How to Make Money In Stocks: A Comprehensive Guide

Investing in shares might be an effective way to develop your funds. Though it has a really excessive ceiling, it additionally has a fairly low ground: lately, all that you must begin investing within the inventory market is only a few {dollars} and an Web connection. On this article, I’ll cowl every thing that you must find out about learn how to earn money in shares, from the steps each newbie investor ought to take to extra superior methods, in addition to the widespread errors you need to keep away from.

Please do not forget that this text doesn’t represent funding recommendation and is posted for academic functions solely.

What Are Shares?

Shares symbolize shares of possession in an organization, making the stockholder a component proprietor of that enterprise. While you purchase particular person shares, you’re basically shopping for a chunk of that firm’s future earnings and progress. The worth of those shares, or inventory costs, fluctuates based mostly on how traders understand the corporate’s prospects.

Corporations situation shares to boost capital for growth, new tasks, or to enhance their monetary well being. This course of is a basic facet of how the inventory market capabilities, offering a platform the place shares are purchased and offered. Investing in shares is taken into account one of many major strategies for people to develop their wealth over time. In contrast to different asset courses, reminiscent of bonds or actual property, shares have the potential for vital progress, however additionally they include larger threat resulting from market volatility.

Kinds of Shares

Shares might be broadly categorized into two primary varieties: widespread shares and most popular shares. Frequent shares are probably the most prevalent type of inventory that folks spend money on. Holders of widespread shares have voting rights at shareholders’ conferences and will obtain dividends, that are a share of the corporate’s earnings. Most well-liked shares, then again, often don’t present voting rights, however they provide a better declare on belongings and earnings than widespread shares; for instance, dividends for most popular shares are usually larger and paid out earlier than these of widespread shares.

Inside these classes, shares will also be categorized based mostly on the corporate’s traits, reminiscent of progress shares and worth shares. Development shares are from corporations anticipated to develop at an above-average charge in comparison with different corporations. They reinvest their earnings into the enterprise for growth, so dividends are much less widespread. Worth shares are people who traders imagine are undervalued by the market. They’re usually corporations with stable fundamentals that, for varied causes, are buying and selling beneath what traders understand to be their true market worth.

