Is Bitcoin headed for $76K? – Peter Brandt’s bearish warning

- Peter Brandt projected a probable short-term correction of BTC to $76K.

- However, Coinbase and different analysts anticipated an prolonged rebound amid renewed accumulation.

Bitcoin[BTC] rallied 6% final week and briefly reclaimed $85K; nonetheless, the cryptocurrency’s subsequent transfer has saved bulls and bears equally divided.

In keeping with famend dealer Peter Brandt, BTC’s rebound might be a set-up for an additional ‘corrective’ part.

“The advance off the April lows appears to be like extra corrective than it does impulsive.”

Supply: BTC/USDT, TradingView

His argument was primarily based on BTC’s bearish rising wedge on the 4-hour chart. The sample may drag BTC to the $76K degree if validated.

Even so, not all analysts have been bearish, although.

BTC in a ‘purchase zone’?

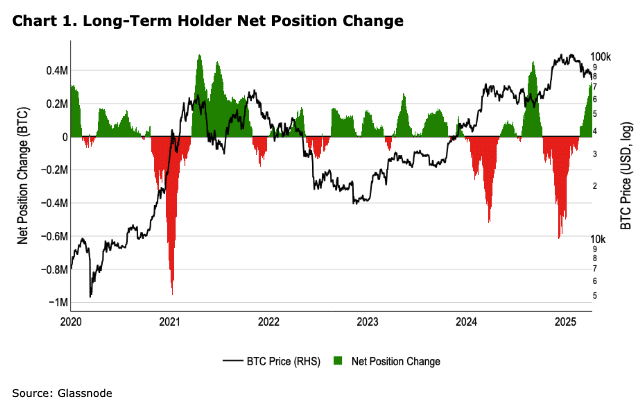

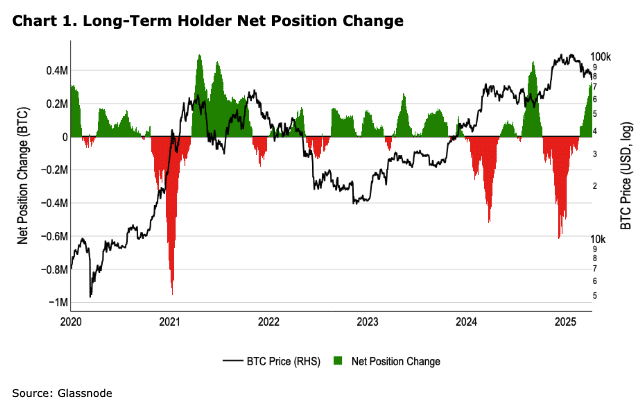

Coinbase analysts famous that BTC’s worth was ‘honest’ and a ‘shopping for alternative,’ citing renewed curiosity from long-term holders (LTH). Of their weekly market report, the analysts mentioned,

“Whereas accumulation by LTH is just not essentially indicative of an imminent value leap, we do suppose it suggests {that a} rising phase of “honest worth” patrons are seeing present BTC value ranges as a shopping for alternative.”

Supply: Glassnode

Right here, it’s price noting that the LTH cohort has been key sellers (purple) since late December when BTC surged above $100K. Whether or not the LTH sentiment shift will increase BTC’s restoration stays to be seen.

For his half, Stockmoney Lizards highlighted the similarity between the present value motion and final 12 months’s accumulation part. He mentioned a decisive transfer above $85K may mark the subsequent leg up.

“72K-74K is our private max ache accumulation goal. Once we break this trendline with conviction? That’s not simply one other pump – it’s doubtlessly the beginning of the subsequent leg up.”

Supply: X

An identical sentiment was echoed by one other analyst, Michael van de Poppe. Poppe noted that the bullish RSI divergence was a strengthening sign for BTC. He added that BTC may surge greater if it holds above $80K.

In the meantime, there have been three key ranges to observe within the brief time period – $86K, $84K, and $82.7K. Coinglass’ liquidation heatmap on the 48-hour chart marked the above ranges as key liquidity swimming pools that might act as value magnets.

Supply: Coinglass