How to Short Crypto: A Beginner’s Guide to Shorting Bitcoin

Quick buying and selling is a technique that permits superior merchants to make a revenue by exploiting the distinction in value of a single asset and betting towards its value actions. Its high-risk, high-reward nature attracts a whole lot of crypto merchants, leaving many questioning whether or not it’s doable to short-trade crypto. On this article, I’ll speak about every thing you should know should you’re considering tips on how to brief Bitcoin and different cryptocurrencies.

What Is Shorting? Quick Promoting Defined

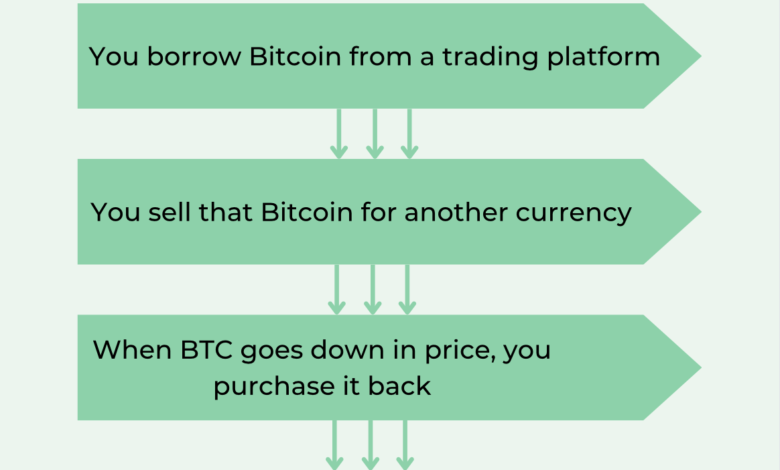

Quick-selling is a buying and selling follow that permits you to profit from a drop in an asset’s value. To place it merely, you promote an asset you don’t personal after which purchase it again later. It goes like this:

- You borrow an asset.

- You promote it.

- You repurchase it when the value drops.

Can You Quick Crypto?

Sure, you may brief promote crypto. It’s performed by borrowing the cryptocurrency from another person, promoting it on the present market value, and hoping to purchase it again at a lower cost later to repay the mortgage and pocket the distinction as revenue.

What’s the distinction between long- and short-selling Bitcoin and different cryptocurrencies? Shorting in crypto means the identical factor it does in conventional buying and selling: you promote Bitcoin you don’t personal and purchase it again later at a lower cost.

Think about a situation during which you assume that the Bitcoin value goes to drop quickly, both since you’ve performed your personal analysis or have learn any individual else’s (keep in mind to by no means blindly comply with different folks’s monetary recommendation!). To revenue from this information, you borrow 1 BTC from an trade and promote it for $60,000. Every week later, simply as you predicted, Bitcoin drops to $40,000 — and also you promptly purchase again that 1 BTC you borrowed, thus getting $20,000 of revenue.

The right way to Quick Promote Bitcoin and Different Cryptocurrencies

Here’s a step-by-step information on tips on how to brief promote crypto.

1. Perceive the Fundamentals of Quick Promoting

Quick promoting is a buying and selling technique the place an investor borrows a crypto asset, sells it on the present value, after which buys it again later at a lower cost to return it to the lender. The distinction between the promoting value and the shopping for value is the revenue.

2. Select a Dependable Crypto Alternate

Choose a crypto trade that helps brief promoting. Some well-liked exchanges providing this function embody:

- Binance

- BitMEX

- Kraken

- Bybit

Make sure that the trade, aside from having sturdy safety measures and a user-friendly interface, additionally provides numerous buying and selling pairs.

3. Create and Confirm Your Account

Join an account in your chosen crypto trade. Verification usually includes:

- Offering private identification paperwork

- Enabling two-factor authentication (2FA)

- Finishing KYC (Know Your Buyer) procedures

4. Fund Your Account

Deposit funds into your trade account. Most exchanges settle for deposits in fiat currencies (e.g., USD and EUR) and cryptocurrencies (e.g., BTC and ETH).

5. Perceive Buying and selling Methods

Develop a strong buying and selling technique for brief promoting. Some widespread methods embody:

- Technical Evaluation: Analyze historic value knowledge and chart patterns to foretell future value actions.

- Basic Evaluation: Consider the intrinsic worth of a crypto asset based mostly on information, developments, and market sentiment.

- Scalping: Make small earnings from minor value actions over brief durations.

