How whales dictate Bitcoin’s price moves: Accumulation begins, what next?

- Bitcoin whales shift from promoting to purchasing, signaling potential bullish momentum forward

- Whale accumulation resumes after a month of promoting, probably setting the stage for a rally

For the previous month, Bitcoin’s [BTC] has confronted constant promoting strain from whales. Binance, one of many world’s largest crypto exchanges, performs a vital position in shaping market liquidity and value discovery.

On-chain information reveals a big shift as giant holders transfer from internet promoting to accumulating as soon as once more. The month-to-month proportion change in whale holdings has turned optimistic, indicating a attainable inflection level.

If this accumulation development continues, it might pave the way in which for renewed bullish momentum out there.

Bitcoin whale exercise: Promoting strain to accumulation

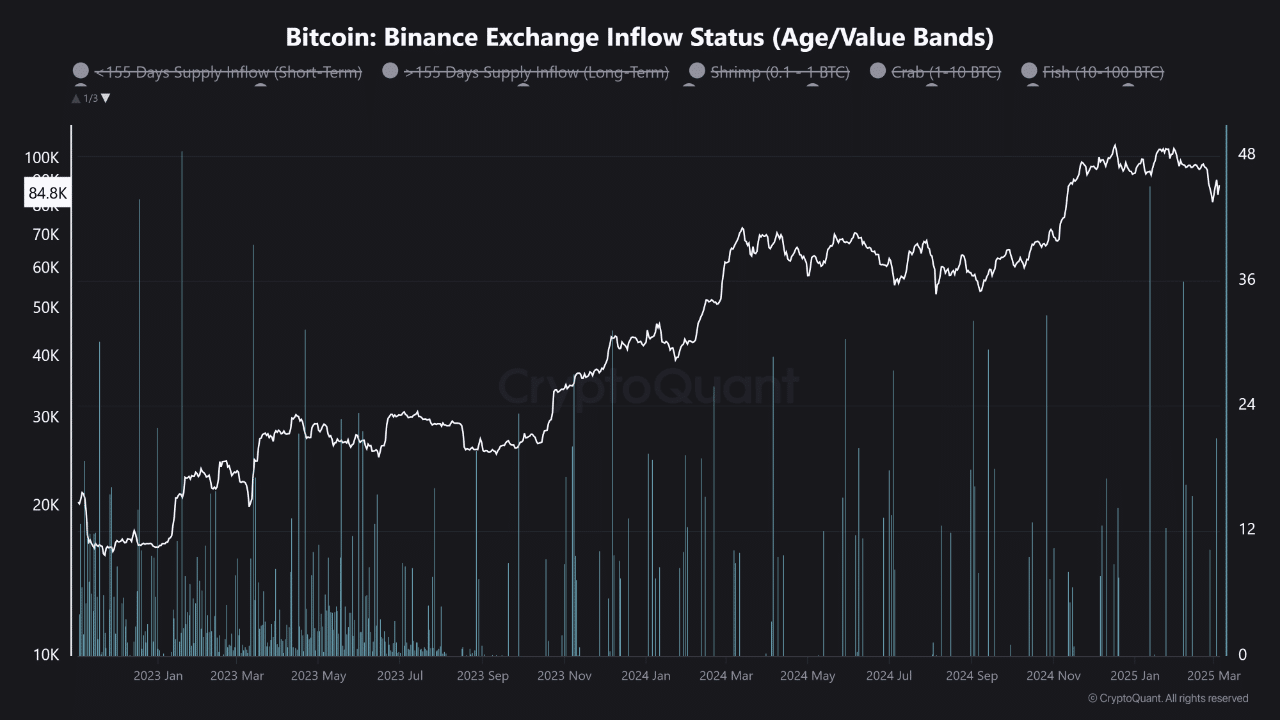

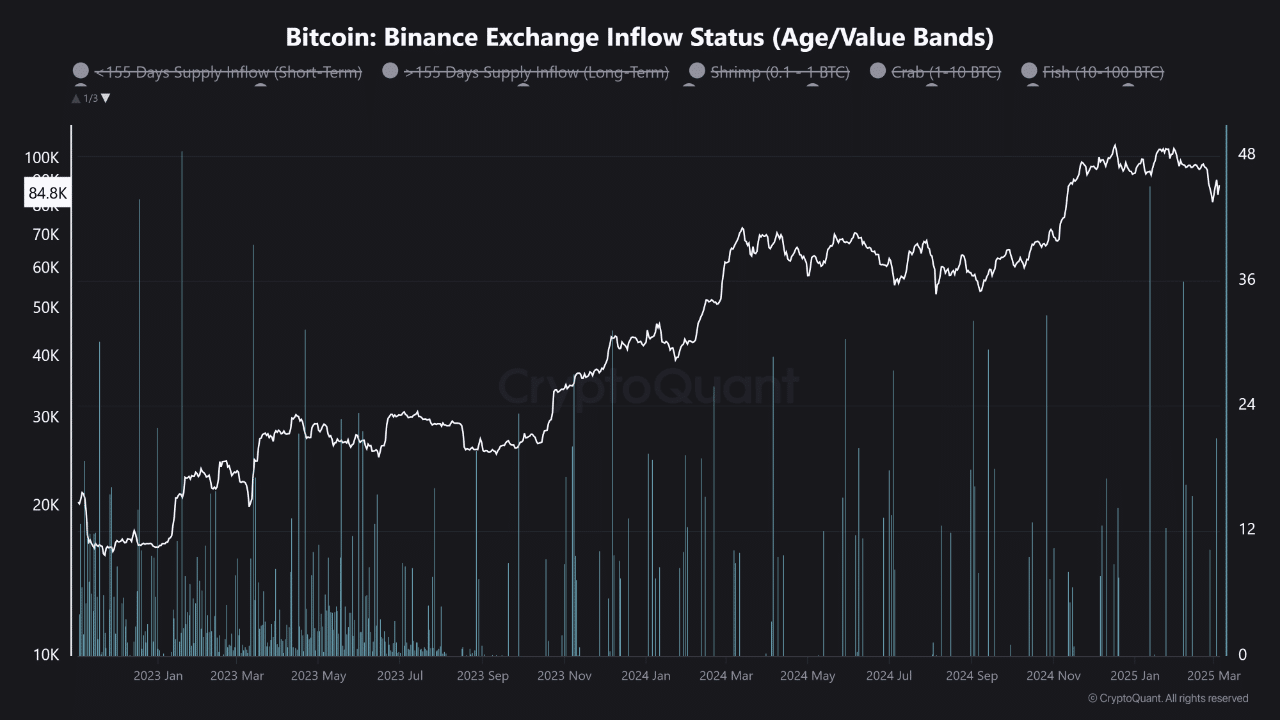

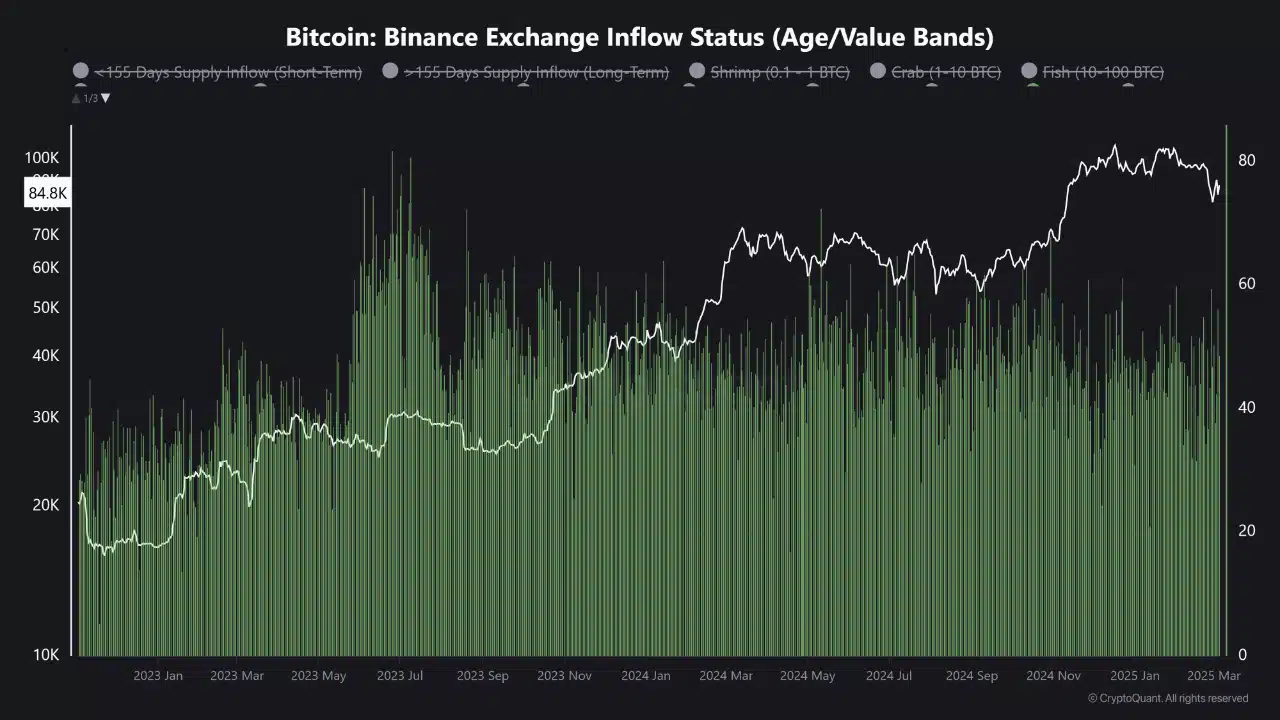

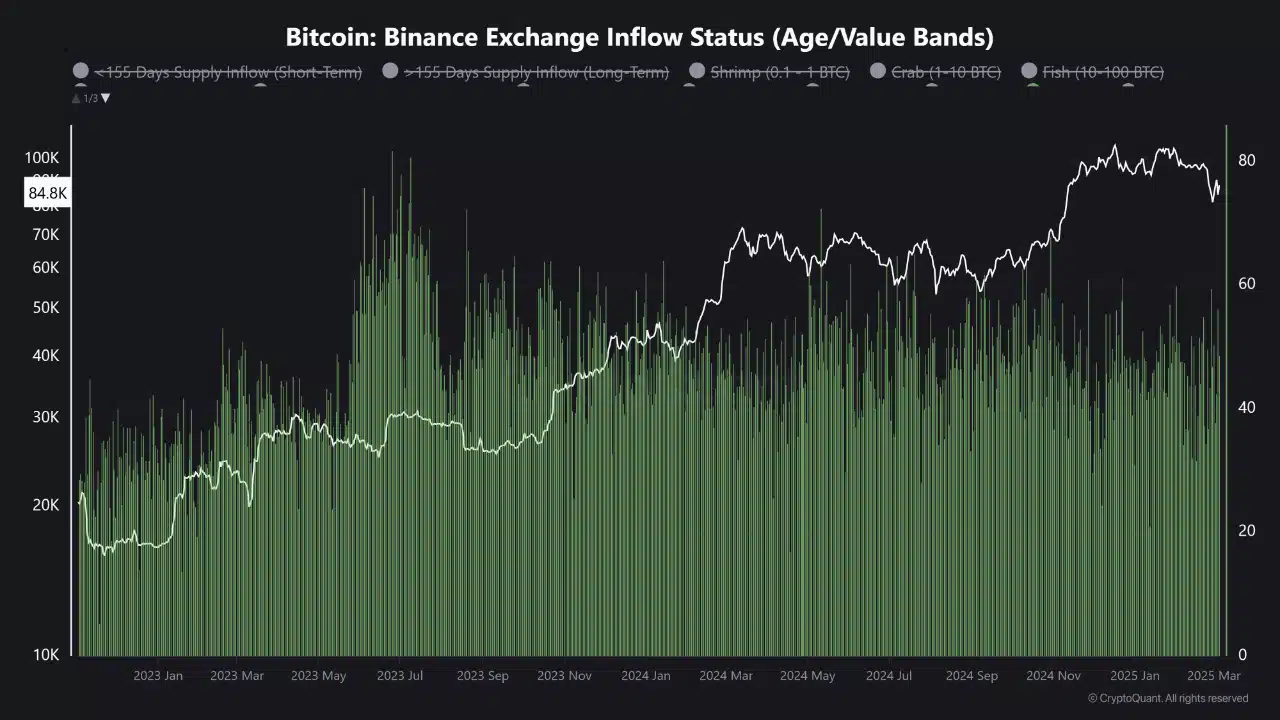

Supply: CryptoQuant

For over a month, Binance’s information reflected sustained Bitcoin inflows, predominantly from giant holders. Traditionally, such inflows point out promoting strain, as whales transfer BTC to exchanges for potential distribution.

