Is Ethereum’s sell pressure easing? What the data suggests

- Ethereum’s trade knowledge confirmed that ETH’s promoting strain was easing.

- Nevertheless, ETH didn’t get well amid a decline in demand.

Ethereum [ETH] has underperformed towards Bitcoin [BTC] this yr. The primary motive behind this dismal efficiency is declining demand amid a rise in promoting exercise.

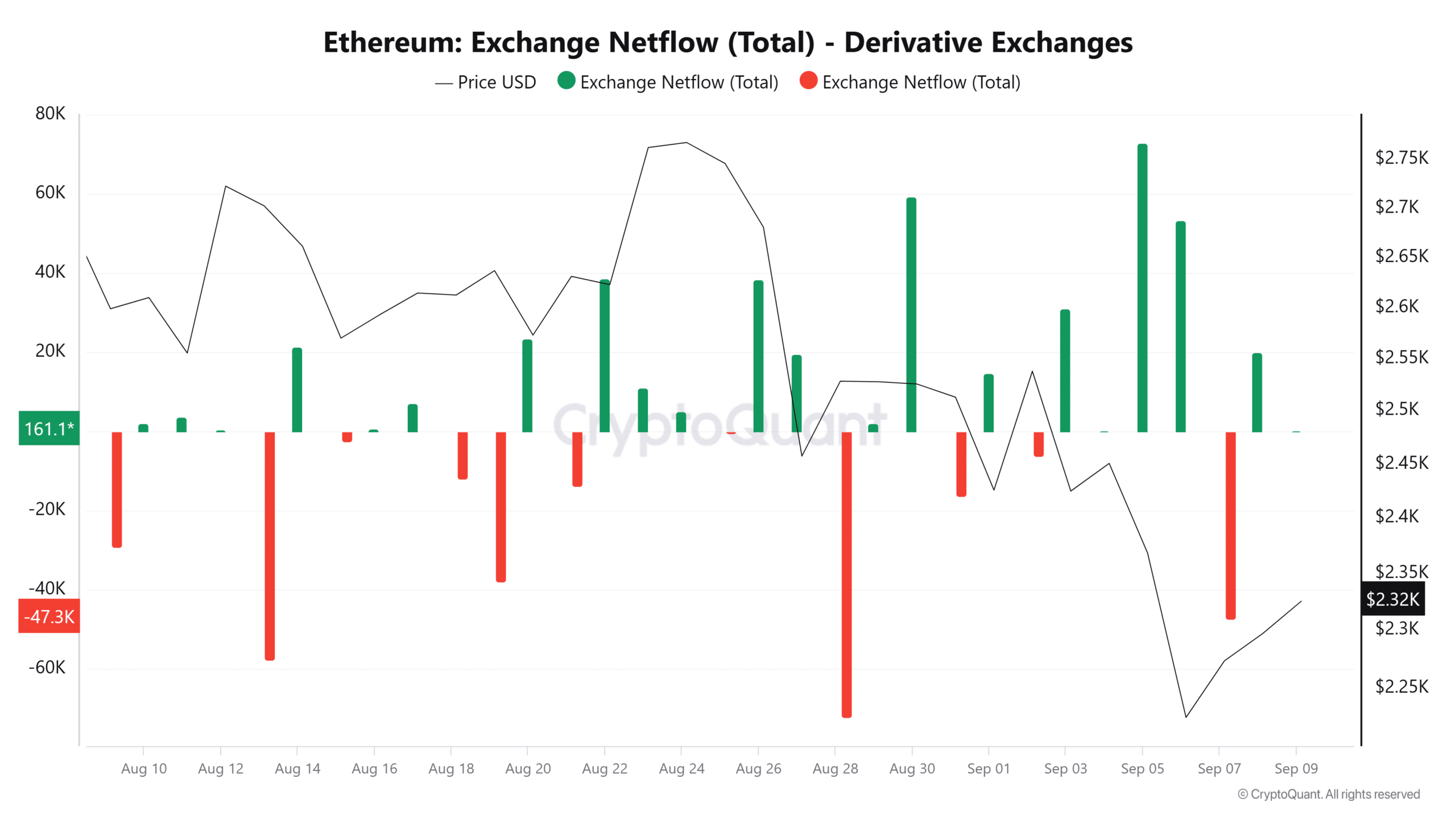

Nevertheless, promoting strain could be on the verge of exhaustion. In line with a Quicktake post by CryptoQuant, ETH netflow on spinoff exchanges surpassed 40,000 ETH on the seventh of September.

