Identifying the odds of TON’s bullish breakout to $7

- The bullish pennant sample signaled a possible breakout, with a goal worth of $7.2

- On-chain metrics and technical indicators had been according to one another, exhibiting robust momentum and rising adoption

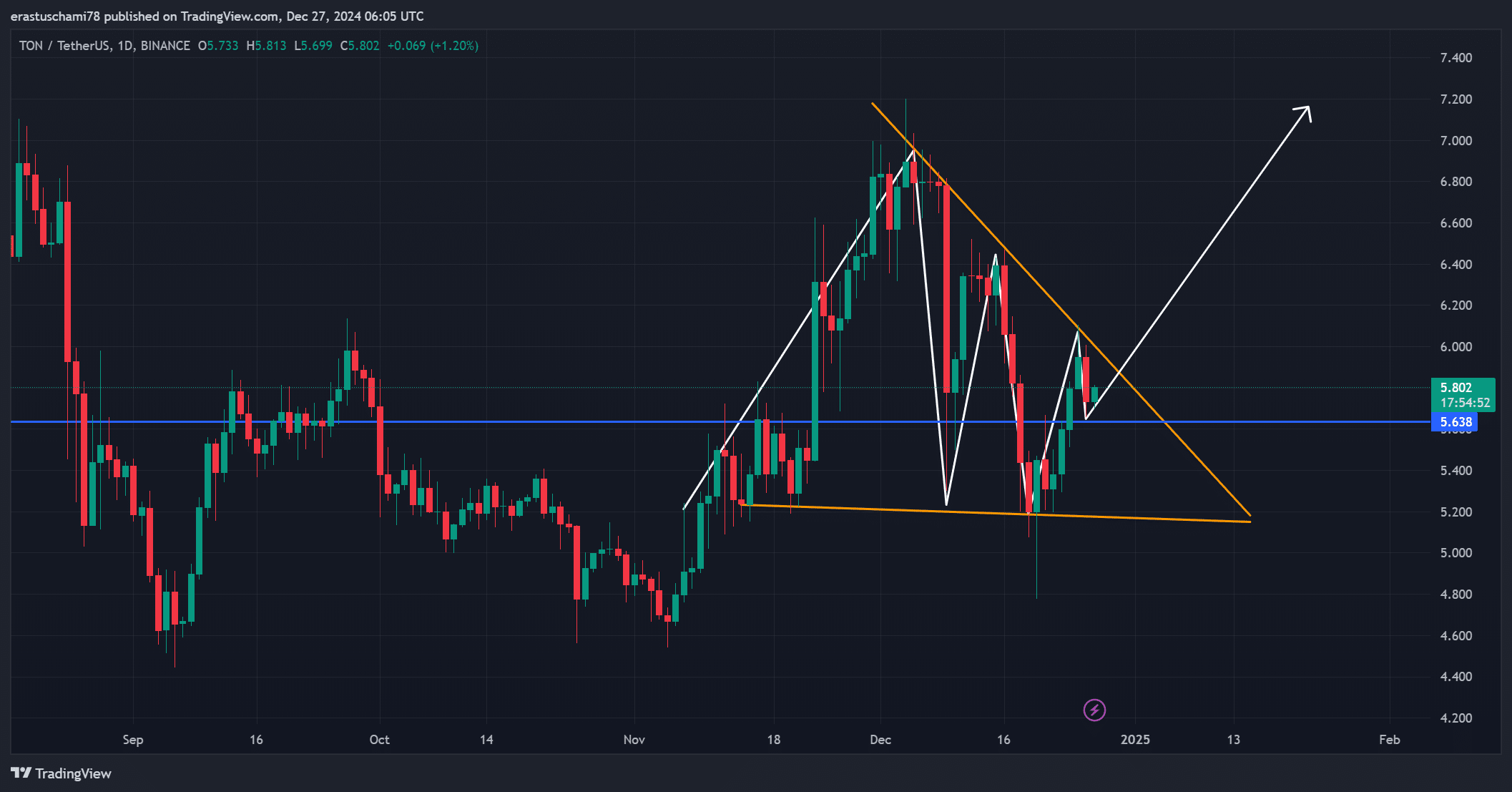

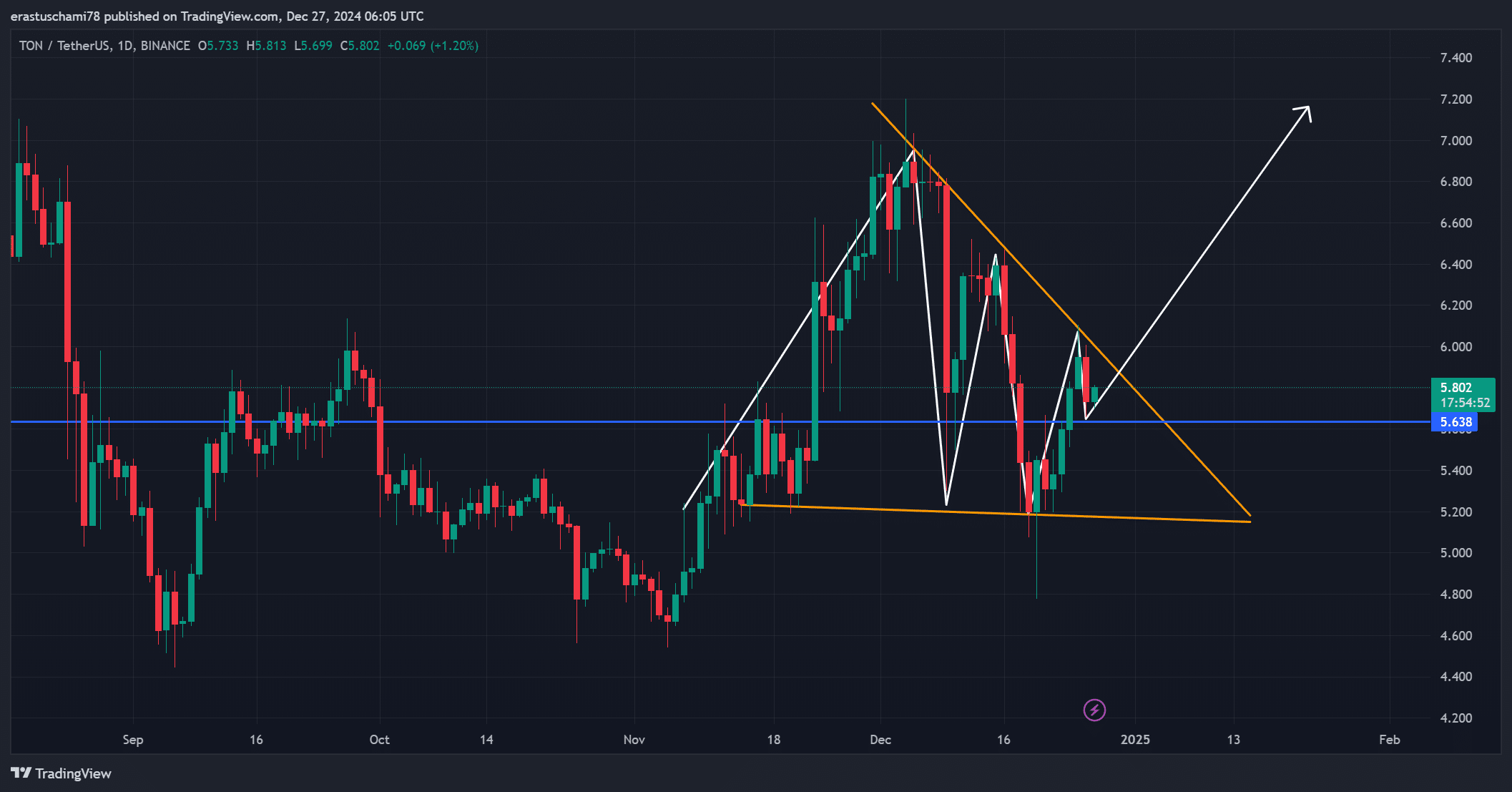

Toncoin’s [TON] market has been heating up these days, with the altcoin gearing up for a possible breakout from a bullish pennant flag sample. At press time, TON was buying and selling at $5.79, down 1.21% within the final 24 hours, with the token nonetheless above the essential $5.6 resistance stage.

This technical setup has captured merchants’ consideration, as a profitable breakout might propel the worth in the direction of $7.2. With robust on-chain metrics supporting the bullish outlook, the momentum behind TON appears to be steadily growing too.

Analyzing TON’s worth motion and breakout potential

TON’s worth motion revealed a transparent bullish pennant flag sample, signifying consolidation earlier than a probable upward transfer. The $5.6 resistance stage has served as a essential threshold, and its current profitable retest strengthened the case for a breakout.

If TON climbs above this stage with important shopping for stress, the subsequent goal may very well be the $7.2 vary, providing important returns. Nonetheless, merchants should look ahead to quantity and momentum to verify the breakout as a failure to maintain these might reverse the pattern.