- Swing Buying and selling: Capitalize on value swings inside a day or over a number of days.

6. Use Technical Evaluation Instruments

Familiarize your self with technical evaluation instruments and indicators, akin to:

- Transferring Averages (MA)

- Relative Energy Index (RSI)

- Bollinger Bands

- MACD (Transferring Common Convergence Divergence)

These instruments assist determine tendencies and potential reversal factors.

7. Open a Quick Place

To brief promote a crypto asset, comply with these steps:

- Navigate to the Futures or Margin Buying and selling Part: Relying on the trade, brief promoting is often discovered there.

- Choose the Crypto Asset: Select the cryptocurrency you wish to brief.

- Select Your Leverage: Leverage means that you can borrow funds to extend your place measurement. Be cautious, as larger leverage will increase danger.

- Set the Order Kind: Market order (rapid execution) or restrict order (set a particular value).

- Enter the Commerce: Verify the main points and execute the commerce.

8. Monitor Your Place

Maintain an in depth eye in your brief place. Use stop-loss and take-profit orders to handle danger and lock in earnings. The unstable nature of the crypto market can result in fast value actions.

9. Shut Your Quick Place

To shut your brief place:

- Purchase Again the Crypto Asset: Buy the identical quantity of the crypto asset you initially offered.

- Return the Borrowed Asset: Repay the borrowed funds together with any curiosity or charges.

10. Superior Buying and selling Methods

For extra skilled merchants, take into account superior methods like:

- Hedging: Use choices contracts to mitigate potential losses.

- Algorithmic Buying and selling: Make use of automated buying and selling bots to execute trades based mostly on pre-set standards.

- Pair Buying and selling: Quick one crypto asset whereas concurrently going lengthy on one other to capitalize on relative value actions.

11. Keep Knowledgeable

Sustain with the newest information and developments within the crypto market. Be part of crypto boards, comply with respected information sources, and take part in buying and selling communities to remain up to date.

High 5 Methods to Quick Promote Crypto

Margin Buying and selling

One of many best methods to brief Bitcoin, margin buying and selling means that you can use leverage, that means you may borrow extra money from the trade than you’ve deposited in your account. Whereas this opens up doorways for larger earnings, it’s naturally riskier, too — your place could shut earlier than you anticipated should you’re partaking in leveraged shorting.

Binary Choices Buying and selling

Binary choices buying and selling means that you can guess on “sure or no” eventualities. This monetary product gives patrons with the choice however not the duty to finish the deal. You principally guess on whether or not an asset’s value will go up or down. To brief promote crypto utilizing this methodology, buy put choices.

Binary choices buying and selling provides nice flexibility and higher-than-usual leverage. We might advise towards partaking in it until you’re an knowledgeable dealer.

Futures Market

Identical to different belongings, Bitcoin has a futures market. In a futures commerce, you basically agree to purchase an asset — in our case, BTC — on the situation that it will likely be offered later at a predetermined value. This settlement is named a futures contract.

Nonetheless, additionally it is doable to promote futures contracts. In that case, not like when shopping for them, it is possible for you to to profit from the asset’s value dropping.

Learn extra in regards to the Bitcoin futures market right here.

Quick-Promoting Bitcoin Property

In case you have sufficient of your personal funds, you can even brief promote Bitcoin immediately. All you should do is promote BTC when the value is excessive after which purchase again when it’s low. This methodology of brief promoting Bitcoin is comparatively beginner-friendly: you don’t have to learn to use buying and selling platforms to use it. Additionally it is a lot much less dangerous since you may’t lose greater than you personal. Then again, it’s much less worthwhile. As at all times, the upper the danger, the upper the reward.

Prediction Markets

Prediction markets are considerably just like sports activities betting businesses. Such platforms haven’t been round within the crypto trade for a very long time, but they current a great way to brief Bitcoin. They assist you to make a wager on a particular end result, akin to “Bitcoin goes to fall by 10% subsequent week.” If any individual takes you up on the guess, you may make fairly a hefty revenue.

Ought to You Quick Promote Bitcoin?

Quick promoting BTC and different cryptocurrencies is usually a good technique to make a revenue, nevertheless it comes with some caveats.

To find out if brief promoting Bitcoin is the best funding technique for you, ask your self the next questions:

Do You Perceive Futures Buying and selling?

