If This Happens, Bitcoin Price Will Shoot To $140,000, Says Analyst

Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

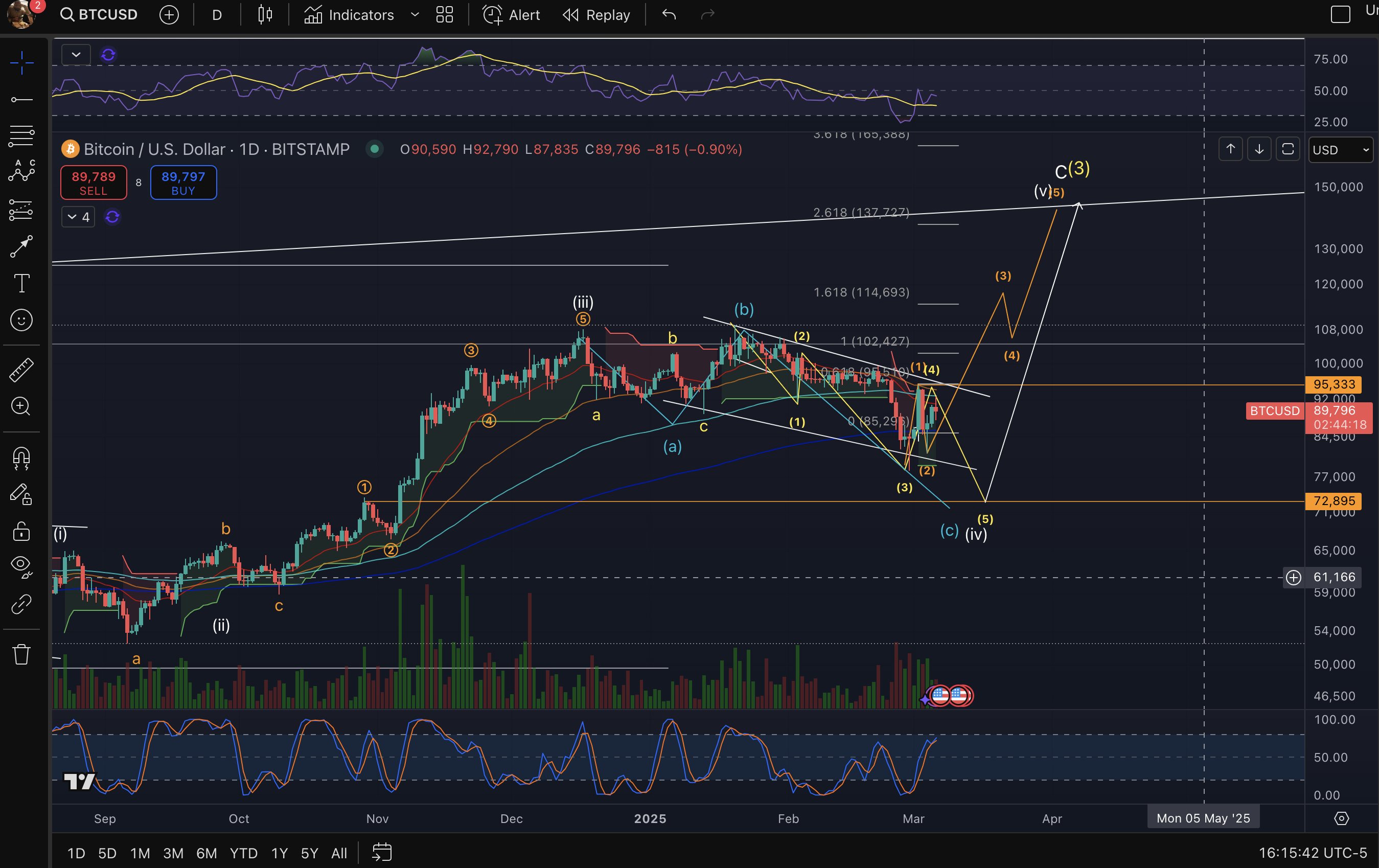

In a newly printed chart, Elliott Wave specialist and crypto analyst Large Mike (@Michael_EWpro) outlines a exact roadmap for Bitcoin’s worth motion, indicating {that a} break above $95,000—or a bounce from decrease assist close to $72,895—may propel BTC towards the $130,000–$140,000 area. His evaluation builds on detailed wave counts, a number of Fibonacci extension targets, and important transferring averages, providing a granular take a look at the BTC’s near- and mid-term prospects.

What’s Subsequent For Bitcoin?

Large Mike’s chart displays a posh Elliott Wave construction consisting of 5 fundamental impulse waves and interspersed corrective sub-waves. A key space labeled close to $72,895 corresponds to wave (c)(iv), representing a significant potential backside if the market breaks beneath $78,000 and continues decrease.

Notable corrective waves round $85,000 to $95,000 seem to have fashioned a bigger consolidation section, which he regards as a precursor to the following directional transfer. The chart additionally pinpoints an upside pathway from roughly $95,000, projecting impulse waves (3), (4), and (5) that stretch into the $100,000–$140,000 zone.