Supply: CryptoQuant

A rise within the ETH being withdrawn from spinoff exchanges urged that promoting strain was dropping, and that merchants have been much less thinking about borrowing to open quick promoting positions.

Spot market promoting spree continues

Whereas knowledge from the derivatives market confirmed that Ethereum merchants have been turning into much less pessimistic, the identical has not been seen within the spot market.

The Ethereum Basis has continued to promote ETH and not too long ago traded 450 ETH for $1M value of DAI per SpotOnChain. Within the final 4 days alone, the group has offered $1.28M ETH tokens.

Metalpha, a Hong Kong-based crypto wealth supervisor, has additionally deposited greater than $54M value of ETH to Binance within the final three days, based on Lookonchain.

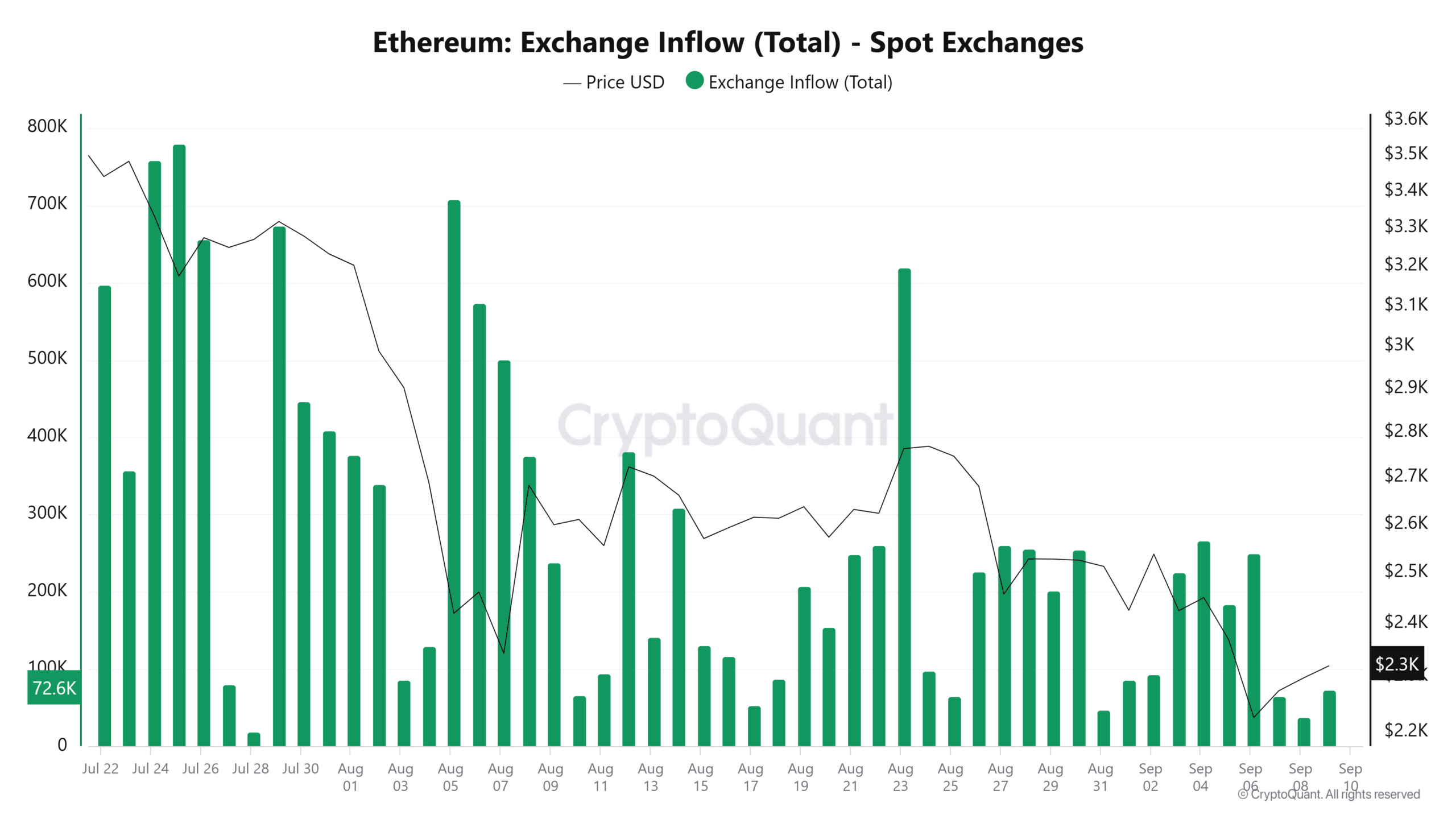

Regardless of the promoting exercise, the quantity of ETH being deposited on spot exchanges is decreasing. On the eighth of September, ETH’s trade inflows reached 37,415 ETH, the bottom stage since late July.

Supply: CryptoQuant

Thus, whereas sellers stay lively, promoting momentum could also be weakening.

