Institution offloads $23.5 mln of Ethereum, But bullish signs persist

- Hong Kong-based Metalpha offloaded over 33,589 ETH value $77.55 million to Binance previously 4 days.

- Based mostly on the historic worth momentum, there’s a excessive chance that ETH might soar by 23% to the $2,700 degree.

Regardless of the continuing market restoration, it seems that Ethereum [ETH] is poised for a big worth decline. At present, each buyers and establishments are bearish as they proceed to dump ETH on exchanges.

Institutional promoting spree

On the tenth of September, on-chain analytic agency Lookonchain famous on X (previously Twitter) that Metalpha, a Hong Kong asset administration large, had dumped 10,000 Ether value $23.45 million to Binance [BNB].

The agency offloaded over 33,589 ETH value $77.55 million to Binance previously 4 days.

However regardless of the notable dump, the asset supervisor nonetheless held a big 51,300 ETH, value $120 million, at press time.

Are whales transferring away from ETH?

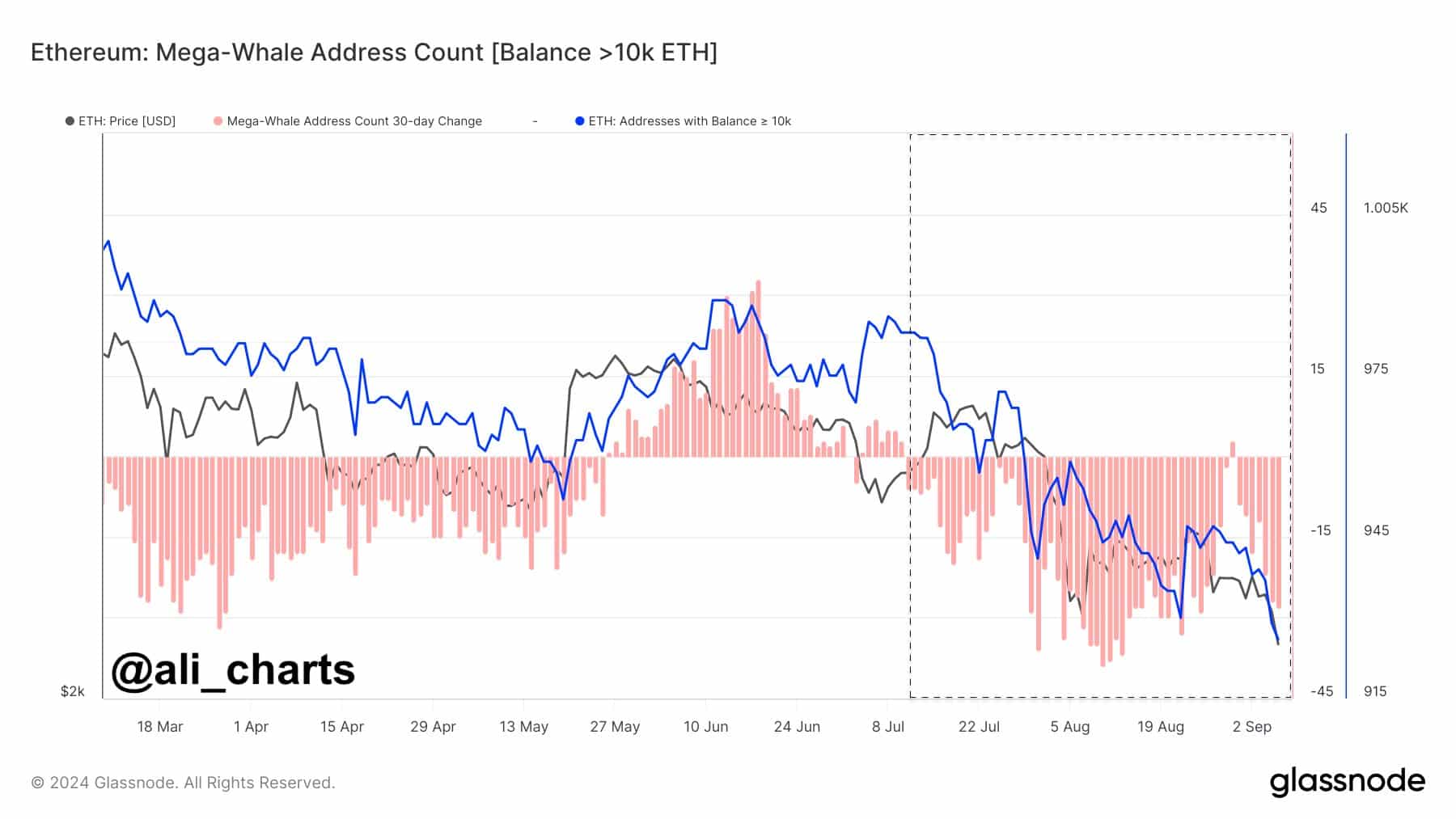

Just lately, a distinguished crypto professional made a publish on X, stating that Ethereum whales have stopped accumulating ETH since early July. As a substitute, they’ve both been promoting or redistributing their ETH holdings.

This means a scarcity of curiosity from buyers and whales previously few weeks.

Supply: X

Nevertheless, if whales and establishments proceed with important ETH dumps, there’s a excessive chance that it might set off an enormous sell-off within the coming days.

Key ranges to observe for

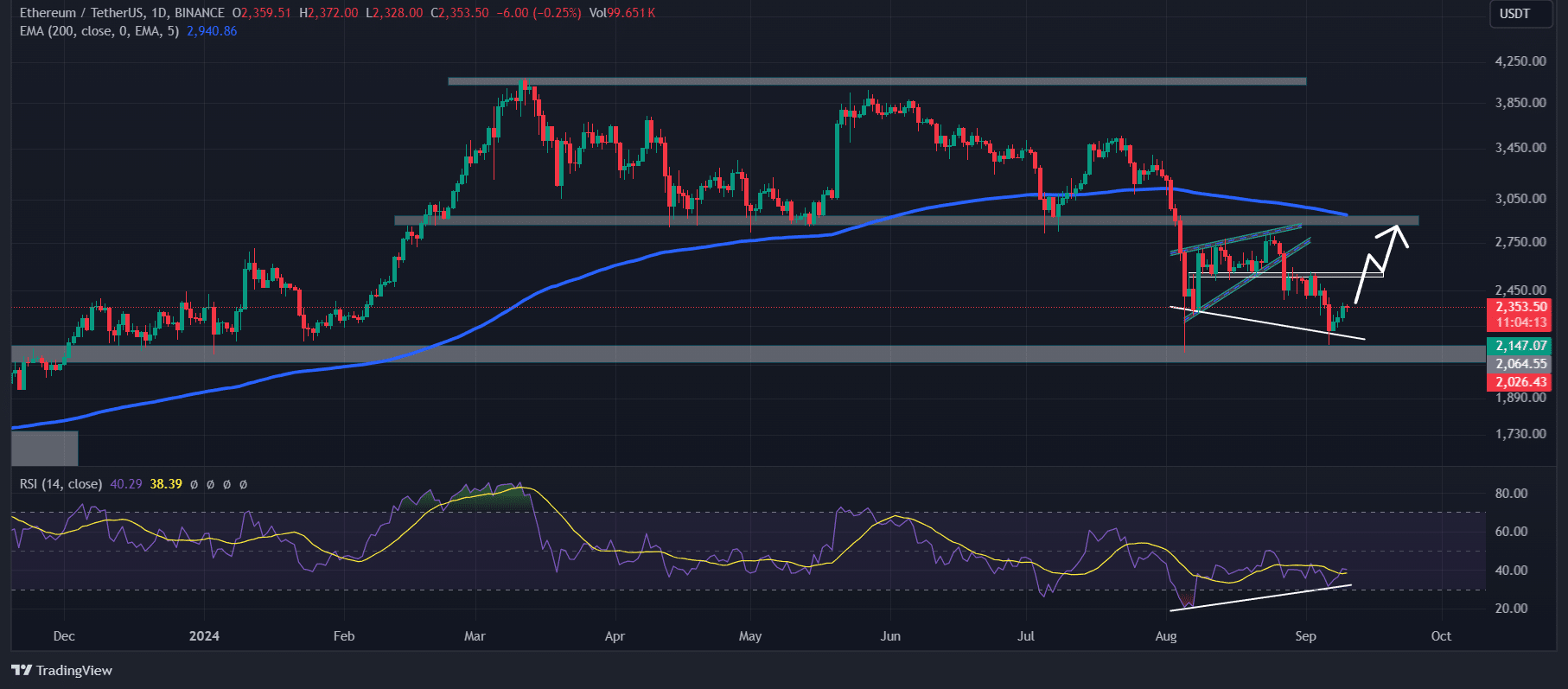

AMBCrypto’s take a look at Ethereum confirmed encouraging indicators.

