Ethereum dips below its realized price amidst bearish sentiments

- ETH has declined by 29% over the previous month.

- Ethereum dips beneath its Realized Worth as bearish sentiments persist.

Over the previous day, Ethereum [ETH] has skilled robust downward stress, dropping to achieve the October 2023 stage of $1754.

Nonetheless, since then, the altcoin has made a average restoration to achieve $1876 as of this writing. This marked a 29.01% decline over the previous months.

Supply: Glassnode

As ETH declined, it dropped beneath its realized value for the primary time in two years. This decline means that common buyers are actually holding ETH on unrealized loss.

Ethereum’s drop to this stage dangers capitulation, as long-term holders begin to panic promote fearing additional decline.

Equally, the drop means that ETH is experiencing excessive bearish sentiment, with buyers persevering with to promote, resulting in robust downward stress.

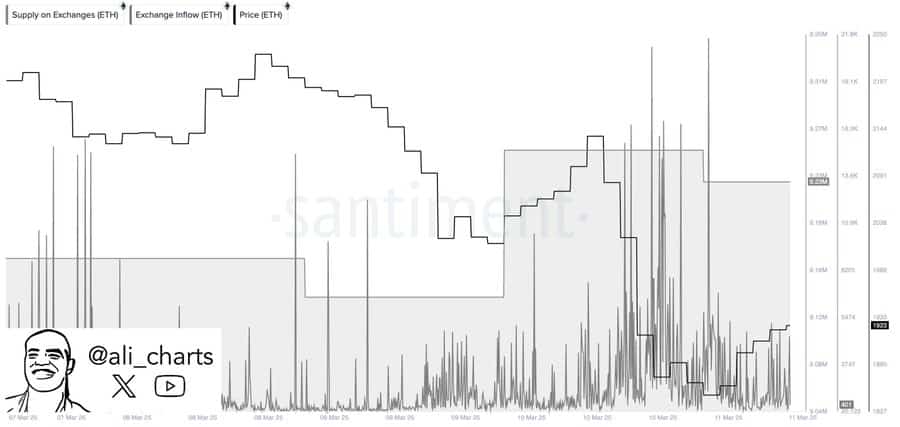

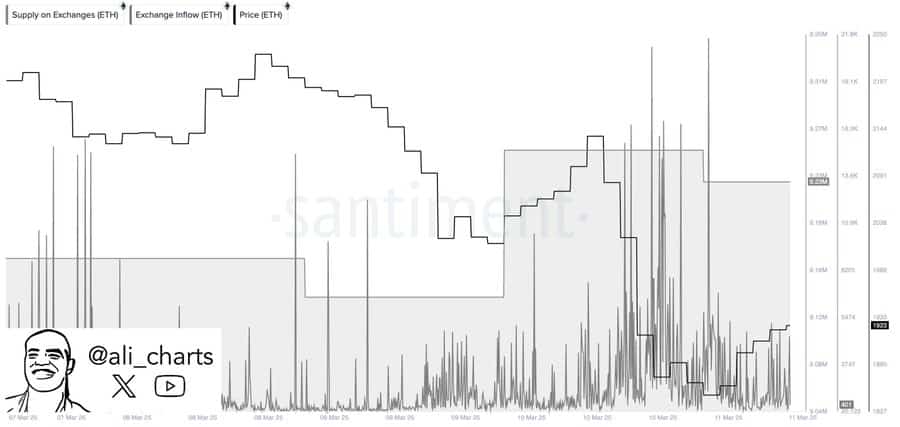

Supply: Ali_charts/X

Taking a look at change flows, it appears this dip arises from important promoting exercise. As such, over the previous two days, ETH has recorded optimistic change inflows with over 100k ETH tokens despatched to exchanges.

This means that buyers have been actively promoting the altcoin to chop their losses.

As such, the markets have recorded two consecutive days of optimistic change netflow. When this turns optimistic, it means that there are extra inflows to exchanges than withdrawals reflecting robust bearish sentiments.

