Is Chainlink [LINK] ready for a bullish breakout? Insights revealed

- LINK faces important resistance at $14.50-$15.30, with 153 million tokens gathered by traders.

- Change reserve decline and elevated lively addresses recommend potential for a worth surge.

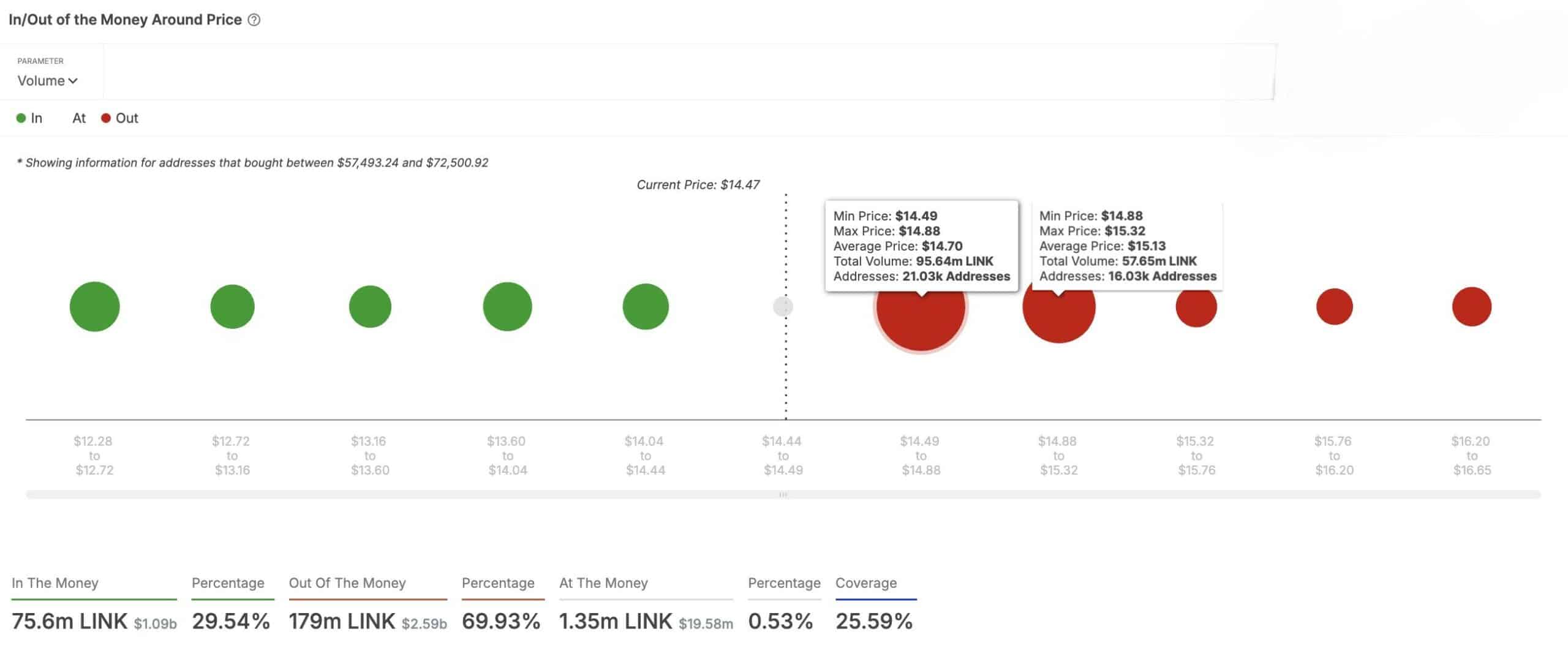

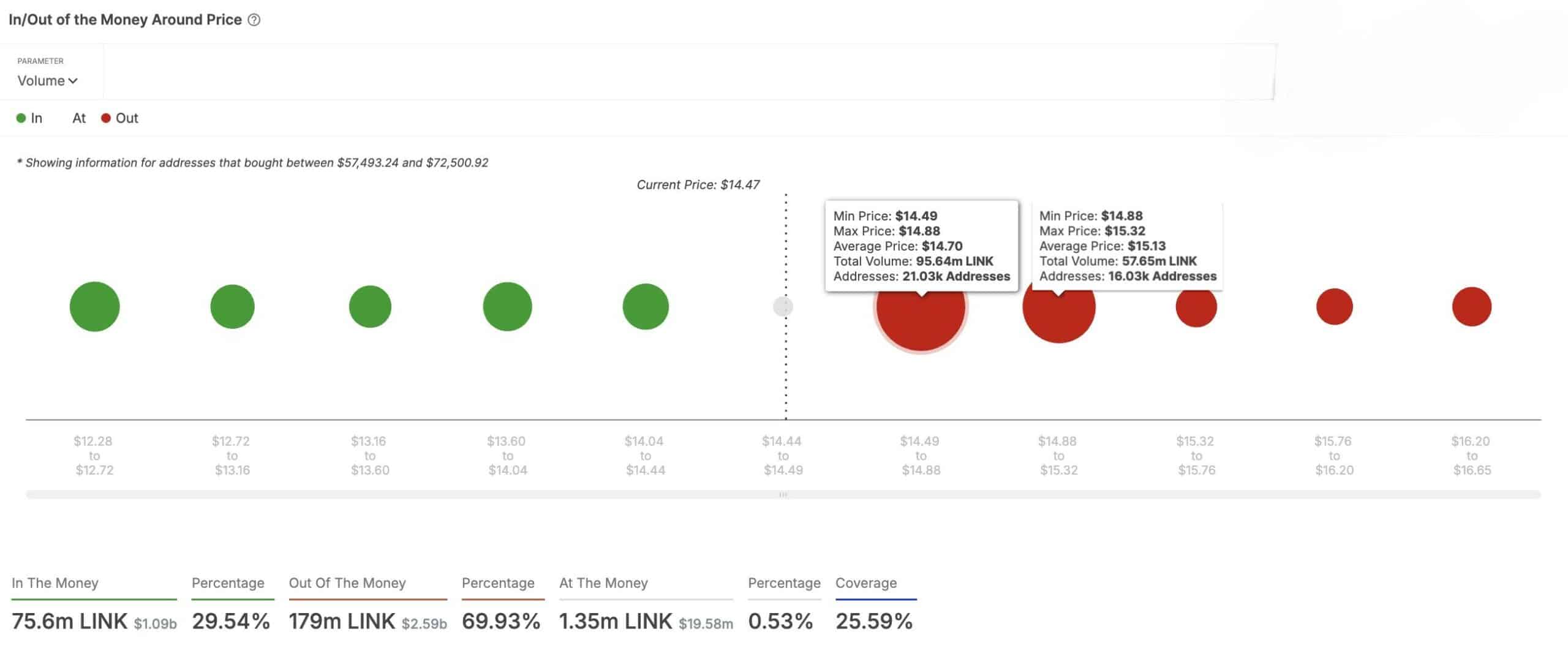

Chainlink [LINK] confronted a big resistance zone between $14.50 and $15.30, the place 37,000 traders gathered a complete of 153 million LINK tokens.

This accumulation indicators rising investor confidence, suggesting that LINK is making ready for a possible breakout.

Nevertheless, the query stays: will LINK efficiently break via this resistance and provoke a brand new bullish pattern?

Supply: IntoTheBlock

What does LINK’s worth motion reveal?