How you can Begin Investing in Shares

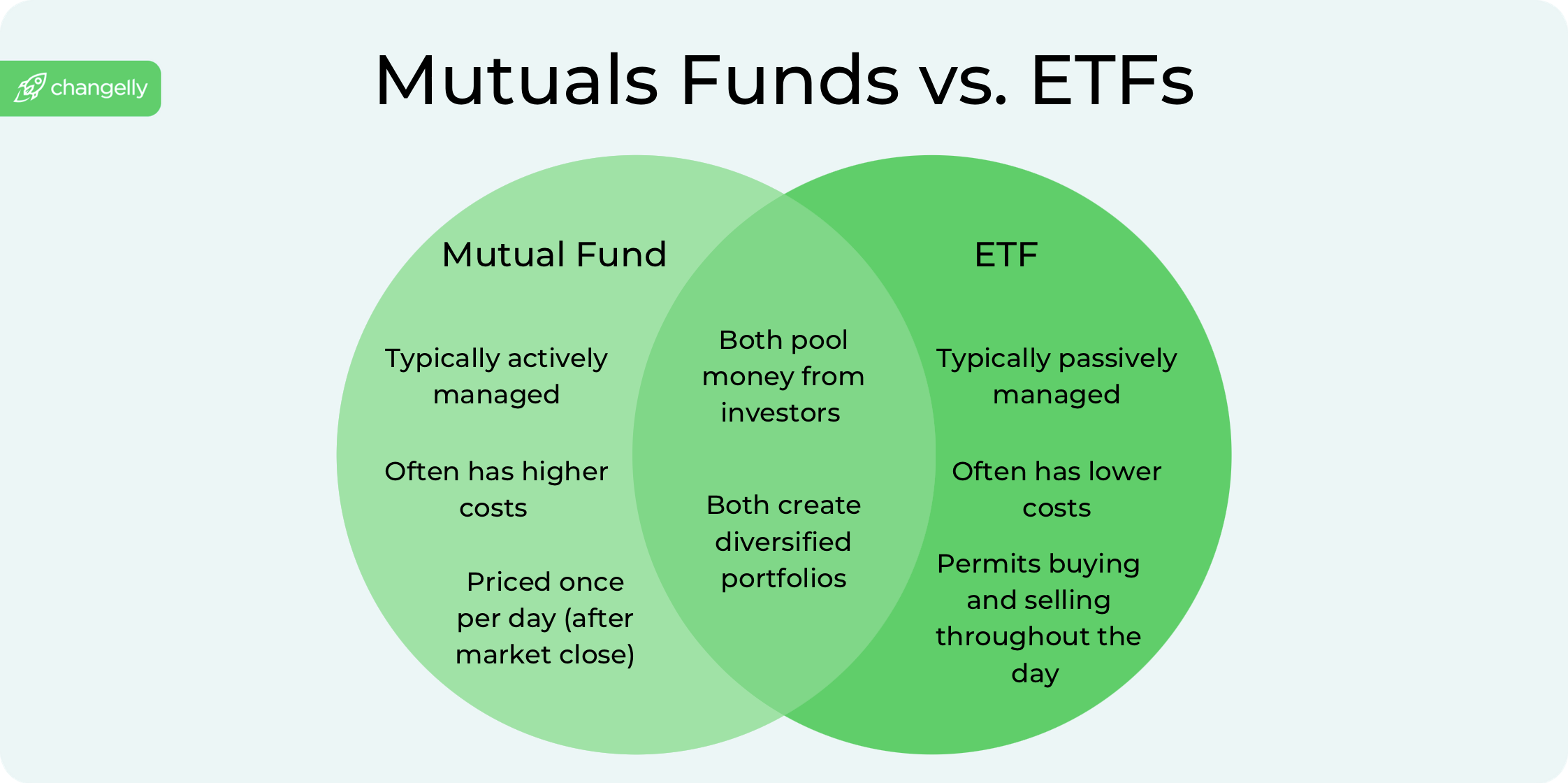

Beginning your journey into inventory investing can appear daunting at first, however with the fitting method, it may be an thrilling technique to develop your wealth. First, it’s vital to grasp that shares are shares of possession in particular person corporations. While you purchase shares, you’re hoping that the businesses you spend money on will develop, rising the worth of your shares. Moreover particular person shares, you can too spend money on mutual funds and exchange-traded funds (ETFs), which let you purchase a basket of shares in a single buy. This may help diversify your portfolio and scale back threat.

Step 1: Outline Your Funding Targets and Threat Tolerance

- Determine your monetary objectives: Are you saving for retirement, a home, or maybe your baby’s schooling? Your objectives will affect your funding technique.

- Perceive how a lot threat you’re keen to take. Youthful, long-term traders would possibly tolerate extra threat in comparison with these nearer to retirement.

Step 2: Select the Proper Funding Account

- For many, an internet brokerage account is one of the best place to start out. These platforms supply entry to a variety of shares, mutual funds, and ETFs.

- Contemplate beginning with a tax-advantaged account like a conventional IRA, particularly for those who’re investing for retirement.

Step 3: Begin With Mutual Funds or ETFs

- Mutual funds and ETFs supply on the spot diversification, which is essential for decreasing threat. They let you spend money on many shares by buying a single share of the fund.

- Search for funds that observe the general marketplace for a begin, as they are typically extra steady and have decrease charges.

Step 4: Diversify Your Portfolio

- As you get extra snug, you can begin including particular person shares to your portfolio. Concentrate on industries and corporations you perceive.

- Bear in mind, a well-diversified portfolio consists of a mixture of sectors and asset courses to mitigate threat additional.

Step 5: Monitor and Regulate Your Portfolio

- Repeatedly assessment your portfolio to make sure it aligns along with your funding objectives and threat tolerance.

- Be ready to regulate your investments as your objectives or the market modifications.

Investing in shares is not only about choosing winners. It’s about setting clear objectives, understanding your threat tolerance, and steadily constructing a diversified portfolio. Whereas particular person shares can supply vital returns, additionally they include larger threat. Beginning with mutual funds or ETFs generally is a safer technique to get entangled within the inventory market, particularly for learners. Bear in mind, investing is a marathon, not a dash; endurance and self-discipline are key to long-term success.

