Is Bitcoin awaiting another price correction?

- Market individuals locked in a non-trivial $537 million in revenue following BTC worth rise.

- BTC’s RSI was in an overbought place, which might trigger bother.

Bitcoin’s [BTC] worth gained upward momentum final week, permitting it to as soon as once more cross the $30,000 mark. The uptrend gave buyers hope for higher days as BTC’s worth had remained comparatively dormant for weeks. Although the value motion seemed optimistic, issues may flip the opposite manner spherical if historical past is to be believed.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

Bitcoin lastly reclaims the $30,000 spot

After a number of weeks of ready, BTC lastly managed to place smiles on buyers’ faces by registering a promising uptick. In accordance with CoinMarketCap, BTC’s worth went up by greater than 18% within the final seven days.

On the time of writing, it was buying and selling at $30,150.42 with a market capitalization of over $587 billion.

A tweet from Glassnode identified that the latest Bitcoin breakout above the $30,000 worth degree has impressed an uptick in revenue despatched to exchanges, recording a worthwhile influx of $62.8 million. Nonetheless, BTC’s positive aspects have halted, as evident from the marginal increment in its worth during the last 24 hours.

This could trigger bother

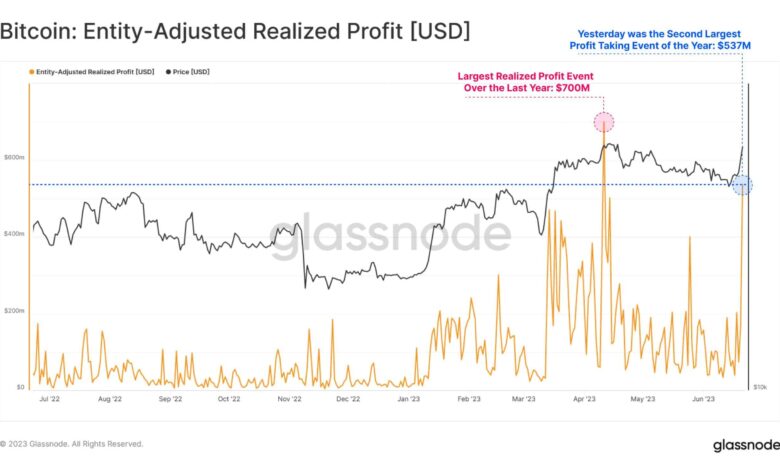

Glassnode, in one other tweet, identified a noteworthy improvement. As per the tweet, following the latest uptick in Bitcoin worth motion, market individuals locked in a non-trivial $537 million in revenue, the second largest revenue taking occasion during the last 12 months.

As is obvious from the chart, the final time such an occasion occurred, it was adopted by a decline in BTC’s worth.

A have a look at BTC’s each day chart didn’t present a motive to be bearish on the coin. As an illustration, the Exponential Shifting Common (EMA) Ribbon displayed a bullish crossover because the 20-day EMA flipped the 55-day EMA.

The MACD’s findings additionally complemented these of the EMA Ribbon, because it did reveal a transparent bullish benefit available in the market. Moreover, BTC’s Chaikin Cash Stream (CMF) registered an uptick after a decline, which additionally seemed bullish.

Supply: TradingView

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

This is the reason warning is suggested

Although the market indicators have been bullish, Bitcoin’s on-chain metrics instructed a special story. As per CryptoQuant, BTC’s Relative Power Index (RSI) was in an overbought place. This could improve promoting strain, leading to a worth correction within the coming days.

BTC’s internet deposits on exchanges have been excessive in comparison with the final seven days, suggesting that promoting strain has already elevated. On prime of that, BTC’s worry and greed index had a rating of 65 at press time, which was additionally a bearish sign.