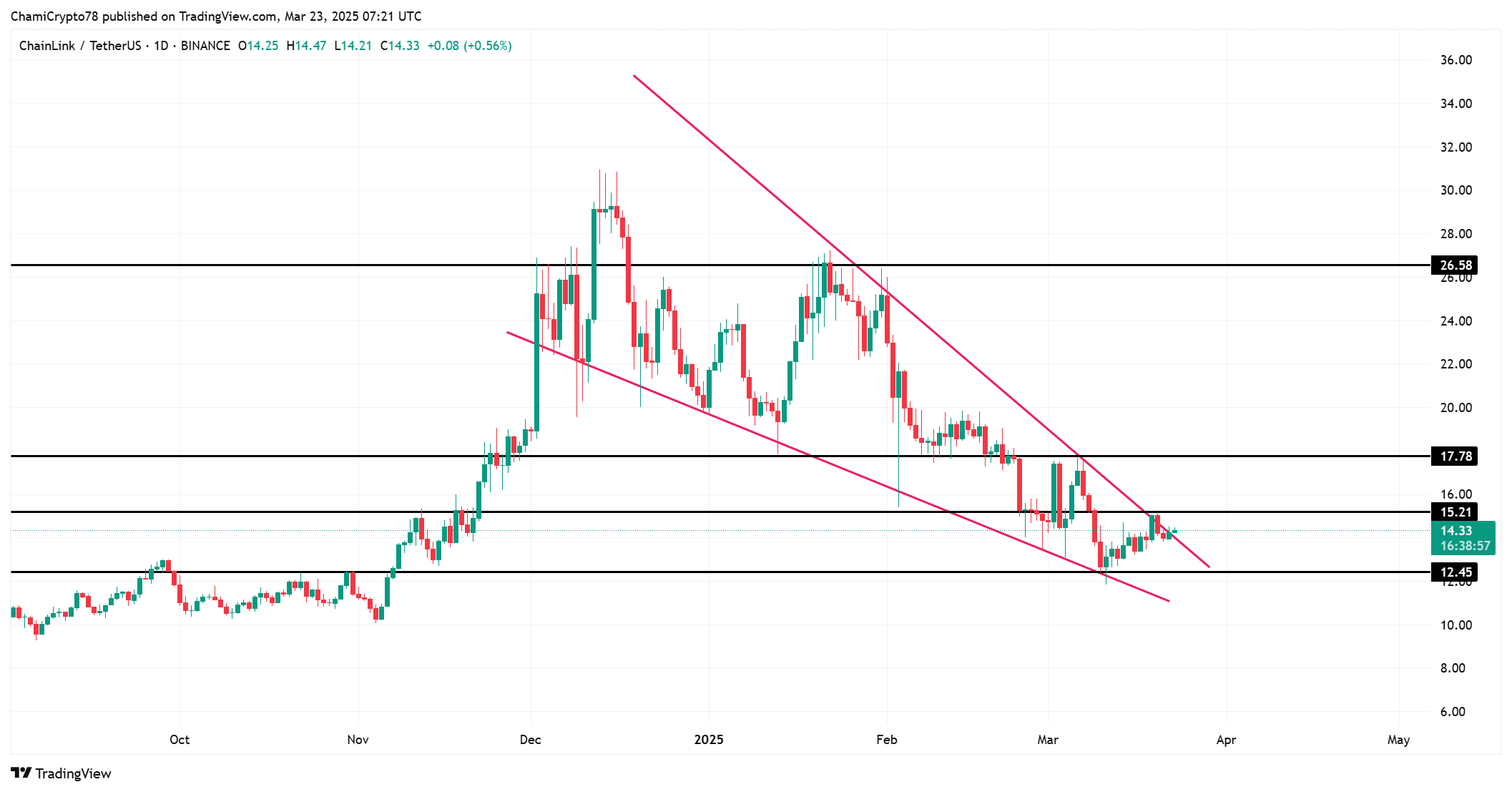

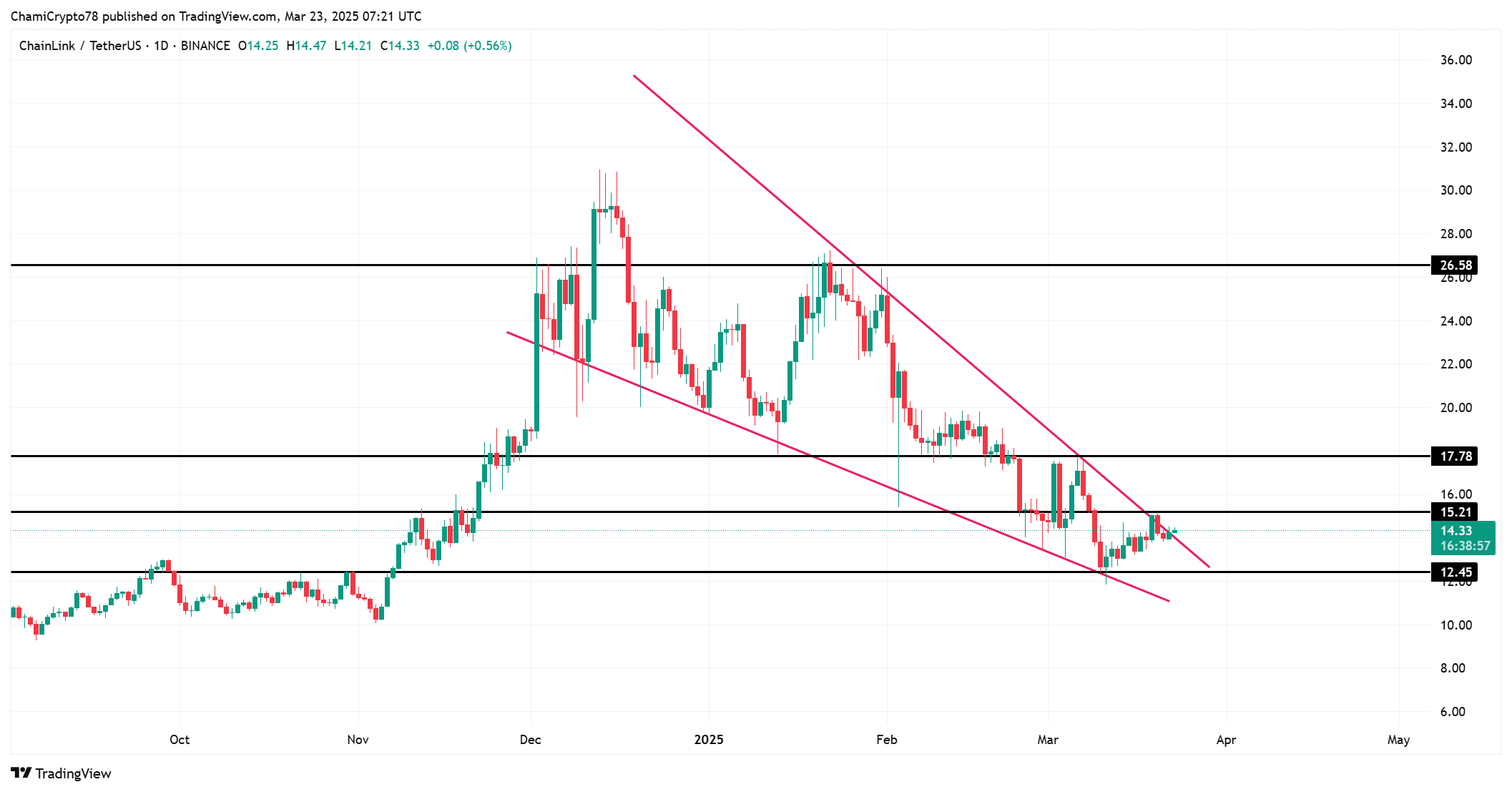

Chainlink’s worth motion indicated a interval of consolidation, with fluctuations primarily contained inside the $12.45 to $17.78 vary. At press time, LINK was buying and selling at $14.32, displaying a 1.54% enhance over the previous 24 hours.

LINK was testing the assist stage at $14.33, which remained a important level for the asset’s motion. If it manages to interrupt via the resistance at $15.30, the following main goal may very well be $17.78.

Subsequently, merchants shall be intently monitoring these worth ranges to gauge the potential for a breakout.

A decisive transfer above $15.30 would considerably enhance LINK’s outlook, suggesting the potential for extra upward momentum.

