Is Ethereum’s price dip signaling the start of a new rally?

- Extra whale addresses have collected ETH in the previous couple of weeks.

- ETH’s bull development has continued to weaken with the worth drop.

Ethereum [ETH], which has been shifting nearer to a bear development over the previous few days, has offered a shopping for alternative for big buyers.

In keeping with current information, large wallets have acquired extra Ethereum as the worth declined, which is a bullish sign.

Whale addresses scoop up Ethereum

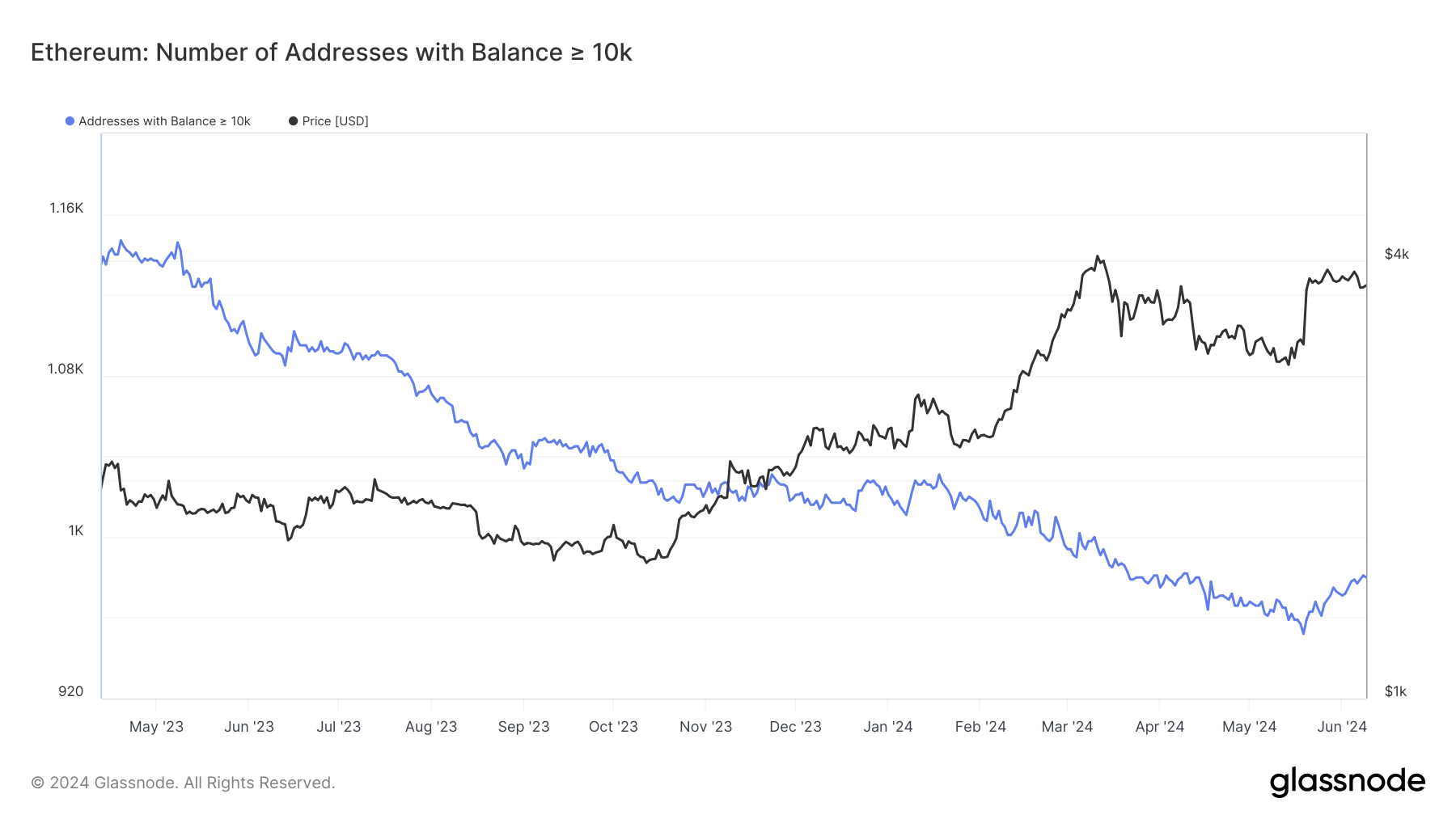

AMBCrypto’s evaluation of some main Ethereum addresses revealed a slight enhance ranging from the top of the earlier month. Particularly, wallets holding over 10,000 ETH confirmed development starting across the nineteenth of Could.

At this level, the variety of such wallets was roughly 952, and Ethereum was buying and selling at round $3,074.

The variety of wallets holding over 10,000 ETH grew from round 952 to roughly 980 as of this writing.

Regardless of the ETH value enhance to round $3,700, these addresses have continued accumulating extra Ethereum.

Supply: Glassnode

Moreover, AMBCrypto’s take a look at the mega whale chart over the past 30 days revealed a noticeable improvement: the development has flipped to the upside.

This indicated a rise in accumulation by a lot of the main wallets, reflecting heightened shopping for strain.

With this transfer, it’s only a matter of time earlier than the worth picks up—a development that these addresses are betting on.