Futures buying and selling is a typical methodology for brief promoting within the cryptocurrency markets. It entails agreements to purchase or promote Bitcoin at a predetermined value at a future date. Do you perceive how futures contracts work and the implications of those agreements?

Can You Deal with Worth Volatility?

Cryptocurrency exchanges usually expertise excessive volatility, that means the value of Bitcoin can fluctuate dramatically inside brief durations. Are you ready to deal with the psychological and monetary stress of those fast adjustments in value?

Have You Developed a Threat Administration Technique?

A strong danger administration technique is important when brief promoting. This consists of setting stop-loss and take-profit orders to handle potential losses and safe earnings. Do you’ve a transparent plan in place to handle your dangers?

Are You Accustomed to Completely different Kinds of Contracts?

Along with futures contracts, contracts for distinction (CFDs) are one other instrument for brief promoting. CFDs assist you to speculate on the value distinction of Bitcoin with out proudly owning the precise asset. Do you perceive the variations between these contracts and tips on how to use them successfully?

Do You Know The right way to Incorporate Technical Evaluation?

Technical evaluation instruments akin to shifting averages, RSI, and MACD are essential for predicting market actions. Are you expert in utilizing these instruments to make knowledgeable buying and selling choices?

Are You Snug with Leverage?

Leverage means that you can improve your place measurement by borrowing funds, nevertheless it additionally will increase your danger. Many cryptocurrency exchanges provide excessive leverage choices for brief promoting. Are you conscious of the dangers concerned and assured in utilizing leverage responsibly?

Do You Keep Knowledgeable Concerning the Crypto Market?

Staying up to date with the newest information and developments within the crypto market is significant. Market sentiment can considerably affect Bitcoin costs. Are you dedicated to repeatedly monitoring market information and tendencies?

Have You Thought-about the Spot Market?

The spot market entails shopping for and promoting Bitcoin for rapid supply. Whereas brief promoting usually is about futures or CFDs, understanding the spot market can present extra insights. Are you conversant in how the spot market works and influences futures costs?

Are You Ready for the Prices?

Quick promoting incurs prices akin to borrowing charges and curiosity, notably when utilizing leverage. Have you ever calculated these prices and factored them into your funding technique?

Do You Have Expertise as a Crypto Dealer?

Expertise in buying and selling cryptocurrencies can considerably improve your means to make worthwhile brief promoting choices. Do you’ve sufficient expertise and data of the crypto markets to confidently execute brief trades?

Do You Perceive the Regulatory Setting?

Rules surrounding cryptocurrency buying and selling range by nation and may affect your means to brief promote. Are you conscious of the regulatory necessities in your jurisdiction and the way they may have an effect on your buying and selling actions?

FAQ: The right way to Quick Crypto

What’s the distinction between futures contracts and choices contracts?

Futures Contracts: Agreements to purchase or promote a crypto asset at a predetermined value at a particular future date. They’re generally used for brief promoting within the crypto market.

Choices Contracts: These give the holder the best, however not the duty, to purchase or promote a crypto asset at a specified value earlier than a sure date. Choices can be utilized for hedging or speculating on value actions.

What’s the finest crypto buying and selling platform?

The most effective crypto buying and selling platform for brief promoting usually provides complete instruments, sturdy safety, and user-friendly interfaces. Binance and Kraken are sometimes beneficial because of their intensive options, together with margin buying and selling accounts and help for Bitcoin futures buying and selling. These platforms additionally present superior danger administration methods to assist merchants navigate the unstable value actions of underlying belongings like Bitcoin.

Is there a Bitcoin brief ETF?

Sure, there are Bitcoin brief ETFs obtainable that permit buyers to revenue from a decline in Bitcoin’s value with out immediately partaking in margin buying and selling or futures buying and selling. These ETFs use numerous monetary devices, together with Bitcoin futures, to attain their funding targets. They supply a handy manner for merchants to brief Bitcoin whereas using skilled danger administration methods.

What’s one of the simplest ways to brief promote Bitcoin?

Among the finest methods to brief promote Bitcoin entails utilizing Bitcoin futures buying and selling on respected cryptocurrency exchanges akin to Binance or Kraken. This methodology permits merchants to take a position on Bitcoin’s value motion and revenue from a decline within the underlying asset’s worth. Opening a margin buying and selling account and using strong danger administration methods are essential to mitigate the inherent dangers of brief promoting.

Disclaimer: Please observe that the contents of this text will not be monetary or investing recommendation. The knowledge offered on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native laws earlier than committing to an funding.