Is Ethereum’s $560B surge in derivatives a sign of the next ETH rally?

Key Takeaways

What does the $560B derivatives surge reveal about Ethereum’s market power?

It exhibits heightened speculative momentum and powerful institutional curiosity as ETH holds close to $4,000.

How are merchants positioning themselves amid rising derivatives exercise and cooling Open Curiosity?

Most merchants stay bullish, with lengthy positions dominating regardless of a 4.28% dip in Open Curiosity.

Ethereum’s [ETH] derivatives buying and selling quantity on Binance surged to almost $560 billion in October, one of many highest ranges in historical past.

This spike coincided with ETH consolidating close to $4,000, signaling intense speculative exercise from each institutional and retail merchants.

The rise displays heightened risk-taking, with extra contributors leveraging futures and choices to capitalize on short-term volatility and potential upside continuation.

Such large derivatives enlargement typically marks a part of robust momentum and liquidity rotation throughout the broader Ethereum market ecosystem.

Ethereum defends $3,950 assist!

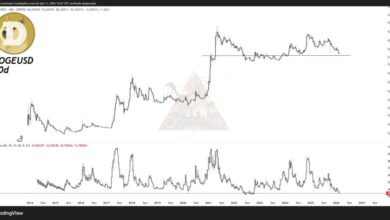

Ethereum continues to carry above its ascending assist close to $3,950, exhibiting resilience regardless of latest profit-taking.

The 4-hour chart reveals a gentle uptrend since mid-October, the place patrons persistently defended greater lows, holding the construction intact.

Key resistance ranges stay at $4,259 and $4,756, and a break above the higher barrier may set off a robust rally towards $4,800.

Nonetheless, failure to keep up the ascending trendline may expose ETH to delicate corrections.

Nonetheless, the sample construction exhibits bullish management as merchants keep confidence in Ethereum’s mid-term momentum.

Supply: TradingView

Are merchants’ lengthy positions an indication of Ethereum’s subsequent rally?

Knowledge from Binance exhibits that 70.63% of ETH merchants are in lengthy positions, with solely 29.37% holding shorts, at press time.

This clear dominance of bullish accounts displays robust conviction amongst leveraged merchants.

Such an imbalance typically happens when sentiment shifts decisively towards upside expectations, supported by enhancing on-chain and technical constructions.

Nonetheless, heavy lengthy positioning may also result in volatility spikes if liquidations speed up throughout minor pullbacks.

Nonetheless, the excessive lengthy/quick ratio underscores the market’s optimism as Ethereum consolidates across the $4,000 zone.

Cautious pullback in Open Curiosity hints at…

Ethereum’s Open Curiosity (OI) dipped 4.28%, as of writing, indicating that some merchants are moderating leverage after the speedy derivatives buildup.

This short-term adjustment typically indicators profit-taking or strategic reallocation somewhat than weak spot.

As volatility rises, disciplined contributors usually scale back publicity to handle danger, paving the best way for renewed accumulation as soon as stability returns.

Furthermore, sustained liquidity round present worth ranges means that capital stays engaged, aligning with the broader bullish framework noticed throughout derivatives and spot markets.

Conclusively, Ethereum’s market exercise exhibits power but in addition indicators of warning.

The report $560 billion derivatives quantity displays heightened speculative demand, but the 4.28% dip in OI signifies merchants are trimming leverage somewhat than increasing it.

Regardless of the dominance of lengthy positions and agency assist close to $3,950, this imbalance may set off volatility if liquidation strain will increase.

Subsequently, Ethereum’s bullish outlook stays legitimate provided that contemporary capital inflows maintain the rally past $4,756, supported by regular OI restoration.