless, not like direct blockchain staking, collaborating in a staking pool makes you depending on that pool’s operator.

Staking on CEXs

As a substitute of staking on a blockchain, whether or not individually or through a pool, you may think about staking through a CEX. For a lot of crypto traders and customers, the CEX route is extra inexpensive, much less dangerous and fewer technically sophisticated.

That is largely as a consequence of two key elements — the safety of your funds, and buyer assist. Main CEXs are the most important crypto buying and selling platforms within the trade. Their safety setups and buyer assist present key benefits over blockchains and DApps.

Any potential hacker assaults on a blockchain may result in potential lack of funds. On the similar time, you could use a custodial pockets on a significant CEX in order that your funds are at decrease threat of being hacked. Naturally, CEXs aren’t resistant to hacker assaults. Nonetheless, the bigger ones characteristic cybersecurity as a essential a part of their enterprise mannequin. Following the insolvency of one of many world’s main exchanges, FTX, many main CEXs similar to Bybit additionally embody proof of reserves (PoR) to make their holdings solely clear to the general public. Thus, custodial wallets on these CEXs are comparatively safer as in comparison with noncustodial blockchain wallets.

Staking on a CEX might also show you how to entry funding merchandise with extra secure and predictable charges and phrases. For novice traders, it is also a simpler technique to enter the world of crypto staking.

Moreover, staking on CEXs permits you to use cash which might be usually not “stakeable” through a blockchain platform. Blockchain staking solely works with cryptocurrencies primarily based on PoS networks. As an example, the world’s largest crypto, Bitcoin (BTC), isn’t primarily based on a PoS community, so it may possibly’t be staked on a blockchain.

| Staking on CEX | Staking on a Blockchain | |

|---|---|---|

| Safety | Safer, as a result of significance of safety on established CEXs | Much less safe, as a consequence of increased threat of hacker assaults |

| Buyer Assist | Available | Just about nonexistent — you’re by yourself in case of any issues or inquiries |

| Alternative of Cash | Wider selection, with the flexibility to stake cash that usually can’t be staked | Extra restricted selection, as some very talked-about cash (BTC, DOGE, BCH) can’t be staked |

Greatest Crypto Staking Cash for Highest Curiosity

The volatility of the crypto market implies that there’s dynamic change in terms of one of the best cash for incomes curiosity. Regardless, one of the best rates of interest within the staking recreation are usually obtainable through CEX staking. Since CEXs supply a big selection of cash and merchandise, there are sometimes nice offers obtainable.

CEXs additionally supply staking for well-liked stablecoins — similar to USDT, USDC, DAI and extra — that may’t usually be staked on a blockchain. As well as, a few of these cash have nice charges on supply. For instance, Bybit’s present rate of interest for USDT staking is 15%, one of many highest charges usually for staking.

The desk beneath reveals the highest 5 cash obtainable for staking on Bybit.

| Coin | Present Greatest APR | Present Market Cap |

|---|---|---|

| USDT | 15% | $83.04 billion |

| USDC | 8% | $26.21 billion |

| SOL | 6% | $7.69 billion |

| MNT | 6% | $1.32 billion |

| ATOM | 5.8% | $1.92 billion |

Cash are listed in descending order by rates of interest. Rate of interest and market cap information are legitimate as of Sep 14, 2023. (Information supply — Bybit.com)

Earn Greater Curiosity on Crypto

Given the volatility of the crypto trade, the important thing to incomes one of the best crypto rates of interest is to control the market and supply one of the best offers as they come up.

Put money into Stablecoins

One technique to cope with the inherent volatility of crypto markets is to take a position utilizing stablecoins. The main stablecoins — USDT, USDC and DAI — are available for staking on exchanges, although indirectly on a blockchain.

Stick With One Platform

Some crypto traders, in chasing the absolute best charges, transfer their funds out and in of centralized and decentralized staking and lending alternatives. Nonetheless, this technique may backfire, particularly with smaller funding quantities, as a result of charges concerned in withdrawing and depositing your funds on some platforms.

