Is Ethereum turning bullish? This indicator is the key

- Ethereum’s Taker Purchase Promote Ratio makes an attempt to breach the middle line in an uptrend.

- Nonetheless, bearish sentiments proceed to develop.

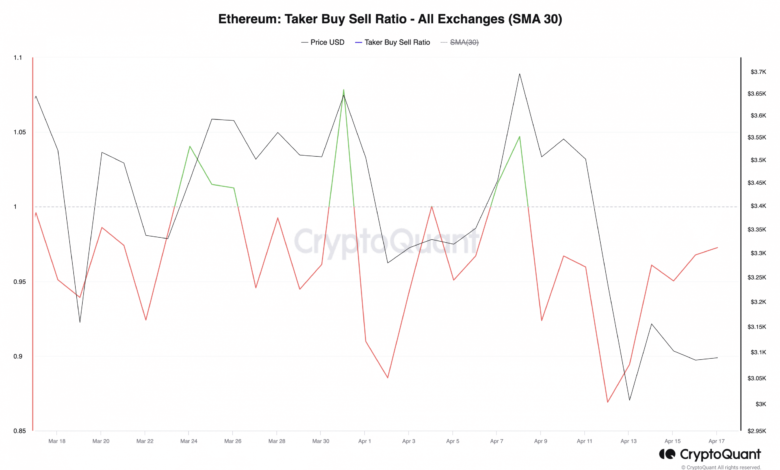

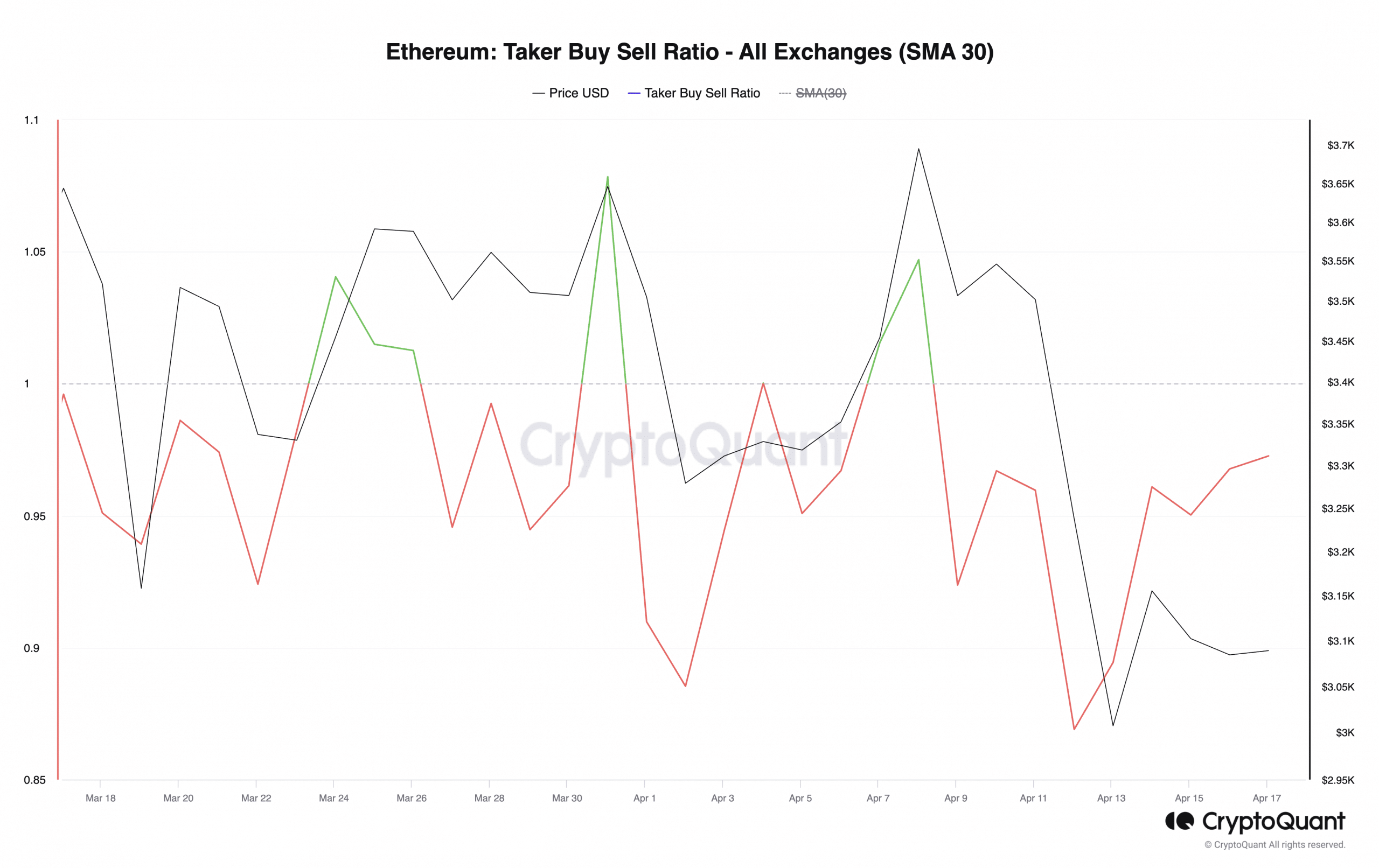

Ethereum’s [ETH] Taker Purchase Promote Ratio is poised to cross above its middle line, signaling an increase in bullish sentiment amid latest market troubles, knowledge from CryptoQuant has proven.

The Taker Purchase Promote Ratio is a metric that measures the ratio between the purchase quantity and promote quantity in an asset’s futures market.

A worth larger than 1 signifies extra purchase quantity than promote quantity, whereas a price lower than 1 signifies extra promote quantity than purchase quantity.

At press time, ETH’s Taker Purchase Promote Ratio was 0.96, per CryptoQuant’s knowledge.

Supply: CryptoQuant

The bears stay in management

