Is Bitcoin ‘losing’ to Gold right now? Here’s what Peter Schiff thinks…

- Bitcoin’s worth dropped whereas gold spiked

- Peter Schiff’s advocacy diminished by BTC’s funding surge

Bitcoin [BTC] has as soon as once more dropped on the charts, with its worth falling from over $70,000 to simply over $67,000 at press time. In truth, BTC misplaced over 5% of its worth in simply 24 hours.

However, Gold – One of many market’s extra conventional property – surged to a brand new ATH on the again of world monetary markets’ uncertainty. The place does that depart Bitcoin?

What’s behind the surge in gold costs?

The aforementioned disparity in worth actions led to numerous Bitcoin skeptics coming ahead and sharing their viewpoints. Peter Schiff, amongst many others, highlighted in his latest podcast that some media tales attribute the rise in gold costs to geopolitical tensions, comparable to these in Ukraine or Israel.

Nonetheless, he believes that this clarification misses the true cause behind the appreciating in gold costs. He mentioned,

“Individuals are simply shopping for gold as a hedge, proper? I imply in a manner they’re proper it’s a hedge, but it surely’s not a hedge in opposition to geopolitical uncertainty it’s a hedge in opposition to inflation.”

Schiff additional famous that though the US Greenback seems robust, in comparison with different currencies, it’s truly weakening, with the identical evidenced by Gold’s rise in opposition to all currencies.

Taking to X (Previously Twitter), he noted,

“It’s a rejection of fiat currencies and a harbinger of the tip of the U.S. greenback’s position because the world’s reserve forex.”

This can be a signal that the usDollar’s reserve standing is unsure, and its obvious energy is just non permanent.