Extra Ethereum flows out of exchanges

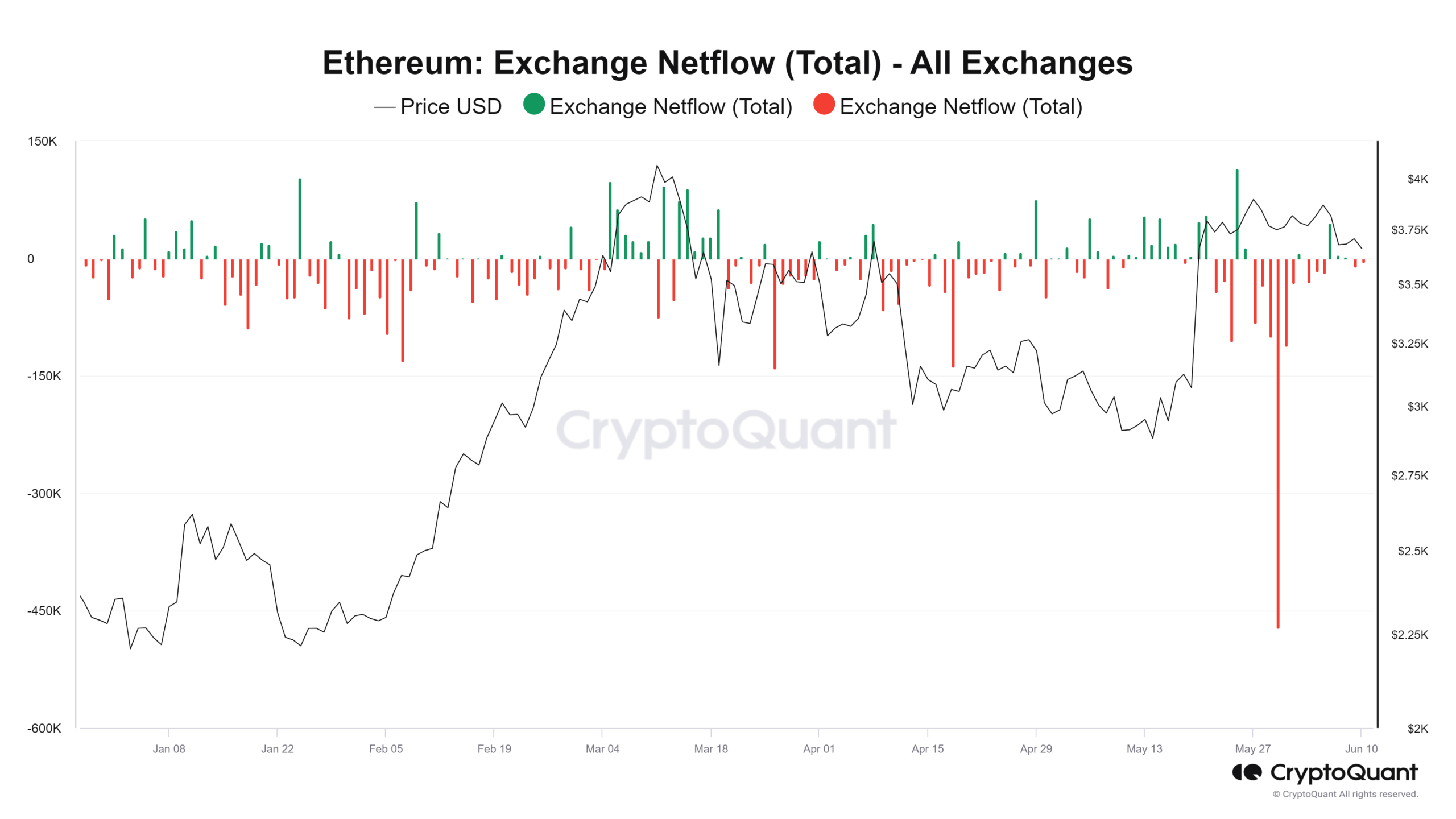

Ethereum’s Netflow on CryptoQuant confirmed that it had been dominated by detrimental flows in the previous couple of weeks. The chart indicated that the quantity of outflows has constantly surpassed inflows within the new month.

Supply: CryptoQuant

A take a look at the chart confirmed that for the reason that starting of the brand new month, extra ETH has left exchanges than has flowed into them.

The evaluation indicated that from the first of June to now, the detrimental circulate quantity was over $354 million, whereas the optimistic netflow quantity was round $226 million.

This netflow development, mixed with the buildup by main wallets, is a optimistic signal for ETH regardless of its current value development.

ETH strikes nearer to the impartial line

AMBCrypto’s evaluation of Ethereum on a every day timeframe confirmed that it has been trending within the $3,600 value vary for the previous three days.

As of this writing, it’s buying and selling at round $3,670, experiencing a decline of roughly 0.8%. ETH noticed a slight achieve within the earlier buying and selling session, however the current decline has wiped this out.

Supply: TradingView

Lifelike or not, right here’s ETH’s market cap in BTC’s phrases

Ethereum’s Relative Power Index (RSI) confirmed that it was above 52 as of this writing. Nonetheless, the RSI is on a downward development, indicating {that a} additional value decline might push it under the impartial line.

Because of this whereas the development is at present bullish, it’s weakening.