Investors trust Binance, Coinbase most for security, says AMBCrypto report

The markets count on the Federal Open Market Committee to chop rates of interest at its subsequent assembly on 18 September. Nevertheless, escalating geopolitical tensions within the Center East and Africa are making buyers fearful.

Take into account this – After the easing of U.S inflation, merchants anticipated BTC to alter fingers at a premium. Nevertheless, the coin as an alternative misplaced its $60,000 psychological help and was buying and selling at a reduction of three.10%, on the time of writing.

A silver lining emerges

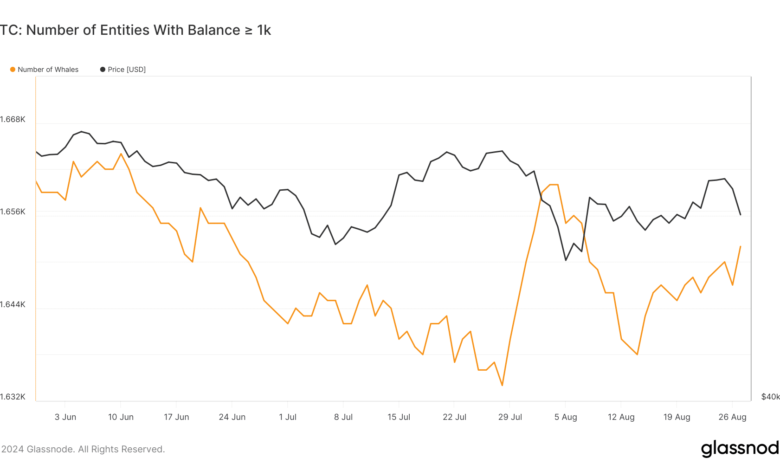

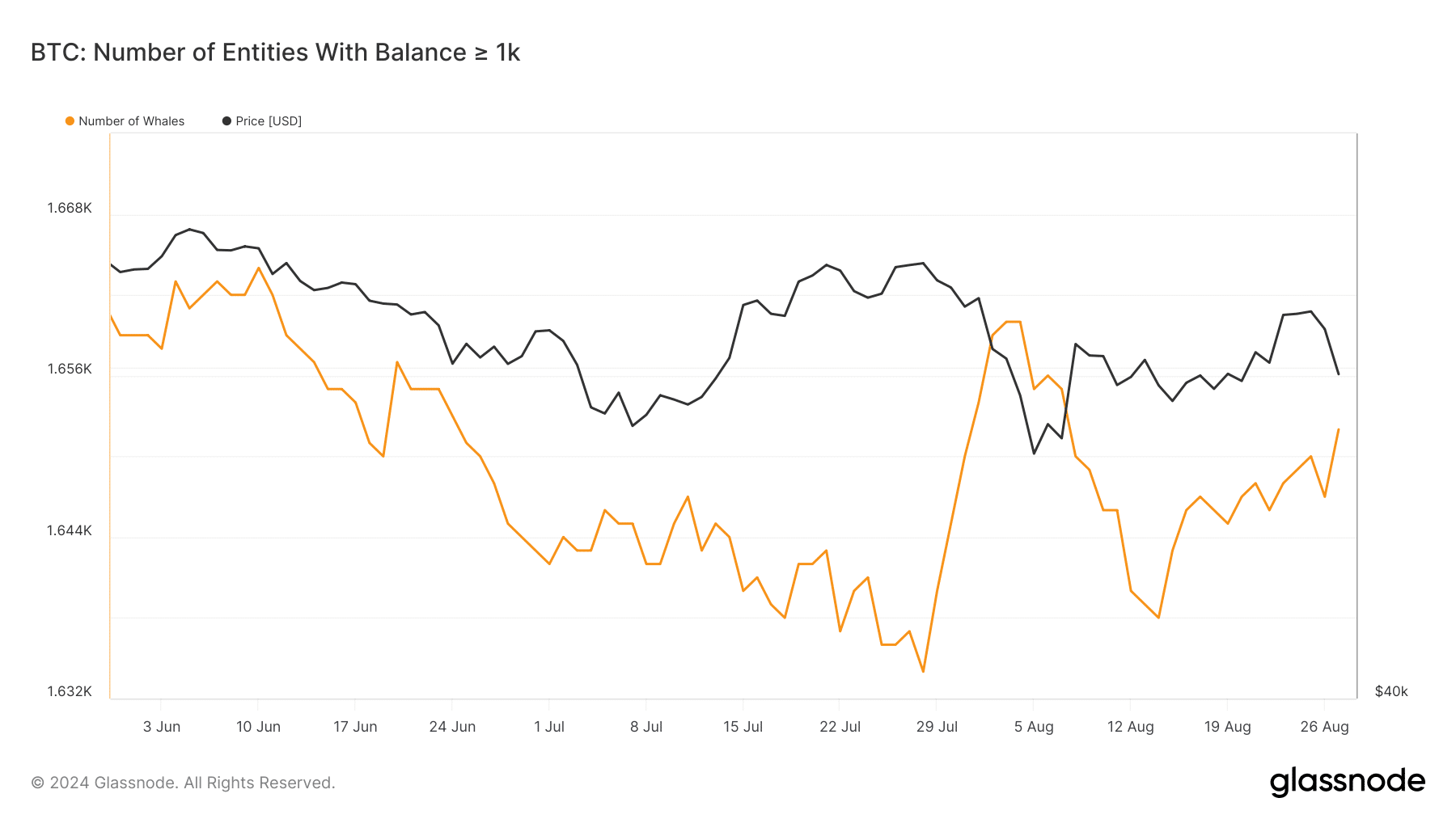

Curiously, AMBCrypto’s August 2024 report discovered that whales have been shopping for the dip and adopting a HODLing technique. In actual fact, the variety of whales, after falling to a low of 1,638, has additionally been progressively rising.

Most undoubtedly, big-pocket buyers are seeing the present market situation as a possibility to go lengthy.

Supply: glassnode

Regardless of the whales’ bullish conviction, curiosity in buying and selling Bitcoin declined in early August as retail buyers favored altcoins over the king coin. However, after 25 August, the sentiment modified in favor of BTC since lively addresses famous a pointy uptick.

Then again, BRC-20 inscription exercise cooled down in August from its April peak of 18,085. Though August recorded a hike in new inscriptions (552), the general quantity was nonetheless far under its earlier excessive.

Amidst all of the on-chain developments, a regarding issue emerged on 28 August when the BTC OI-Weighted Funding Price moved to the detrimental aspect. This implied that perpetual contract merchants have been leaning in direction of a bearish outlook.

Elements that might spark a short-term bullish reversal

In an unique dialog with AMBCrypto, 21Shares’ Head of U.S Enterprise Federico Brokate revealed that ETF inflows might be a turning level for Bitcoin’s worth trajectory. In response to the exec,