How you can Spend money on the Inventory Market

Investing within the inventory market entails a sequence of strategic actions geared toward rising your capital and attaining monetary beneficial properties. Listed here are some common ideas and steps that may get you began in your funding journey.

Choosing Shares and Inventory Funds

- Selecting Particular person Shares: While you’re prepared to speculate, choosing particular person corporations requires analysis into their monetary well being, market place, and potential for future progress. Search for corporations with robust earnings progress, stable administration groups, and aggressive benefits of their business. Investing in particular person shares gives the potential for top returns however comes with larger threat.

- Investing in Inventory Mutual Funds or ETFs: For these in search of diversification with a single transaction, inventory mutual funds and ETFs are ideally suited. These funds pool cash from many traders to purchase a portfolio of shares. Index funds, which observe a selected index just like the S&P 500, supply broad market publicity and are a favourite alternative amongst long-term traders for his or her low charges and stable returns over time.

Making Your Funding

- Utilizing an On-line Brokerage Account: To purchase shares of inventory or inventory funds, you’ll want an account with an internet dealer. These platforms supply instruments for analysis and buying and selling, with various ranges of help and costs. Some brokers additionally supply the choice to purchase fractional shares, making it simpler to spend money on high-priced shares with much less cash.

- Inserting Orders: You should purchase shares by way of several types of orders. A “market order” buys instantly on the present market value, whereas a “restrict order” units a selected value at which you’re keen to purchase. Understanding these choices helps you management your funding technique extra exactly.

- Portfolio Administration: When you’ve made your investments, managing your inventory portfolio entails monitoring the efficiency of your shares or funds, keeping track of the marketplace for modifications, and adjusting your holdings as wanted. This may increasingly embrace promoting underperformers or shopping for extra shares of profitable investments.

Reinvesting Dividends and Taking Benefit of Compound Curiosity

- Dividend Reinvestment: Many shares and mutual funds distribute dividends, which you’ll be able to select to reinvest by buying extra shares. This compounding impact can considerably enhance your funding returns over time.

Evaluating Efficiency and Adjusting Your Technique

- Repeatedly assessment the efficiency of your investments compared to your objectives and the broader market. Regulate your holdings to align along with your funding technique, bearing in mind modifications in market situations, financial indicators, and your monetary objectives.

Investing within the inventory market is a dynamic and fascinating course of. By actively deciding on shares or funds, using an internet brokerage platform for trades, managing your portfolio with knowledgeable selections, and leveraging the ability of compounding by way of dividend reinvestment, you place your self to capitalize on the potential monetary rewards the inventory market gives. Bear in mind, whereas the purpose is to earn money, understanding the dangers and sustaining a disciplined method to investing is essential for long-term success.

Making Cash with Shares: Superior Methods and Ideas

Past the fundamentals of choosing shares and managing a portfolio, there are superior methods that profitable traders use to extend their possibilities of getting cash from shares. These approaches bear in mind market traits, firm efficiency, and the broader financial panorama to make knowledgeable selections. Listed here are some methods and ideas that will help you maximize your funding returns:

