Is Iran’s latest crisis a threat to its Bitcoin mining industry?

Iran’s web blackout did greater than disrupt day by day on-line life; it despatched shockwaves by means of the Bitcoin [BTC] community. Miners have been reduce off, and the hashrate fell sharply.

The outage pressured mining operations to pause and prompted a shift towards extra steady jurisdictions. In at the moment’s panorama, dependable connectivity has change into simply as essential as low cost electrical energy.

The occasion highlights a broader development: geopolitical and community dangers are shaping the place Bitcoin mining thrives. Miners abruptly went offline, and hashrate started migrating away from the nation’s unstable digital infrastructure.

In at the moment’s mining panorama, connectivity issues as a lot as low cost energy, and Tehran’s outage is a transparent indication that geopolitical and community dangers now dictate the place Bitcoin lives.

Iran’s 2025 protests, web blackouts, energy outages, and authorities crackdowns triggered vital Bitcoin miner migration and shutdowns.

Iran beforehand accounted for 4–7% of the worldwide hashrate, making it the fifth‑largest operator. Nonetheless, at press time, its share had fallen to 4% or much less.

This decline led to momentary drops of two–5% in international hashrate, earlier than the community’s issue adjustment mechanisms stepped in to stabilize efficiency.

Supply: Hashrate Index

Migration redistributed energy to steady areas like Kazakhstan or Russia, weakening Iran’s sanctions-evasion instrument and mining income amid financial disaster.

Why low cost energy is not sufficient

In 2026, low cost electrical energy will not be sufficient to maintain Bitcoin miners aggressive.

AI knowledge facilities are outbidding miners for grid capability, inflicting frequent curtailments in hubs like Texas. Political dangers add strain.

Iran’s 2025 protests and web blackouts reduce its hashrate share under 5%, exposing instability. Community issue hit record highs, demanding ultra-efficient ASICs.

Profitable miners now want greater than low-cost energy. They depend on owned power property, regulatory stability, and diversified income streams like AI internet hosting. Low kWh alone can’t shield margins anymore.

Iran’s blackout affect on Bitcoin’s ecosystem

Iran accounts for roughly 2-5% of the worldwide Bitcoin hashrate in early 2026, down from 4-8% in 2021 as a result of crackdowns and power points.

Trailing Iran are smaller contributors, resembling Argentina and Kazakhstan, every holding round 1-3%.

The nationwide web blackout disrupted mining operations, forcing nodes offline and briefly halting Iran’s pool contributions.

The disruption resembled China’s shutdowns in late 2025, inflicting related swings in hashrate and temporary drops in community issue.

Each incidents have been authorities‑pushed and brief‑lived. This contrasts with the October 2025 BTC crash, which pressured miner margins however didn’t straight affect the hashrate.

Climate occasions, such because the chilly snaps of 2025, additionally brought on momentary interruptions in mining operations.

The community has stayed resilient by means of automated issue changes, however these outages spotlight a transparent development: miners are shifting towards extra steady areas to keep away from connectivity and geopolitical dangers.

Whereas the worldwide community has remained steady because of issue changes, the occasion underscores how geopolitical and connectivity dangers can shift hashrate flows.

Even small disruptions ripple by means of the ecosystem, impacting miner revenues, pool competitors, and native transaction validation. In brief, mining is more and more delicate to stability, not simply low cost energy.

Ultimate Ideas

- Iran’s web blackout reveals miners prioritize connectivity over low cost energy, driving hashrate migration to steady areas.

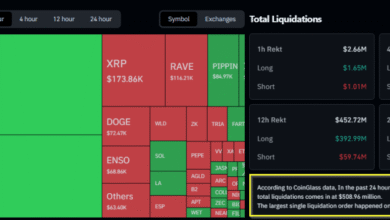

- Short-term dips ripple by means of the community, affecting income, swimming pools, and transaction validation regardless of total resilience.