Regardless of the spike in ETH’s Taker Purchase Promote Ratio, an evaluation of the coin’s spot and futures markets revealed that bearish sentiments stay vital.

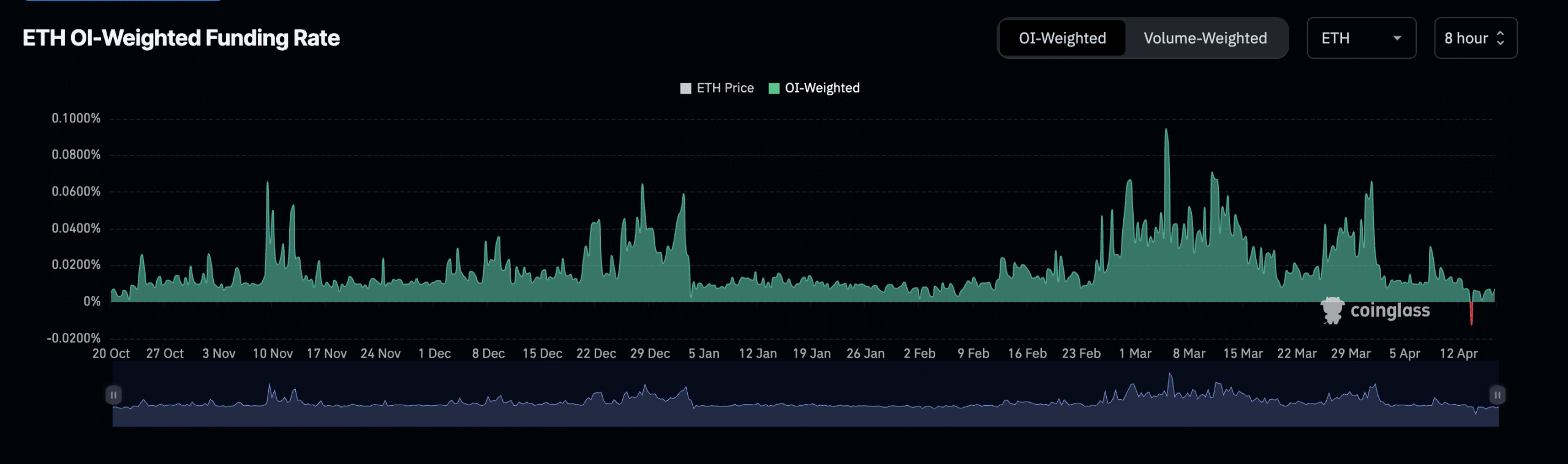

For instance, ETH’s Futures Open Curiosity has fallen to its lowest for the reason that twenty eighth of February, in accordance with Coinglass knowledge. It peaked at $15 billion on the ninth of April and has since declined.

At $11 billion as of this writing, ETH’s Open Curiosity has plummeted 27% within the final seven days.

An asset’s Open Curiosity measures the worth of its Futures contracts which can be but to be closed.

When it declines this manner, it means that market members are closing their positions and exiting the market with out opening new ones.

Over the past week, ETH’s funding charges briefly turned unfavorable on 14th April, when a major variety of market members opened trades in opposition to the coin’s value.

This marked the primary time ETH would report a unfavorable Funding Fee for the reason that bull market rally started in October 2023.