Supply: TradingView

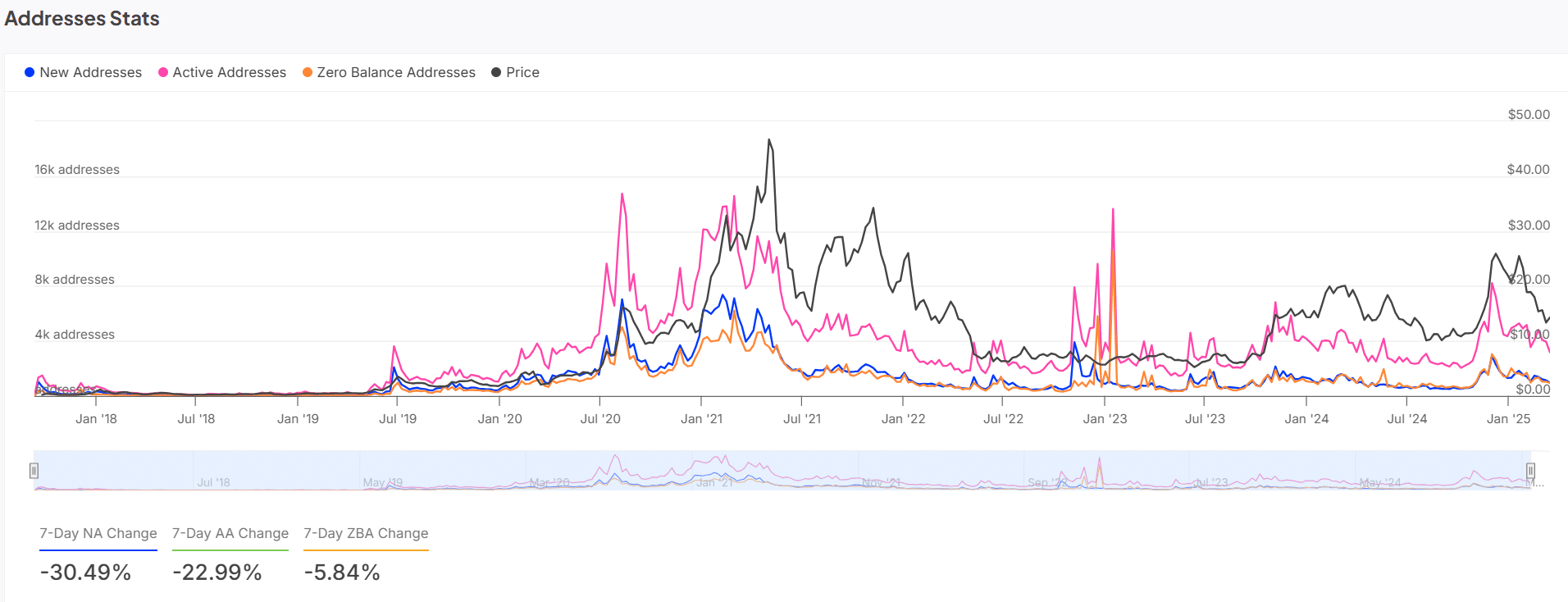

What do Chainlink’s tackle stats present?

Wanting on the tackle statistics, the image for LINK is blended. Over the previous seven days, new addresses have decreased by 30.49%, displaying a slowdown in recent curiosity from new market contributors.

Alternatively, lively addresses have additionally decreased by 22.99%, suggesting that there’s much less engagement from present holders, indicating a cooling of market exercise.

Moreover, zero steadiness addresses have decreased by 5.84%, which suggests fewer traders are utterly exiting their positions.

Whereas the discount in new addresses and lively addresses could appear regarding, it signifies a shift in market sentiment the place traders could also be in a holding sample, ready for a clearer worth route.