Nonetheless, fluctuations in these inflows counsel that promoting could also be giving strategy to strategic accumulation.

The newest figures affirm this shift. Binance inflows are actually exhibiting indicators of contemporary accumulation amongst bigger holders.

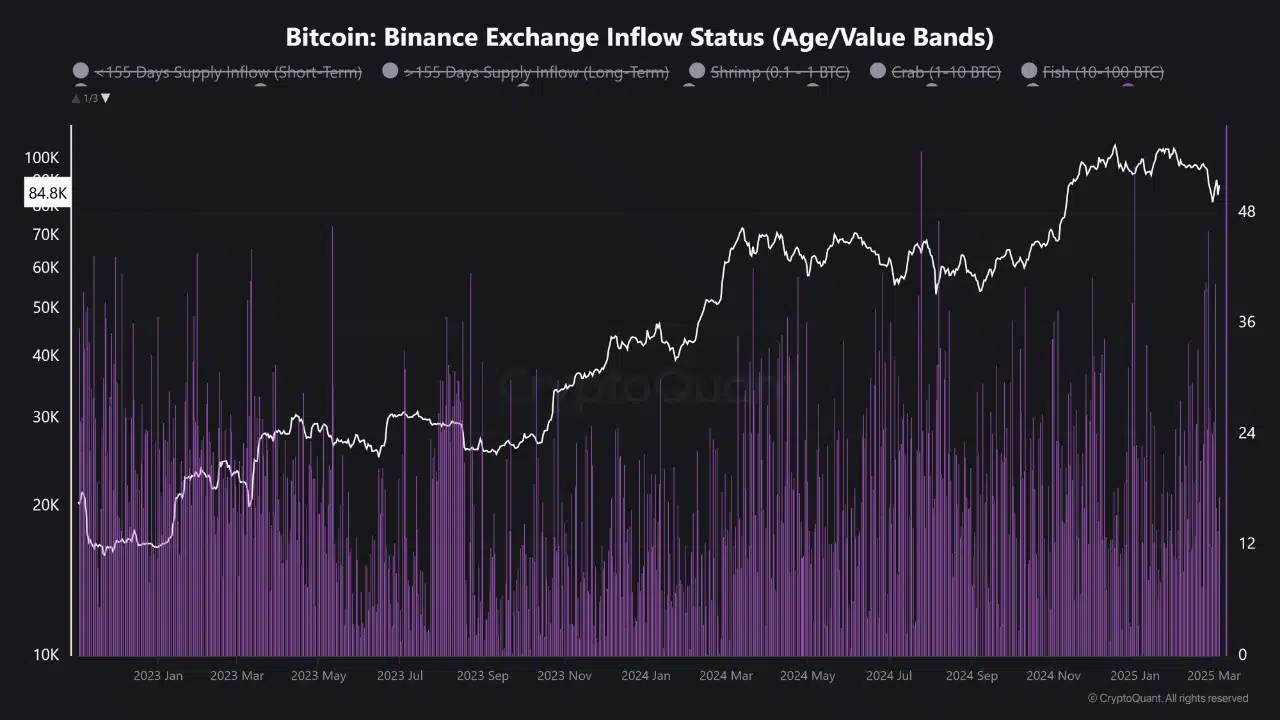

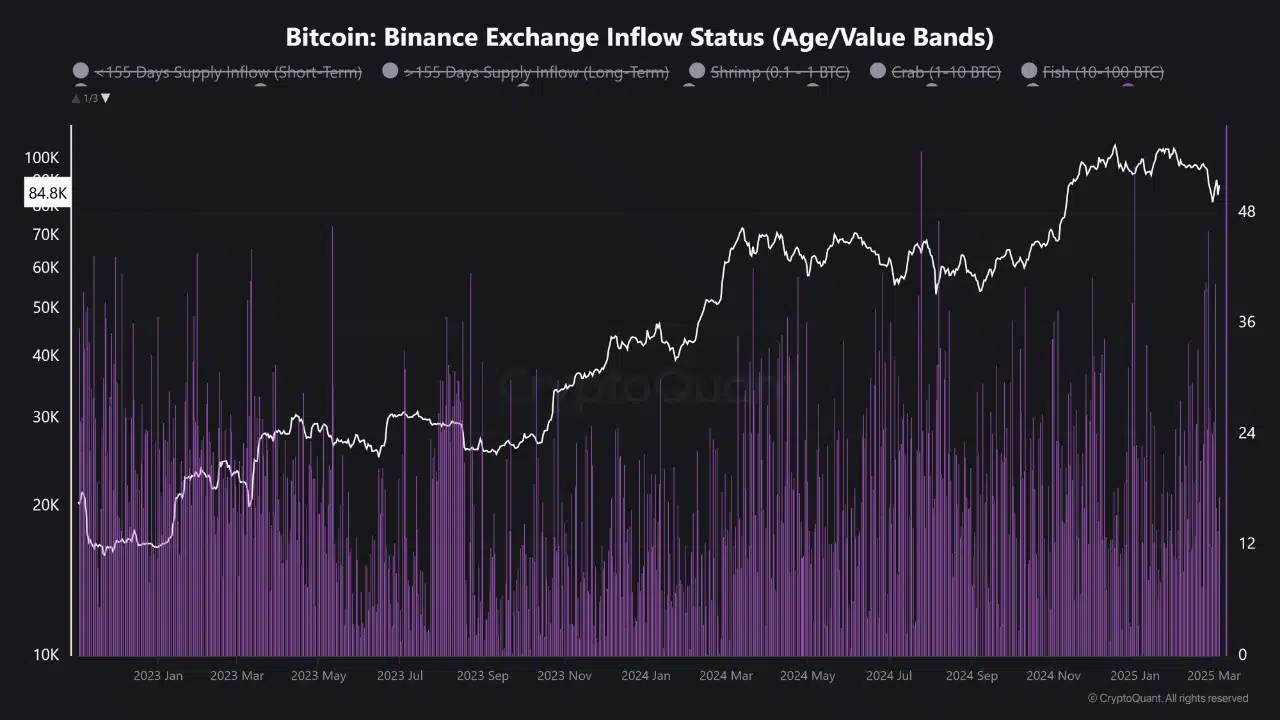

Supply: CryptoQuant

Moreover, the rise in inflows from youthful cash suggests renewed confidence, whereas elevated whale deposits point out a transition away from distribution.

With the month-to-month proportion change in whale holdings now in optimistic territory, this might mark a turning level in market sentiment.

Supply: CryptoQuant

Whales are again!

Supply: X

After the longest part of whale internet discount in a 12 months, accumulation has resumed. Giant holders are growing their positions, reversing the earlier downtrend.

This means whales is likely to be making ready for the following market cycle part. And, continued shopping for strain might set off widespread bullish sentiment.

Nonetheless, it’s unsure if this development is sustained or just a short-term repositioning.

Bitcoin: Will accumulation drive a rally?

Supply: TradingView

Bitcoin’s value motion stays unsure regardless of renewed whale accumulation. At press time, BTC is buying and selling at $88,227, down 1.92%, because the market adjusts to this shift.