“The gamers that would be the longest or the most important patrons long-term truly haven’t even began taking part in BTC spot ETFs.”

So, as soon as pension funds and asset managers begin allocating extra money to the risk-on property, BTC’s $100k aim gained’t be too far. The approaching launch of Solana-based ETFs might additionally considerably have an effect on the broader crypto market.

In anticipation of this, AMBCrypto requested 21Shares about the opportunity of SHIB or DOGE ETFs. Whereas acknowledging the cultural affect of memecoins, Brokate acknowledged that the corporate is prioritizing extra established cryptocurrencies for its present ETF choices.

Though not dismissing the potential for future memecoin ETFs, the exec harassed the necessity for clear utility and worth propositions in ETF product improvement.

Headwinds for the crypto market

Whereas on-chain indicators and the macroeconomic outlook appear to be favoring cryptocurrencies, incidents of hacks, thefts, and ransomware assaults are rising as the largest problem for the crypto market.

Crypto hackers made a dramatic comeback in 2024, stealing over $1.58 billion in digital property by way of July. This marked an 84% improve, in comparison with final 12 months when hacking exercise had considerably declined.

To intently perceive buyers’ protection mechanism in opposition to crypto hacks, AMBCrypto performed an unique survey. The outcomes revealed that 78% of respondents thought-about Binance and Coinbase to be probably the most safe cryptocurrency exchanges.

And, over 43% prioritize {hardware} wallets for safeguarding their digital property. AMBCrypto’s August 2024 report mentioned this insightful survey in full element.

Dive into AMBCrypto’s August 2024 crypto market report

This complete report dives deeper than simply Bitcoin and safety. It explores rising tendencies just like the surge in staking and restaking on Ethereum, and the rising reputation of memecoins on Solana.

The report even talks a few massive improvement on this planet of stablecoins and discusses elements that may assist the NFT market get well.

You possibly can obtain the complete report right here.