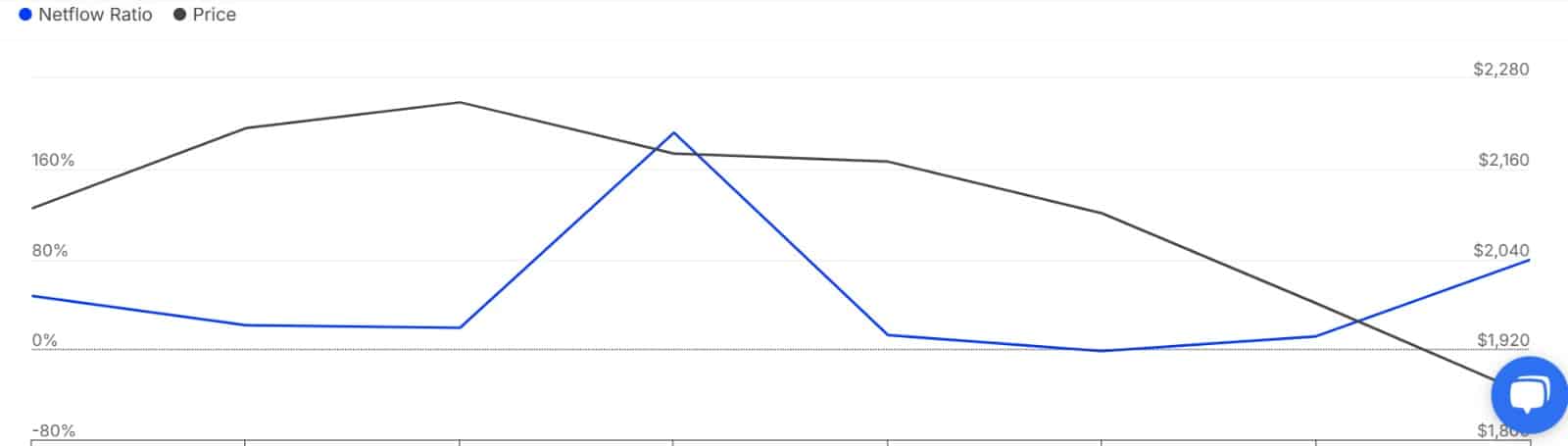

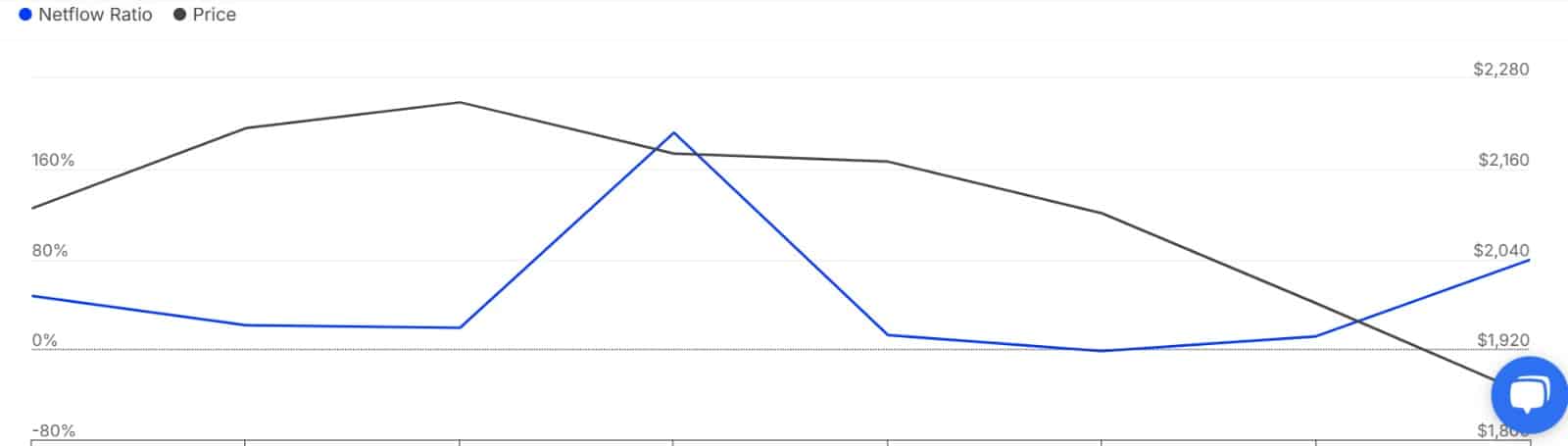

Supply: IntoTheBlock

This sentiment can be extremely prevalent amongst whales. Actually, Ethereum’s Giant Holders Netflow to Change Netflow Ratio has surged over the previous day to hit 79%.