Ethereum worth motion

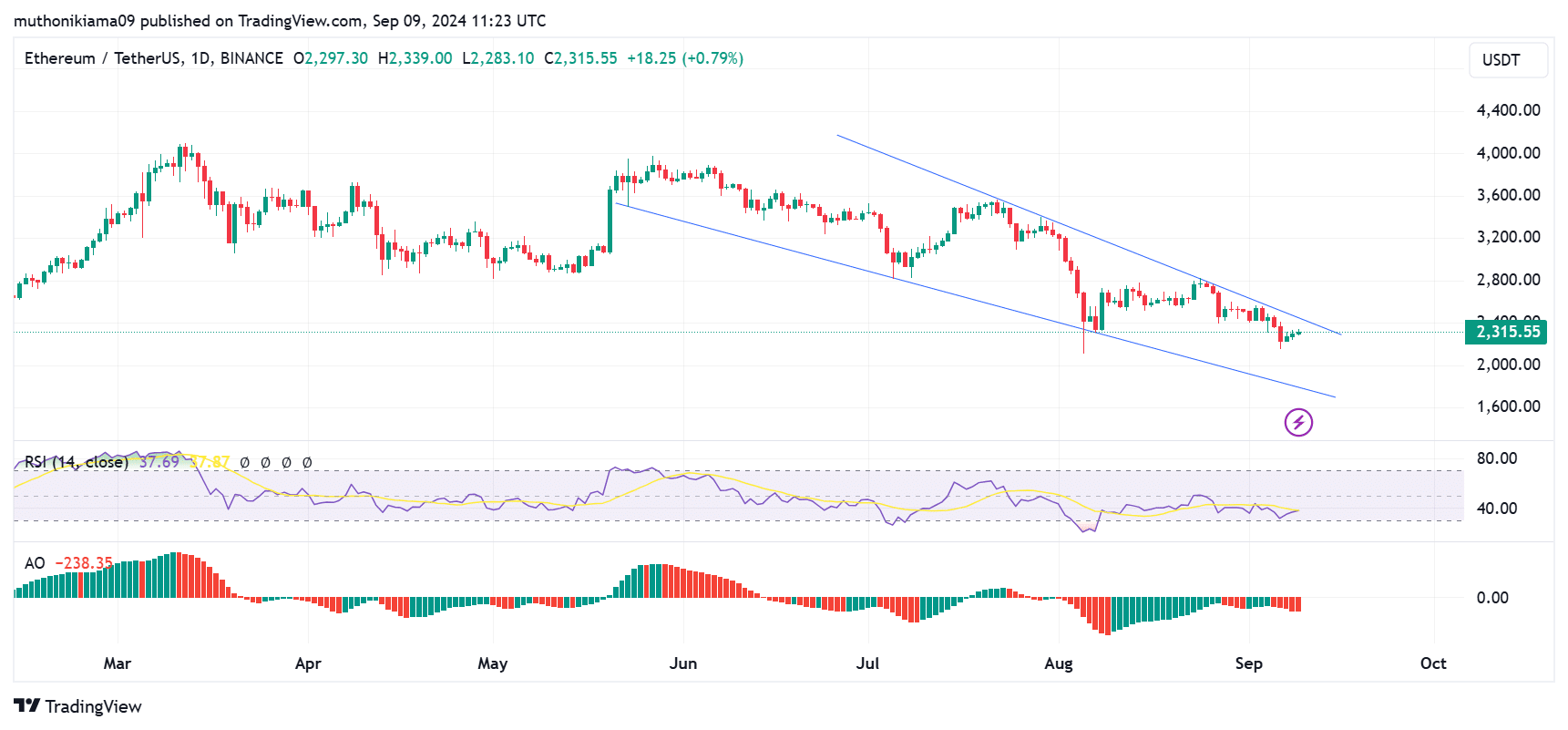

ETH was buying and selling at $2,319 on the time of writing after a slight 0.6% achieve in 24 hours.

The altcoin was buying and selling inside a descending channel on the one-day chart, whereas the Superior Oscillator was detrimental, displaying that bears remained in management.

Nevertheless, ETH is trying a breakout to the upside after forming three inexperienced consecutive candles. If a breakout occurs, it might sign a shift in momentum and the start of a rally.

Supply: TradingView