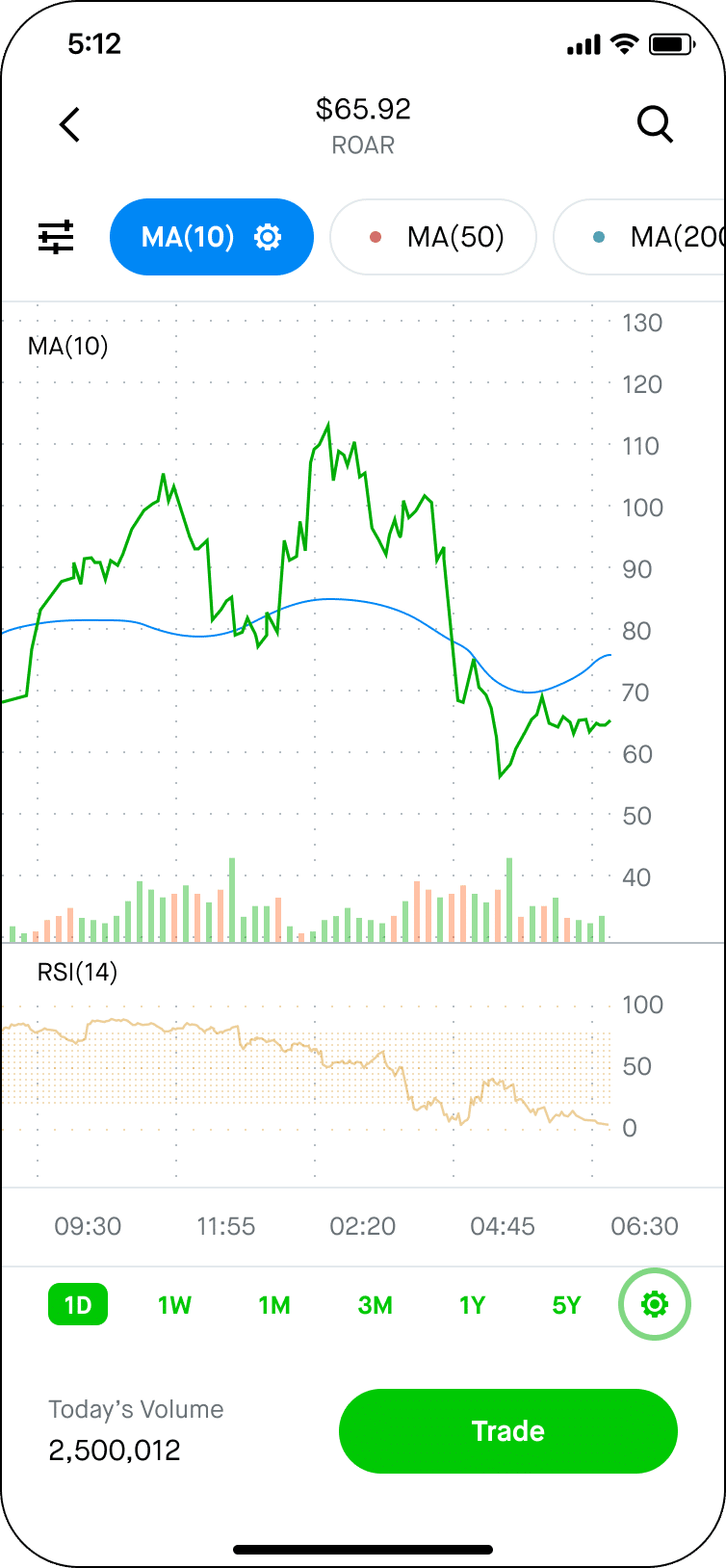

Understanding and Using Inventory Charts

Charts present a visible illustration of a inventory’s previous and current efficiency, providing insights into potential future actions. Search for patterns and traits that may point out shopping for or promoting alternatives. Use technical evaluation to research inventory charts to make predictions about future value actions based mostly on previous efficiency. Whereas not foolproof, it may be a useful gizmo in your funding decision-making course of.

Tax-Environment friendly Investing

Reap the benefits of tax advantages by using tax-advantaged accounts like IRAs and 401(okay)s to reduce the tax affect in your funding beneficial properties. Moreover, promote underperforming shares to appreciate losses that may offset beneficial properties and scale back your tax legal responsibility.

Attempt Totally different Funding Methods

There are lots of alternative ways to earn money from shares. For instance, you possibly can take into account the buy-and-hold technique — a long-term funding technique that entails buying shares and holding onto them for a number of years or a long time, no matter market volatility. It’s based mostly on the assumption that the inventory market will generate optimistic returns over time. You may also diversify your portfolio by investing in varied sectors. This may help you mitigate threat and capitalize on progress in several areas of the economic system. One other avenue you possibly can department out into is IPOs — preliminary public choices and secondary choices can current alternatives for traders. Nevertheless, they will also be dangerous, so it’s vital to analysis these alternatives totally earlier than investing.

Investing in Shares: Additional Ideas

- Evaluation your funding technique frequently, as your monetary state of affairs and objectives can change over time.

- Set and alter your time horizon — your funding technique ought to mirror the period of time you propose to remain invested.

- Use stop-loss orders to reduce potential losses.

- Rebalance your portfolio yearly to keep up your required asset allocation.

- Contemplate dividend reinvestment plans (DRIPs) to mechanically reinvest dividends, compounding your funding returns.

