Off The Grid confidential letter sparks speculation around tokenomics

This can be a phase from The Drop e-newsletter. To learn full editions, subscribe.

The shooter recreation Off The Grid has confronted some disapproval — and a few reward — over a purported confidential letter.

The letter in query was reportedly emailed to Gunzilla Video games’ personal traders in regard to its GUN token that turned tradeable on Binance this week. GUN launched on Monday and hit a $68 million market cap inside hours of launch, however that quantity has since fallen to $40 million.

The letter references a SAFT, or a Easy Settlement for Future Tokens, meaning traders gave the corporate cash upfront for tokens at a later, future date.

The copy-pasted textual content of the letter was posted on X yesterday by a crypto dealer and acquired over 115,000 views in lower than a day. The bigger publish additionally included the dealer’s scathing criticism of the choice. We don’t know extra concerning the specifics of the SAFT but, although.

The supposed textual content of that electronic mail additionally references a change to GUN’s vesting tokenomics — and provides traders an opportunity for a refund in the event that they don’t wish to conform to the brand new phrases.

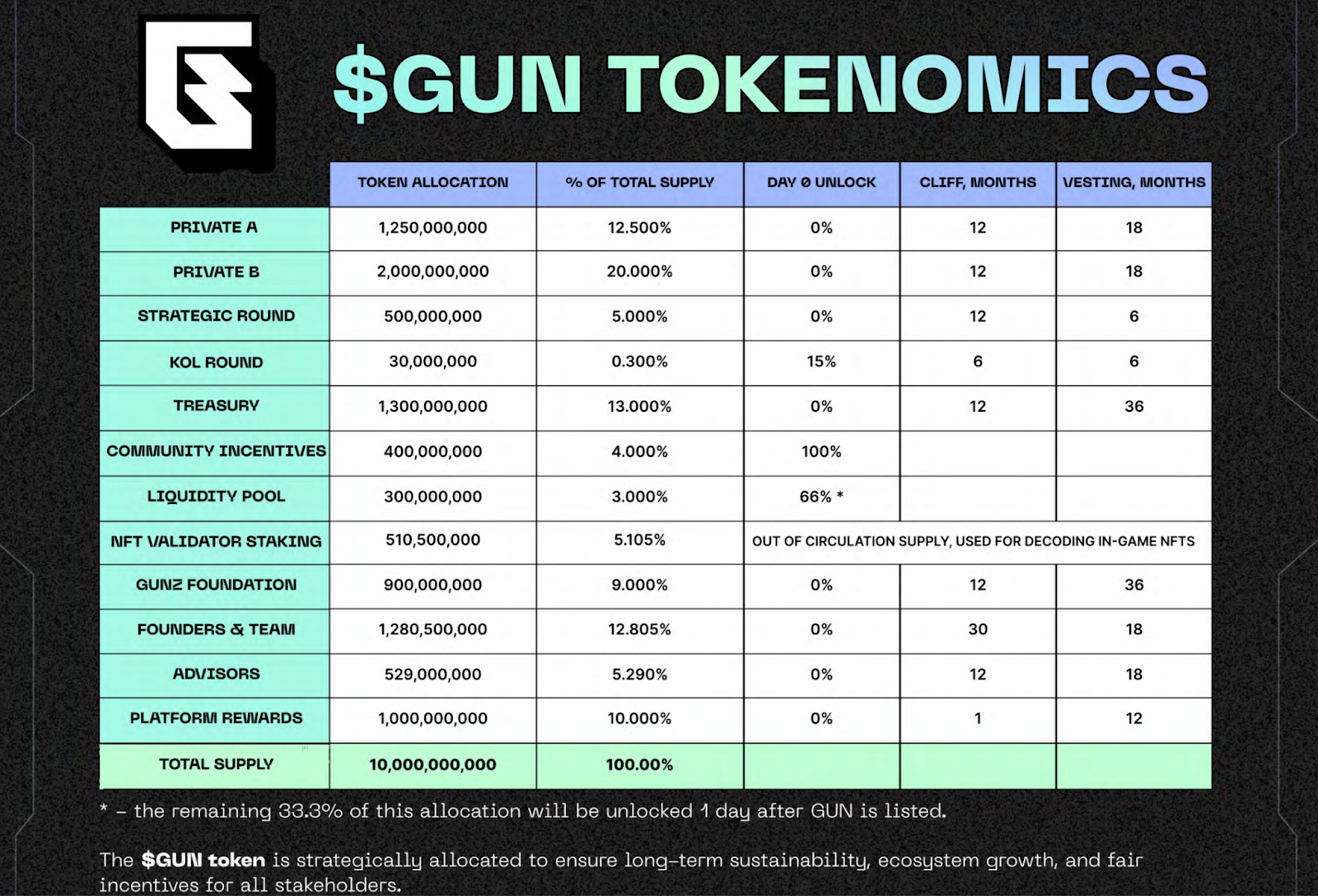

What precisely may these modifications be? The dealer who leaked the purported letter, Grail.eth, claims seed spherical traders have been imagined to get 5% of their GUN tokens unlocked on launch day, whereas strategic spherical traders have been imagined to see 2% of their tokens unlock on launch.

In line with the general public GUN whitepaper, the strategic spherical is seeing 0% of tokens unlocked on launch. The Non-public A and B rounds have been granted the identical. This implies these teams’ tokens received’t be unlocked for at the least a yr as a result of their tokens have a 12-month cliff, with 18 months of vesting.

Some merchants on Twitter speculate that the modifications could also be in an effort to fund the token’s itemizing on Binance, although this has not been confirmed by Gunzilla or Binance.

“We don’t cost itemizing charges to initiatives itemizing on Binance,” a Binance spokesperson tells Blockworks. “Regardless, deposits from undertaking groups are refundable and designed to assist shield customers by guaranteeing that initiatives are severe about constructing their initiatives, conserving them alive and persevering with to construct after itemizing on Binance. The deposit additionally serves to assist shield customers in conditions the place initiatives hurt them by failing to ship on their commitments.”

Others have criticized GUN’s tokenomics for allotting a major quantity to traders within the first place.

However not everybody’s seeing these tokenomics in a unfavorable mild.

I’m personally a fan of any undertaking that makes traders wait longer to unlock their tokens. The “dump on retail” value motion isn’t enjoyable for anybody, and it could actually kill pleasure round a brand new undertaking quick if it occurs shortly after a token launches.

“A uncommon occasion the place the undertaking chooses its customers over VCs,” wrote Ava Labs Advertising Lead Avery Bartlett in response to the publish with the letter, whereas additionally admitting he understood the criticism round it (Gunzilla is utilizing its personal Avalanche L1).

In a DM, Bartlett advised Blockworks: “The individuals I do know didn’t get [a letter]. I acquired nodes on secondary and didn’t get it,” suggesting validator traders didn’t see a change to their tokenomics.

Theodore Agranat, Gunzilla’s Director of Web3, advised Blockworks he was “unsure” when requested concerning the letter’s legitimacy.

“I do know that no matter letter was despatched out had [a] confidentiality clause hooked up to it. So unsure,” he stated, including that he would communicate along with his group.