Nevertheless, for this breakout to occur, patrons must overwhelm sellers. At press time, the Relative Power Index (RSI) was at 37, which pointed in the direction of ETH being in bearish territory.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

The exhaustion of sellers has been seen within the motion of the RSI line because it makes an attempt to crossover above the sign line. If this crossover is confirmed, it would present a purchase sign.

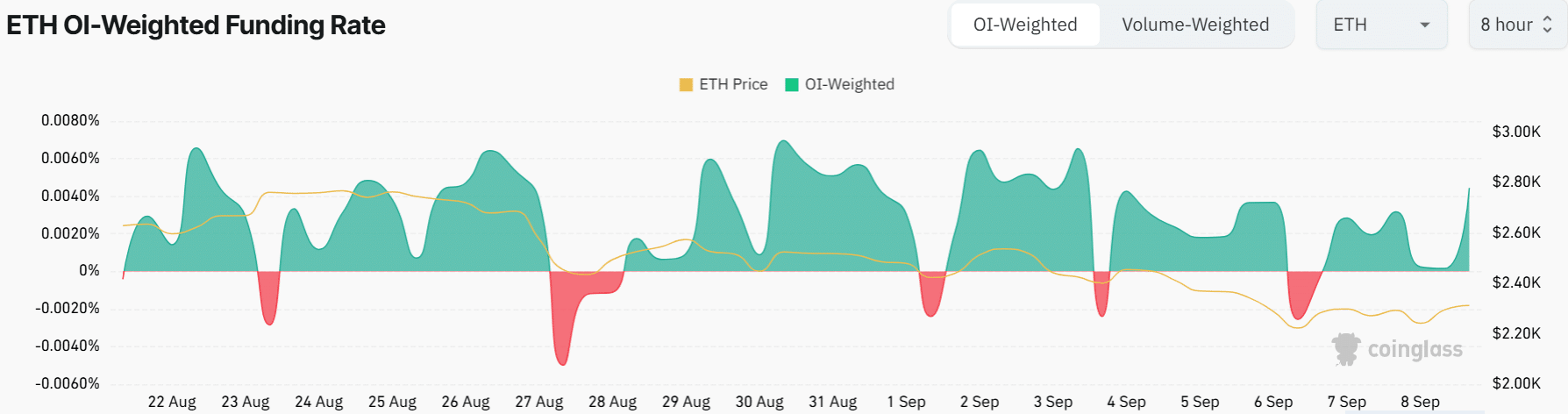

Ethereum’s Funding Charges have additionally flipped optimistic, signaling optimism amongst futures merchants regardless of the bearish sentiment.

Supply: Coinglass