Thus, to earn the next rate of interest in the long run, it’s greatest to decide on a trusted platform by which to stake and maintain your crypto, as an alternative of shifting your belongings round.

Easy Curiosity vs. Compound Curiosity

One other vital consideration for maximizing your returns is the kind of rate of interest relevant to a staking or lending product. A few of these pay curiosity primarily based on APY, whereas others use the APR calculation technique.

The important thing distinction is that APR is a straightforward rate of interest calculation that doesn’t take compounding into consideration. Alternatively, APY is predicated on compounding curiosity. All different issues being equal, an APY-based funding will earn you increased complete returns as in comparison with an APR product with the very same numeric rate of interest.

Do Crypto Curiosity Charges Range Over Time?

Rates of interest on crypto investments do change over time. These adjustments might be abrupt, and fairly substantial. That is notably true for DeFi lending investments on platforms like Compound, which has algorithmic rates of interest that may change inside a single day. Alternatively, staking rates of interest are comparatively much less unstable.

Are You Eligible to Earn Crypto Curiosity?

Earlier than making your first funding, verify your eligibility, as necessities might fluctuate from platform to platform. As the primary, apparent requirement, it’s worthwhile to have some precise cryptocurrency funds available.

On most established centralized platforms, you additionally have to fulfill Know Your Buyer (KYC) and residency necessities. The residency requirement is especially related for Individuals, as some CEXs outdoors of the U.S. don’t present service to U.S. residents.

Moreover, you need to, in fact, do your individual analysis (DYOR) so that you simply perceive the dangers and technicalities concerned in crypto staking and lending.

Half 2: Begin Incomes Crypto Curiosity on Bybit

Bybit is among the main crypto buying and selling and funding platforms on the earth, providing a variety of interest-bearing merchandise. To begin investing with Bybit, you’ll first have to open an account. You may register your new account with Bybit through e-mail and cellular.

Purchase Crypto on Bybit

There are three most important methods to purchase crypto on Bybit: Peer-to-peer (P2P) service, fiat deposit and stability cost service, and bank card/financial institution switch.

1. Shopping for Crypto With P2P

The primary choice permits you to purchase crypto from one other Bybit person through Bybit’s P2P platform. There are zero taker and maker charges for these transactions.

2. Shopping for Crypto With Fiat Deposit and Stability Cost Service

You can even buy crypto using cash by means of the Fiat Deposit and Stability Cost service. The fiat currencies obtainable for this service are the euro (EUR), Brazilian actual (BRL), Argentine peso (ARS), British pound (GBP) and Russian ruble (RUB).

3. Shopping for Crypto Utilizing Credit score Playing cards/Financial institution Switch

Bybit additionally permits you to buy crypto utilizing bank cards and/or financial institution wire transfers with the One-Click Buy choice.

Deposit Crypto on Bybit

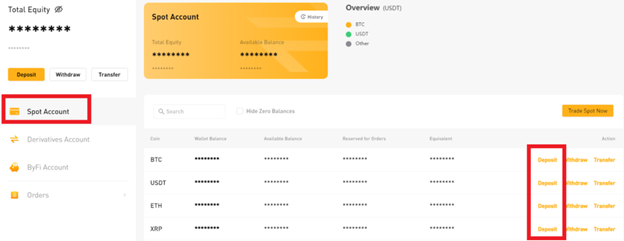

You may immediately deposit crypto funds into your Bybit account from a wide range of centralized and decentralized sources — for example, accounts on different exchanges, chilly or scorching wallets, and multisig wallets. To take action, head over to the Belongings web page in your Bybit account’s homepage. From there, select the Spot Account part. The obtainable cryptocurrencies shall be proven on this part. Click on on Deposit subsequent to the crypto you’d wish to switch to Bybit.

Picture supply: Bybit.com

Whenever you click on on Deposit, you’ll see Bybit’s deposit tackle for the chosen crypto. Merely use this because the vacation spot pockets tackle in your pockets or account on one other alternate.