Supply: TradingView

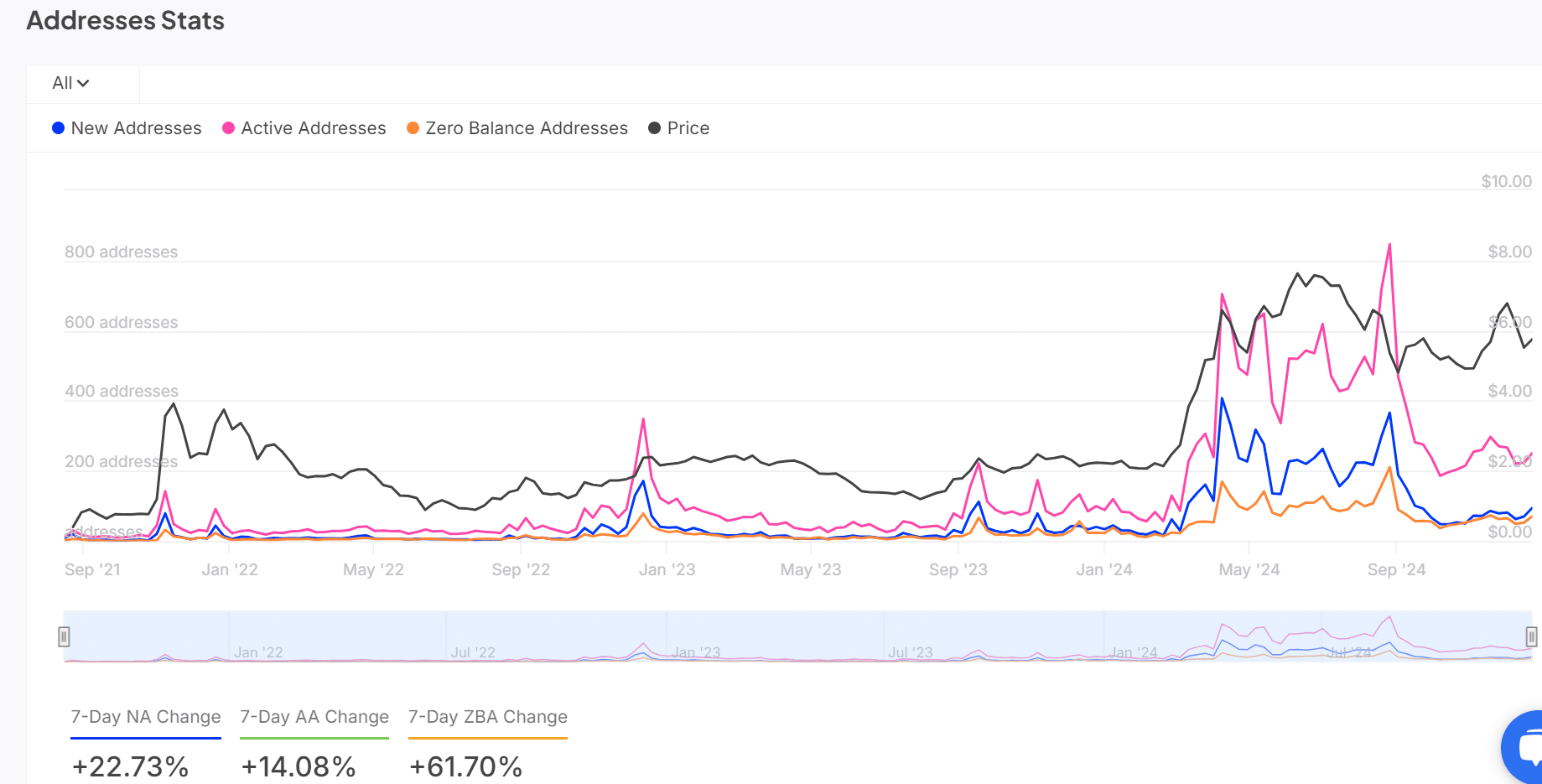

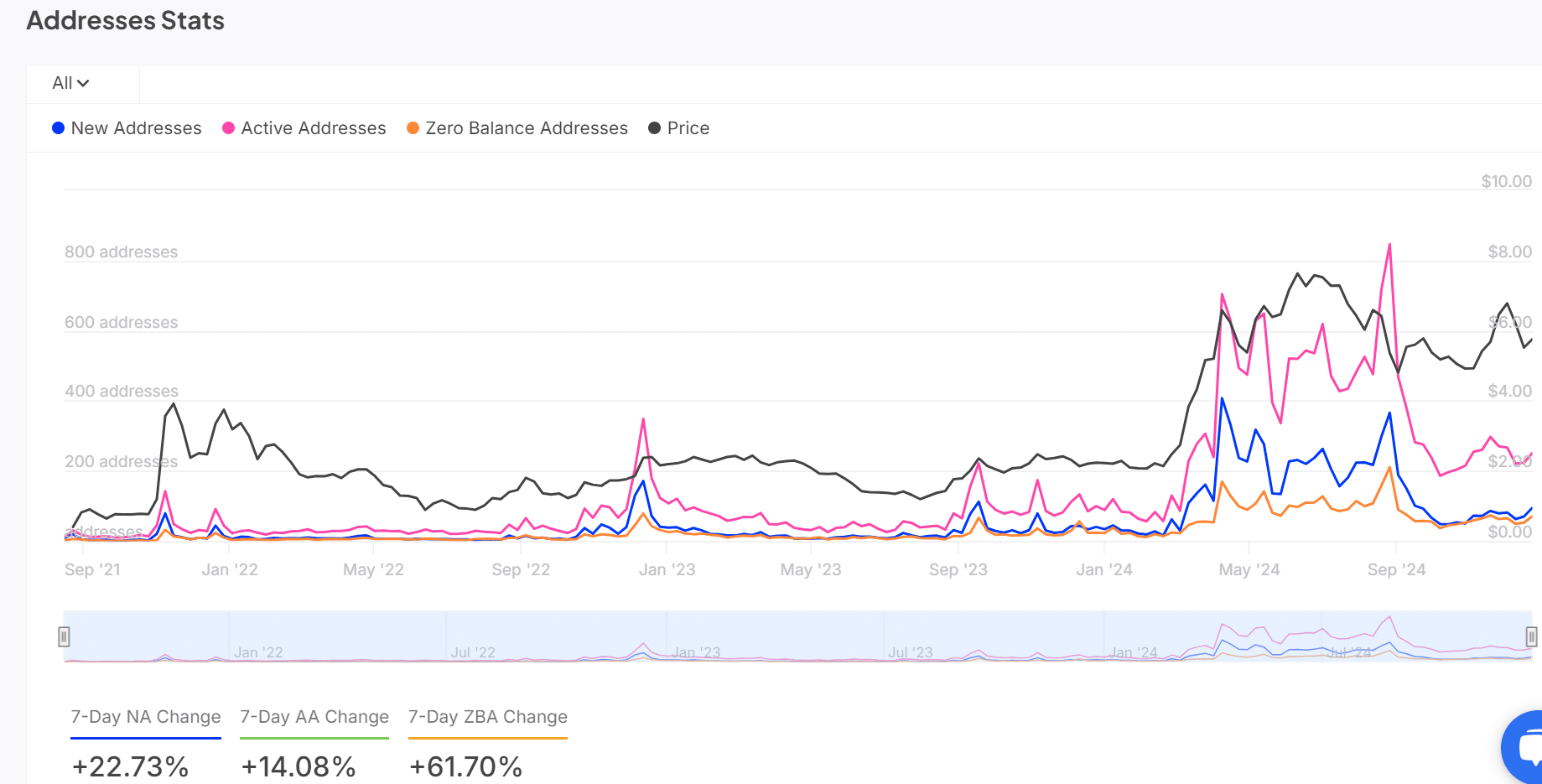

On-chain metrics present rising community exercise

On-chain information highlighted growing exercise throughout TON’s community. Over the previous week, new addresses rose by 22.73%, leaping from 167 to 205, whereas energetic addresses grew by 14.08% – Mountain climbing from 178 to 203.

Moreover, zero-balance addresses noticed a large 61.7% spike, rising from 330 to 534 – An indication of an inflow of recent members.

These metrics recommended that TON’s adoption has been accelerating. Nonetheless, sustained progress might be important to take care of investor confidence and help additional worth appreciation on the charts.

