Analyzing Bitcoin’s price charts – Long-term confidence vs. short-term selling pressure

- Brief-term and medium to long-term metrics revealed differing alerts for Bitcoin

- Fast lack of power from bulls might push the worth beneath $80k once more

Bitcoin [BTC], on the time of writing, was on a downtrend after shedding the $92,000-support stage within the last week of February. Technical indicators such because the OBV confirmed that promoting strain has been dominant, which means extra losses could also be probably forward.

Supply: CryptoQuant

In a submit on CryptoQuant, analyst Darkfost identified that obvious demand has been falling since December. The obvious Bitcoin demand chart compares the brand new provide to the availability that has been inactive for a yr. This chart identifies whether or not the brand new BTC is being absorbed into the market on account of demand or if there’s a lack of shopping for strain.

The obvious demand ratio fell beneath zero in the direction of the top of February, coinciding with the lack of the $92k help. And, it has remained adverse since. Therefore, AMBCrypto analyzed different metrics to grasp holder conduct higher.

Bitcoin faces intense short-term bearishness, however HODLers have some hope

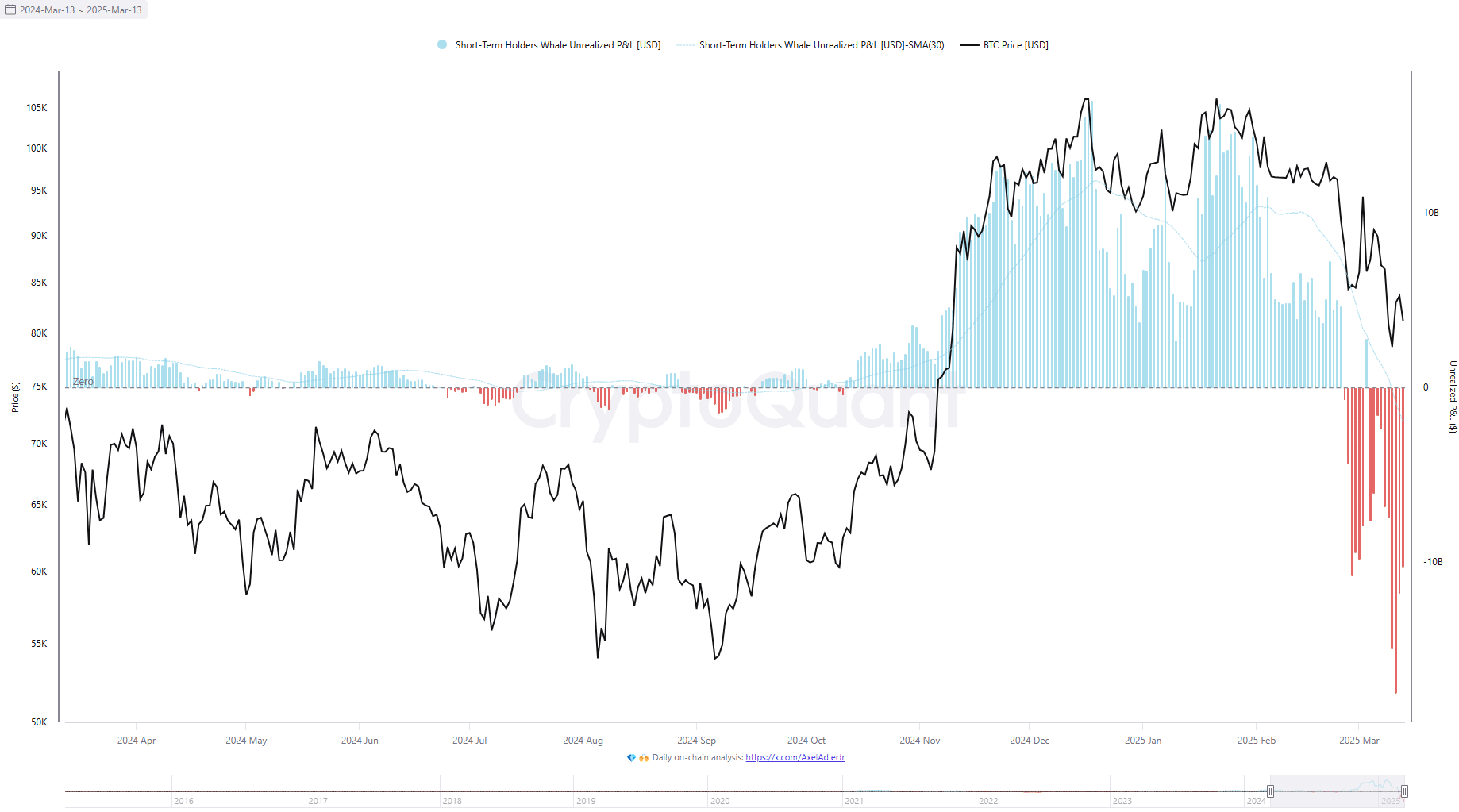

Whale holders with a holding interval of below 155 days are classed as short-term holders (STHs). These STH whales noticed unrealized losses within the last week of February as the worth maintained its downtrend.