Half 3: 8 Methods to Earn Curiosity on Crypto With Bybit

There are six key methods to earn curiosity or revenue in your crypto with Bybit. Let’s take a more in-depth have a look at every one.

1. Earn Curiosity on Crypto with Staking (Bybit Financial savings)

Bybit Financial savings is an funding product that permits you to stake crypto for curiosity. There are round 40 cash and tokens obtainable for staking, together with BTC, ETH, USDT and USDC. Select between a versatile staking time period, the place you possibly can withdraw your funds at any time, or a hard and fast time period, which relies upon upon every crypto and is often 30 or 60 days.

Bybit Financial savings is a superb selection for risk-averse crypto traders. It gives a easy technique to earn secure curiosity from well-liked cash and tokens, and you may even select a versatile staking interval. For those who’re taking your first steps on the earth of crypto investing — or, usually, choose predictable and low-risk funding merchandise — Bybit Financial savings could be the best option for you.

Earn crypto interest on Bybit Savings now!

Execs and Cons of Bybit Financial savings

| Execs | Cons |

|---|---|

|

|

2. Earn Curiosity on Crypto With Liquidity Mining

Bybit Liquidity Mining makes use of a revamped automated market maker (AMM) buying and selling mannequin to help you in offering liquidity to coin-swap liquidity swimming pools. By including liquidity, you earn a share of the buying and selling charges relevant to the corresponding pool. Every pool includes a pair, primarily based on USDT and one other well-liked coin, similar to BTC, ETH, SOL, XRP, LTC, AVAX and extra. Leveraged borrowing can also be obtainable that will help you maximize your potential earnings.

You may add and withdraw liquidity at any time. Liquidity Mining provides yields that may go as excessive as 35%, relying upon the coin and buying and selling exercise within the pool. It’s an acceptable product for these searching for good long-term yields, and a good way to turn out to be proficient with AMM-based liquidity investing.

Earn crypto interest on Bybit Liquidity Mining now!

Execs and Cons of Bybit Liquidity Mining

| Execs | Cons |

|---|---|

|

|

3. Earn Curiosity on Crypto With Twin Asset

Bybit’s Twin Asset permits you to earn yields even in stagnant or falling markets. Merely predict the value motion of your chosen crypto asset — e.g., BTC, ETH or BIT — towards USDT for a preset interval. In case your chosen crypto will increase in value upon maturity of the Twin Asset contract, you’ll obtain your funds in USDT. If the value of the coin declines, you’ll be paid out in your chosen crypto.

The maturity durations are usually 1, 3 and 5 days, with a few of the highest rates of interest provided. Annualized charges of over 380% are doable underneath a few of the 1-day contracts.

Twin Asset is a product appropriate for merchants preferring short-term funding choices and wish to earn excessive yields, even when the market is sluggish or in decline.

Earn crypto interest on Bybit Dual Asset now!

Execs and Cons of Bybit Twin Asset

| Execs | Cons |

|---|---|

|

|

4. Earn Curiosity on Crypto With Wealth Administration

Wealth Administration is a monetary service that lets you handle and develop your investments intelligently by means of automated funding methods. It at present provides a Fund Pool geared toward maximizing earnings whereas minimizing dangers, whatever the market situation. By subscribing to the Fund Pool for a interval of 30 days, you possibly can earn as much as 4.5% APR on USDT investments. Bybit VIP customers are additionally given the choice to redeem their earnings earlier than the 30 days are up. When you subscribe to the pool, the funding is made mechanically for you. It even contains an Auto-Make investments characteristic, permitting you to reap secure earnings in a completely hands-free method.

Wealth Administration is right for risk-averse traders, because it makes use of skilled risk-neutral funding methods. VIP clients and customers with excessive internet value may also respect the skilled wealth administration service supplied, which facilitates zero-effort funding with excessive returns.

Earn crypto interest with Bybit Wealth Management now!