Supply: IntoTheBlock

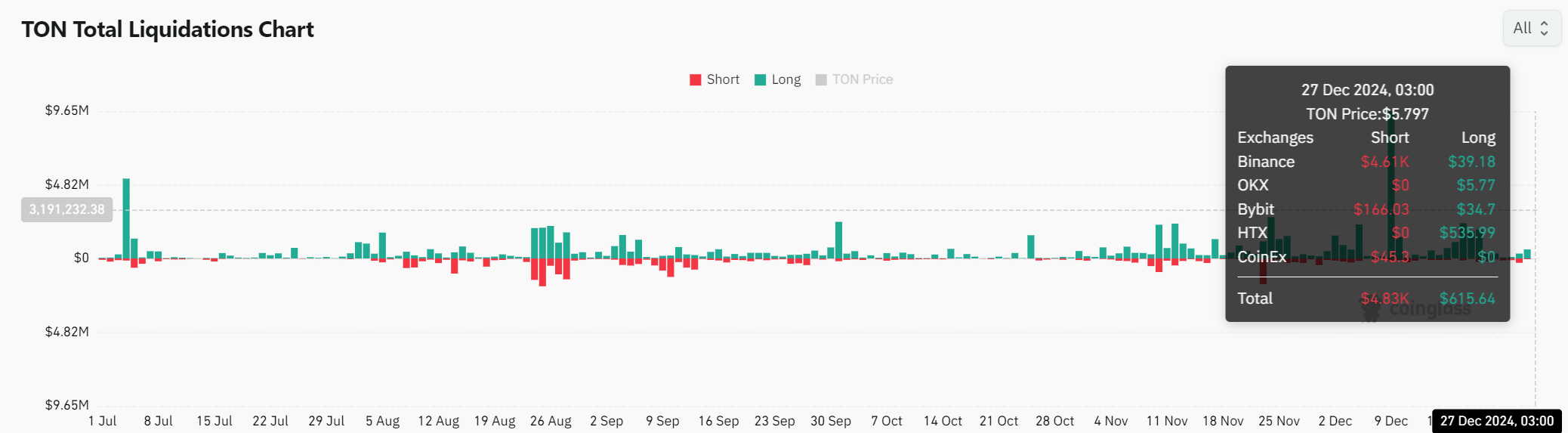

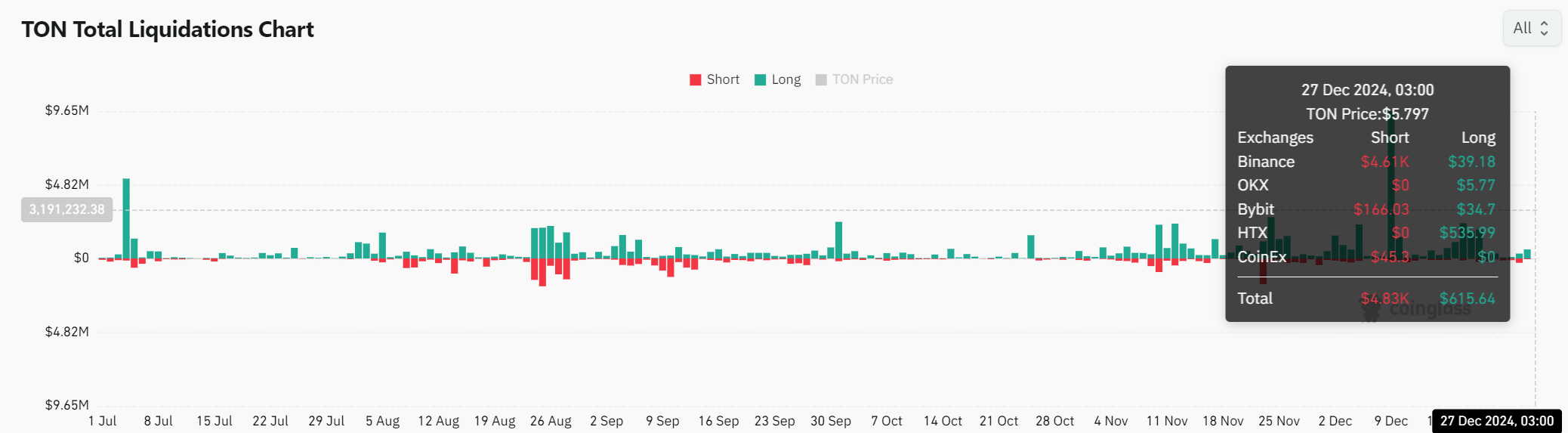

TON’s liquidation information hints at cautious optimism

Liquidation traits revealed a cautious, however optimistic sentiment amongst merchants. Brief liquidations totalled $4.83k, in comparison with $615.64 in longs, exhibiting that market members stay hesitant to leverage lengthy positions closely.

Nonetheless, a confirmed breakout above $5.6 might set off a cascade of brief liquidations, which can amplify upward momentum. Subsequently, merchants ought to intently monitor these liquidation ranges as a key indicator of market shifts.