Notably, the king of altcoins could expertise an upside rally as a result of present bullish divergence on its Relative Energy Index (RSI). Moreover, it has discovered assist on the essential $2,150 degree.

Supply: TradingView

Based mostly on the historic worth momenta, every time ETH’s worth reaches this assist degree, it at all times tends to expertise an enormous worth surge of over 23%. This time, there’s a related expectation is that ETH might soar to $2,700.

Nevertheless, this bullish outlook thesis will solely work till ETH maintains itself above the essential assist degree of $2,150 degree.

Bullish on-chain knowledge

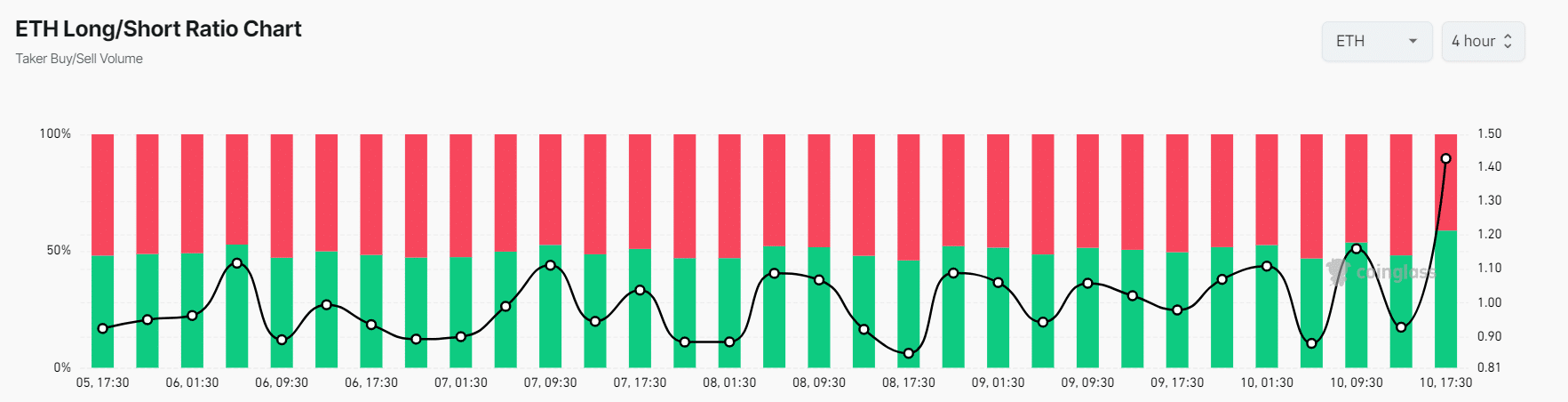

On-chain knowledge additionally supported the bullish outlook. Coinglass’s ETH Lengthy/Brief Ratio Chart stood at +1.424 at press time, the very best degree previously week, indicating merchants’ bullish sentiment.

Moreover, ETH’s Futures Open Curiosity elevated by 2.5%, indicating that merchants are doubtlessly betting extra on lengthy positions.

Supply: Coinglass

A optimistic Lengthy/Brief Ratio and elevated Open Curiosity alerts potential shopping for alternatives. At press time, 58.75% of prime ETH merchants held lengthy positions, whereas 41.25% held quick positions.

This steered that bulls had been dominating the asset, and have the potential to liquidate quick positions.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

At press time, ETH was buying and selling close to the $2,350 degree, having skilled a worth surge of over 2.35% within the final 24 hours.

Its buying and selling quantity elevated by a modest 14% throughout the identical interval, suggesting increased participation from merchants amid the market restoration.