Execs and Cons of Bybit Wealth Administration

| Execs | Cons |

|---|---|

|

|

Learn extra: What Is Bybit Wealth Management?

5. Earn Curiosity on Crypto With ETH 2.0 Liquid Staking

As talked about earlier, you possibly can earn from staking ETH by becoming a member of staking swimming pools and receiving a liquid tokenized model of ETH, which can be utilized to generate passive revenue even whereas your ETH is locked up. Some examples of such liquid staking tokens are stETH (Lido), rETh (Rocket Pool) and frxETH (Frax Finance).

Bybit additionally integrates Lido’s Staking Pool to supply ETH 2.0 Liquid Staking, so you possibly can stake ETH to obtain stETH. You solely have to stake a minimal of 0.1 ETH to start out incomes stETH rewards with as much as 7% APR, and you may select to redeem your stETH for ETH anytime at a 1:1 ratio.

Furthermore, you possibly can achieve further curiosity out of your stETH belongings in a number of methods: Maintain stETH in your Bybit account to safe day by day yield, commerce it on the Bybit Spot market or pledge stETH as collateral to borrow ETH for different investments. When you’ve got a Unified Buying and selling Account (UTA), you possibly can commerce utilizing stETH as collateral.

For those who’d like extra flexibility in your ETH investments, then ETH 2.0 Liquid Staking is for you, since you’ll achieve a liquid token that you should use to revenue in different methods whereas incomes out of your staking rewards. Moreover, since stETH is a liquid staking token from Lido, you can even choose to withdraw stETH with the intention to earn from DeFi automobiles similar to yield farming.

Earn crypto interest on Bybit ETH 2.0 Liquid Staking now!

Execs and Cons of Bybit ETH 2.0 Liquid Staking

| Execs | Cons |

|---|---|

|

|

6. Earn Curiosity on Crypto With Bybit Launchpool

Bybit Launchpool allows you to put money into tokens of recent and promising blockchain tasks that are listed periodically on Launchpool. You may stake and unstake your tokens at any time, with no further charges concerned. There are alternatives to earn very excessive yields of as much as 1,000% or extra through Launchpool staking.

For those who’re always looking out for brand spanking new blockchain tasks with the potential to turn out to be tomorrow’s star performers, then Bybit Launchpool is right for you. Furthermore, you possibly can probably earn a few of the highest yields obtainable on the earth of crypto.

Earn crypto interest on Bybit Launchpool now!

Execs and Cons of Bybit Launchpool

| Execs | Cons |

|---|---|

|

|

7. Earn Curiosity on Crypto With Bybit Lending

Bybit Lending permits customers to lend their crypto to debtors in alternate for an hourly curiosity cost. You may effortlessly deposit your idle crypto funds into an asset pool, producing passive revenue as your belongings are loaned to numerous Bybit merchandise similar to Leveraged Token, Crypto Loans and UTA. The versatile rate of interest is decided by the borrowing demand and precise curiosity generated by the mortgage quantity.

Customers’ funds are fully safe and might be redeemed anytime throughout the day by day redemption window. Nonetheless, you could not be capable of redeem your funds when the redemption day by day restrict has been reached, or when the Mortgage-to-Pool Ratio of the asset pool is maxed out. At such instances, you’ll have to attend until both the Mortgage-to-Pool Ratio falls beneath 100%, or till the subsequent day within the case of reaching the day by day redemption restrict.

Bybit Lending is a service fitted to risk-averse traders trying to earn secure passive revenue as Bybit helps assure the protection of customers’ funds in a number of methods, together with collateral worth ratios and an Insurance coverage Fund.

Earn crypto interest on Bybit Lending now!

Execs and Cons of Bybit Lending

| Execs | Cons |

|---|---|

|

|

Learn extra: Bybit Lending: A Complete Walkthrough to Crypto Lending

8. Earn Curiosity on Crypto With NFTs

Bybit’s NFT Market is one other potential supply of crypto revenue. In contrast to the Bybit Earn merchandise above, NFTs on {the marketplace} aren’t interest-bearing investments per se. As a substitute, you possibly can earn passive revenue from NFTs in the event that they respect in value, notably with the GrabPic program, which launches low-priced NFTs (between 0.1 USDT and 10 USDT) that may shortly respect.