Supply: Coinglass

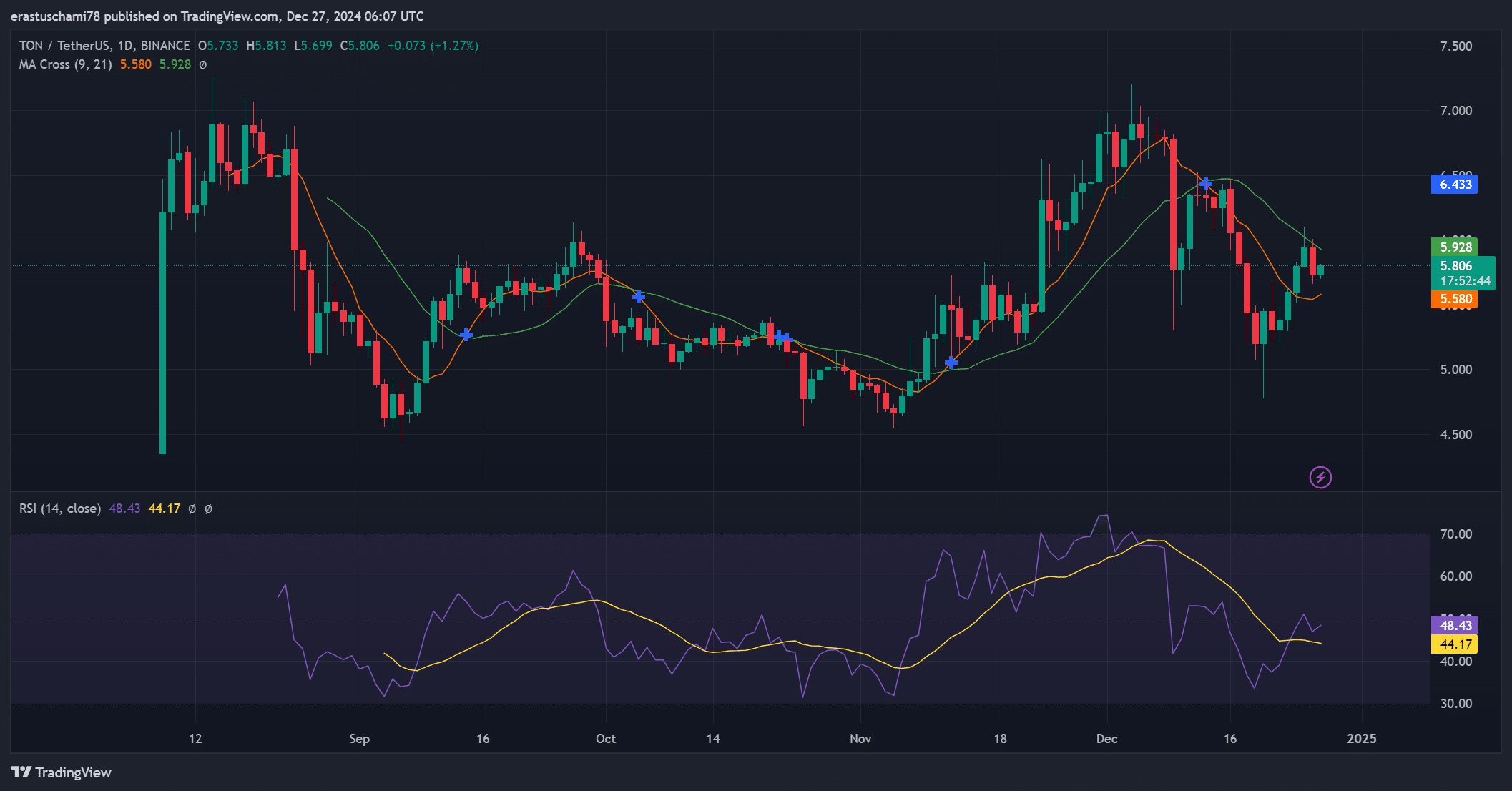

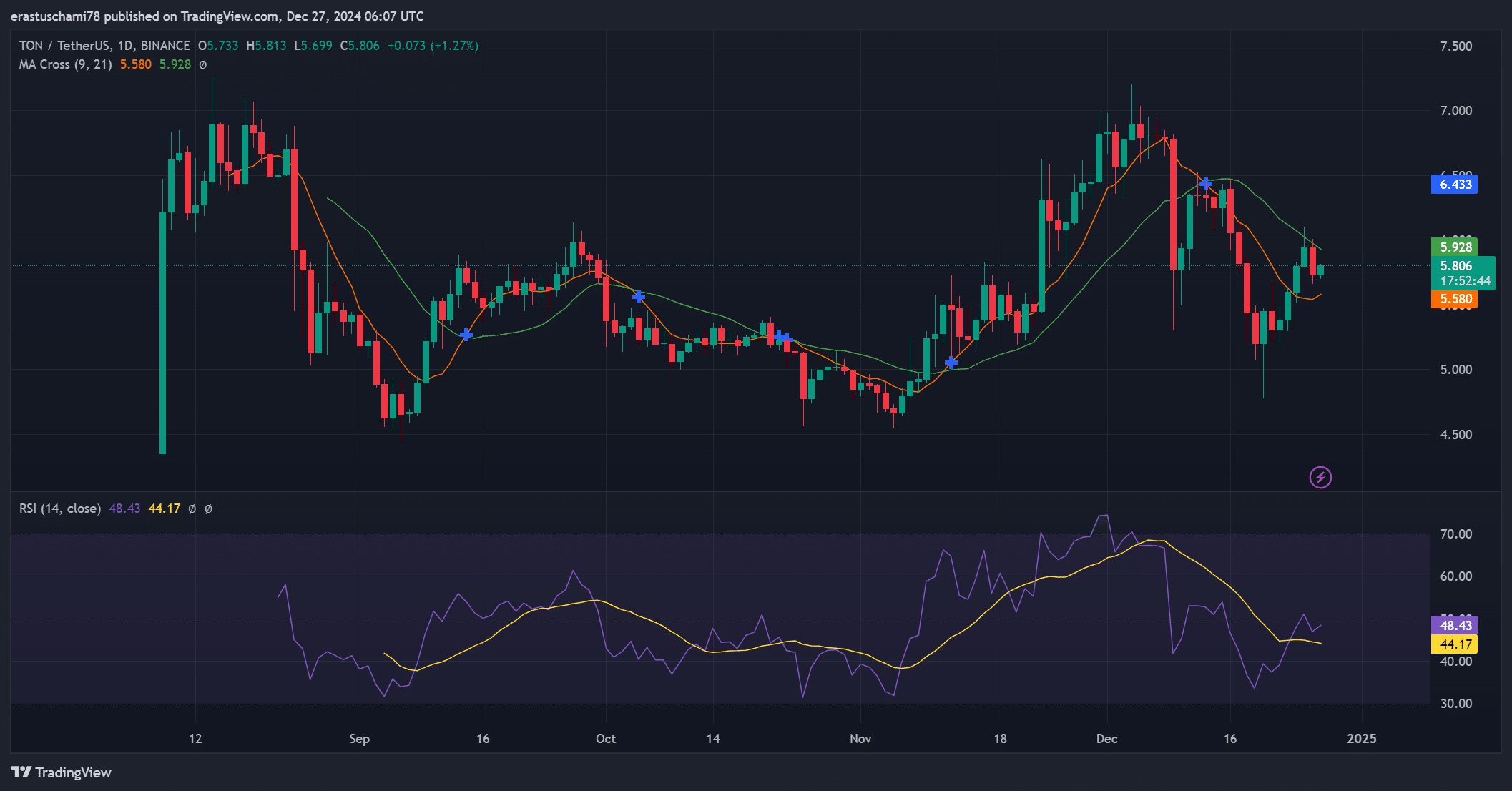

Technical indicators sign bullish momentum

Technical indicators supported the bullish case for TON. The RSI had a price of 48.43, indicating impartial momentum however with room for progress. Moreover, the 9-day transferring common at $5.80 was above the 21-day transferring common at $5.58 – An indication of a good pattern.

Mixed with the pennant flag setup, these indicators appeared to trace at a market primed for a breakout. Nonetheless, constant shopping for stress might be essential to sustaining this momentum.