Supply: IntoTheBlock

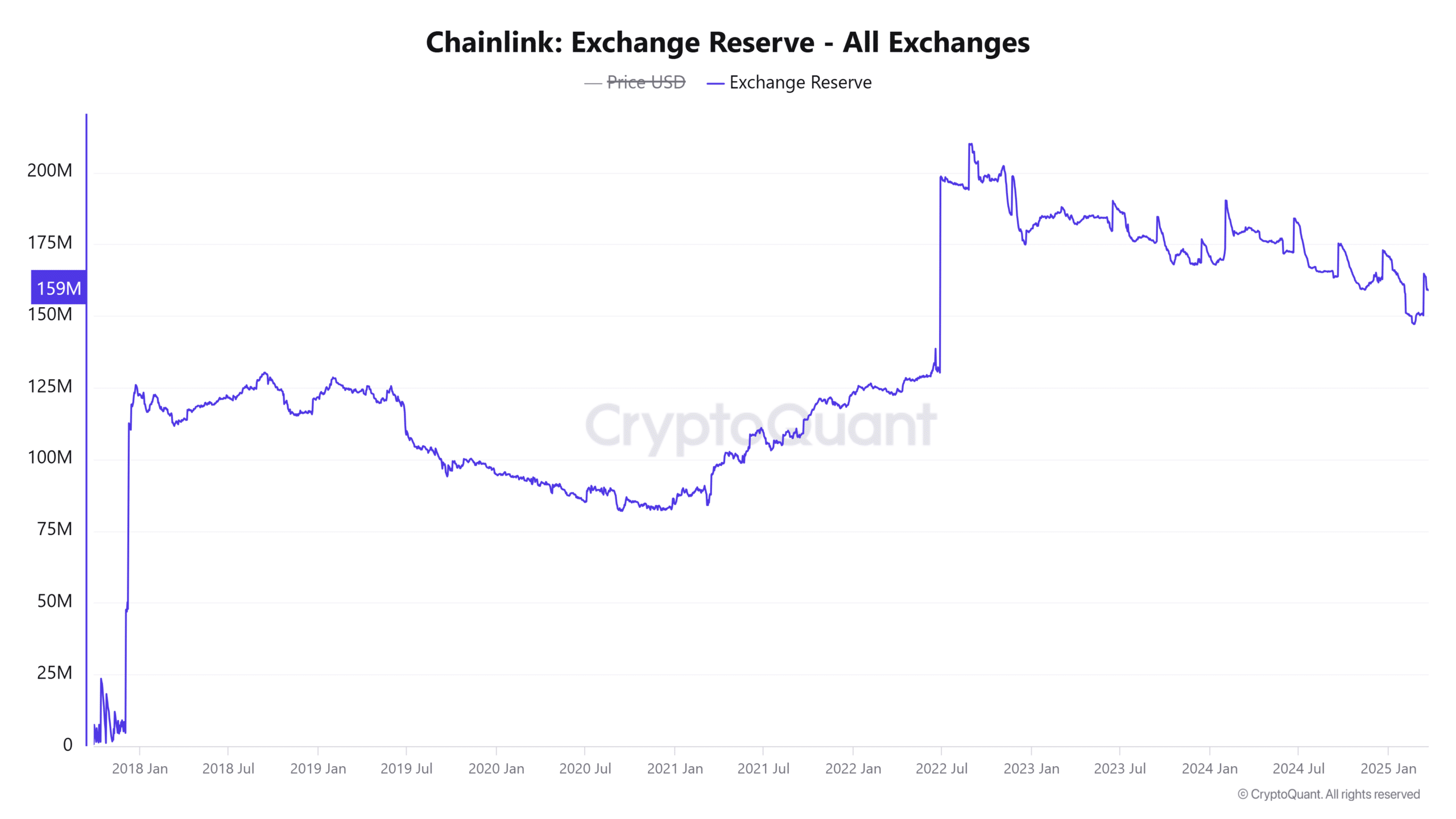

How does LINK’s change reserve have an effect on its market outlook?

At press time, Chainlink’s change reserve was 159.036 million LINK, with a slight decline of 0.18% over the previous 24 hours.

This lower signifies that traders are pulling their tokens off exchanges, possible in anticipation of holding long-term.

With fewer tokens accessible on the market on exchanges, promoting stress may lower, which might possible profit the worth.

Moreover, as traders decide to carry their Chainlink positions, the probabilities of a worth surge enhance, particularly if shopping for stress stays robust.

Supply: CryptoQuant

Can Chainlink break via its resistance?

Chainlink is at a important juncture, testing vital resistance ranges.

Whereas the buildup of 153 million tokens by 37,000 traders suggests confidence in LINK’s future, the discount in lively addresses and new tackle exercise means that the market sentiment is much less exuberant than it may very well be.

If LINK can break via the $15.30 resistance, it could open the door to additional upward motion. Nevertheless, a failure to carry assist at $14.33 may sign extra draw back potential.

Subsequently, whereas the potential for a breakout exists, it will depend on whether or not LINK can maintain shopping for stress and break via its resistance ranges.