The STH whales’ unrealized losses reached their highest level ever on 11 March, with the worth being a whopping $17.52 billion. It receded barely these days, however showcased the potential of additional promoting to guard towards larger losses. The truth is, it additionally created and maintained fearful sentiment throughout the market.

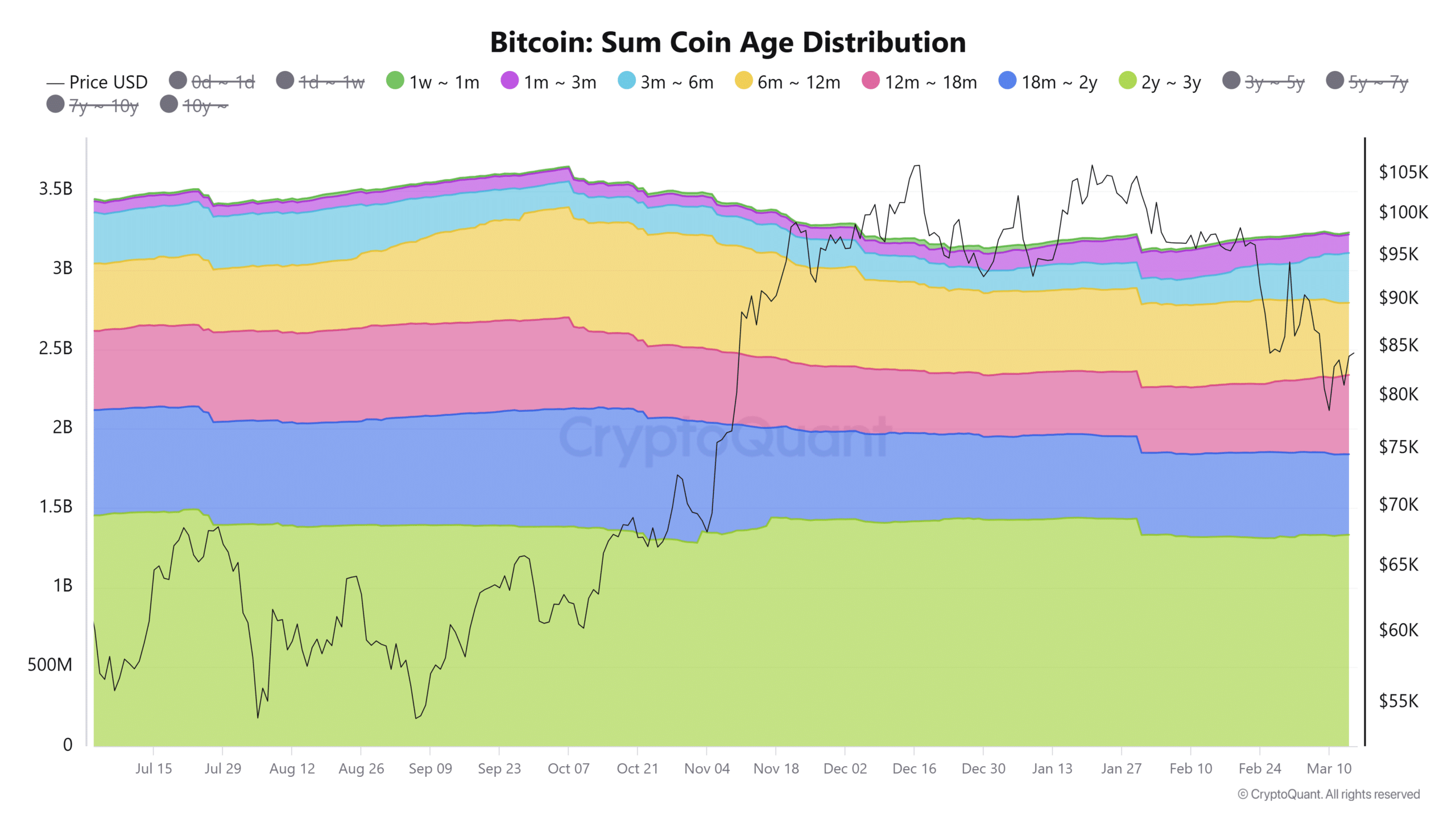

Lastly, the sum coin age distribution analyzes the age of Bitcoin’s unspent transaction output [UTXO]. The metric offers extra weight to the older cash. The age bands are shaped based mostly on the age of the UTXOs.

Rising values of the SCA inside these age bands point out HODL conduct or accumulation whereas falling values point out distribution and hike in promote strain.

Since late January, the 1 month-18-month age bands have typically seen elevated holding and accumulation conduct. The 6-12 month age band has trended down noticeably over the previous week. This hike in holding sentiment throughout completely different age bands is a constructive signal.

The STH whales metric confirmed that latest, massive BTC consumers had been deep underwater. The weak obvious demand confirmed that there was a scarcity of quick shopping for strain to soak up the availability. Nevertheless, medium to long-term holders appeared to retain some confidence, based mostly on the SCA distribution.

Till the short-term strain eases, Bitcoin might see one other value drop beneath $80k.