- Preserve an emergency fund to keep away from having to promote shares in a down market.

Frequent Errors to Keep away from When Investing in Shares

Regardless of whether or not you’re a novice inventory dealer or have been navigating the inventory trade for years, there are widespread errors that may hinder your success. By figuring out and avoiding these errors, particular person traders can enhance their possibilities of getting cash from shares. Listed here are some important missteps to be careful for:

- Chasing excessive returns with out contemplating extra threat: Excessive returns usually include excessive threat. It’s important to steadiness the lure of potential beneficial properties with the danger you’re keen to take, particularly with unstable belongings like small-cap shares.

- Ignoring the significance of diversification: Relying an excessive amount of on a single inventory, sector, or asset class can expose your funding portfolio to pointless threat. Diversifying throughout varied sectors, together with dividend shares and inventory mutual funds, may help unfold threat.

- Neglecting the funding’s time horizon: Your funding technique ought to align along with your monetary objectives and the time-frame you must obtain them. Brief-term market fluctuations matter much less for long-term traders, who can usually journey out volatility.

- Overreacting to short-term market volatility: The inventory market is inherently unstable, and share costs fluctuate. Making hasty selections in response to short-term actions can jeopardize long-term beneficial properties.

- Overlooking charges and bills: Charges can eat into your returns over time. Take note of transaction charges, fund administration charges, and different prices related along with your brokerage account (e.g., Charles Schwab, Vanguard).

- Making an attempt to time the market: Making an attempt to foretell one of the best instances to purchase and promote is notoriously tough, even for skilled traders. A extra dependable technique is common, disciplined investing, no matter market situations.

By being conscious of those widespread errors, particular person traders can take steps to keep away from them, making extra knowledgeable monetary selections that align with their funding objectives and threat tolerance. Bear in mind, profitable investing requires a mixture of diligence, endurance, and steady studying. Whether or not you’re investing in dividend shares, exploring small-cap shares, or constructing a diversified portfolio with inventory mutual funds, staying knowledgeable and avoiding these pitfalls may help you navigate the complexities of the inventory market extra successfully.

FAQ: How you can Make Cash in Shares

How do learners earn money within the inventory market?

Newbies can earn money within the inventory market by beginning with funding accounts that require low preliminary investments, reminiscent of on-line brokers or robo-advisors. Investing in mutual funds or exchange-traded funds (ETFs) will also be a very good begin, as they provide diversification with only a few {dollars}. Consulting a monetary advisor for personalised recommendation can additional improve funding selections.

Are you able to make some huge cash in shares?

Sure, it’s potential to make some huge cash in shares, particularly for those who make investments properly over an extended interval. Profitable inventory investments usually contain a mixture of diversified belongings, endurance, and a well-researched technique. Nevertheless, the inventory market additionally carries the danger of losses.

Can I make $100 a day with shares?

Making $100 a day with shares is feasible however extremely variable and is determined by the quantity of capital invested and market situations. Such short-term buying and selling requires vital information, expertise, and threat tolerance, because it usually entails speculative methods.

How a lot cash do I want to speculate to make $1,000 a month?

The quantity wanted to speculate to make $1,000 a month is determined by the anticipated return charge. For instance, to generate $12,000 yearly with a 5% return, you would want to speculate roughly $240,000. This calculation varies based mostly on the return charge and doesn’t account for taxes or charges.

What are one of the best brokers for inventory buying and selling?

The perfect brokers for inventory buying and selling supply low charges, a user-friendly platform, and a spread of funding choices. In style decisions embrace on-line brokers like Charles Schwab, Vanguard, and Constancy. These platforms cater to each learners and skilled merchants with varied instruments for wealth administration and retirement accounts.

Is inventory investing protected?

Inventory investing entails threat, together with the potential lack of principal. Nevertheless, diversifying your investments throughout totally different asset courses and sectors can mitigate some dangers. It’s additionally safer to speculate with a long-term perspective moderately than attempting to make fast earnings from short-term market fluctuations. Consulting monetary advisors for tailor-made recommendation may also assist navigate the dangers related to inventory investing.

Disclaimer: Please word that the contents of this text aren’t monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native laws earlier than committing to an funding.