Ethereum drops over 10% – Can ETH hold the $2,000 line?

- Ethereum’s worth drops 10.40%, nearing $2,000 assist, whereas whales accumulate 330,000 ETH, signaling potential rebound.

- The subsequent transfer hinges on holding onto this stage; a breakdown may set off additional liquidations

Ethereum [ETH] has been caught in a bearish spiral, shedding 10.40% previously week and nearing the essential $2,000 assist stage.

The most recent 10.40% drop has raised issues amongst traders, as macroeconomic pressures and market-wide sell-offs proceed to weigh on property.

Whereas short-term merchants are exiting their positions, massive Ethereum whales have taken a contrarian method, accumulating 330,000 ETH in simply 48 hours.

This divergence between worth motion and whale conduct raises an essential query — are we witnessing the beginning of a deeper correction, or is that this a strategic accumulation section earlier than a possible rebound?

Ethereum worth outlook and key ranges

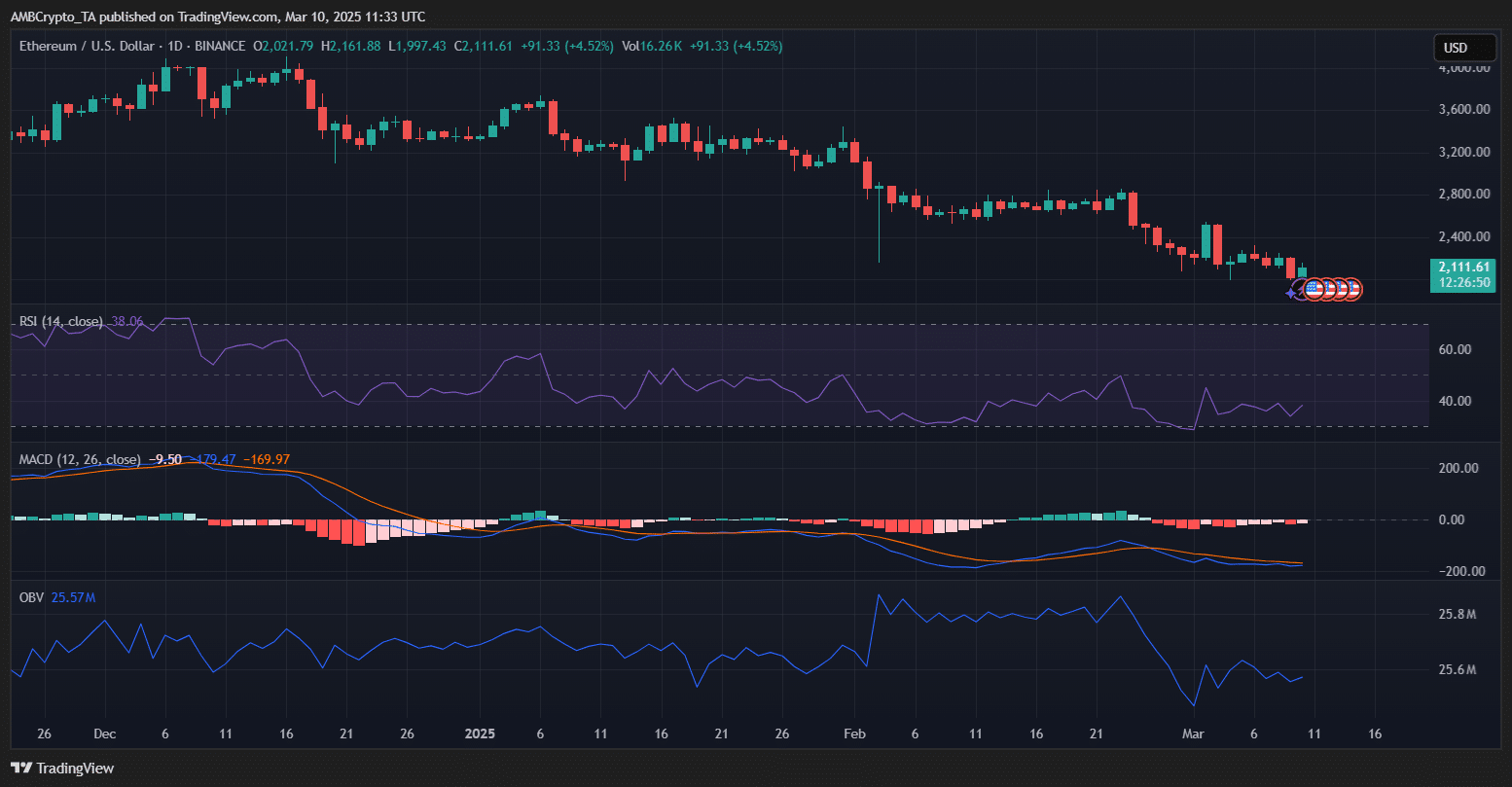

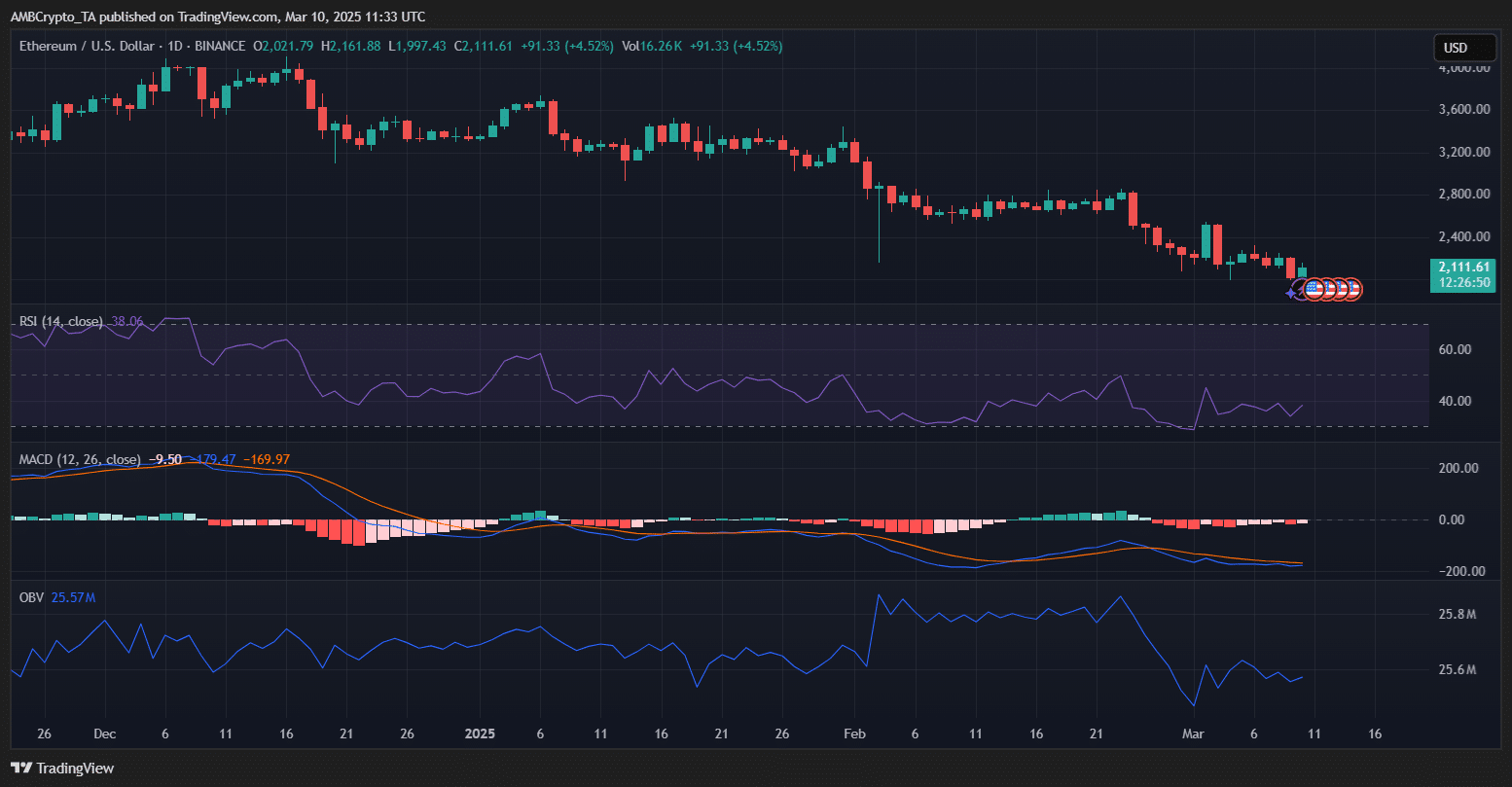

Ethereum’s latest 10.40% weekly drop, is mirrored in key technical indicators signaling bearish momentum.

The RSI sat at 38.06 at press time, nearing the oversold area, suggesting that promoting strain was dominant, however a possible reversal may emerge if consumers step in.

Supply: TradingView

The MACD indicator remained in damaging territory, with the MACD line at -9.50 and the sign line under zero, reinforcing the continued bearish development.

Moreover, the OBV confirmed a slight decline, indicating lowered shopping for exercise and weaker demand.

Ethereum should maintain the $2,000 assist stage, as previous information means that dropping this zone may set off cascading liquidations.

Nevertheless, if consumers capitalize on present whale accumulation, a restoration towards $2,200 may very well be potential.

Whale accumulation: An indication of confidence or warning?

Ethereum’s worth has dipped considerably, yet on-chain data reveals that enormous holders have collected 330,000 ETH previously 48 hours.

There’s been a pointy enhance in balances held by wallets with 100,000+ ETH, indicating strategic shopping for by deep-pocketed traders.

Supply: X

These main gamers may embrace establishments, long-term holders, or market makers positioning themselves forward of potential worth swings.

The timing means that whales is perhaps shopping for the dip, anticipating a restoration, or hedging towards additional volatility.

Traditionally, such whale accumulation has preceded worth rebounds, however with Ethereum hovering across the essential $2,000 stage, the following transfer will depend upon whether or not shopping for strain sustains or broader market circumstances pressure one other leg downward.

On-chain metrics and market sentiment

Supply: Cryptoquant