Such an enormous spike means that whales are actively sending their holdings to exchanges in preparation to promote.

When whale change influx rises, it implies an absence of market confidence the place long-term massive holders are fearing extra losses.

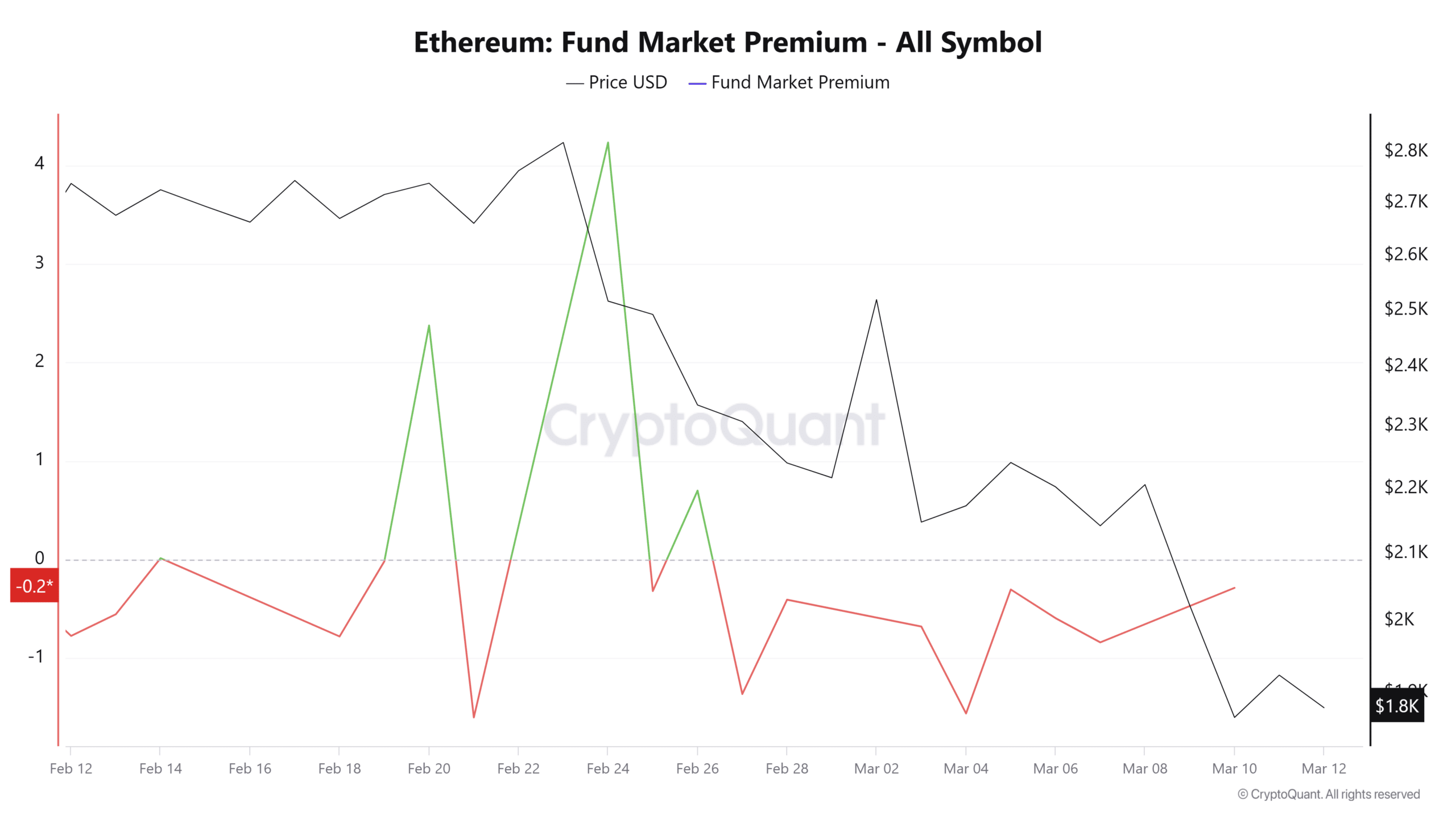

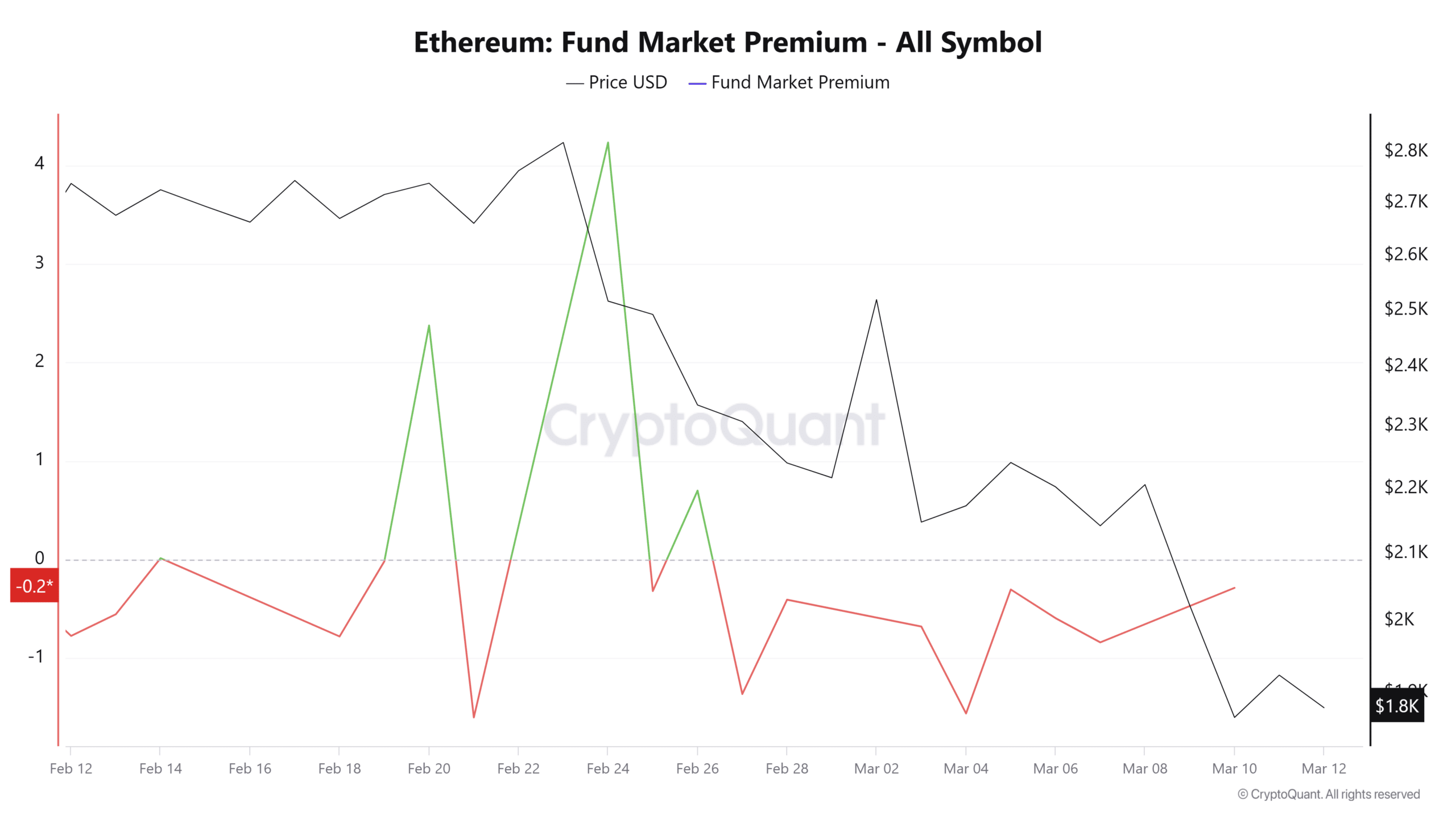

Supply: CryptoQuant

Lastly, Ethereum’s fund market premium has remained destructive for a sustained interval. Buyers have remained bearish, and there’s a low institutional or whale demand for ETH.

Thus, markets are seeing a risk-off sentiment.

What’s subsequent for ETH?

The present market situations place ETH for extra losses on its value charts until optimistic occasions deliver speculative demand for a rebound.

Nonetheless, when costs drop beneath realized value, it provides an ideal shopping for alternative and has traditionally provided important returns.

Thus, with robust bearish sentiments holding out there, ETH should reclaim $2058 which is the realized value for a possible upside reversal. Failure to reclaim this stage, the subsequent help for the altcoin is $1440.