Is It Time To Doubledown?

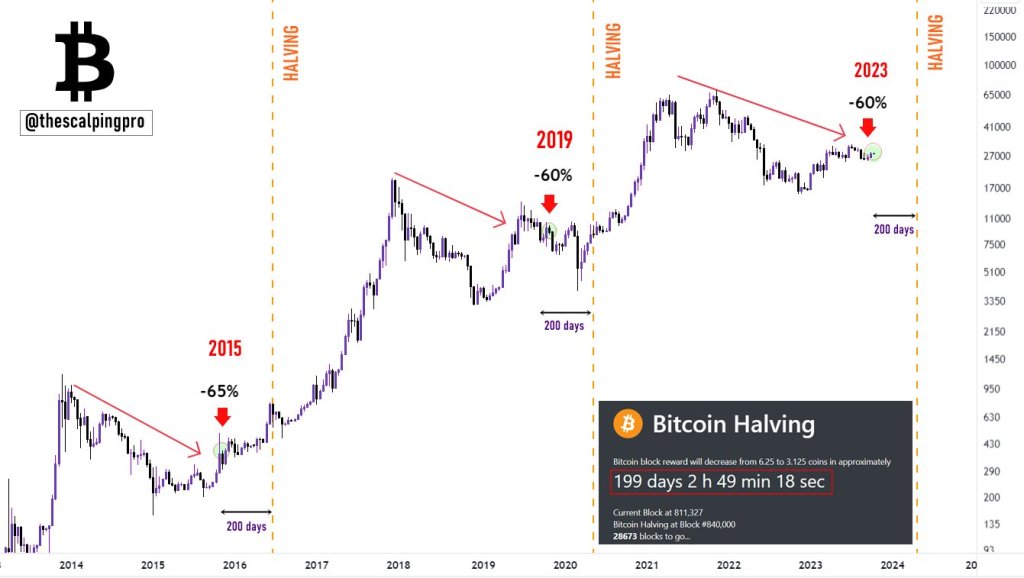

Bitcoin is 200 days earlier than halving, a provide shock that historic patterns present that costs are inclined to rally, even clearing earlier all-time highs as soon as it occurs. In a value chart shared by the “thescalpingpro” on X on October 9, the analyst seems to counsel that the world’s Most worthy coin is within the early levels of not solely breaking above 2021 highs however registering new highs after the community halves in 2024.

Early Indicators Of Bull Rally: 200 Days Earlier than Halving

To this point, the dealer notes that Bitcoin is down 60% from earlier all-time highs in 2021. This formation, the analyst says, seems to copy the identical sample earlier than Bitcoin halved in 2019. Then, similar to it’s presently, the coin fell 60% from 2017 highs of round $20,000.

As historic sample exhibits, Bitcoin costs are inclined to bounce again strongly after posting sharp losses from earlier highs. These upswings are sometimes accelerated by the halving occasion momentum, pushing costs additional away from cyclical lows.

Each 4 years, Bitcoin halving happens, the place the reward for mining a Bitcoin block is decreased by half. This function is constructed into the protocol to gradual the issuance of recent Bitcoin. Because of the lower within the variety of cash launched to circulation throughout halving, inflation is decreased, which helps costs, as earlier value motion has proven.

Though the affect of halving has been nicely studied, the sequence of occasions previous this occasion seems to be stirring demand. As aforementioned, 200 days earlier than the 2016 and 2019 halvings, Bitcoin fell roughly 60% from all-time highs.

The asset’s costs are at an identical value level exactly 200 days earlier than halving. For this “near-perfect” replication of occasions, “thescalpingpro” is bullish that the coin may observe a well-recognized sample of previous cycles.

Bitcoin Race To $48,000 Earlier than Halving?

The spike to all-time highs and past, as previewed, is a situation that might occur as soon as the halving occurs. Earlier than then, nonetheless, one other analyst is satisfied the coin may rally to $48,000.

The evaluation is based on essential help and resistance ranges shaped by the Fibonacci retracement ranges. The analyst is satisfied that the coin will retest the 61.8% of the swing excessive low of the current 2021 to 2022 vary, inserting Bitcoin at $48,000 as soon as it recovers.

The race to this stage will probably be additional pushed by “halving momentum” and the “bear-to-bull transition from varied indicators,” together with the Relative Power Index (RSI), Transferring Common Convergence Divergence (MACD), and the on-balance quantity of main exchanges, which seem oversold.

Function picture from Canva, chart from TradingView