Associated Studying

Fibonacci extension targets seem at roughly $114,693 (1.618 extension) which could possibly be the goal for wave (3), adopted by a corrective transfer to $102,000 earlier than beginning wave 5 which goals for $137,727 (2.618 extension), or perhaps a remaining leg close to $150,000 aligns with wave c(3).

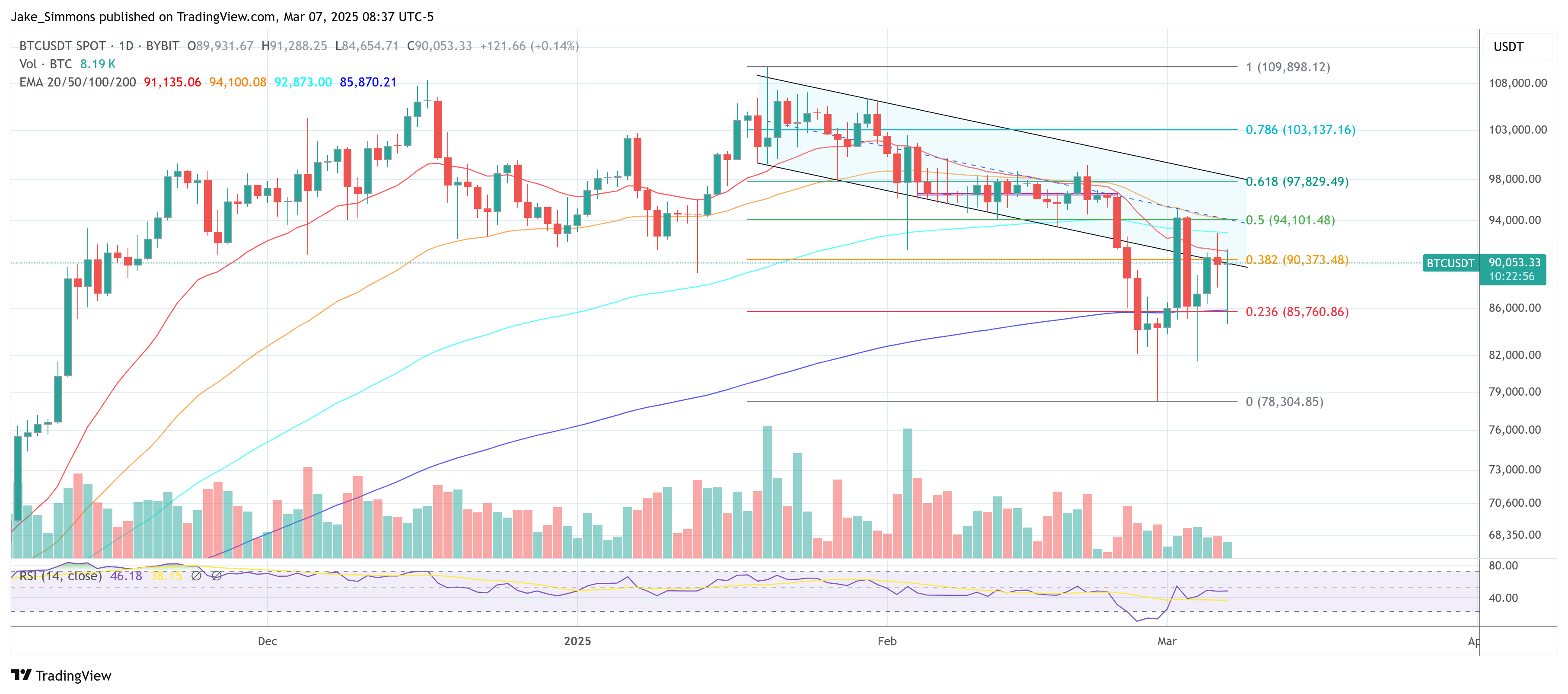

Transferring averages within the $72,000–$90,000 vary underscore the importance of assist close to $78,000–$72,895, whereas an higher band round $90,000–$95,000 represents a vital resistance hall. The analyst observes a descending wedge formation from mid-February to early March, spanning $95,000 right down to $85,000, and notes that an upside breakout may herald a renewed push into six-figure territory.

Associated Studying

Quantity profiles point out subdued participation throughout current corrective phases, alongside a impartial Stochastic RSI studying that means momentum may shift decisively relying on which worth threshold provides approach first.

Large Mike emphasizes two vital strains within the sand: “BTC above $95k will set off the transfer shortly in direction of my goal of $130-$140k. Beneath $78k and we check $72k, then run to $140k.” From his perspective, each a direct break above $95,000 and a deeper dip to $72,895 in the end converge on the identical upside goal close to $130,000–$140,000.

At press time, BTC traded at $90,053.

Featured picture created with DALL.E, chart from TradingView.com