Bitcoin stands robust in opposition to gold

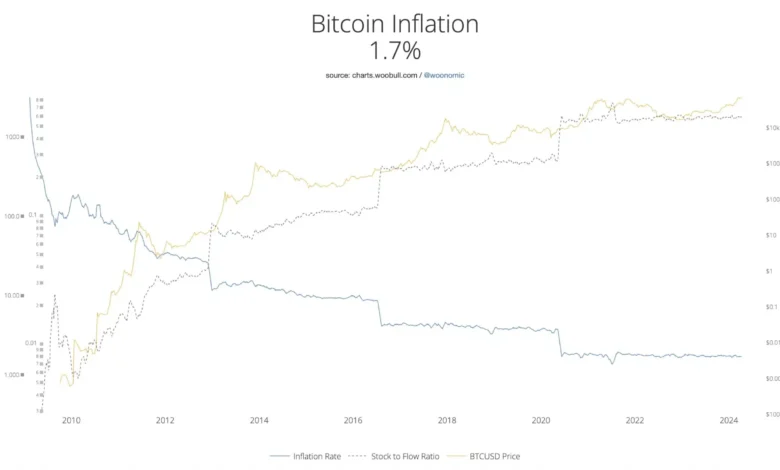

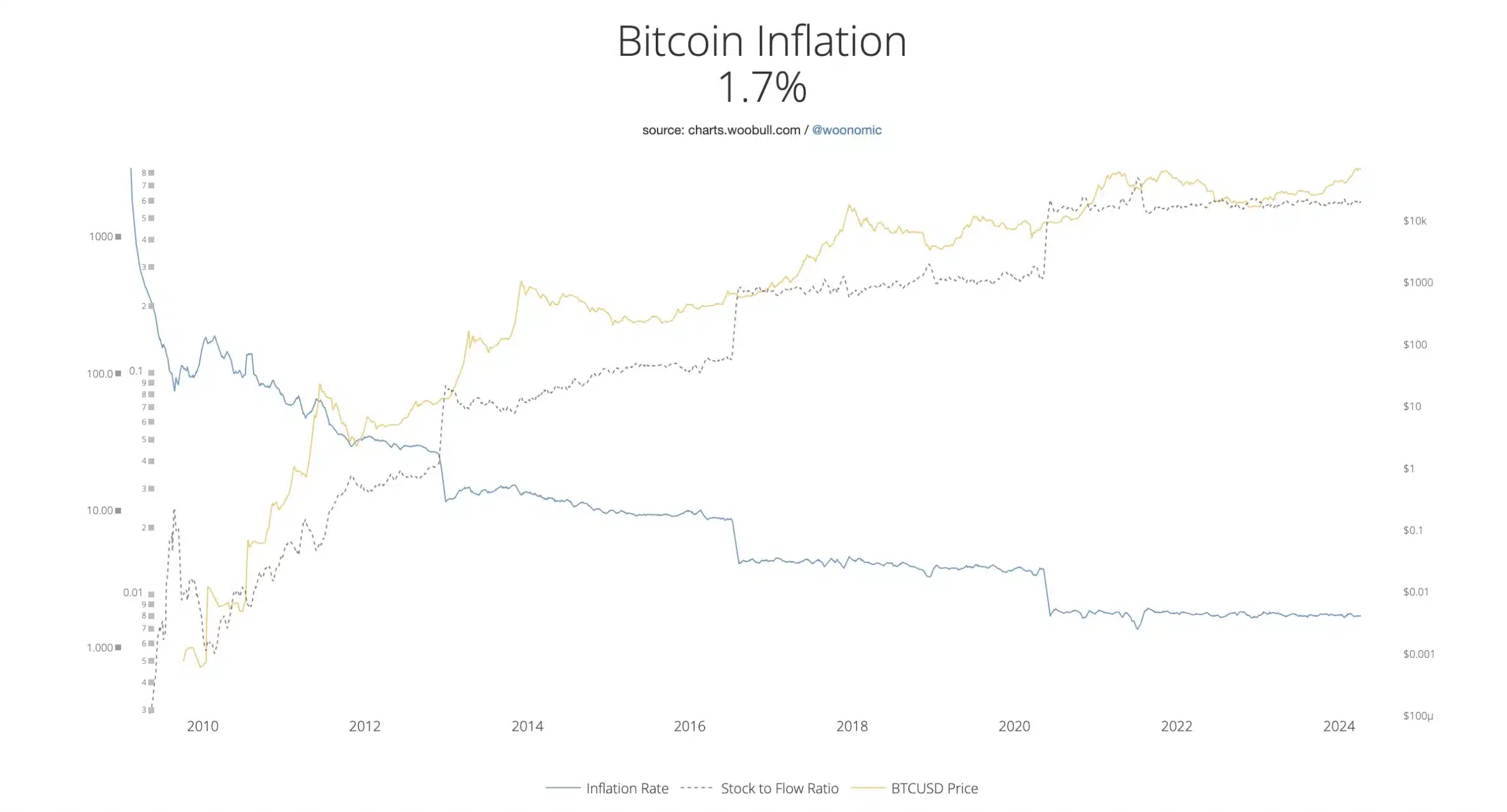

Regardless of Bitcoin’s latest worth volatility, nevertheless, Woodbull Charts highlighted a fall in its inflation over the previous 4 years, dropping from 3.72% in 2020 to 1.7% in 2024. This may be implied as an indication that short-term declines in BTC’s worth are unlikely to immediate widespread promoting of the cryptocurrency.