Supply: Coinglass

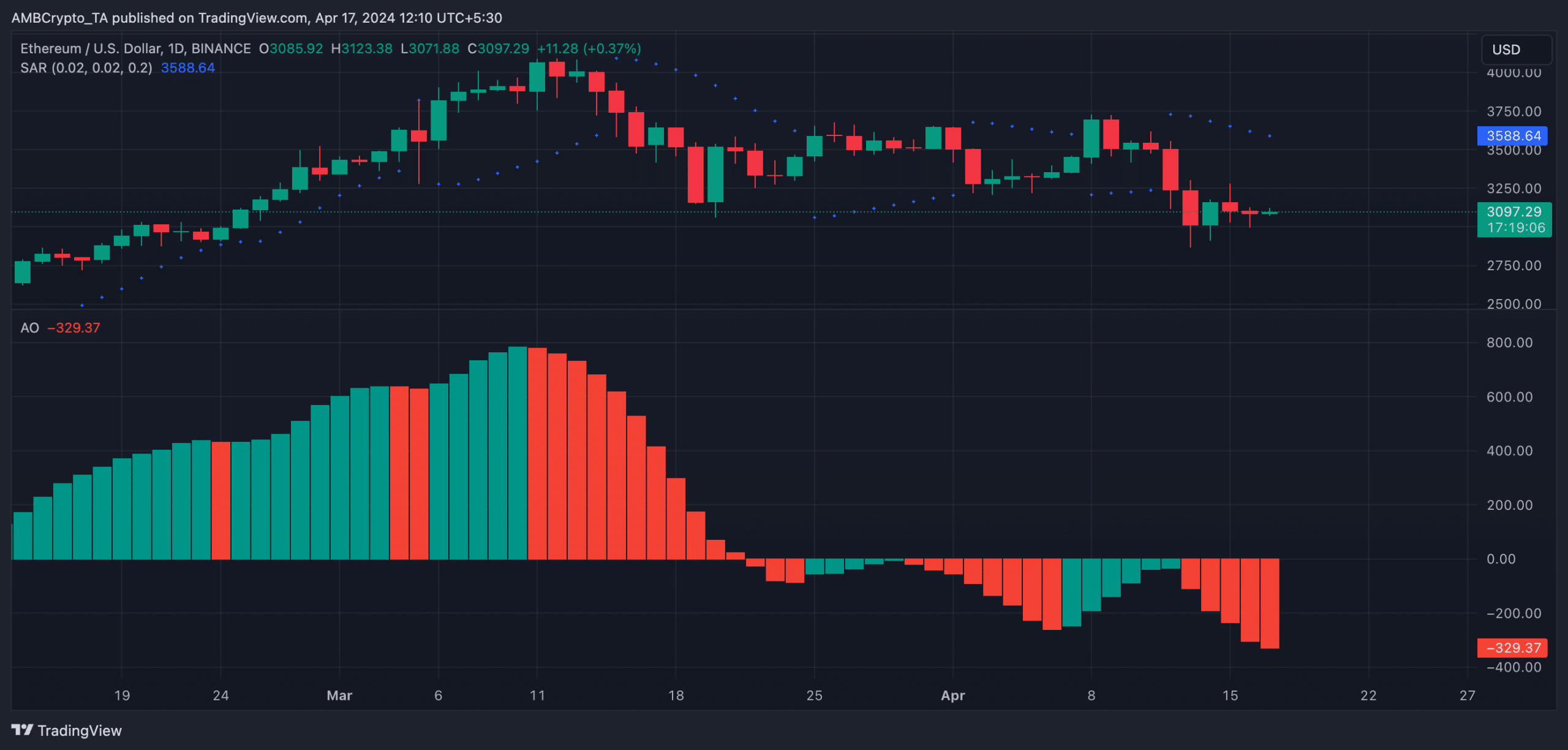

In its spot market, key technical indicators noticed on a every day chart hinted at the potential of a decline under $3000 if bearish sentiments linger.

ETH’s Superior Oscillator, which measures market momentum, posted downward-facing purple histogram bars at press time. This development has been current since thirteenth April.

Downward-facing Pink bars on an asset’s Superior Oscillator are sometimes interpreted as a bearish signal, suggesting a hike in promoting strain.

Likewise, readings from ETH’s Parabolic Cease and Reverse (SAR) confirmed the dots that make up the indicator resting above the coin’s value.

Learn Ethereum’s [ETH] Value Prediction 2024-25

The Parabolic SAR indicator is used to establish potential development course and reversals.

Supply: ETH/USDon TradingView

The market development is taken into account bearish when its dotted traces are positioned above an asset’s value.