GrabPic doesn’t simply supply low-priced, high-quality NFTs: You can even commerce at zero charges, which suggests you’ll get to earn extra. There are different methods you possibly can earn earnings as properly, similar to by means of Merge, GrabPic’s flagship characteristic that permits you to mix a number of common NFTs to create a “legendary” NFT probably value 100 USDT.

Bybit NFT Market additionally provides Thriller Containers each one or twice a month, which provide the probability to obtain a uncommon NFT that you may promote for the next value. And in case you obtain a GameFi NFT, you should use it to reap much more earnings within the related play-to-earn recreation.

The NFTs listed on the Market come from various domains, similar to GameFi, the metaverse, artworks and extra. You can even conduct multi-chain trades, with assist obtainable for 4 blockchain platforms — Polygon, Tezos, BNB Chain and Klaytn. Bybit’s safe infrastructure ensures that every one the NFTs traded on the Market are genuine.

For those who’re an NFT fanatic, then Bybit’s NFT Market is a perfect place to earn crypto curiosity and have enjoyable.

Earn crypto interest on Bybit NFT Marketplace now!

Execs and Cons of Bybit NFT Market

| Execs | Cons |

|---|---|

|

|

Learn extra: What Is Bybit NFT Marketplace?

Half 4: Dealing With Your Crypto Curiosity Taxes

Which International locations Enable You to Earn Tax-Free Curiosity on Crypto?

Resulting from its novelty as a monetary asset class, many nations all over the world haven’t but launched taxes on crypto. This is applicable to nearly all of jurisdictions. Except your nation’s taxation authority particularly addresses the problem of crypto revenue, you could get pleasure from, no less than for now, tax-free crypto revenue. A number of the most crypto-friendly nations on the earth embody Germany, Portugal, Singapore, Switzerland, El Salvador, Malta, Cyprus and Belarus.

Observe, nonetheless, that in a few of these jurisdictions, crypto revenue could be taxable if crypto buying and selling is decided to be your principal enterprise exercise.

Which International locations Require You to File Crypto Curiosity Taxes?

Many OECD nations — in addition to a few of the largest economies outdoors of the OECD — have explicitly legislated crypto taxes. Under, we’ll briefly cowl the present state of affairs on this space as relevant to 4 economies — america, Australia, India and Japan. Crypto taxation legal guidelines in these nations are among the many least forgiving on the planet.

United States

U.S. authorities tax cryptocurrency capital positive aspects, in addition to any non-capital revenue from crypto, which incorporates crypto curiosity revenue. Within the land of the free, your crypto curiosity revenue is usually handled as extraordinary revenue and is topic to revenue tax guidelines. There are additionally cases the place it could be handled as capital positive aspects — for instance while you commerce crypto belongings, similar to NFTs — by which you’ll be taxed accordingly.

Australia

Just like the U.S., Australia treats your crypto curiosity earnings as extraordinary revenue, except you swap belongings, by which case you’ll be topic to capital positive aspects tax.

India

Since April 1, 2022, the Indian authorities costs a 30% flat tax charge on all crypto positive aspects and revenue. The federal government applies this tax rule broadly, whatever the nature of the crypto revenue. As such, crypto curiosity is prone to fall underneath this rule.

Japan

For Japanese tax residents, crypto curiosity is assessed as “miscellaneous revenue” and kinds a part of your complete taxable revenue. As a Japanese taxpayer, you’re required to pay revenue tax on crypto curiosity earnings at your corresponding tax bracket charge.

