Is Another Bitcoin Rally Coming Soon? This Pattern May Say So

On-chain knowledge reveals a sample within the stablecoin shark and whale holdings which will counsel the Bitcoin rally may make a return within the close to future.

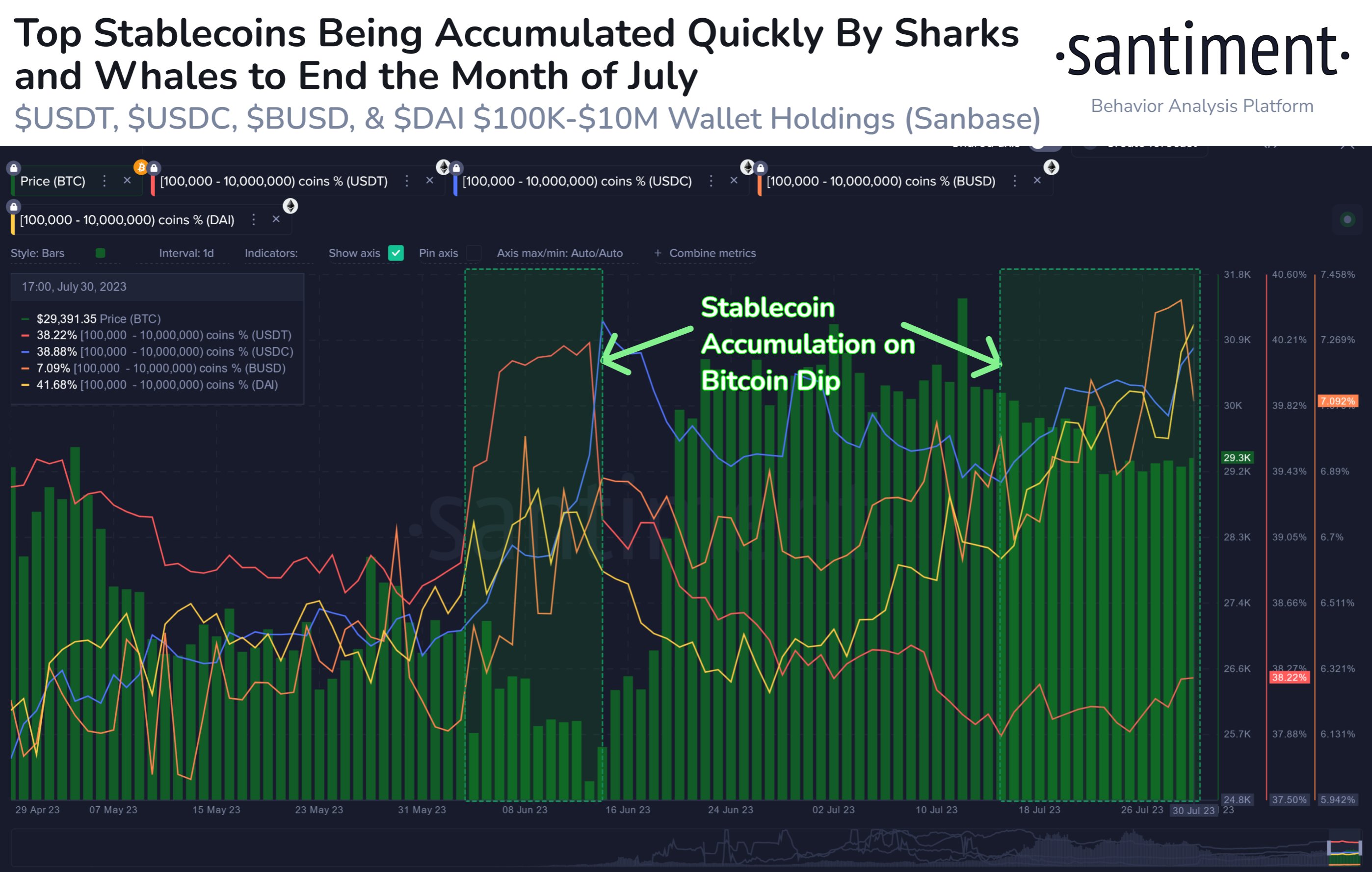

Stablecoin Sharks & Whales Have Been Accumulating Just lately

In accordance with knowledge from the on-chain analytics agency Santiment, the sharks and whales of the main stablecoins have been rising their reserves whereas Bitcoin has been struggling just lately.

The “sharks” and “whales” are two of the most important cohorts within the sector, with buyers belonging to the previous holding at the very least $100,000 and at most $1 million price of the asset, whereas the latter has pockets balances within the $1 million to $10 million vary.

On account of such giant holdings, these buyers can doubtlessly transfer round a lot of cash directly, one thing that may make them influential entities available in the market.

Within the context of the present dialogue, the sharks and whales of stablecoins are of curiosity. Particularly, the 4 largest gamers available in the market are of relevance right here: Tether (USDT), USD Coin (USDC), Binance USD (BUSD), and Dai (DAI).

Santiment has used its “Provide Distribution” metric to trace the holdings of those humongous holders and this indicator tells us in regards to the proportion of the availability that every group available in the market is holding proper now.

Here’s a chart that reveals the development on this metric particularly for the sharks and whales of the highest 4 stablecoins within the sector:

The metrics seem to have been going up in current days | Supply: Santiment on Twitter

As displayed within the above graph, the holdings of those stablecoin sharks and whales have been on the rise just lately. Curiously, whereas this development has shaped, the value of Bitcoin has dipped under the $30,000 stage.

An analogous sample within the provide held by these giant buyers had additionally shaped final month, as these buyers had been shopping for extra stablecoins, whereas BTC had been on a decline.

What adopted this era of accumulation again then was a pointy Bitcoin rally that had taken the cryptocurrency’s value above the $30,000 stage.

A proof of this curious development could lie in what the holdings of those giant stablecoin holders signify. Typically, these buyers go for stables each time they need to exit risky belongings reminiscent of BTC.

Such holders, nonetheless, often solely search to quickly take shelter in these dollar-tied tokens, as a result of in the event that they needed to keep away from the sector for prolonged durations, they’d have exited by different means like fiat.

Thus, these buyers would ultimately shift their stablecoins into Bitcoin and others once more, and with this alternate, present a bullish enhance to their costs. Because of this the availability of those sharks and whales could also be checked out because the out there shopping for strain that these humongous buyers can placed on the asset at any level they need.

From the chart, it’s seen that the BTC rally above $30,000 didn’t really kick off from new cash being pumped again into the asset by the sharks and whales, however quite the conversions that they made again into the asset, as their holdings decreased whereas the rally occurred.

As the massive buyers of the main stables have once more been accumulating just lately, it’s potential that Bitcoin may see a bullish impact from this down the street as soon as extra, though it’s unsure how lengthy it could be earlier than these buyers deploy their stablecoins again into the market.

Bitcoin Value

On the time of writing, Bitcoin is buying and selling round $29,300, up 1% within the final week.

BTC has stagnated because the decline | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.web