On the time of writing, the RSI stood at 43.43, indicating weak momentum with out clear indicators of oversold circumstances. Though promoting strain seems to be easing, consumers have but to take cost.

OBV remained unfavorable, reflecting low demand. Continued accumulation might alleviate liquidity constraints and help a stronger value restoration.

A breakout above $90,000 would sign a bullish reversal whereas failing to carry present ranges might result in additional declines.

Bitcoin’s value trajectory is dependent upon whether or not whales proceed accumulating or revert to profit-taking.

Whales take the lead as retail stays cautious

The market is witnessing a transparent divergence: retail buyers stay sidelined, whereas whales and institutional gamers drive the narrative.

On-chain information means that smaller holders haven’t considerably elevated their positions, highlighting persistent warning. In distinction, whales are accumulating, shifting market dynamics of their favor.

Will contemporary accumulation be sufficient to offset previous distribution? If institutional gamers proceed shopping for, Bitcoin might set up robust help, fueling a sustained rally.

Additionally, do not forget that macroeconomic circumstances, regulatory modifications, and general sentiment will play a vital position in figuring out Bitcoin’s development.

If retail demand returns alongside rising institutional curiosity, BTC could regain upward momentum. Nonetheless, renewed whale offloading might set off one other wave of promoting, probably hindering the restoration.