Supply: Woodbull Charts

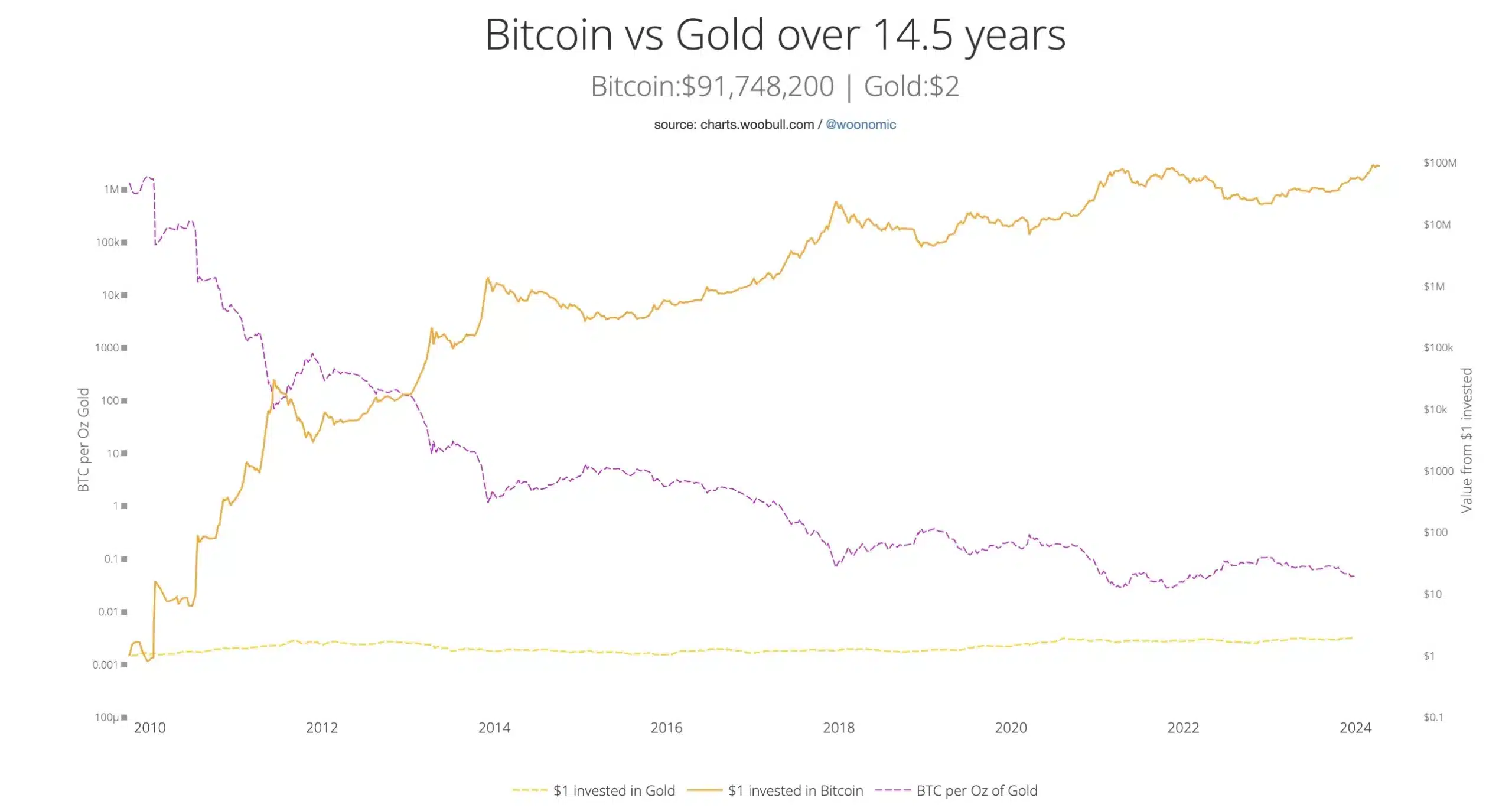

In step with these observations, Woodbull charts additionally not too long ago in contrast the efficiency of Bitcoin to gold over a interval of 14.5 years. As of April 2024, Bitcoin’s funding worth stood at $19.83, whereas gold was struggling at $1.97.

Right here, it’s price noting that Woodbull Charts had a degree to make to Peter Schiff and his followers too,

Bitcoin continues to win hearts

Ergo, regardless of its erratic fluctuations in worth, Bitcoin has established itself as a fascinating funding alternative for a lot of. In truth, many establishments like MicroStrategy has additionally began together with BTC of their portfolios owing to its performances over the previous few years.

Evidently, sentiment round BTC stays as constructive as ever, with one commentator claiming,

“Repeat after me. They gained’t shake me out. 100k, BTC to the moon!”