Supply: TradingView

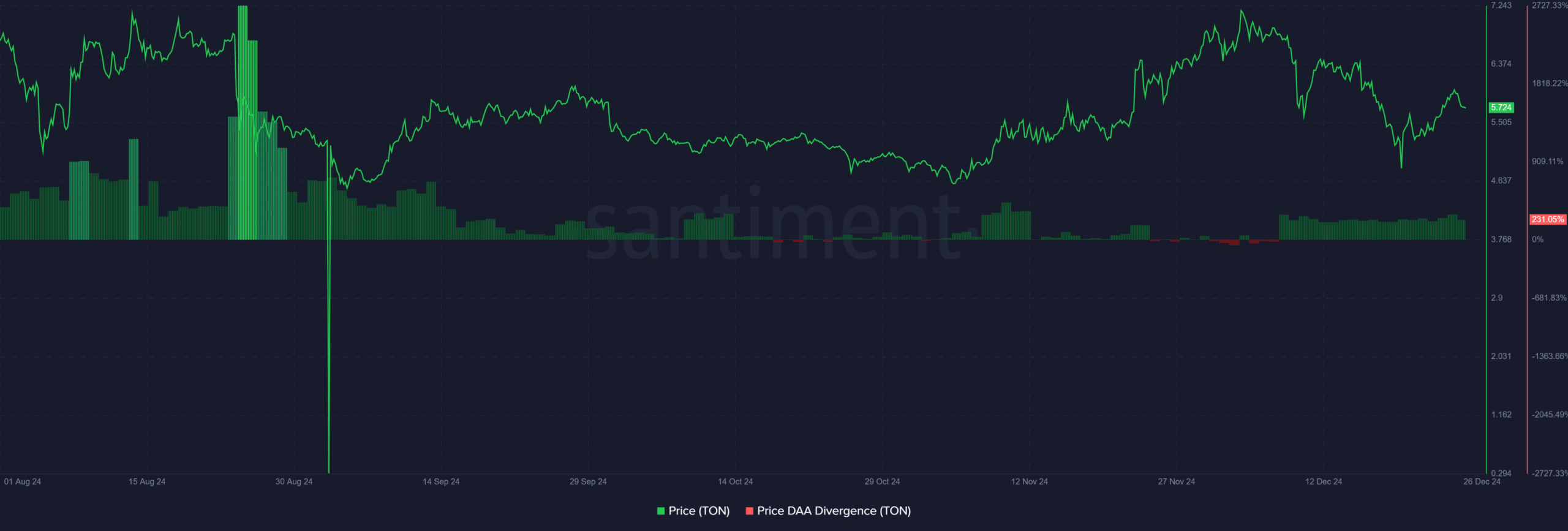

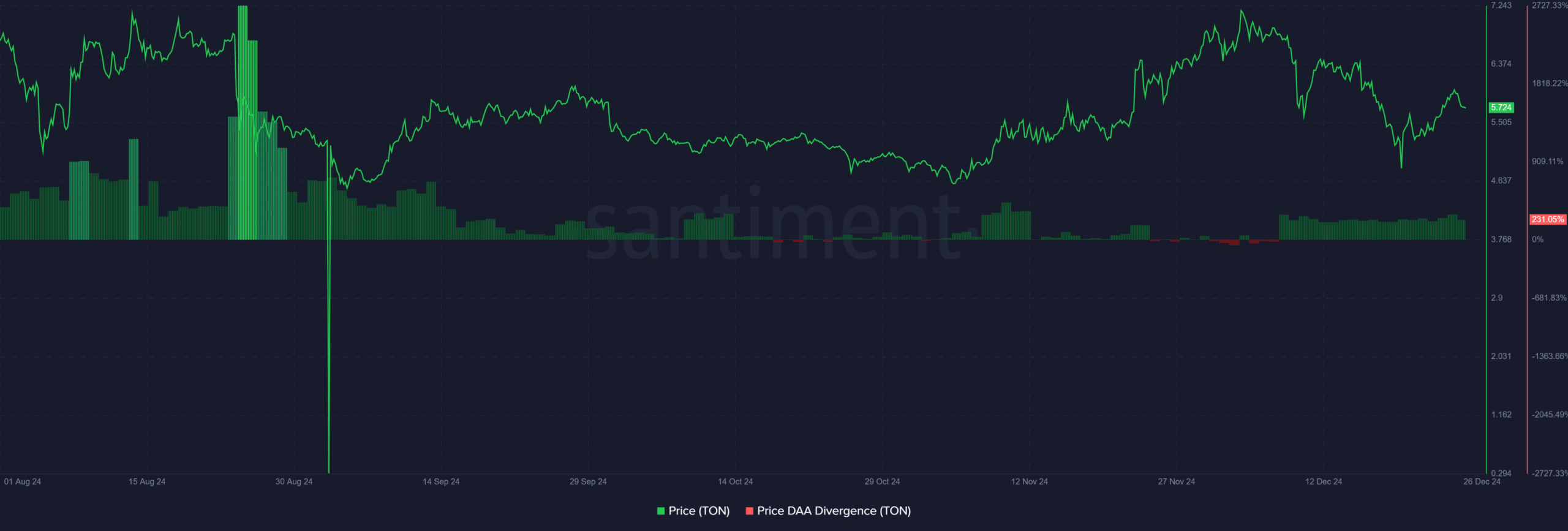

Day by day energetic addresses divergence displays power

The value and each day energetic addresses (DAA) divergence provided some extra optimism. In truth, the DAA at 231% aligned intently with TON’s worth motion at $5.7.

This narrowing divergence highlighted bettering fundamentals, suggesting that TON’s community could also be rising stronger alongside its worth motion.

Supply: Santiment

Learn Toncoin’s [TON] Value Prediction 2024–2025

TON is well-positioned for a breakout, with robust technical indicators and rising on-chain exercise. A decisive transfer above $5.6 would probably push the worth in the direction of $7.2, confirming the beginning of a robust rally.

Merely put, TON’s outlook stays extremely promising because it continues to realize momentum.