Is Ethereum’s massive $1.26B inflow hinting at a major shakeup?

- Ethereum’s massive transaction surge by 13%, hinting at a looming value motion.

- Over 547,600 ETH value $1.26 billion hit exchanges, stirring market pleasure.

Up to now three weeks, a complete of 547,600 Ethereum [ETH], valued at greater than $1.26 billion has been transferred onto cryptocurrency exchanges, in accordance with a renown analyst tweet.

This important switch signifies heightened Ethereum market liquidity and buying and selling exercise.

Traditionally, when such enormous numbers of any cryptocurrency start to make their approach into the exchanges, holders need to both promote or regulate positions, which may end in potential market volatility.

Ethereum transactions soar by 13%

In accordance with IntoTheBlock information, Ethereum has witnessed a 13% enhance in massive transactions during the last 24 hours. The variety of transactions involving substantial Ethereum volumes jumped from 3,070 to three,370.

With such a rise in massive transactions, it merely implies that institutional traders or large holders have gotten within the token, therefore the growing exchanges.

Supply: IntoTheBlock

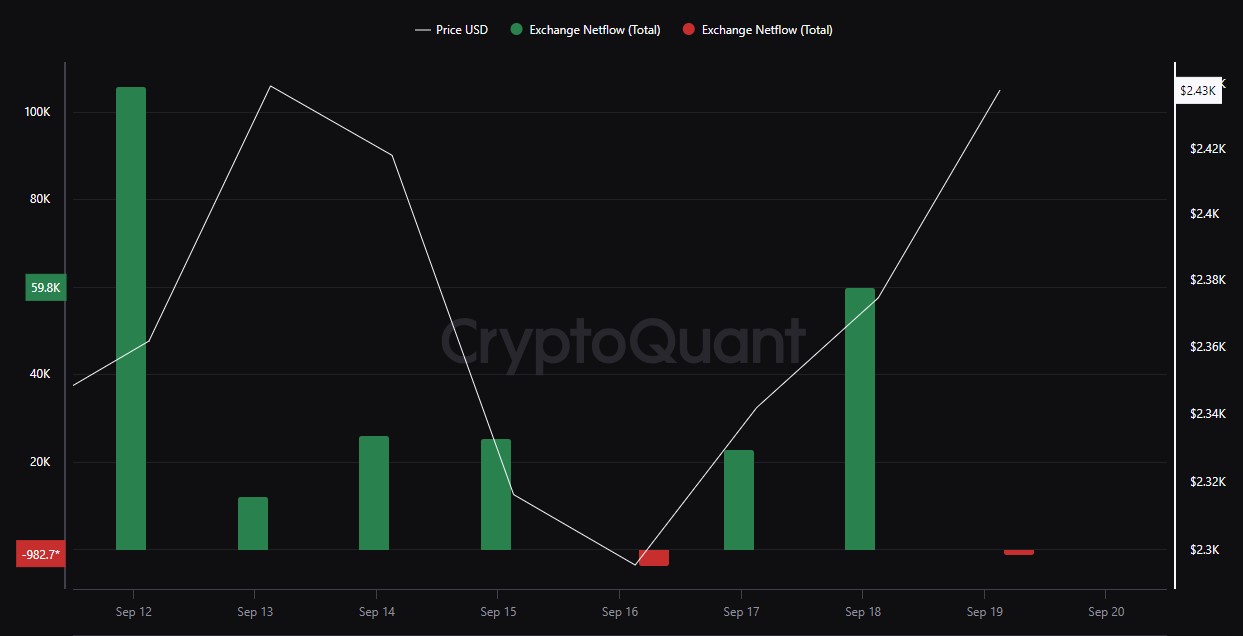

Ethereum netflows skyrocket

CryptoQuant information additional illustrated that Ethereum’s netflow to exchanges has seen a hanging enhance within the final 24 hours.

Typically, excessive internet stream is an indicator of elevated Ethereum volatility available in the market, as extra gamers are more likely to money out or speculate on adjustments in costs.

This provides to the present sentiment that the market might be gearing up for important shifts.

Supply: CryptoQuant

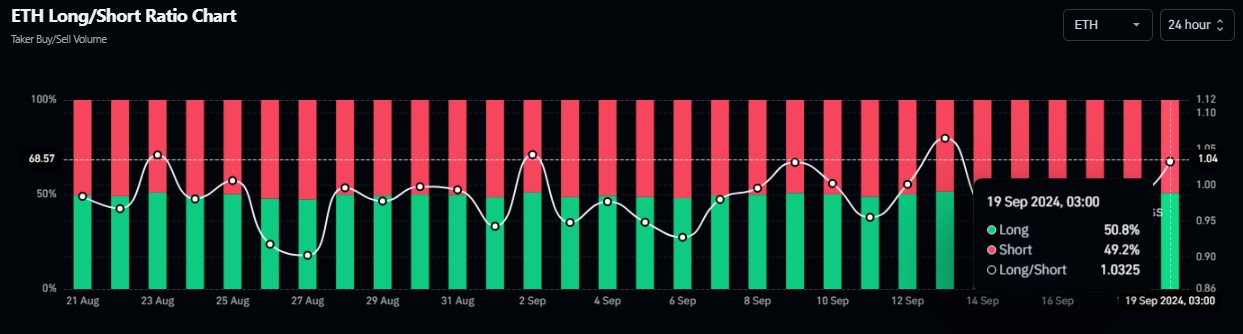

Bulls are in management

In accordance with Coinglass, 50.8% traders had been holding lengthy positions at press time. This slight majority indicated that market individuals have been optimistic in betting on the rise in Ethereum’s value anytime quickly.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

Nonetheless, judging from the quantity of Ethereum transferring to exchanges, this large change stream might problem the bullish sentiment if extra sellers begin flooding the market.

Supply: Coinglass

Primarily based on the current Fed curiosity cuts for the primary time in 4 years and favorable market sentiments, Ethereum costs might rally within the close to future.