Half 5: Execs and Cons of Incomes Crypto Curiosity

Advantages of Incomes Curiosity on Crypto

Incomes crypto curiosity carries quite a few advantages. The primary ones are as follows:

- The power to generate passive revenue with out having to dedicate time to lively buying and selling

- Earnings diversification away from overreliance on shares, bonds and fiat currencies

- Some merchandise — similar to Bybit Financial savings (staking) — are particularly appropriate for novice traders, as they require minimal monitoring

- Merchandise like Bybit Launchpool supply low-risk, high-yield returns, not like buying and selling, which is usually riskier

- Potential to earn throughout bear markets with merchandise like Twin Asset

Dangers Concerned in Staking Crypto

Regardless of its advantages, crypto staking (and crypto investing usually) is definitely not a very risk-free exercise. The important thing dangers embody:

- Potential value declines for the coin(s) you personal. As a result of volatility within the crypto market, your excessive yields could be offset by a coin’s value decline, leaving you within the purple consequently.

- Some staking platforms, notably decentralized ones, have lock-up durations lasting weeks or months, a major period of time by the requirements of the fast-changing crypto market.

Half 6: Recap of Earn Excessive Curiosity on Crypto

Bybit Guidelines: Discovering the Greatest Product to Earn Curiosity on Crypto

As a recap of our dialogue, right here’s a abstract of the eight key merchandise on Bybit that allow you to earn crypto revenue.

Bybit Financial savings: A low-risk, principal-guaranteed funding with customizable funding durations, notably appropriate for inexperienced persons and risk-averse traders.

Liquidity Mining: Supplies good long-term yields, with the flexibility so as to add leverage to maximise yields. Splendid for knowledgeable merchants conversant in leverage and the liquidity mining course of.

Twin Asset: Earn considered one of two completely different cash, relying upon the market’s route, by betting on the speed actions of a selected crypto asset towards USDT. Fits short-term, targeted swing merchants.

Wealth Administration: Earn a secure passive revenue from automated skilled funding methods. Focused for risk-averse traders, VIP clients and customers with excessive internet value.

ETH 2.0 Liquid Staking: Versatile use of liquid staking spinoff token, stETH, obtained from staking ETH. match for traders well-versed in each CeFi and DeFi buying and selling who can revenue from stETH in a number of methods whereas incomes staking rewards.

Bybit Launchpool: Versatile staking for promising new cash with high-yield returns. Appropriate for traders in search of excessive yields and potential “future star” cash.

Bybit Lending: Hourly curiosity payouts from depositing idle cryptocurrencies into asset swimming pools, from which they’ll be loaned to numerous Bybit merchandise similar to Leveraged Token, Crypto Loans and UTA. Suited to risk-averse traders trying to earn a gradual passive revenue stream.

NFT Market: Investing on low-price, high-quality NFTs that respect shortly in worth. Splendid for NFT lovers and merchants targeted on capital positive aspects revenue fairly than curiosity.

FAQs: Crypto Curiosity Incomes

1. What’s one of the simplest ways to earn curiosity on crypto?

The easiest way to earn crypto curiosity shall be extremely dependent in your threat urge for food. Naturally, increased yield alternatives include increased dangers. Among the many Bybit merchandise detailed above, the very best potential yields are sometimes present in Bybit Launchpool and Twin Asset. On the opposite finish of the danger/reward spectrum is Bybit Financial savings, a product with assured yields for essentially the most risk-averse traders.

2. How do I calculate curiosity earned on crypto?

APR and APY are the 2 major strategies of curiosity calculation. Whereas APR is a simple, easy curiosity calculation technique, the system for APY is extra advanced. You should use a web-based crypto APY calculator to calculate APY.

3. Which crypto pays essentially the most curiosity?

Apart from extremely unstable or new cash, one of the best rates of interest are sometimes provided for established stablecoins, similar to USDT and USDC.

4. Are crypto staking rewards taxable?

This relies solely upon your nation of residence. Particularly, for U.S. residents, it’s protected to imagine that the Inside Income Service (IRS) will apply revenue taxes to your staking earnings, simply because it does for crypto curiosity revenue. The prevailing consensus is that the IRS is eager to tax something in sight that has the phrase “crypto” on it.